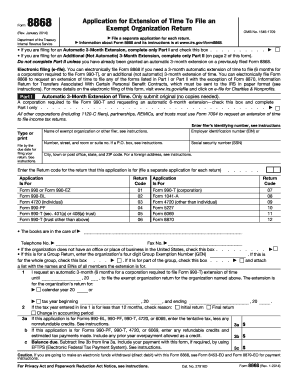

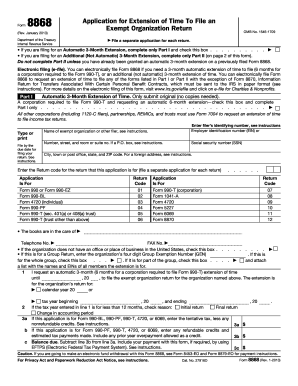

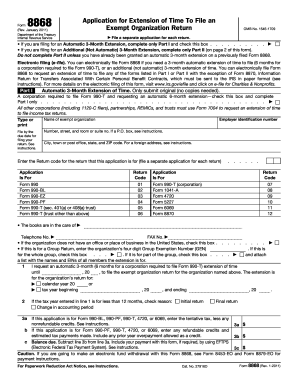

8868 Form

What is 8868 Form?

The 8868 Form is an IRS tax form used by tax-exempt organizations to request an automatic extension of time to file certain information returns. This form is specifically designed for organizations such as nonprofits, charities, and foundations to properly report their financial information and maintain their tax-exempt status. By completing the 8868 Form, organizations can ensure they have sufficient time to gather and verify all the necessary data before submitting their information returns.

What are the types of 8868 Form?

There are two types of 8868 Forms that tax-exempt organizations can use. The first one is Form 8868, which grants a 3-month extension of time to file. The second type is Form 8868-B, which provides an additional 3-month extension, making it a total of 6 months. It's important for organizations to choose the appropriate form based on their specific needs and requirements. By understanding the different types, organizations can ensure they have enough time to accurately complete their information returns.

How to complete 8868 Form

To successfully complete the 8868 Form, follow these steps:

pdfFiller empowers users to create, edit, and share their 8868 Forms online. With unlimited fillable templates and powerful editing tools, pdfFiller is the ultimate PDF editor for tax-exempt organizations. Take advantage of pdfFiller's features to streamline the form completion process and ensure accurate and timely submission of your information returns.