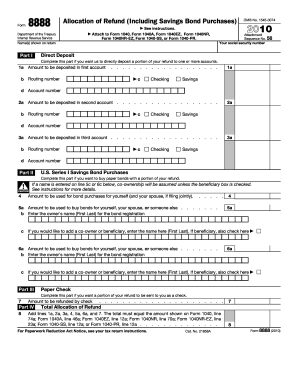

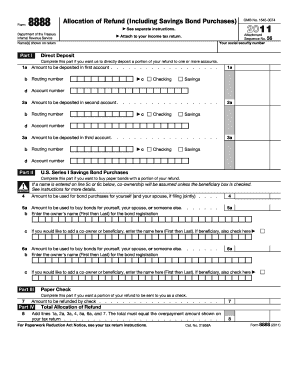

8888 Form

What is 8888 Form?

The 8888 Form is a document used for reporting certain gambling winnings to the Internal Revenue Service (IRS). It is specifically designed for individuals who have won $1,200 or more from bingo or slot machines, and $1,500 or more from keno. The form provides important information such as the amount of winnings, the name and address of the payer, and the taxpayer's identification number.

What are the types of 8888 Form?

There is only one type of 8888 Form, which is the official form recognized by the IRS. It is a standardized document that ensures consistent reporting of gambling winnings. The form can be obtained from the IRS website or through tax preparation software.

How to complete 8888 Form

Completing the 8888 Form is a straightforward process. Here are the steps to follow:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.