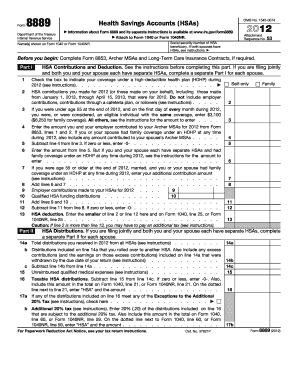

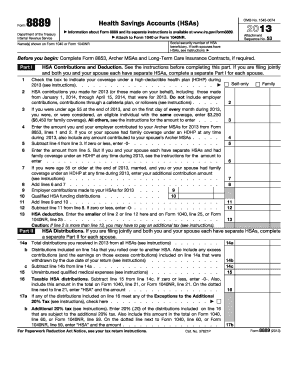

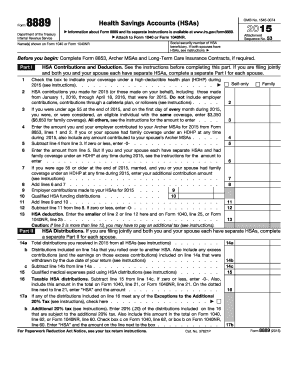

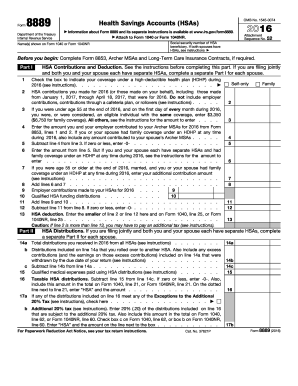

8889 Form

What is 8889 Form?

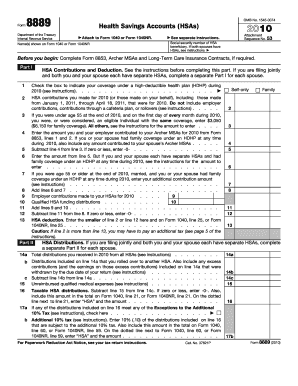

The 8889 Form is an Internal Revenue Service (IRS) document used by individuals who have a Health Savings Account (HSA) and are required to report their HSA contributions, distributions, and other relevant information on their federal tax return. It is an important form for HSA holders to ensure accurate reporting and compliance with tax regulations.

What are the types of 8889 Form?

There is only one type of 8889 Form, which is used to report HSA activity on your federal tax return. However, depending on your individual circumstances, you may need to fill out different sections of the form. These sections include Part I - Health Savings Accounts (HSAs), Part II - HSA Contributions, Part III - HSA Distributions, and Part IV - HSA Contributions From the Prior Year. It is important to carefully read the instructions and complete the sections that apply to you.

How to complete 8889 Form

Completing the 8889 Form accurately is crucial to ensure compliance with IRS regulations. Here is a step-by-step guide to help you complete the form:

Remember, accurate reporting on the 8889 Form is essential to comply with IRS requirements and avoid any potential penalties. If you need assistance or further guidance, consider using pdfFiller, an online platform that empowers users to create, edit, and share documents easily. With unlimited fillable templates and powerful editing tools, pdfFiller is the perfect PDF editor to help you complete your 8889 Form efficiently.