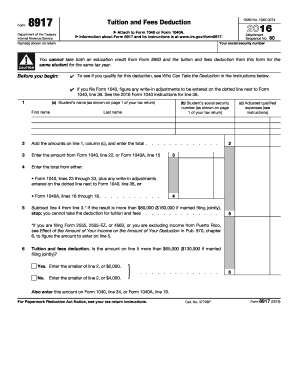

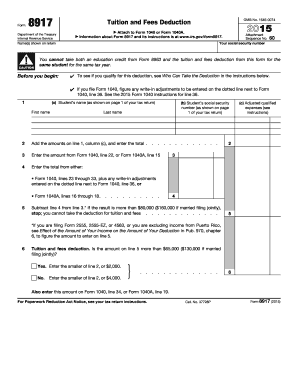

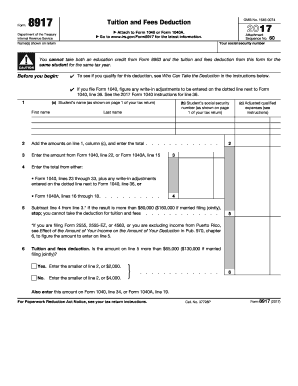

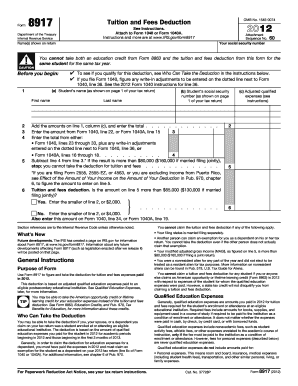

8917 Form

What is 8917 Form?

The 8917 Form is an IRS tax form used by individuals to report the information related to the deductions for tuition and fees. This form is specifically used to claim the tuition and fees deduction, which can help reduce your taxable income if you are eligible.

What are the types of 8917 Form?

There is only one type of 8917 Form, which is the Tuition and Fees Deduction form. It is used to report the necessary details for claiming the deduction on your tax return.

How to complete 8917 Form

Completing the 8917 Form is a simple process. Follow these steps to ensure you provide accurate information:

pdfFiller empowers users to create, edit, and share documents online, making the process of completing the 8917 Form even easier. With unlimited fillable templates and powerful editing tools, pdfFiller is the go-to PDF editor for all your document needs.