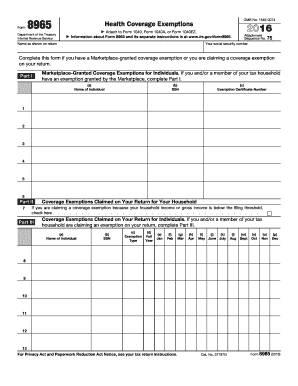

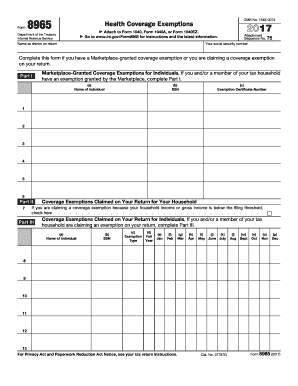

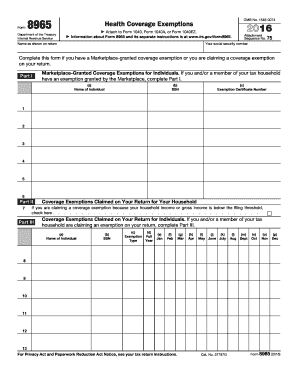

8965 Form

What is 8965 Form?

The 8965 Form is a document used for reporting certain health coverage exemptions on your federal tax return. It is specifically designed for individuals who were not able to obtain qualifying health insurance coverage or were exempt from the requirement to have coverage.

What are the types of 8965 Form?

There are several types of 8965 Forms that you may need to be aware of. These include: 1. Form 8965, Health Coverage Exemptions: This is the main form used to report exemptions. 2. Form 8965, Part I: This section is used to claim exemptions for individuals who didn't have coverage. 3. Form 8965, Part II: This section is used to report exemptions for individuals who had coverage for part of the year. 4. Form 8965, Part III: This section is used to report exemptions granted through the Marketplace. 5. Form 8965, Part IV: This section is used to report exemptions for individuals who experienced hardship.

How to complete 8965 Form

Completing the 8965 Form is a relatively straightforward process. Here are the steps to follow: 1. Gather the required information: You will need to have your personal details, including your name, Social Security number, and address, as well as any relevant documentation for the exemptions you plan to claim. 2. Fill out the form: Enter your information in the appropriate sections of the form, making sure to provide accurate and complete information. 3. Attach supporting documents: If required, attach any supporting documentation for the exemptions you are claiming. 4. Review and submit: Double-check all the information you have entered, make any necessary corrections, and then submit the form.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.