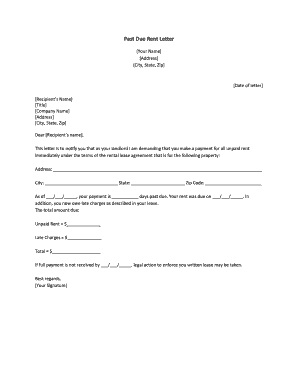

Past Due Letter

What is a past due letter?

A past due letter is a formal document sent to a customer who has overdue payments or outstanding debts. It serves as a reminder and request for payment, outlining the amount owed and any potential consequences for further delays in payment.

What are the types of past due letter?

There are two main types of past due letters: 1. First Reminder Letter: This letter is usually sent shortly after a payment becomes past due, reminding the customer of the outstanding balance and requesting prompt payment. 2. Final Notice Letter: This letter is sent after multiple reminders have been ignored, indicating that legal action may be taken if the debt is not resolved.

How to complete a past due letter

Completing a past due letter effectively involves several key steps: 1. Begin by addressing the customer by name and clearly stating the purpose of the letter. 2. Provide details of the overdue amount, including any late fees or interest charges. 3. Clearly outline the consequences of continued non-payment. 4. Include instructions on how the customer can make payment and contact information for any questions or concerns.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.