What is payroll deduction form for employee purchases?

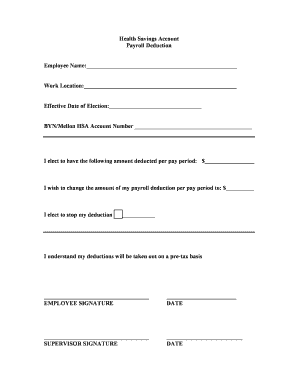

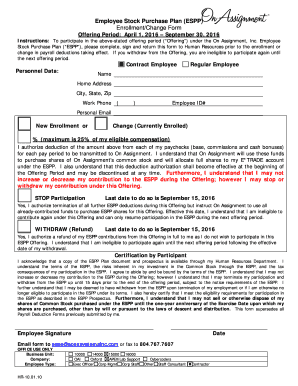

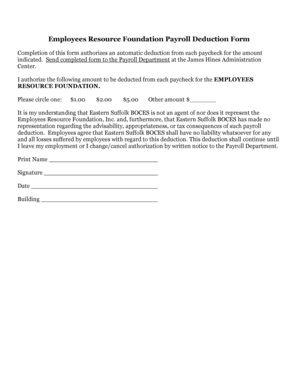

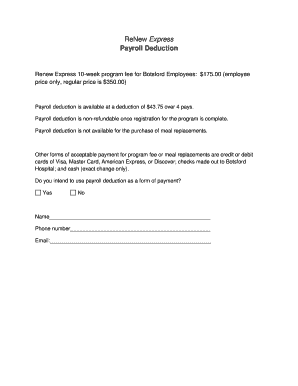

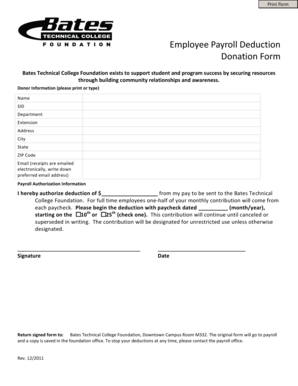

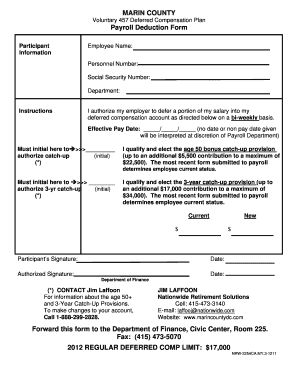

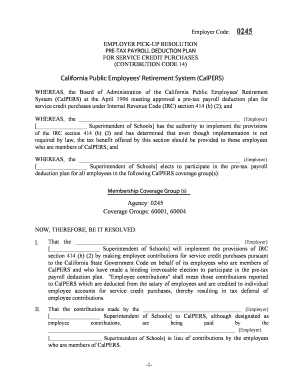

A payroll deduction form for employee purchases is a document that allows employees to authorize the deduction of a certain amount of money from their paycheck for the purpose of purchasing certain items or services. This form ensures that the employer deducts the specified amount from the employee's salary and provides a record of the purchase.

What are the types of payroll deduction form for employee purchases?

There are several types of payroll deduction forms for employee purchases. These include:

Uniform Deduction Form: This form is used when employees are required to wear uniforms for their job and the cost of the uniform is deducted from their paycheck.

Equipment Deduction Form: This form is used when employees need to purchase specific equipment or tools for their job and the cost is deducted from their salary.

Benefit Deduction Form: This form is used for employee benefit programs where the cost of the benefit is deducted from the employee's paycheck.

Loan Deduction Form: This form is used when employees have taken a loan from the employer and the repayment is deducted from their salary.

How to complete payroll deduction form for employee purchases

Completing a payroll deduction form for employee purchases is simple and straightforward. Here are the steps you need to follow:

01

Fill in your personal information, including your name, employee ID, and contact details.

02

Specify the type of deduction form you are filling out, such as Uniform Deduction Form or Equipment Deduction Form.

03

Provide details about the purchase, including the item or service you want to purchase, the cost, and any other relevant information.

04

Sign and date the form to authorize the deduction from your paycheck.

05

Submit the completed form to your employer or the designated department.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.