Personal Profit And Loss Statement

What is personal profit and loss statement?

A personal profit and loss statement is a financial document that provides an overview of an individual's income, expenses, and overall financial health. It is used to assess personal financial performance, track income sources, and identify areas of financial improvement.

What are the types of personal profit and loss statement?

There are several types of personal profit and loss statements, including:

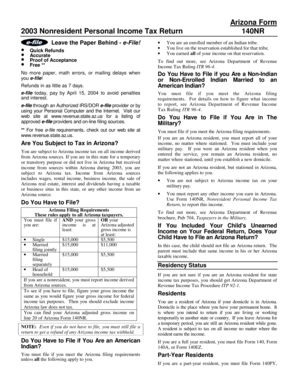

Standard profit and loss statement: This type of statement provides a comprehensive view of an individual's income and expenses, including salary, interest, dividends, and various expenses.

Simple profit and loss statement: This type of statement focuses on the basic income and expenses, offering a simplified view of an individual's financial situation.

Itemized profit and loss statement: This statement breaks down income and expenses into specific categories, allowing for detailed analysis and budgeting.

How to complete personal profit and loss statement

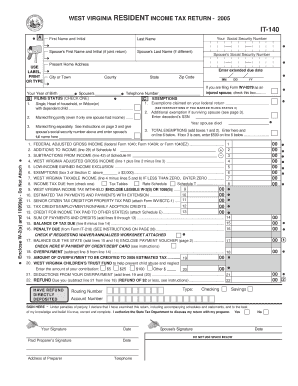

Completing a personal profit and loss statement can be done by following these steps:

01

Gather all relevant financial documents, such as bank statements, pay stubs, and receipts.

02

List all sources of income, including salary, freelance work, and investment returns.

03

Record all expenses, categorizing them into groups such as housing, transportation, and entertainment.

04

Calculate net income by subtracting expenses from income.

05

Analyze the statement to identify areas of financial improvement or opportunities for growth.

06

Review and update the personal profit and loss statement regularly to track progress and make necessary adjustments.

pdfFiller empowers users to create, edit, and share personal profit and loss statements online. With unlimited fillable templates and powerful editing tools, pdfFiller is the leading PDF editor that individuals need to efficiently manage their financial documents.

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What does a p-trap look like?

If you look at the drain pipe under your sink, you'll see a curve in the pipe that resembles the shape of a “U” or a “P.” That's an example of a P-trap. A P-trap is a bend in a drain and waste pipe with a specific purpose.

What is a personal P and L?

Key Takeaways. The profit and loss (P&L) statement is a financial statement that summarizes the revenues, costs, and expenses incurred during a specified period.

How do I make a P&L spreadsheet?

How to Create a Profit and Loss Statement in Excel Download, Open, and Save the Excel Template. Input Your Company and Statement Dates. Calculate Gross Profit. Input Sales Revenue to Calculate Gross Revenue. Input the Cost of Goods Sold (COGS) Calculate the Net Income. Input Your Business Expenses.

How do I create a personal P&L statement?

To create a basic P&L manually, take the following steps: Gather necessary information about revenue and expenses (as noted above). List your sales. List your COGS. Subtract COGS (Step 3) from gross revenue (Step 2). List your expenses. Subtract the expenses (Step 5) from your gross profit (Step 4).

What is included in a personal profit and loss statement?

It shows a company's financial progress during the time period being examined. The P & L statement contains uniform categories of sales and expenses. The categories include net sales, costs of goods sold, gross margin, selling and administrative expense (or operating expense), and net profit.

How do I create a personal P&L?

To create a basic P&L manually, take the following steps: Gather necessary information about revenue and expenses (as noted above). List your sales. List your COGS. Subtract COGS (Step 3) from gross revenue (Step 2). List your expenses. Subtract the expenses (Step 5) from your gross profit (Step 4).

Related templates