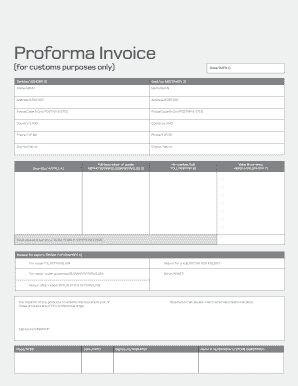

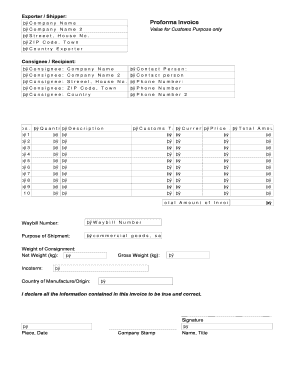

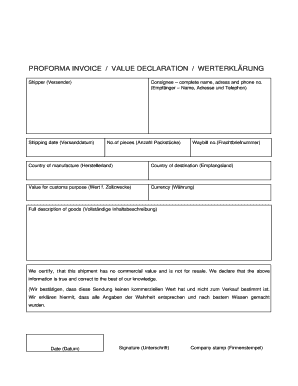

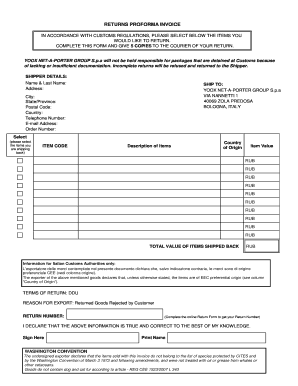

What is proforma invoice for customs purposes?

A proforma invoice for customs purposes is a preliminary document used in international trade to provide essential information about a shipment. It serves as a quotation or an estimate of the value, quantity, and type of goods being exported or imported. This invoice is not a final demand for payment but helps customs authorities determine the necessary import duties, taxes, and other fees.

What are the types of proforma invoice for customs purposes?

There are two common types of proforma invoices for customs purposes:

Commercial Invoice: This type of proforma invoice includes detailed information about the goods, including their description, quantity, price, and total value. It is often used for commercial and official purposes, providing a comprehensive overview of the transaction.

Consular Invoice: A consular invoice is required for certain countries and serves as a declaration of the goods being shipped. It may require verification or certification from the consulate of the importing country.

How to complete proforma invoice for customs purposes?

Completing a proforma invoice for customs purposes can be a straightforward process if you follow these steps:

01

Start by including your contact information, including your name, address, phone number, and email.

02

Provide the recipient's contact information, including the importer's details if known.

03

Indicate the invoice number and the date of issuance.

04

Clearly describe the goods being shipped, including their quantity, weight, and value. Be specific and include any relevant codes or classification numbers.

05

Include the terms of delivery, such as the shipping method and any additional services requested.

06

Specify the payment terms and any applicable currency.

07

Mention any additional charges or discounts if applicable.

08

Provide your signature and the date of completion.

09

Ensure all the necessary supporting documents are attached, such as product specifications, certificates of origin, or permits, if required by the importing country.

With the power of pdfFiller, completing proforma invoices for customs purposes has never been easier. Whether you need to create, edit, or share your documents online, pdfFiller offers unlimited fillable templates and powerful editing tools. Say goodbye to outdated PDF editors and rely on pdfFiller to get your documents done seamlessly.