What is Retirement Savings Calculator?

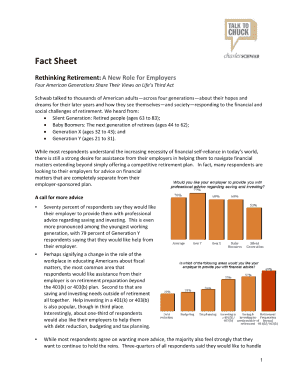

A Retirement Savings Calculator is a tool that helps individuals determine how much money they need to save in order to achieve their desired retirement goals. It takes into account factors such as current savings, annual income, expected inflation rate, and desired retirement age to provide an estimate of the total amount needed at retirement.

What are the types of Retirement Savings Calculator?

There are several types of Retirement Savings Calculators available depending on individual preferences and needs. Some common types include:

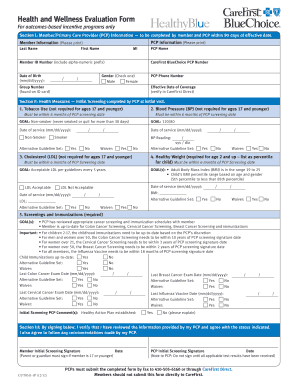

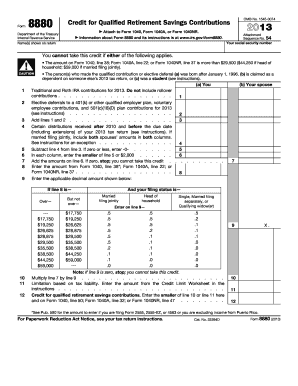

Traditional Retirement Savings Calculator: This calculates retirement savings based on factors such as current savings, annual income, and expected rate of return on investments.

Simplified Retirement Savings Calculator: This provides a quick estimate of retirement savings based on basic inputs like age, current savings, and annual income.

Advanced Retirement Savings Calculator: This offers a more detailed analysis of retirement savings, taking into account additional factors like expected Social Security benefits, pensions, and other sources of income during retirement.

How to complete Retirement Savings Calculator

Completing a Retirement Savings Calculator is a simple process. Follow these steps to get an accurate estimate of your retirement savings:

01

Gather financial information: Collect information on your current savings, annual income, and any additional sources of income during retirement.

02

Enter the data: Input the collected information into the calculator, ensuring accuracy and completeness. Consider adjusting for inflation and expected rate of return on investments.

03

Review the results: Analyze the calculated estimate of your retirement savings. Take note of any gaps between your estimated savings and desired retirement goals.

04

Make adjustments: If the estimated savings fall short of your goals, consider increasing your savings rate, extending your retirement age, or exploring additional sources of income.

05

Track progress: Regularly revisit the Retirement Savings Calculator to update your financial information and track progress towards your retirement goals.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.