Sample Balance Sheet Excel

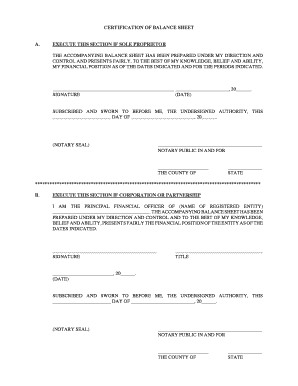

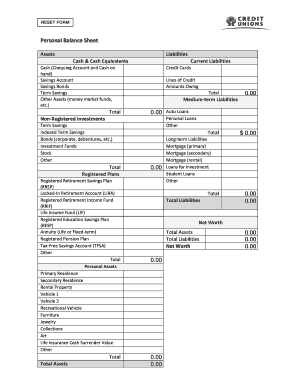

What is Sample Balance Sheet Excel?

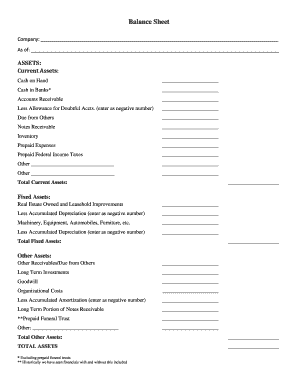

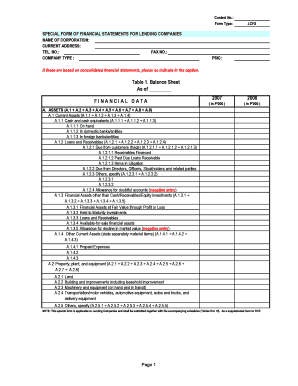

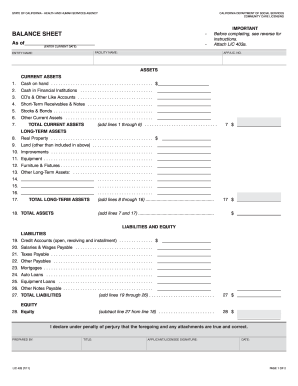

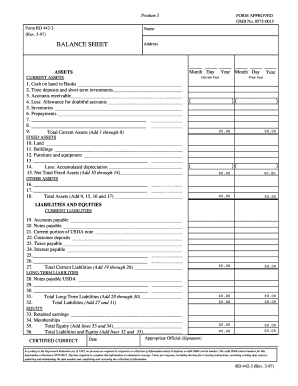

A Sample Balance Sheet Excel is a financial statement that provides a snapshot of a company's financial position at a specific point in time. It displays the company's assets, liabilities, and shareholders' equity, allowing stakeholders to assess the company's financial health and performance.

What are the types of Sample Balance Sheet Excel?

There are two main types of Sample Balance Sheet Excel: classified and unclassified. Classified balance sheets provide a more detailed view by categorizing assets and liabilities into current and non-current sections. On the other hand, unclassified balance sheets do not categorize items, presenting all assets and liabilities in a single section.

How to complete Sample Balance Sheet Excel

Completing a Sample Balance Sheet Excel involves the following steps:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.