Sample Budget Statement - Page 2

What is Sample Budget Statement?

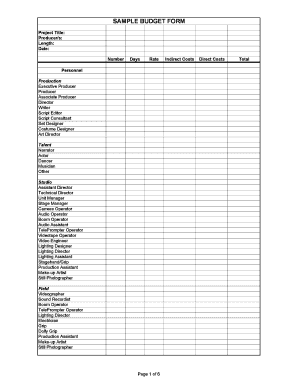

A Sample Budget Statement is a financial document that provides a detailed breakdown of income and expenses over a specific period of time. It is used to track and analyze financial activity, helping individuals or businesses gain a better understanding of their financial situation.

What are the types of Sample Budget Statement?

There are several types of Sample Budget Statement that cater to different needs and purposes:

Personal Budget Statement: This type of budget statement is designed for individuals to manage their personal finances.

Business Budget Statement: This type of budget statement is used by businesses to track and plan their financial activities.

Project Budget Statement: This type of budget statement is created specifically for managing the finances of a project, including income, expenses, and resource allocation.

How to complete Sample Budget Statement

Completing a Sample Budget Statement can be done in a few simple steps:

01

Gather all relevant financial information, including income sources and expenses.

02

Categorize your income and expenses into different categories, such as income, utilities, groceries, transportation, etc.

03

Calculate the total income and total expenses for the specified period.

04

Subtract the total expenses from the total income to determine whether you have a surplus or deficit.

05

Analyze the budget statement to identify areas where you can cut expenses or allocate more funds.

06

Adjust and update the budget statement regularly to reflect any changes in your financial situation.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How do I create a budget template in Word?

0:00 1:02 How to Create a Budget in Microsoft Word 2010 - YouTube YouTube Start of suggested clip End of suggested clip And then you're going to select new on the right side of the screen you'll notice that there areMoreAnd then you're going to select new on the right side of the screen you'll notice that there are budgets. In terms of templates under office comm. So you click on budgets.

How do you write a budget statement?

The following steps can help you create a budget. Step 1: Calculate your net income. The foundation of an effective budget is your net income. Step 2: Track your spending. Step 3: Set realistic goals. Step 4: Make a plan. Step 5: Adjust your spending to stay on budget. Step 6: Review your budget regularly.

How do you format a budget spreadsheet?

A simple, step-by-step guide to creating a budget in Google Sheets Step 1: Open a Google Sheet. Step 2: Create Income and Expense Categories. Step 3: Decide What Budget Period to Use. Step 4: Use simple formulas to minimize your time commitment. Step 5: Input your budget numbers. Step 6: Update your budget.

What needs to be included in a budget statement?

On your business budget, you'll want to tally your total income and your total expenses (i.e., adding your total fixed costs, variable expenses, and one-time spends)—then compare cash flow in (income) to cash flow out (expenses) to determine your overall profitability.

How do you write a simple budget proposal?

How to create a budget proposal template Describe your project objectives. To introduce your project budget proposal, start with an overview of your project objectives. Summarize cost elements. Break down costs. Provide a cost summary. Submit for approval.

What is a budgeting statement?

A budgeted income statement (sometimes called a budget income statement) is a document that helps estimate and evaluate a business' revenue and expenditure. It's a planning tool many companies create at the beginning of the fiscal year as they develop and finalize their annual budgets.

Related templates