What is sample demand letter for payment of debt?

A sample demand letter for payment of debt is a written communication sent by a creditor to a debtor, requesting the repayment of a debt. It outlines the details of the debt and demands that the debtor fulfill their obligation to pay. The sample demand letter serves as a formal notice to the debtor and can be used as evidence in legal proceedings if necessary. It is an effective way for creditors to assert their rights and encourage prompt payment.

What are the types of sample demand letter for payment of debt?

There are several types of sample demand letters for payment of debt, depending on the specific situation and relationship between the creditor and debtor. Some common types include:

First Reminder Letter: This type of letter is sent as an initial reminder to the debtor, typically after the payment has become past due for a short period of time.

Final Notice Letter: If the debtor does not respond to the first reminder letter, a final notice letter is sent. This letter emphasizes the urgency of the debt repayment and warns of further action if payment is not received.

Cease and Desist Letter: This type of letter is used when a debtor has been engaging in unfair collection practices or harassment. It demands that the debtor cease all communication and collection activities immediately.

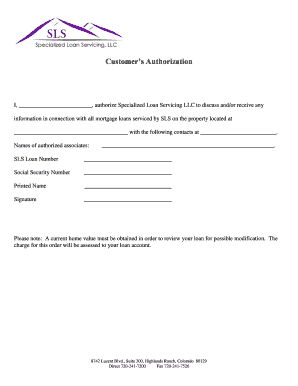

How to complete sample demand letter for payment of debt

Completing a sample demand letter for payment of debt requires careful attention to detail and effective communication. Here are the steps to follow:

01

Start with a formal salutation, addressing the debtor by name.

02

Clearly state the purpose of the letter: to demand payment of the debt.

03

Include the essential details of the debt, such as the amount owed, the due date, and any interest or fees.

04

Specify a deadline for payment to be made, giving the debtor a reasonable timeframe.

05

Clearly explain the consequences of non-payment, such as legal action or credit damage.

06

Provide contact information for the creditor, including a phone number and email address, in case the debtor has any questions or wishes to discuss payment arrangements.

07

End the letter with a formal closing, again addressing the debtor by name.

08

Make a copy of the letter for your records before sending it.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.