Sample Hardship Letter For Loan Modification

What is Sample Hardship Letter For Loan Modification?

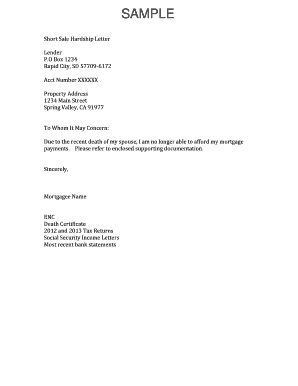

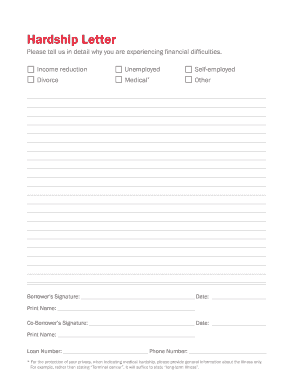

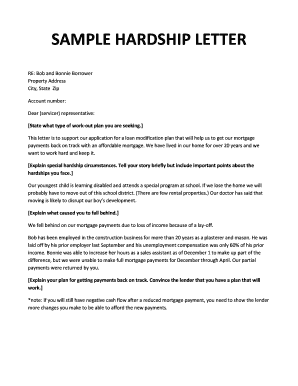

A Sample Hardship Letter For Loan Modification is a written statement that a borrower prepares to explain their financial situation and request a modification to the terms of their loan. It is typically used when a borrower is facing financial hardship and is struggling to make their loan payments. The letter explains the reasons for the financial difficulty and outlines the borrower's proposed modification, such as a lower interest rate or extended repayment period. It is important for the letter to be clear, concise, and compelling in order to increase the chances of approval.

What are the types of Sample Hardship Letter For Loan Modification?

There are several types of Sample Hardship Letter For Loan Modification that a borrower can use, depending on their specific financial circumstances. These types include: 1. Financial Hardship Letter: This type of letter explains the borrower's current financial situation, including reasons for the hardship, such as job loss, medical expenses, or divorce. 2. Income Reduction Letter: This type of letter focuses on a decrease in income and how it has affected the borrower's ability to make loan payments. 3. Overdue Payment Letter: This type of letter addresses a borrower's delinquent payments and requests a loan modification to help them catch up on their payments. 4. Adjustable Rate Mortgage (ARM) Reset Letter: This type of letter is used when a borrower's ARM is about to reset to a higher interest rate, causing financial strain. It requests a modification to convert the loan to a fixed rate. These are just a few examples, and the type of letter to be used will depend on the borrower's specific circumstances.

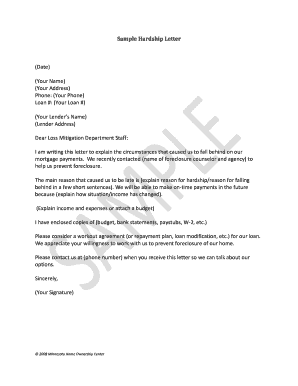

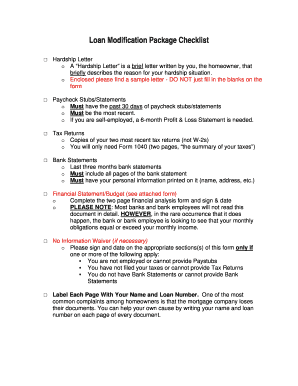

How to complete Sample Hardship Letter For Loan Modification

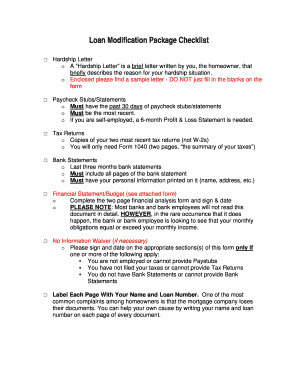

Completing a Sample Hardship Letter For Loan Modification can seem daunting, but with the right guidance, it can be a smooth process. Here are the steps to complete the letter: 1. Introduction: Start the letter with a formal salutation and introduce yourself as the borrower. Mention the purpose of the letter and briefly explain your financial situation. 2. Explain the Hardship: Clearly state the reasons for your financial hardship and how it has affected your ability to make loan payments. Be honest and provide any relevant documentation to support your claims. 3. Proposed Modification: Clearly outline the specific modifications you are requesting, such as a lower interest rate, extended repayment period, or reduced monthly payments. Explain how these modifications will help you overcome your financial hardship. 4. Supporting Information: Include any additional information or documents that might strengthen your case, such as proof of income or medical bills. 5. Conclusion: Express your gratitude for considering your request and provide your contact information for any further communication. Remember to proofread the letter and make necessary edits to ensure clarity and professionalism.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.