Sample Loan Agreement Between Two Parties

What is a sample loan agreement between two parties?

A sample loan agreement between two parties is a legally binding document that outlines the terms and conditions of a loan transaction between a lender and a borrower. It includes important details such as the loan amount, interest rate, repayment schedule, and any collateral or guarantors involved. This agreement serves as a safeguard for both parties, ensuring that they are protected throughout the loan process. By having a sample loan agreement, both parties can refer to it in case of any dispute or misunderstanding.

What are the types of sample loan agreement between two parties?

There are several types of sample loan agreements between two parties, depending on the specific needs and circumstances of the loan transaction. The most common types include: 1. Promissory Note: This is a simple agreement where the borrower agrees to repay the loan with specific terms. 2. Installment Loan Agreement: This type of agreement sets out a repayment plan with regular installments. 3. Secured Loan Agreement: In this agreement, the borrower provides collateral as security for the loan. 4. Unsecured Loan Agreement: This type of agreement does not require any collateral. 5. Personal Loan Agreement: This is a loan agreement between individuals, often friends or family members. 6. Business Loan Agreement: This type of agreement is used for loans between a lender and a business entity.

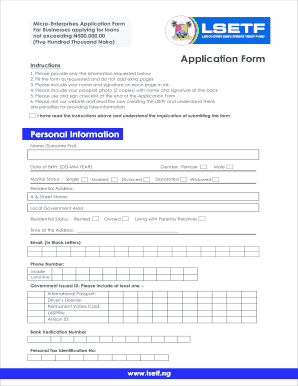

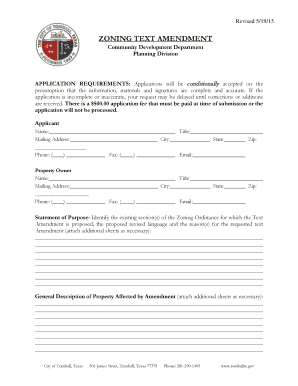

How to complete a sample loan agreement between two parties

When completing a sample loan agreement between two parties, follow these steps: 1. Begin by identifying the parties involved: Clearly state the full names and contact information of both the lender and the borrower. 2. Specify the loan details: Include the loan amount, interest rate, repayment schedule, and any late payment penalties. 3. Describe any collateral or guarantors: If applicable, provide detailed information about any assets or individuals involved in securing the loan. 4. Include clauses for default or breach of contract: Clearly outline the consequences or actions that will be taken in case either party fails to fulfill their obligations. 5. Sign and date the agreement: Both parties should carefully review the agreement and sign it to indicate their acceptance and understanding of the terms.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.