What is Simple Financial Statement Sample?

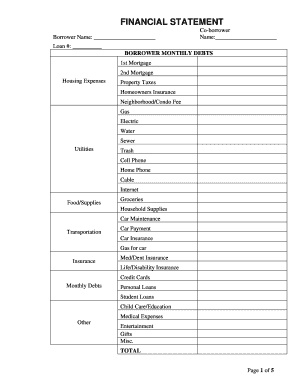

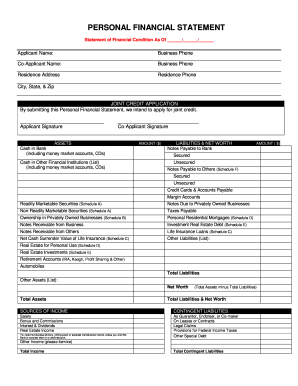

A Simple Financial Statement Sample is a document that summarizes the financial activities and status of an individual, business, or organization. It provides a clear picture of the income, expenses, assets, liabilities, and equity of the entity. This statement is essential for financial analysis, decision-making, and measuring the financial performance of the entity.

What are the types of Simple Financial Statement Sample?

There are several types of Simple Financial Statement Samples available, each serving a different purpose. The main types include:

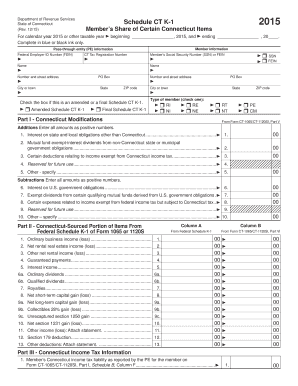

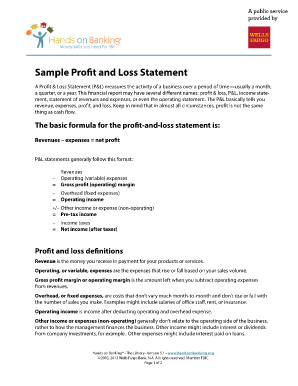

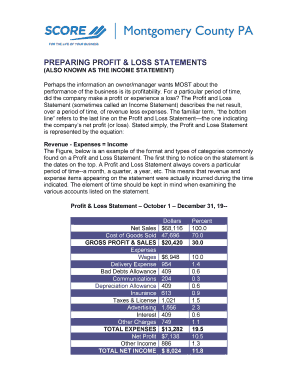

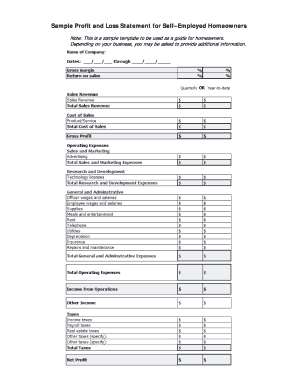

Income Statement: Provides an overview of the revenue, expenses, and net income or loss for a specific period.

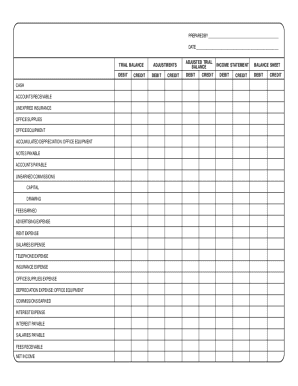

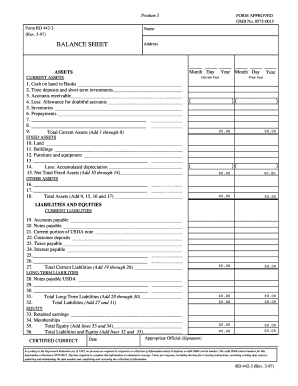

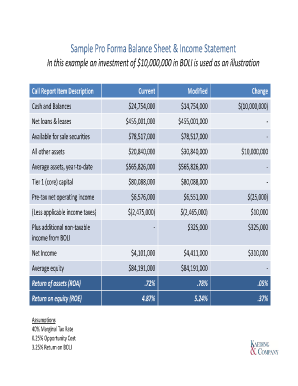

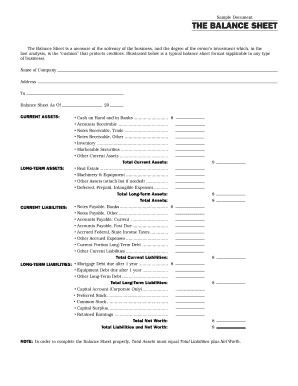

Balance Sheet: Represents the financial position of the entity by showing its assets, liabilities, and equity at a given point in time.

Cash Flow Statement: Tracks the flow of cash in and out of the entity, showcasing the sources and uses of cash.

Statement of Owner's Equity: Highlights the changes in the owner's capital or stockholder's equity over a specific period.

How to complete Simple Financial Statement Sample

Completing a Simple Financial Statement Sample requires careful organization and attention to detail. Here are the steps to follow:

01

Gather all necessary financial information, including income documents, expense records, asset and liability details.

02

Create sections for income, expenses, assets, liabilities, and equity in the statement.

03

Record the specific items and their corresponding amounts under each section.

04

Calculate the totals for each section and tally the overall financial position of the entity.

05

Review and double-check the statement for accuracy and completeness.

06

Make any necessary adjustments or corrections.

07

Share the completed Simple Financial Statement Sample with relevant stakeholders, such as investors, lenders, or financial advisors.

By following these steps, you can create a comprehensive Simple Financial Statement Sample that accurately reflects the financial activities and position of the entity.