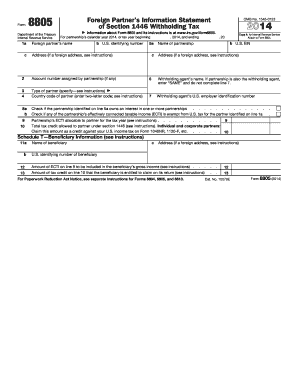

What is state tax withholding calculator?

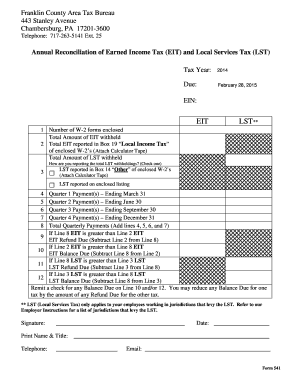

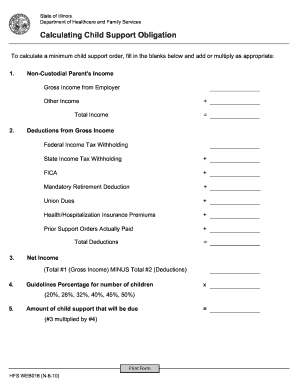

A state tax withholding calculator is a tool used to estimate the amount of state income tax that will be withheld from your paychecks based on your income, filing status, and other factors. It helps you determine the appropriate amount of tax to be withheld so that you don't end up owing any additional taxes when you file your state tax return.

What are the types of state tax withholding calculator?

There are various types of state tax withholding calculators available, each designed for a specific state or region. Some common types include:

State-specific calculators: These calculators are tailored to a specific state and take into account the state's tax laws, rates, and deductions.

Multi-state calculators: These calculators are useful for individuals who work in multiple states and need to calculate their tax withholding for each state separately.

Payroll software calculators: Many payroll software platforms offer built-in calculators that automatically calculate state tax withholding based on the employee's information.

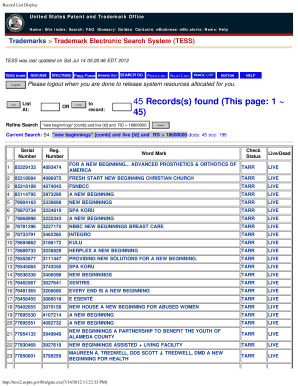

Online tax calculators: These calculators are available on various websites and allow users to estimate their state tax withholding by inputting their income and other relevant details.

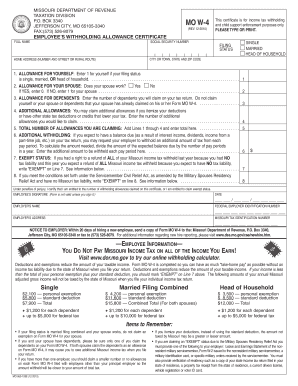

How to complete state tax withholding calculator?

Completing a state tax withholding calculator is a simple process. Here are the steps to follow:

01

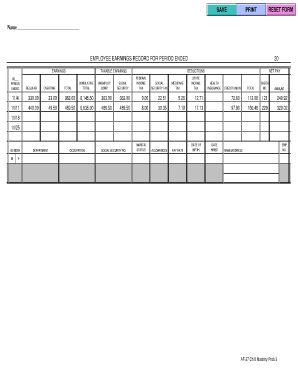

Gather your financial information: Collect details of your income, deductions, and any other relevant tax information.

02

Choose the right calculator: Select a calculator that is specific to your state or region, or opt for a multi-state calculator if you work in multiple states.

03

Enter your information: Fill in the required fields, such as your filing status, income, and deductions.

04

Review and adjust: Review the calculated withholding amount and make any necessary adjustments based on your preferences and financial situation.

05

Save or print the results: Once you're satisfied with the calculations, you can save or print the results for future reference.

06

Consult a tax professional: If you have complex tax situations or uncertainties, it may be beneficial to seek advice from a tax professional.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.