What is Tax Invoice Sample?

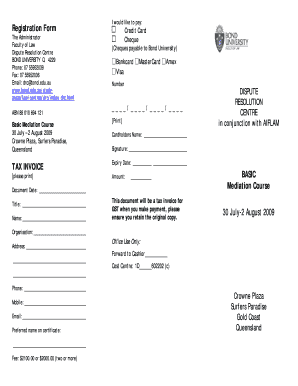

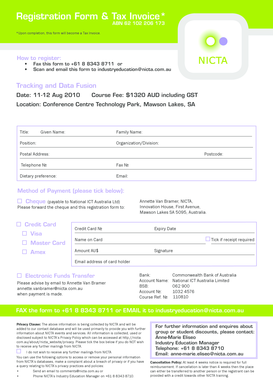

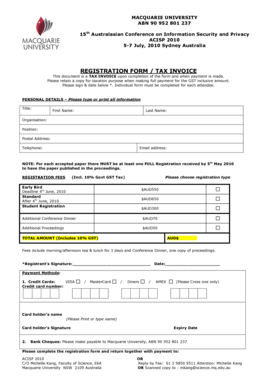

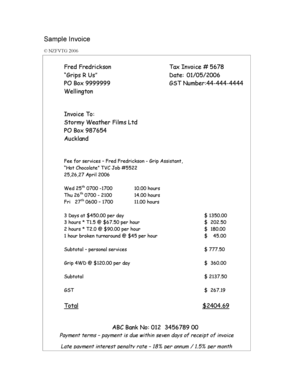

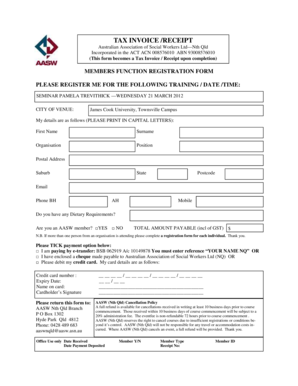

A tax invoice sample is a document that provides detailed information about a sale or purchase transaction. It includes important details such as the names and addresses of both the seller and buyer, the date of the transaction, a description of the goods or services provided, the quantity, and the total amount payable. Tax invoice samples are used for various purposes, such as record-keeping and tax reporting.

What are the types of Tax Invoice Sample?

There are several types of tax invoice samples that can be used depending on the nature of the transaction and the applicable tax laws. Some common types include:

Standard Tax Invoice: This is the most commonly used type of tax invoice and is used for regular sales transactions.

Export Tax Invoice: This is used for sales transactions involving goods or services that are being exported to another country.

Interstate Tax Invoice: This is used for sales transactions that occur between different states within the same country.

Special Tax Invoice: This is used for specific types of transactions that are subject to special tax rules, such as sales of alcohol or tobacco.

Credit Note: This is used to provide a credit or refund to a customer for an overpayment or returned goods.

How to complete Tax Invoice Sample?

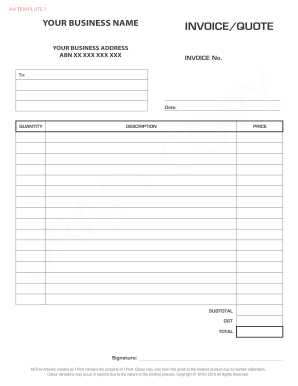

Completing a tax invoice sample is a straightforward process. Here are the steps to follow:

01

Start by entering your business details, including your name, address, and contact information.

02

Next, include the customer's details, such as their name, address, and contact information.

03

Specify the invoice number and the date of the transaction.

04

Provide a detailed description of the goods or services provided, including the quantity and unit price.

05

Calculate the total amount payable, including any applicable taxes.

06

Include payment terms, such as the due date and accepted payment methods.

07

Finally, review the completed tax invoice sample for accuracy and make any necessary corrections before issuing it to the customer.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.