Tax Invoice Template Word

What is tax invoice template word?

A tax invoice template word is a pre-designed document that businesses can use to create professional invoices. It is specifically designed to be used in Microsoft Word, a widely used word processing software. With a tax invoice template word, businesses can easily enter their invoice details, such as customer information, itemized products or services, and sales tax information. This template can be customized to match the branding and style of the business, ensuring a consistent and professional look for all invoices.

What are the types of tax invoice template word?

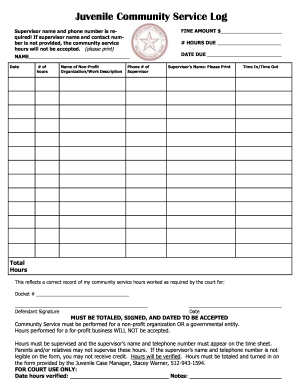

There are several types of tax invoice template word available to businesses. Some common types include: 1. Basic tax invoice template: This template includes the essential elements required for a tax invoice, such as business name, customer details, itemized products or services, and tax information. 2. Detailed tax invoice template: This template provides more space for itemizing products or services, allowing businesses to provide a detailed breakdown of costs. It may also include additional sections for terms and conditions or payment details. 3. Blank tax invoice template: This template provides a blank canvas for businesses to create their own customized tax invoice. It typically includes the necessary fields and sections but allows for more flexibility in design and layout.

How to complete tax invoice template word

Completing a tax invoice template word is a simple process. Here are the steps to follow: 1. Open the tax invoice template word in Microsoft Word. 2. Fill in your business information, including your company name, address, and contact details. 3. Enter the customer's information, such as their name, address, and contact details. 4. Itemize the products or services provided, including a description, quantity, and price for each item. 5. Calculate the subtotal, any applicable sales tax, and the total amount due. 6. Include any additional information or terms and conditions, if necessary. 7. Review the completed tax invoice for accuracy and ensure all necessary information is included. 8. Save and/or print the invoice to share with the customer.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.