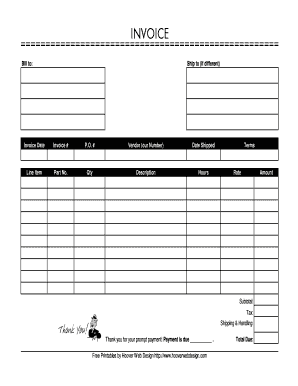

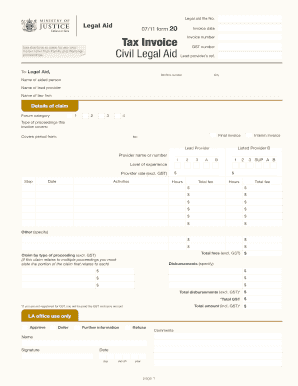

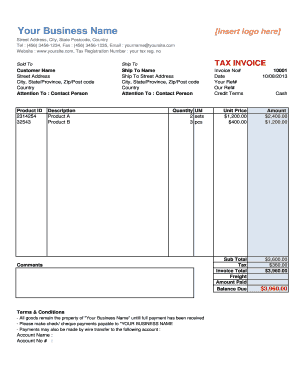

Tax Invoice Template

What is Tax Invoice Template?

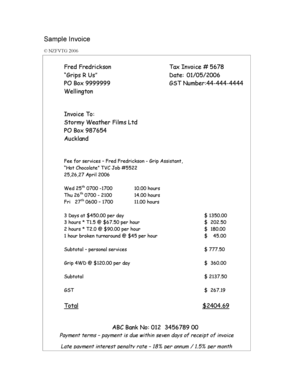

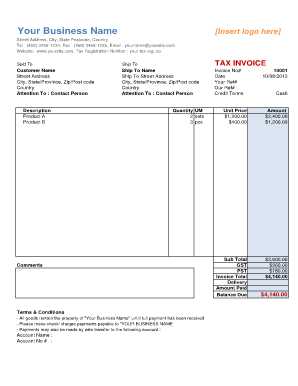

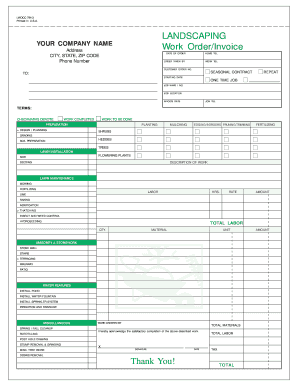

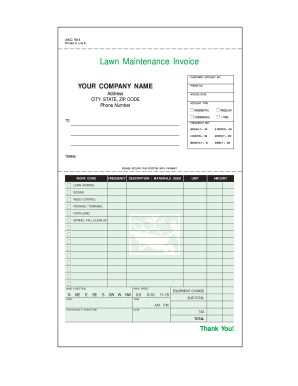

A Tax Invoice Template is a pre-designed document that is used to create invoices for tax-related purposes. It includes all the necessary fields and sections required by tax authorities to calculate and process taxes. By using a Tax Invoice Template, businesses can ensure that they comply with tax regulations and provide accurate and transparent information to their customers and tax authorities.

What are the types of Tax Invoice Template?

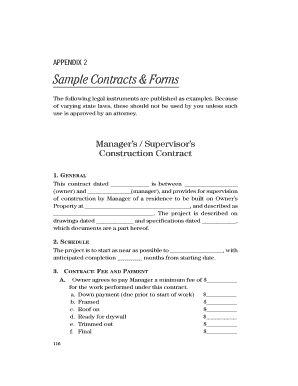

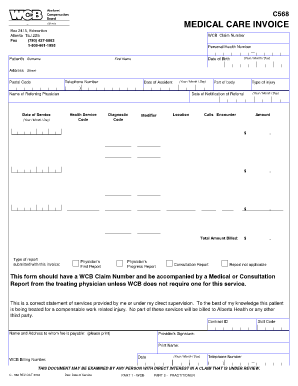

There are various types of Tax Invoice Templates available to cater to different business needs. Some common types include:

How to complete Tax Invoice Template

Completing a Tax Invoice Template is a straightforward process that involves the following steps:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.