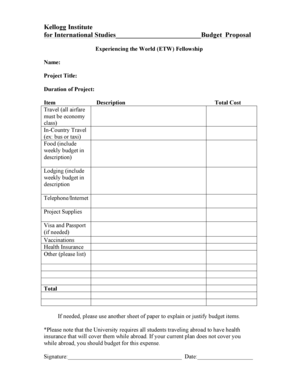

What is Weekly Budget?

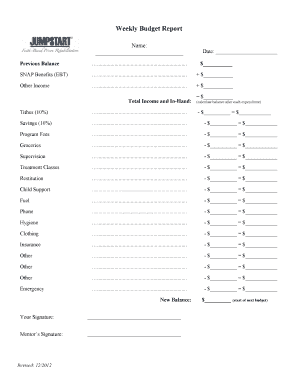

A weekly budget is a financial plan that helps individuals or households allocate their income and expenses on a weekly basis. It provides a structured approach to managing personal finances and allows individuals to track their spending, save money, and achieve financial goals.

What are the types of Weekly Budget?

There are several types of weekly budgets that individuals can choose from based on their financial needs and preferences. Some common types of weekly budgets include:

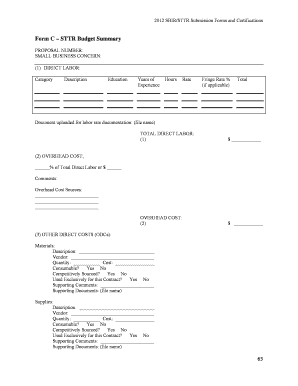

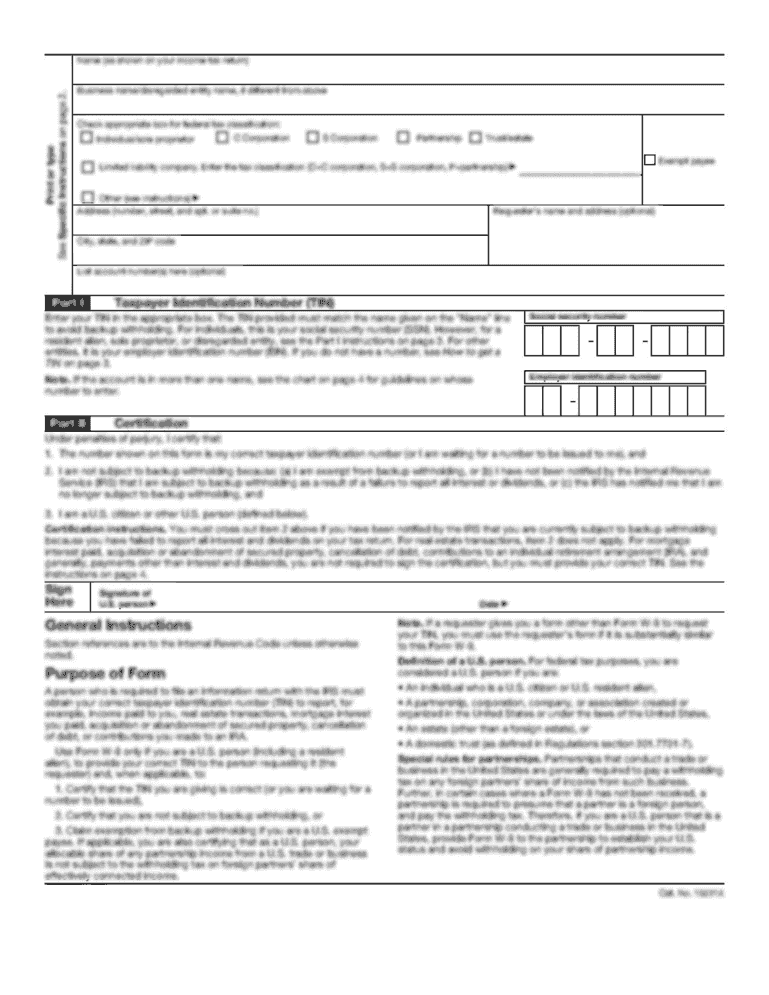

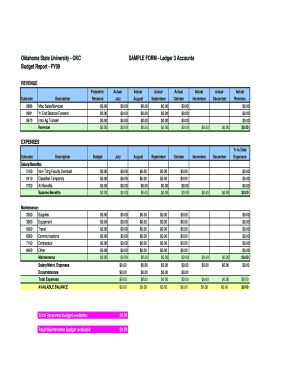

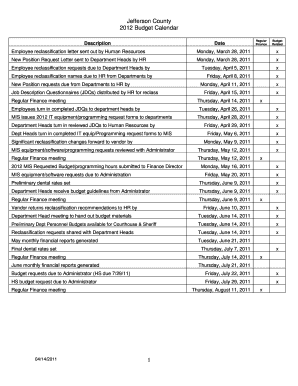

Traditional Budget: This type of budget involves tracking income and expenses manually using pen and paper or a spreadsheet.

Envelope Budget: In this budgeting method, individuals divide their cash into different envelopes representing different spending categories.

Digital Budget: With the advancement of technology, digital budgeting tools and apps are now available to help users track their income and expenses digitally.

Zero-Based Budget: This type of budget requires individuals to allocate every dollar of their income to a specific expense, savings, or debt payment category, resulting in zero remaining dollars.

Percentage Budget: In this budgeting method, individuals allocate a certain percentage of their income to different expense categories, such as housing, transportation, and savings.

Bi-Weekly Budget: This budgeting method is based on a two-week period rather than a traditional weekly budget, allowing individuals to manage their finances on a longer time frame.

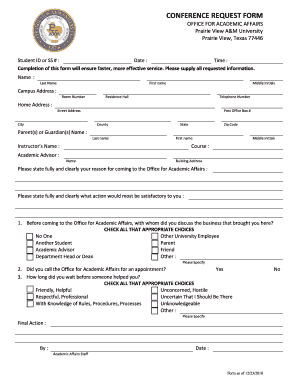

How to complete Weekly Budget

Completing a weekly budget is a simple process that can help individuals take control of their finances. Here are the steps to complete a weekly budget:

01

Determine your income: Calculate your total income for the week from various sources, such as salary, freelance work, or side hustles.

02

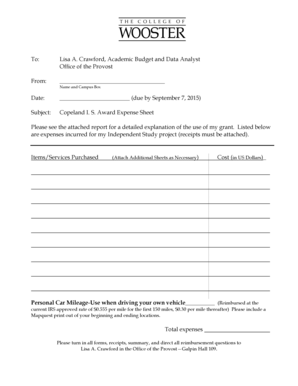

Track your expenses: Keep track of all your expenses throughout the week, including fixed expenses like rent or mortgage payments, utility bills, and variable expenses like groceries, entertainment, and transportation.

03

Categorize your expenses: Group your expenses into different categories, such as housing, transportation, groceries, entertainment, and savings.

04

Allocate your income: Allocate your income to different expense categories based on your priorities and financial goals. Make sure to allocate a portion of your income for savings and emergencies.

05

Monitor your budget: Regularly review and adjust your weekly budget to ensure it aligns with your financial goals and accommodate any changes in income or expenses.

06

Use digital budgeting tools: Consider using digital budgeting tools or apps like pdfFiller to streamline the budgeting process, track your expenses, and easily make adjustments.

07

Seek professional help if needed: If you need assistance with budgeting or managing your finances, don't hesitate to seek help from a financial advisor or credit counselor.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.