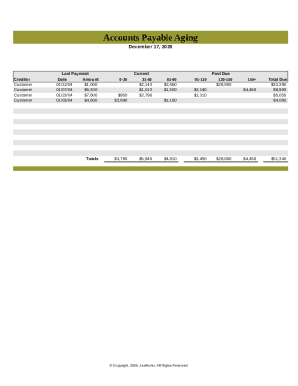

Accounts Payable Aging Spreadsheet

What is Accounts Payable Aging Spreadsheet?

An Accounts Payable Aging Spreadsheet is a tool used by businesses to track and manage their outstanding accounts payable. It helps businesses see how long invoices have been open and identify overdue payments.

What are the types of Accounts Payable Aging Spreadsheet?

There are two main types of Accounts Payable Aging Spreadsheets: Vendor Aging Summary and Vendor Aging Detail.

Vendor Aging Summary: This type provides a summary of the amounts owed to each vendor and how long they have been outstanding.

Vendor Aging Detail: This type gives a detailed breakdown of each invoice, including the invoice date, due date, and amount owed.

How to complete Accounts Payable Aging Spreadsheet

Completing an Accounts Payable Aging Spreadsheet is crucial for managing your company's financial health. Here are some steps to help you complete it:

01

Gather all necessary invoices and payment information.

02

Enter each invoice into the spreadsheet, including the invoice date, due date, and amount owed.

03

Calculate the aging of each invoice by determining how long it has been outstanding.

04

Review the spreadsheet regularly to ensure timely payment of invoices and proper management of accounts payable.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Accounts Payable Aging Spreadsheet

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How do I run an AP aging report in SAP?

Go to the Main Menu and find, Business Partners – Business Partner Reports – Aging – Customer Receivables Aging. Once you have done this, you will be presented with selection criteria. Choose the criteria you wish, such as the customers you wish to appear on the report and the segments of the aging report.

What is an AP aging report?

An accounts payable aging report (or AP aging report) is a vital accounting document that outlines the due dates of the bills and invoices a business needs to pay. The opposite of an AP aging report is an accounts receivable aging report, which offers a timeline of when a business can expect to receive payments.

How do you calculate aging accounts payable in Excel?

The formula here is =D5-E5. Due Date: Due date is the last date for making payment to the creditor. Days Above Due Date: This column shows the number of days that pass the due date. If the due date has not yet arrived it will show “NOT DUE”.

What is the aging schedule of accounts payable?

What Is an Aging Schedule? An aging schedule is an accounting table that shows a company's accounts receivables, ordered by their due dates. Often created by accounting software, an aging schedule can help a company see if its customers are paying on time.

How do I create an AP aging report in Quickbooks?

You can run an A/R Aging summary report to see the total outstanding balances and how long they're past due. Go to Business overview and select Reports (Take me there). In the Who owes you section, select Accounts receivable aging summary. Customize the report as needed:

How do I create an Ageing report in Excel?

How to Create an Aging Report & Formulas in Excel Label the following cells: A1: Customer. B1: Order # C1: Date. D1: Amount Due. Add additional headers for each column as: E1: Days Outstanding. F1: Not Due. G1: 0-30 Days. H1: 31-60 days.