Blend Payment Voucher For Free

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

Discover the simplicity of processing PDFs online

Upload your document in seconds

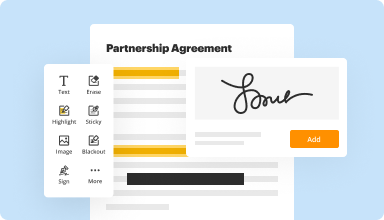

Fill out, edit, or eSign your PDF hassle-free

Download, export, or share your edited file instantly

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Every PDF tool you need to get documents done paper-free

Create & edit PDFs

Generate new PDFs from scratch or transform existing documents into reusable templates. Type anywhere on a PDF, rewrite original PDF content, insert images or graphics, redact sensitive details, and highlight important information using an intuitive online editor.

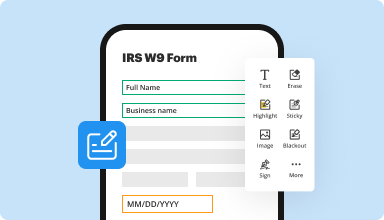

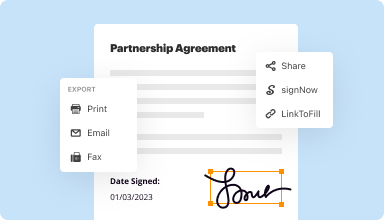

Fill out & sign PDF forms

Say goodbye to error-prone manual hassles. Complete any PDF document electronically – even while on the go. Pre-fill multiple PDFs simultaneously or extract responses from completed forms with ease.

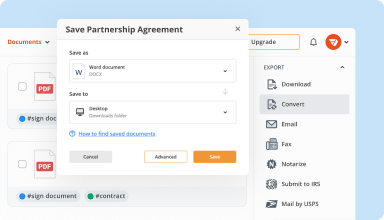

Organize & convert PDFs

Add, remove, or rearrange pages inside your PDFs in seconds. Create new documents by merging or splitting PDFs. Instantly convert edited files to various formats when you download or export them.

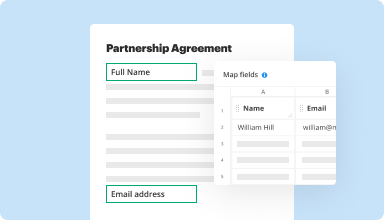

Collect data and approvals

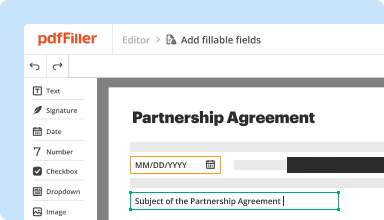

Transform static documents into interactive fillable forms by dragging and dropping various types of fillable fields on your PDFs. Publish these forms on websites or share them via a direct link to capture data, collect signatures, and request payments.

Export documents with ease

Share, email, print, fax, or download edited documents in just a few clicks. Quickly export and import documents from popular cloud storage services like Google Drive, Box, and Dropbox.

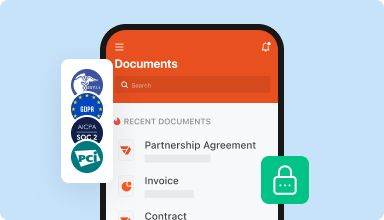

Store documents safely

Store an unlimited number of documents and templates securely in the cloud and access them from any location or device. Add an extra level of protection to documents by locking them with a password, placing them in encrypted folders, or requesting user authentication.

Customer trust by the numbers

64M+

users worldwide

4.6/5

average user rating

4M

PDFs edited per month

9 min

average to create and edit a PDF

Join 64+ million people using paperless workflows to drive productivity and cut costs

Why choose our PDF solution?

Cloud-native PDF editor

Access powerful PDF tools, as well as your documents and templates, from anywhere. No installation needed.

Top-rated for ease of use

Create, edit, and fill out PDF documents faster with an intuitive UI that only takes minutes to master.

Industry-leading customer service

Enjoy peace of mind with an award-winning customer support team always within reach.

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

at first it was a little frustrating and I am still having difficulty in put totals on one of the pages. How do i remove the 0, to replace my correct figure?

2015-08-21

PDFFiller responded to my concerns and moved me from inexperienced to competent user status. They promote a feature that pulls PDF files from your email to your account - looking forward to learning how that works.

2016-01-10

It took just seconds to send my agreement for signature. The customer experience inspires confidence in the security of the transaction and gives a good impression of my company. It is far better than the old - email it, print it, sign it, scan it, email it, "did you get it?"- approach.

2018-02-03

I used your program to work with government forms we needed to complete so I decided to try it for our Contract and Form paperwork that needs to be submitted.

2018-05-25

Excellent program, way easier then DocuSign

Super easy to use and if you need tech support they are there for you.

Its very easy to use and very informative. A couple of clicks and you are done. Tech support is great as well!

It would be nice to get an email when the client opens the contract I send, rather then always having to check

2017-11-20

Excellent support by the Support team…

Excellent support by the pdf filer Support team to check the contents of the issue raised and solve it amicably

Highly appreciate the good work done

Regards

Mohan Nair

2024-02-03

What do you like best?

I. An fill in forms without printing any paper.

What do you dislike?

I haven't found any downsides using pdf filler

What problems is the product solving and how is that benefiting you?

I don't have to print as many papers anymore and I can also fax without being in the office.

2022-11-08

I moved across the country since I had my brochure designed and printed. Meanwhile Covid-19 restrictions gave me the extra push to go 100% virtual with my business. Thus the online marketing material had to be accurate and up to-date. [pdfFiller made it easy for me to easy to update/edit my existing marketing materials.

2021-11-22

It is great for what I am using it to do, however there is likely much more I don't know about yet.

After 2 weeks, I know much more and find the took extremely valuable. Don't know how I worked without it.

2021-02-18

Blend Payment Voucher Feature

The Blend Payment Voucher feature simplifies your payment processes, allowing seamless transactions and better management of financial activities. With this tool, you gain the ability to effectively handle payments while ensuring transparency and efficiency.

Key Features

Easy tracking of payment vouchers

User-friendly interface for quick navigation

Integration with existing accounting systems

Customizable templates for specific business needs

Secure storage of transaction data

Potential Use Cases and Benefits

Ideal for small businesses managing multiple payments

Useful for freelance professionals invoicing clients

Helps in tracking expenses for team projects

Assists in automating payment reminders and follow-ups

Enhances financial reporting and auditing processes

This feature addresses challenges such as lost vouchers and payment discrepancies. By providing clear documentation and an organized approach, the Blend Payment Voucher feature allows you to focus on growth rather than financial headaches. Gain control over your transactions today.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

How do I make a payment voucher?

Serial number of voucher. Type of Voucher. Date of Voucher. Debit Column. Credit Column. Amount in figures and words. Total Column. Particulars column in which brief description of the transaction is being mentioned.

How do I use a payment voucher?

A document which can be used as proof that a monetary transaction has occurred between two parties. In business, a payment voucher can be used for a variety of purposes, sometimes taking the place of cash in a transaction, acting as a receipt, or indicating that an invoice has been approved for payment.

What is payment voucher with example?

Payment voucher is used for all types of payments like payment to creditor, bill payment, etc. Receipt voucher for all types of money receipts example amount received from customers, capital introduced in to the business, loans taken, loans and advances refunded, commission,rent etc.

Is there a payment voucher for Form 1040?

If you can't pay your tax bill in its entirety right now, but you know that you'll be able to do so within 45 days, send in a partial payment using the Form 1040-V payment voucher at the time you file your return. Most tax preparation software provides the form, and it's also available online at the IRS website.

How do I create a payment voucher in Excel?

7:03 13:14 Suggested clip payment Voucher in MS. Excel. Business Transaction Payment YouTubeStart of suggested client of suggested clip payment Voucher in MS. Excel. Business Transaction Payment

What is 1040v payment voucher?

Form 1040-V is a payment voucher that taxpayers send to the Internal Revenue Service (IRS) along with their tax return if they choose to make a payment with a check or money order. Mailing in a payment is an option if there's a figure on the “Amount you owe” line of your Form 1040, 1040-SR, or 1040NR.

Can you pay 1040 V payment vouchers online?

You can also pay your taxes online or by phone either by a direct transfer from your bank account or by credit or debit card. Paying online or by phone is convenient and secure and helps make sure we get your payments on time. For more information, go to www.irs.gov/e-pay.

How do I pay my 1040 V online?

You can also pay your taxes online or by phone either by a direct transfer from your bank account or by credit or debit card. Paying online or by phone is convenient and secure and helps make sure we get your payments on time. For more information, go to www.irs.gov/e-pay.

#1 usability according to G2

Try the PDF solution that respects your time.