Byline IRS Form 1040-ES For Free

Users trust to manage documents on pdfFiller platform

Watch a short video walkthrough on how to add an Byline IRS Form 1040-ES

pdfFiller scores top ratings in multiple categories on G2

Create a legally-binding Byline IRS Form 1040-ES in minutes

pdfFiller enables you to handle Byline IRS Form 1040-ES like a pro. No matter what platform or device you run our solution on, you'll enjoy an instinctive and stress-free way of executing paperwork.

The entire pexecution flow is carefully safeguarded: from adding a document to storing it.

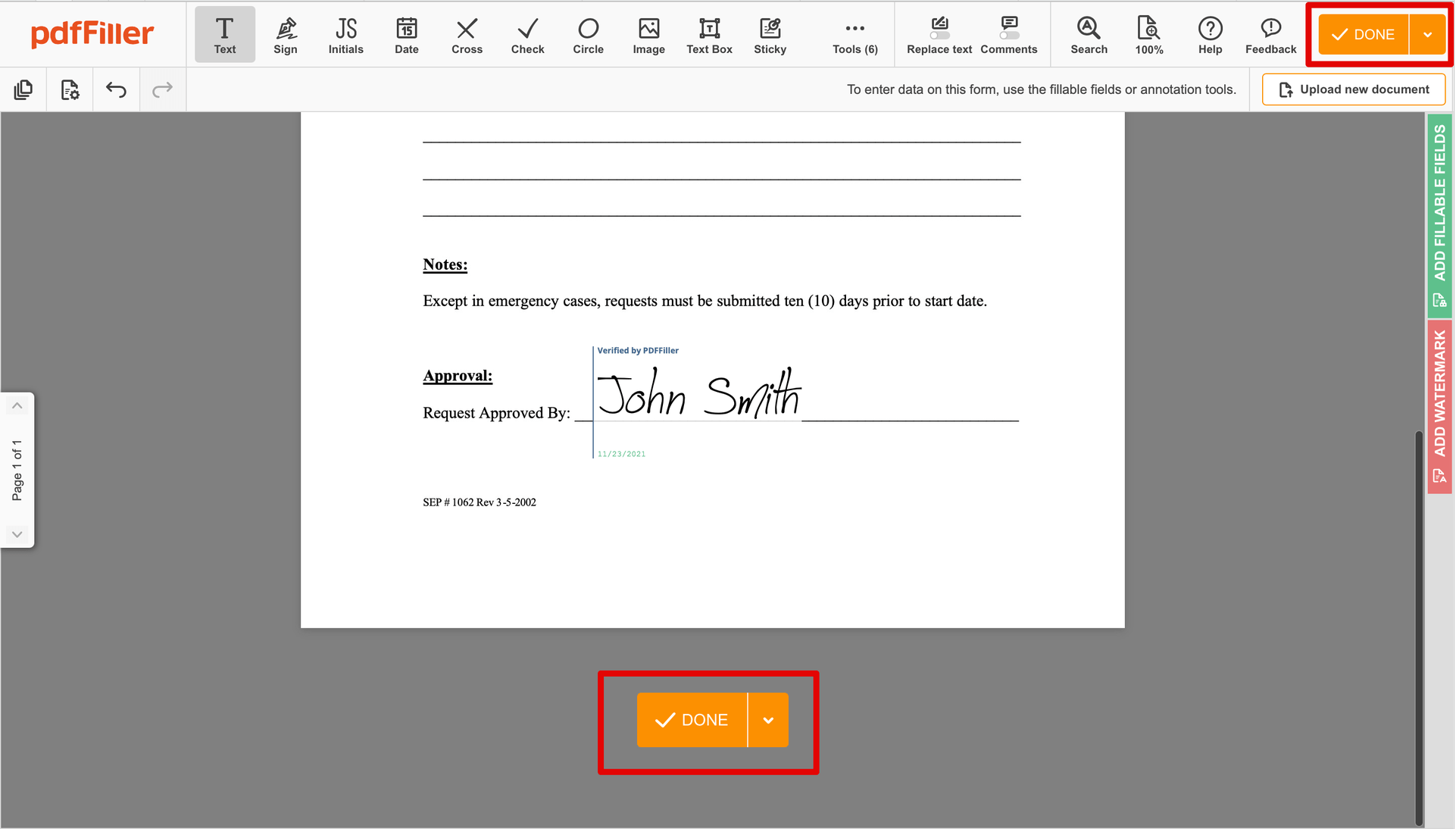

Here's how you can generate Byline IRS Form 1040-ES with pdfFiller:

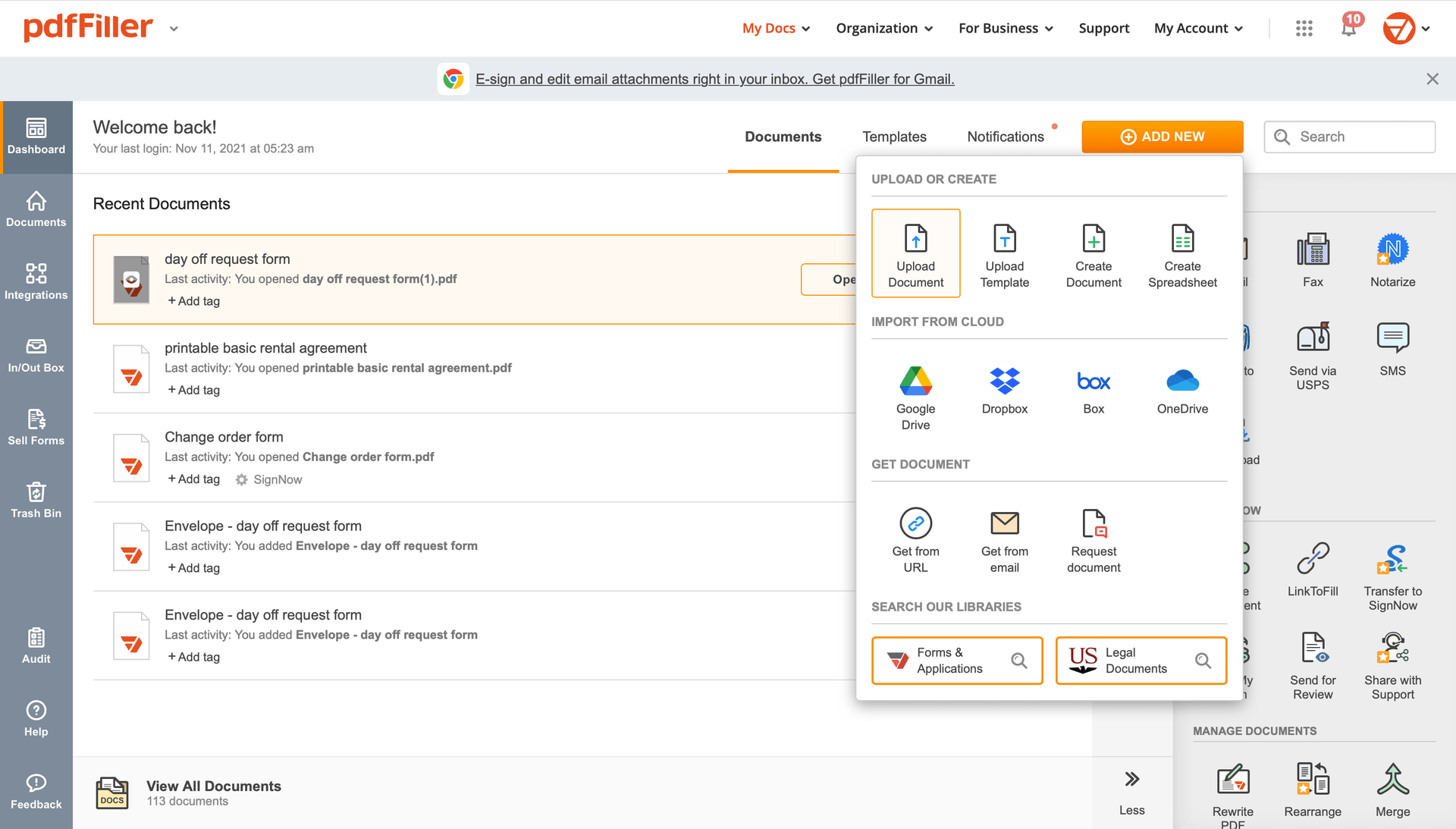

Choose any available option to add a PDF file for completion.

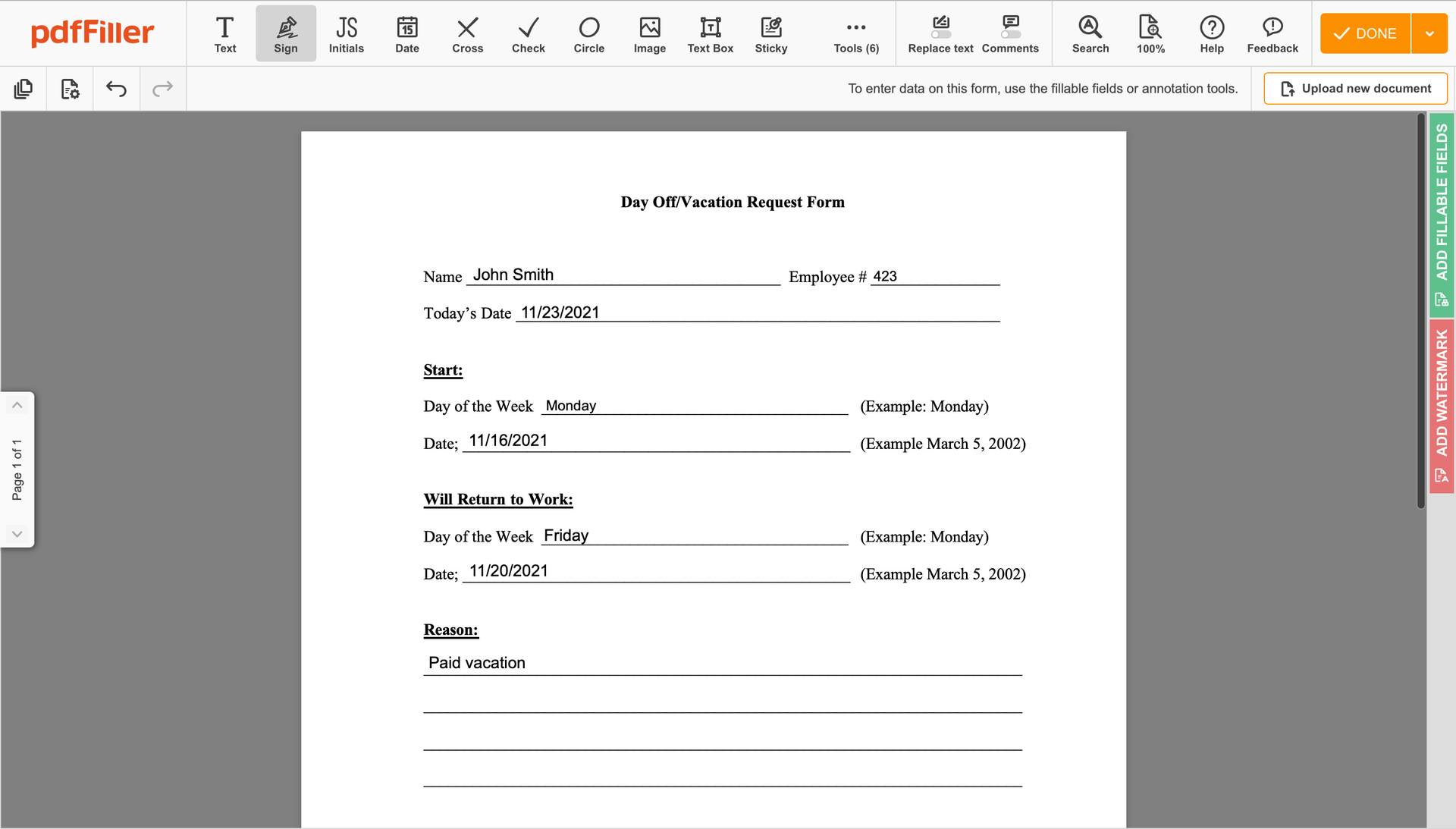

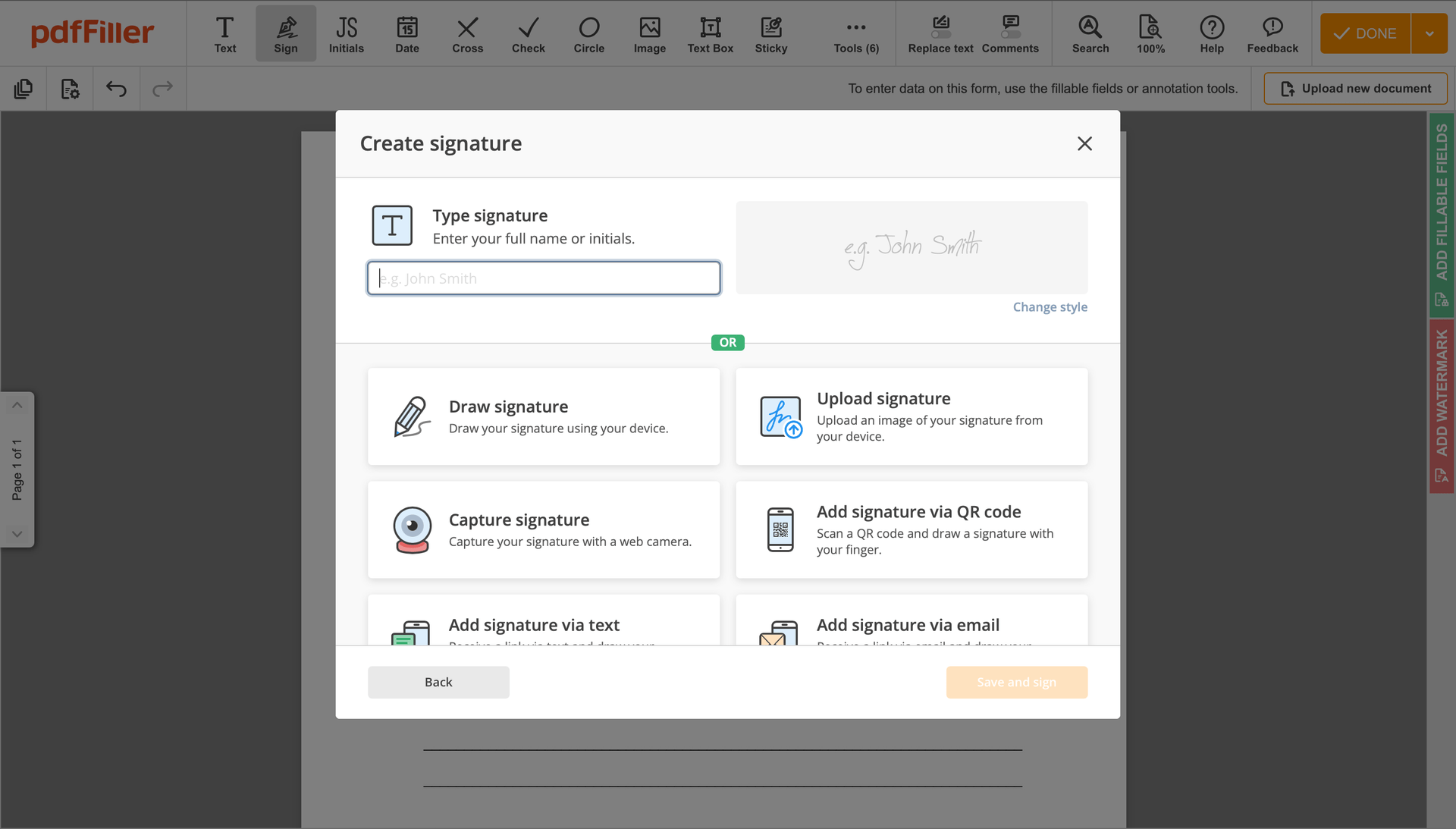

Utilize the toolbar at the top of the interface and choose the Sign option.

You can mouse-draw your signature, type it or add a photo of it - our tool will digitize it automatically. As soon as your signature is created, click Save and sign.

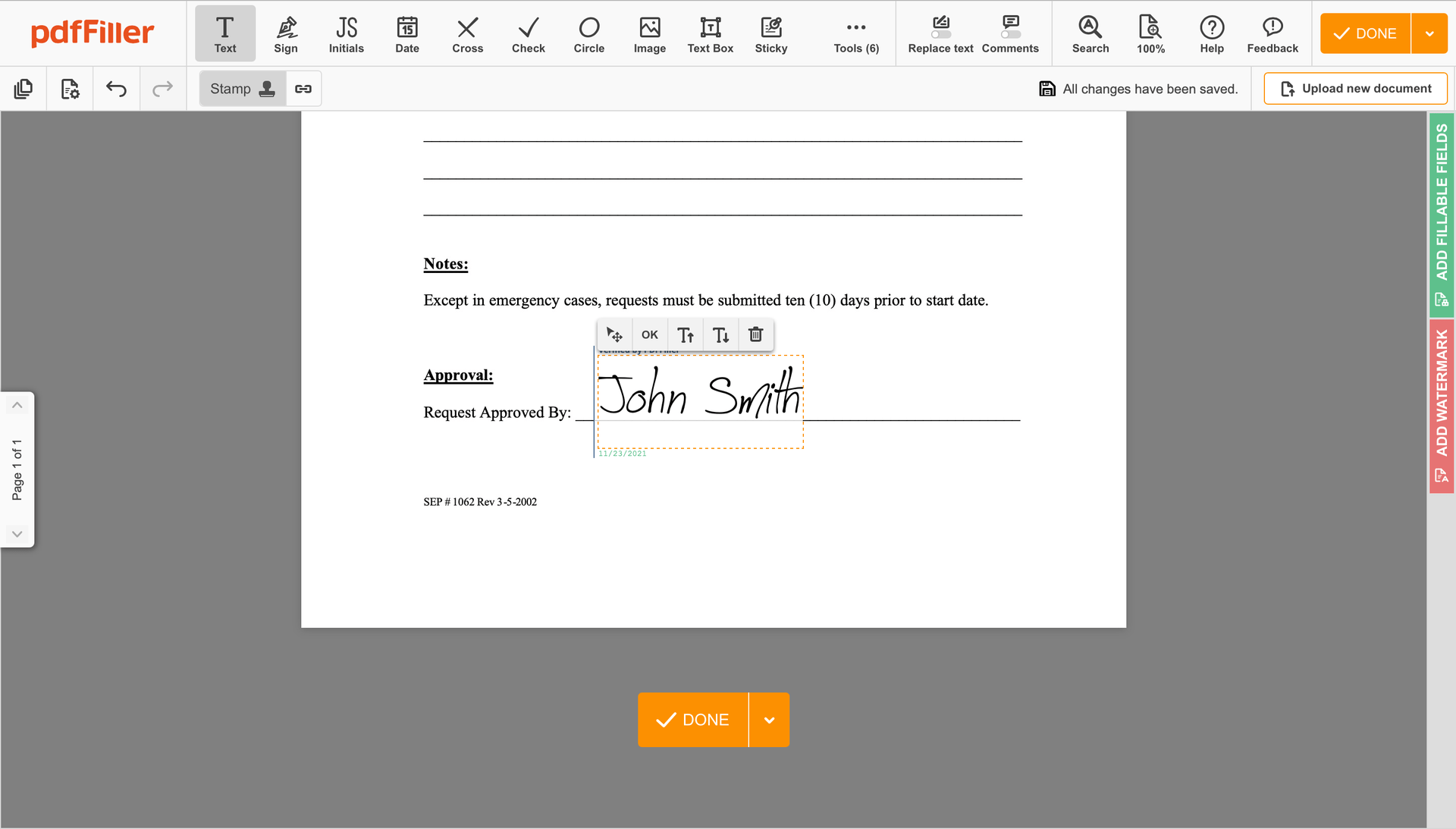

Click on the form area where you want to add an Byline IRS Form 1040-ES. You can move the newly created signature anywhere on the page you want or change its configurations. Click OK to save the adjustments.

Once your document is all set, hit the DONE button in the top right corner.

As soon as you're through with signing, you will be redirected to the Dashboard.

Use the Dashboard settings to get the executed copy, send it for further review, or print it out.

Are you stuck working with numerous programs for creating and managing documents? We have the perfect all-in-one solution for you. Use our platform to make the process efficient. Create document templates on your own, modify existing formsand other useful features, within one browser tab. You can use Byline IRS Form 1040-ES with ease; all of our features are available instantly to all users. Have the value of full featured tool, for the cost of a lightweight basic app. The key is flexibility, usability and customer satisfaction.

How to edit a PDF document using the pdfFiller editor:

How to Send a PDF for eSignature

What our customers say about pdfFiller

I enjoy the ability to create fillable forms along with the e-signature. PDF filler allows me to make forms for use around the office that were once blank copies to fill in by hand where many mistakes were made. Having the ability to make forms has reduced the amount of mistakes to almost none. This program saves time, ensures more accuracy to your documents, keeps files stored neatly and are easy to access in the future. This is a must when preparing any proposals. Have tried other PDF edit programs and they are clunky and not easy to use. The other programs are hard to find your documents after creation.

What do you dislike?

There are a couple of uses that are not at my price level that would be nice to pay just if you need that function for a one time use.

Recommendations to others considering the product:

PDF filler is so much easier to use rather than free trial software. The application allows you to make quick edits of all document types and is a real time saver when it comes to preparing proposals and gathering signatures. If you require mass editing multiple file formats and want to save time this program is a must. This program is used exclusively when compiling proposals. The ease of edits and write over capability saves time by not needing to re-type documents, instead write right to the document. The cost of PDF filler is really affordable for all you get when it comes to processing pdf's.

What problems are you solving with the product? What benefits have you realized?

I receive many forms to fill out by hand and instead use PDF Filler. This saves a lot of time and ensures less errors on when sending forms back to the sender. The receiver doesn't have to hope handwritten documents can be read. PDF Filler has reduced the amount of printed documents.