Choose Chart Deed For Free

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

Discover the simplicity of processing PDFs online

Upload your document in seconds

Fill out, edit, or eSign your PDF hassle-free

Download, export, or share your edited file instantly

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Every PDF tool you need to get documents done paper-free

Create & edit PDFs

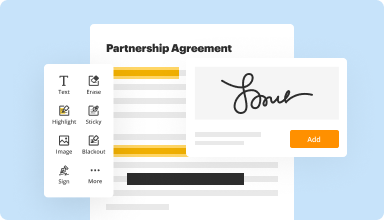

Generate new PDFs from scratch or transform existing documents into reusable templates. Type anywhere on a PDF, rewrite original PDF content, insert images or graphics, redact sensitive details, and highlight important information using an intuitive online editor.

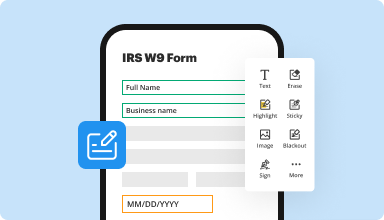

Fill out & sign PDF forms

Say goodbye to error-prone manual hassles. Complete any PDF document electronically – even while on the go. Pre-fill multiple PDFs simultaneously or extract responses from completed forms with ease.

Organize & convert PDFs

Add, remove, or rearrange pages inside your PDFs in seconds. Create new documents by merging or splitting PDFs. Instantly convert edited files to various formats when you download or export them.

Collect data and approvals

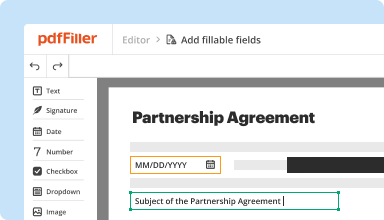

Transform static documents into interactive fillable forms by dragging and dropping various types of fillable fields on your PDFs. Publish these forms on websites or share them via a direct link to capture data, collect signatures, and request payments.

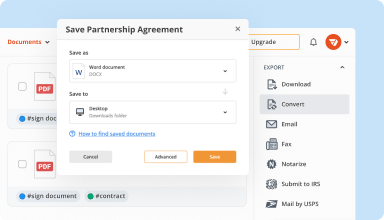

Export documents with ease

Share, email, print, fax, or download edited documents in just a few clicks. Quickly export and import documents from popular cloud storage services like Google Drive, Box, and Dropbox.

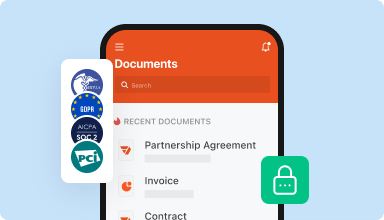

Store documents safely

Store an unlimited number of documents and templates securely in the cloud and access them from any location or device. Add an extra level of protection to documents by locking them with a password, placing them in encrypted folders, or requesting user authentication.

Customer trust by the numbers

64M+

users worldwide

4.6/5

average user rating

4M

PDFs edited per month

9 min

average to create and edit a PDF

Join 64+ million people using paperless workflows to drive productivity and cut costs

Why choose our PDF solution?

Cloud-native PDF editor

Access powerful PDF tools, as well as your documents and templates, from anywhere. No installation needed.

Top-rated for ease of use

Create, edit, and fill out PDF documents faster with an intuitive UI that only takes minutes to master.

Industry-leading customer service

Enjoy peace of mind with an award-winning customer support team always within reach.

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

So far so good. Was very helpful in completing government report on non-fillable .pdf document. That was the original purchase purpose. Now trying out modification / repair of existing fillable forms.

2016-02-04

I originally downloaded Adobe Flash Player thinking I could make my own PDS I was wrong it was I'm no help. Just by doing a simple internet search. I came across your website it's amazing. It does everything I needed to do and more so happy I found it! I'm a landlord and now I can send applications online and fill out leases online so convenient.

2018-02-12

i love the user experience but it is a little difficult to tell where the writing will show up on the lines once I save to PDF and send to clients. also, if the lines are close together it is hard to tell if your letters will get cut off. but overall its a great product going to try to use online and see how that works.

2019-02-03

This really works

My over all experience was pretty good I really like this software and would reccomend it to everyone it is definitely my top choice.

I liked the fact that you could take virtually any document and fill in the spaces with the information of your own. It really makes things a lot easier

I didnt like how you couldn't delete words that were already there I wish it was all in one app instead of having to download 3 or 4 different apps to get what I want done accomplished

2019-12-03

Been incredibly helpful and ultra convenient.  I recommend it to everyone The lists of documents is very beneficial and highly informative

2024-11-10

pdf filler is exactly what I needed

pdf filler is exactly what I needed! I no longer have to hand write every field, I can quickly and easily type the information. It helps make my document much neater and legible.

2023-07-23

I love that they are there to help and…

I love that they are there to help and support you in times of need. Kara was a great help to me today and was able to fix my problem expeditiously.

2023-07-04

I'm am satisfied with the services and…

I'm am satisfied with the services and Support PDFFiiller provides.. Very Helpful and I highly recommend. Thank You

2021-04-27

Fillable Forms

I wish you could download your fillable form to a website with all features included

You an edit PDFs and make forms fillable. It is easy to navigate and design your forms. I thought it was easy to add additional information to an existing pdf.

I would like to be able to download the form to my computer and post to my company website and have all features work.

2020-05-05

Choose Chart Deed Feature

Discover the Choose Chart Deed feature, a powerful tool designed to help you create and manage chart deeds with ease. This feature simplifies your workflow and enhances your ability to make informed decisions based on visual data.

Key Features

User-friendly interface for quick navigation

Customizable chart templates to suit your needs

Real-time data integration for accurate reporting

Collaboration tools for team input and feedback

Export options for sharing and presenting data

Potential Use Cases and Benefits

Create visual representations of financial data to influence investment strategies

Design project timelines to improve team collaboration and efficiency

Prepare insightful presentations for stakeholders or clients

Analyze market trends to make data-driven business decisions

Monitor progress on key metrics to achieve your goals

The Choose Chart Deed feature addresses your need for clear, digestible data representation. It eliminates the frustration of complex data sets by transforming them into easy-to-understand charts. You can now make decisions based on visual insights, enhancing your effectiveness and boosting your confidence in the choices you make.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

What is the difference between a deed of trust and a mortgage?

The basic difference between the mortgage as a security instrument and a Deed of Trust is that in a Deed of Trust there are three parties involved, the borrower, the lender, and a trustee, whereas in a mortgage document there are only two parties involved, the borrower and the lender.

What is the difference between a trust and a deed?

They serve different purposes and are signed by different parties. The warranty deed transfers the property's ownership from the current owner to the new buyer, while the deed of trust ensures the lender has interest in the property in the event a buyer defaults on the loan.

What does a deed of trust mean?

In real estate in the United States, a deed of trust or trust deed is a deed wherein legal title in real property is transferred to a trustee, which holds it as security for a loan (debt) between a borrower and lender. ... The borrower is referred to as the trust or, while the lender is referred to as the beneficiary.

How does a deed of trust work?

Real Estate A Deed of Trust is essentially an agreement between a lender and a borrower to give the property to a neutral third party who will serve as a trustee. The trustee holds the property until the borrower pays off the debt. ... Deeds of Trust are not as common as they once were.

Is a mortgage a trust?

A mortgage is a two-some; a deed of trust is a trio: A mortgage has two parties: a mortgagor (the borrower) and a mortgagee (the lender). A deed of trust, however, has three parties: the borrower, the lender, and a trustee.

How long does a deed of trust last?

A deed of trust expires can and will expire based upon one of two specific timelines. The deed can either expire at a designated point follow the maturity date or, in the absence of this information, exactly 35 years after the date on which the deed had been recorded.

What is a deed of trust on a house?

In real estate in the United States, a deed of trust or trust deed is a deed wherein legal title in real property is transferred to a trustee, which holds it as security for a loan (debt) between a borrower and lender. The equitable title remains with the borrower.

What is a deed of trust on a property?

In real estate in the United States, a deed of trust or trust deed is a deed wherein legal title in real property is transferred to a trustee, which holds it as security for a loan (debt) between a borrower and lender. The equitable title remains with the borrower.

What information is on a deed of trust?

The deed of trust is security of the debt, secured by the property, whereas the promissory note is secured by the deed of trust. The promissory note is the evidence of the debt. It's a promise to pay, signed by the borrower in favor of the lender.

Does a deed of trust have to be recorded?

The person who owns the property usually signs a promissory note and a deed of trust. The deed of trust does not have to be recorded to be valid. A deed of trust is recorded, however, to give constructive notice of the encumbrance to the...

#1 usability according to G2

Try the PDF solution that respects your time.