Comment 1040 Form For Free

Users trust to manage documents on pdfFiller platform

Watch a quick video tutorial on how to Comment 1040 Form

pdfFiller scores top ratings in multiple categories on G2

Comment 1040 Form with the swift ease

pdfFiller allows you to Comment 1040 Form quickly. The editor's hassle-free drag and drop interface ensures fast and user-friendly document execution on any device.

Ceritfying PDFs electronically is a quick and secure method to verify documents at any time and anywhere, even while on the go.

Go through the detailed instructions on how to Comment 1040 Form electronically with pdfFiller:

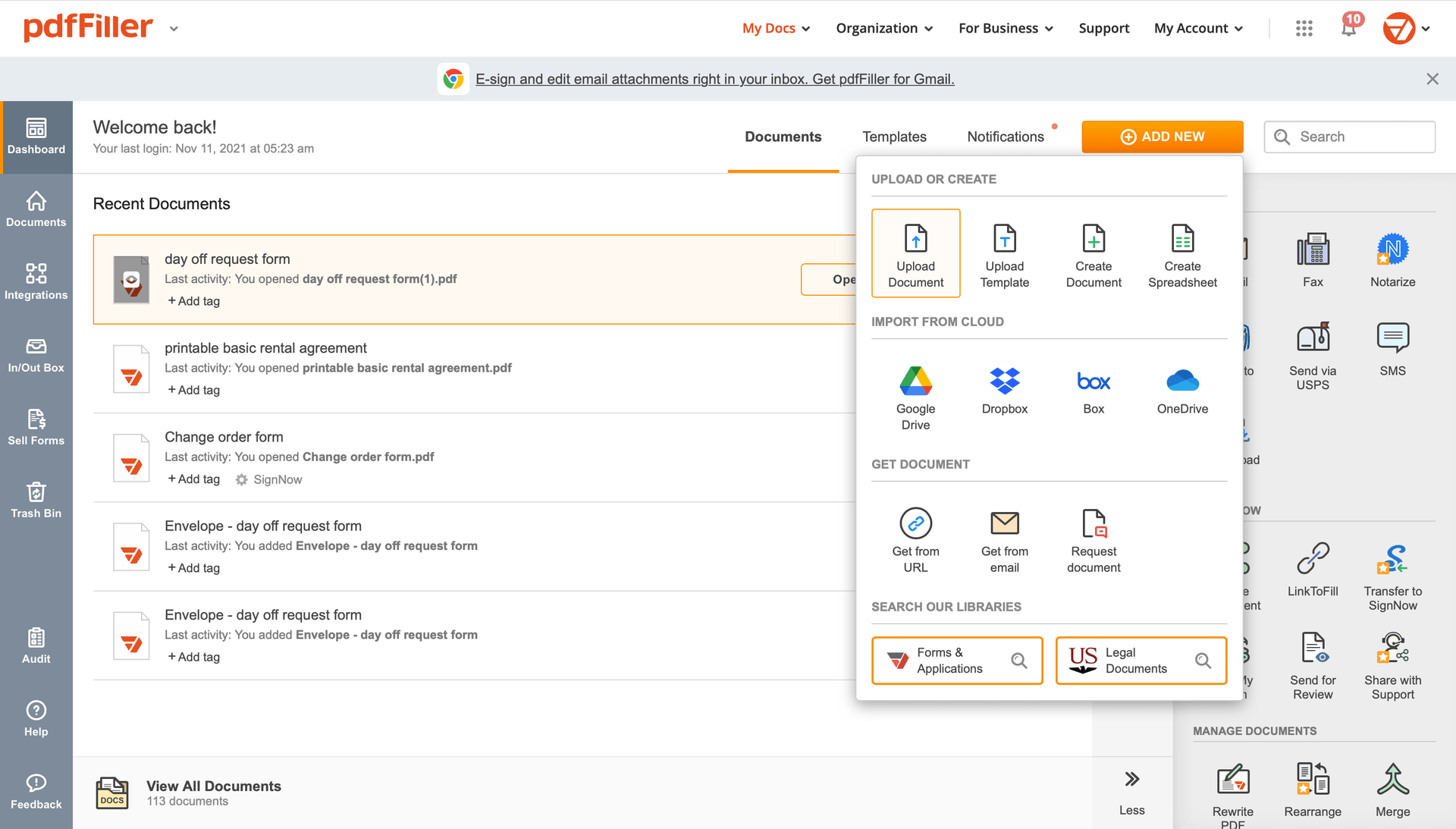

Add the form for eSignature to pdfFiller from your device or cloud storage.

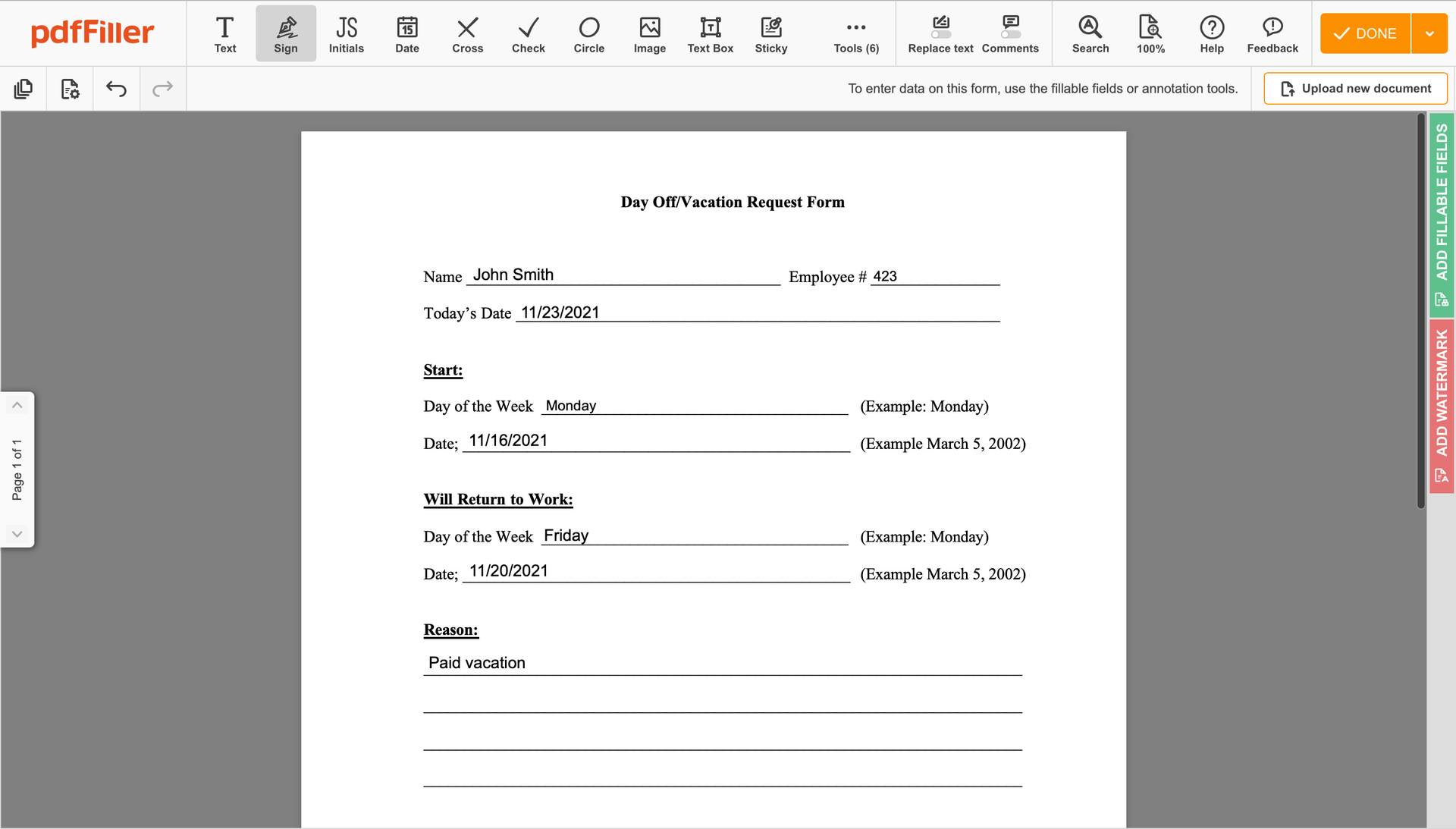

Once the document opens in the editor, hit Sign in the top toolbar.

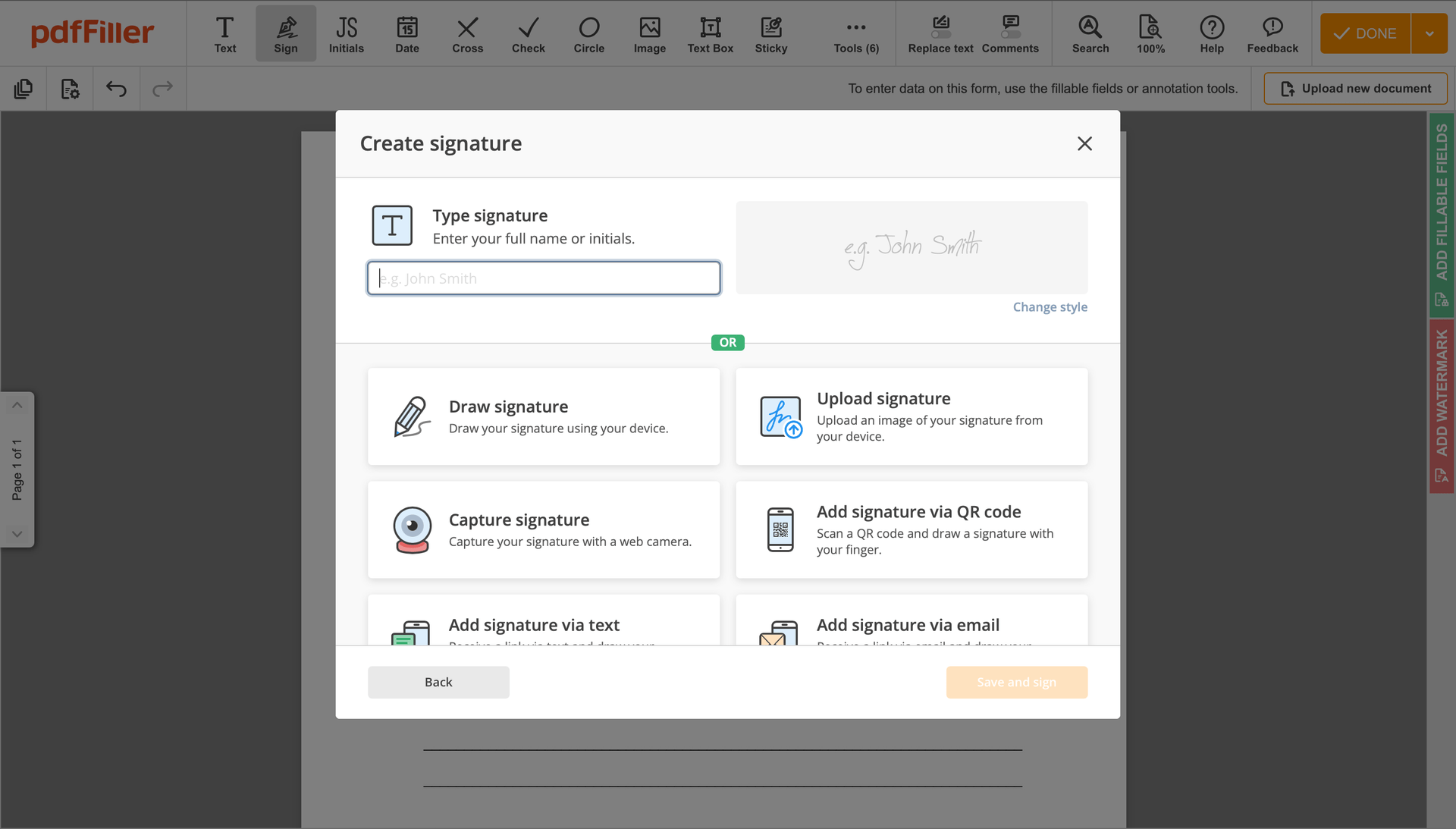

Generate your electronic signature by typing, drawing, or adding your handwritten signature's image from your device. Then, click Save and sign.

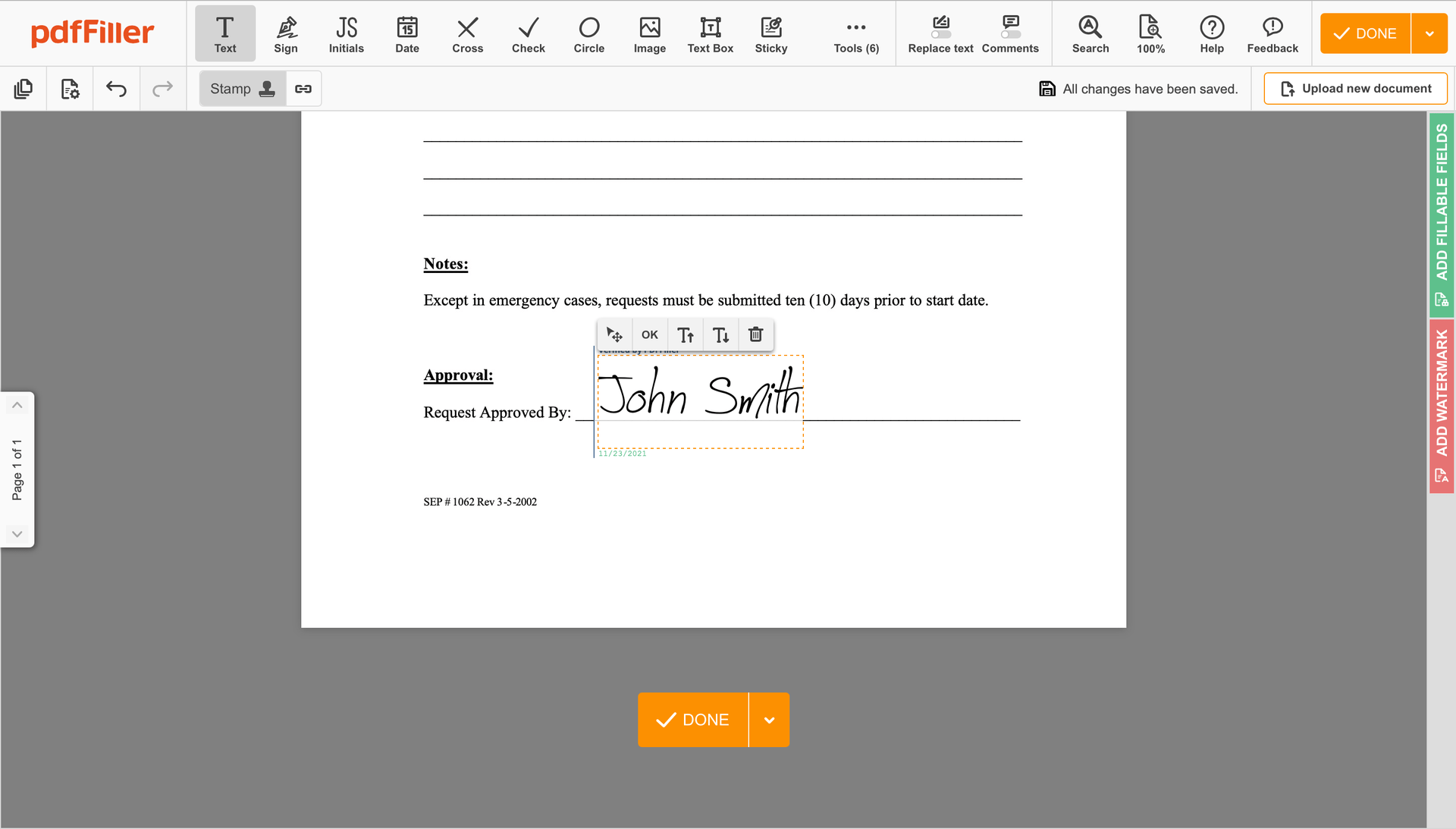

Click anywhere on a document to Comment 1040 Form. You can drag it around or resize it using the controls in the floating panel. To apply your signature, click OK.

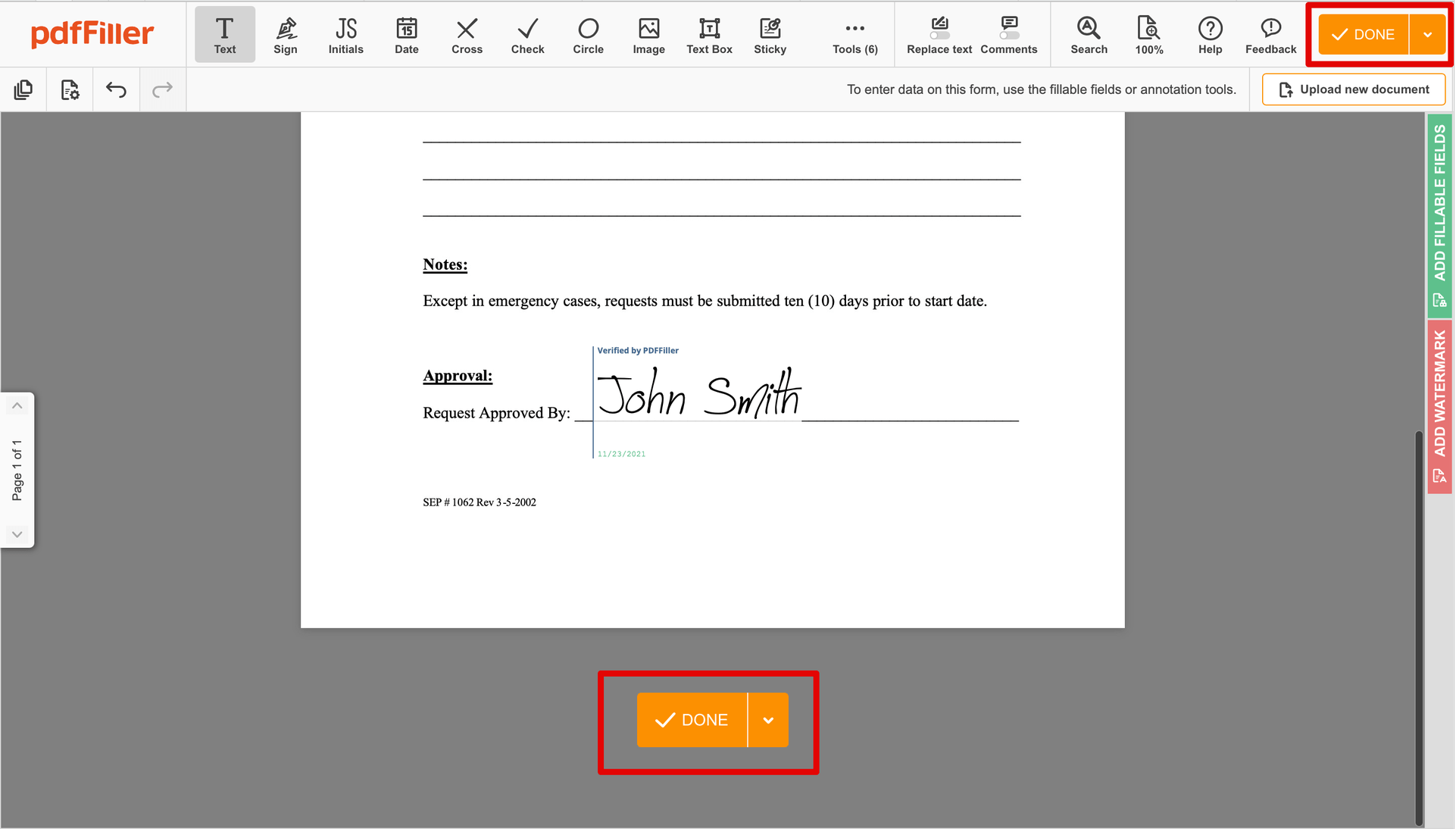

Complete the signing session by hitting DONE below your form or in the top right corner.

After that, you'll go back to the pdfFiller dashboard. From there, you can get a signed copy, print the form, or send it to other people for review or validation.

Still using numerous applications to manage your documents? Use our solution instead. Use our platform to make the process simple. Create forms, contracts, make template sand even more useful features, without leaving your account. Plus, the opportunity to use Comment 1040 Form and add high-quality features like orders signing, alerts, attachment and payment requests, easier than ever. Pay as for a basic app, get the features as of a pro document management tools. The key is flexibility, usability and customer satisfaction.

How to edit a PDF document using the pdfFiller editor:

How to Send a PDF for eSignature

How to Use the Comment 1040 Form Feature in pdfFiller

The Comment 1040 Form feature in pdfFiller allows you to easily add comments and annotations to your 1040 form. Follow these simple steps to make the most of this feature:

With the Comment 1040 Form feature, you can easily collaborate with others and provide additional information or explanations on your 1040 form. Start using this feature today to enhance your document workflow!

What our customers say about pdfFiller

This has saved me some much time on filling out all my documents & storing them as well !!! I just love how you can erase information & add other items to it as well!

What do you dislike?

Sometimes it does have a hard time reading some of the documents & uploading them correctly . I then have to restart the program a couple of times before it actually is able to load the document .

What problems are you solving with the product? What benefits have you realized?

With this software i am able to edit all my PDF'S add & delete any information that needs to be revised & have an amazing clean, clear & legible PDF's for my clients to view!!!