Comment ISDA Master Agreement For Free

Users trust to manage documents on pdfFiller platform

Watch a quick video tutorial on how to Comment ISDA Master Agreement

pdfFiller scores top ratings in multiple categories on G2

Comment ISDA Master Agreement with the swift ease

pdfFiller enables you to Comment ISDA Master Agreement quickly. The editor's handy drag and drop interface ensures quick and intuitive signing on any operaring system.

Ceritfying PDFs online is a fast and safe way to verify paperwork at any time and anywhere, even while on the go.

See the detailed guide on how to Comment ISDA Master Agreement online with pdfFiller:

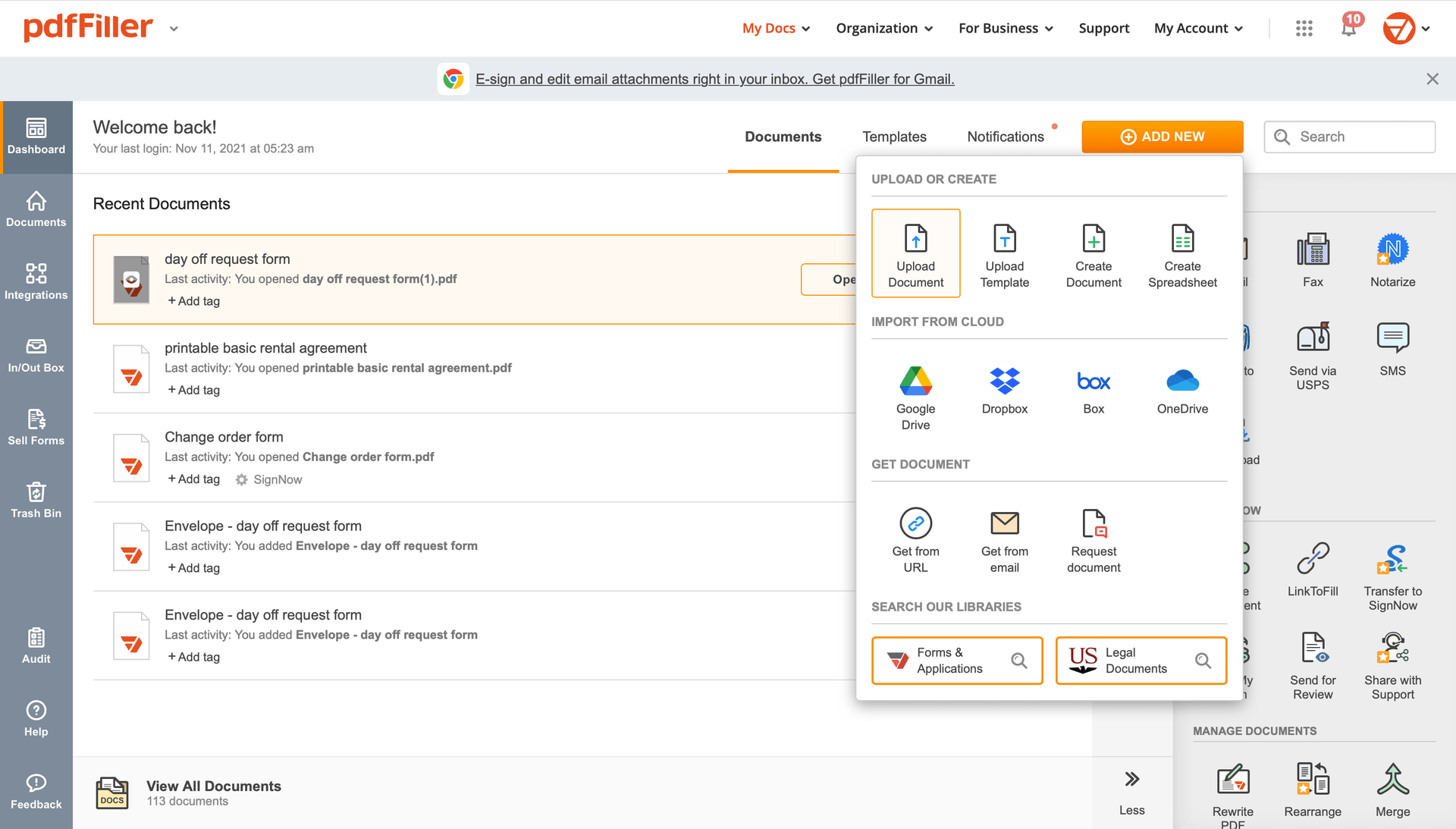

Upload the document you need to sign to pdfFiller from your device or cloud storage.

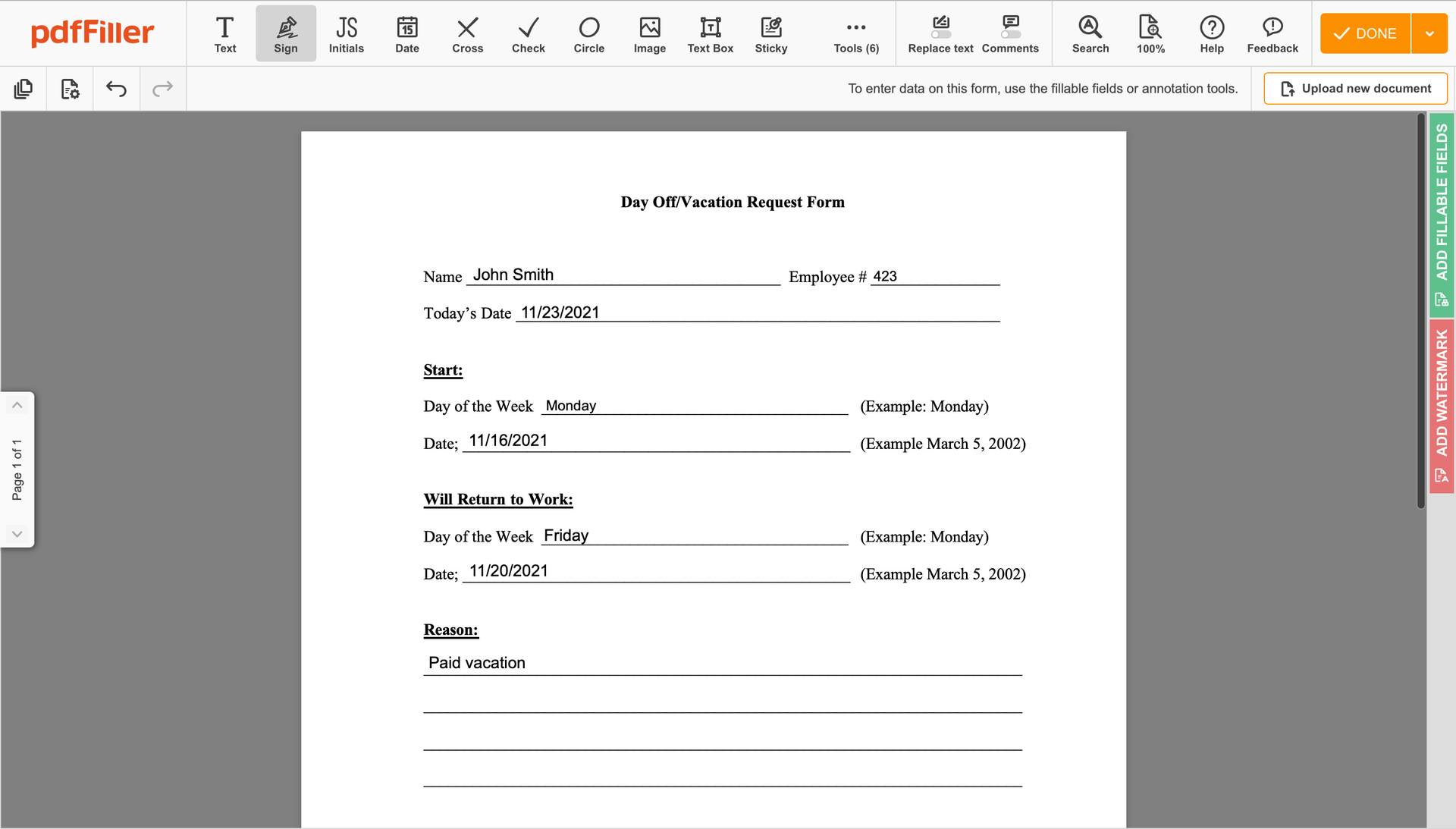

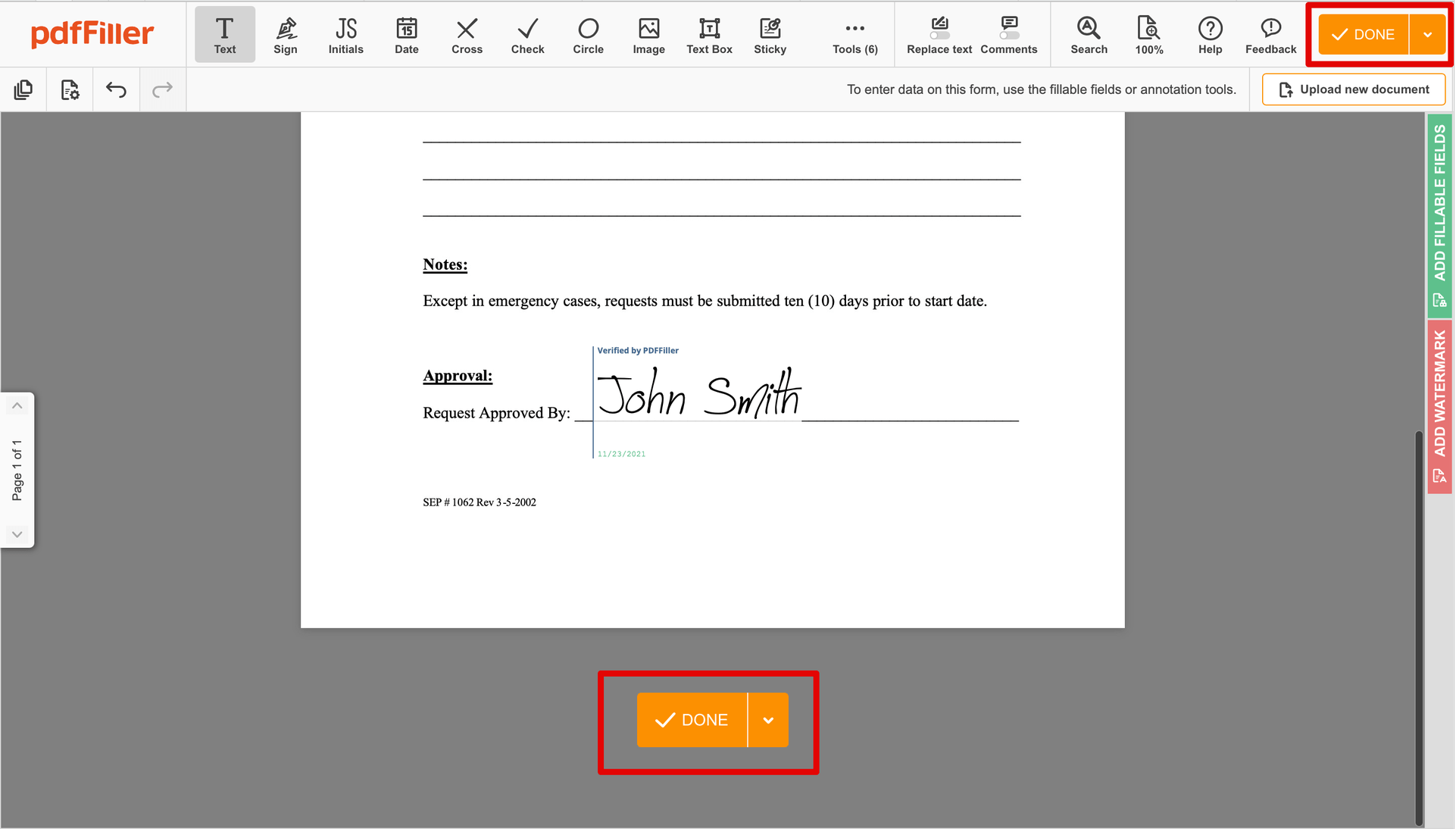

Once the file opens in the editor, hit Sign in the top toolbar.

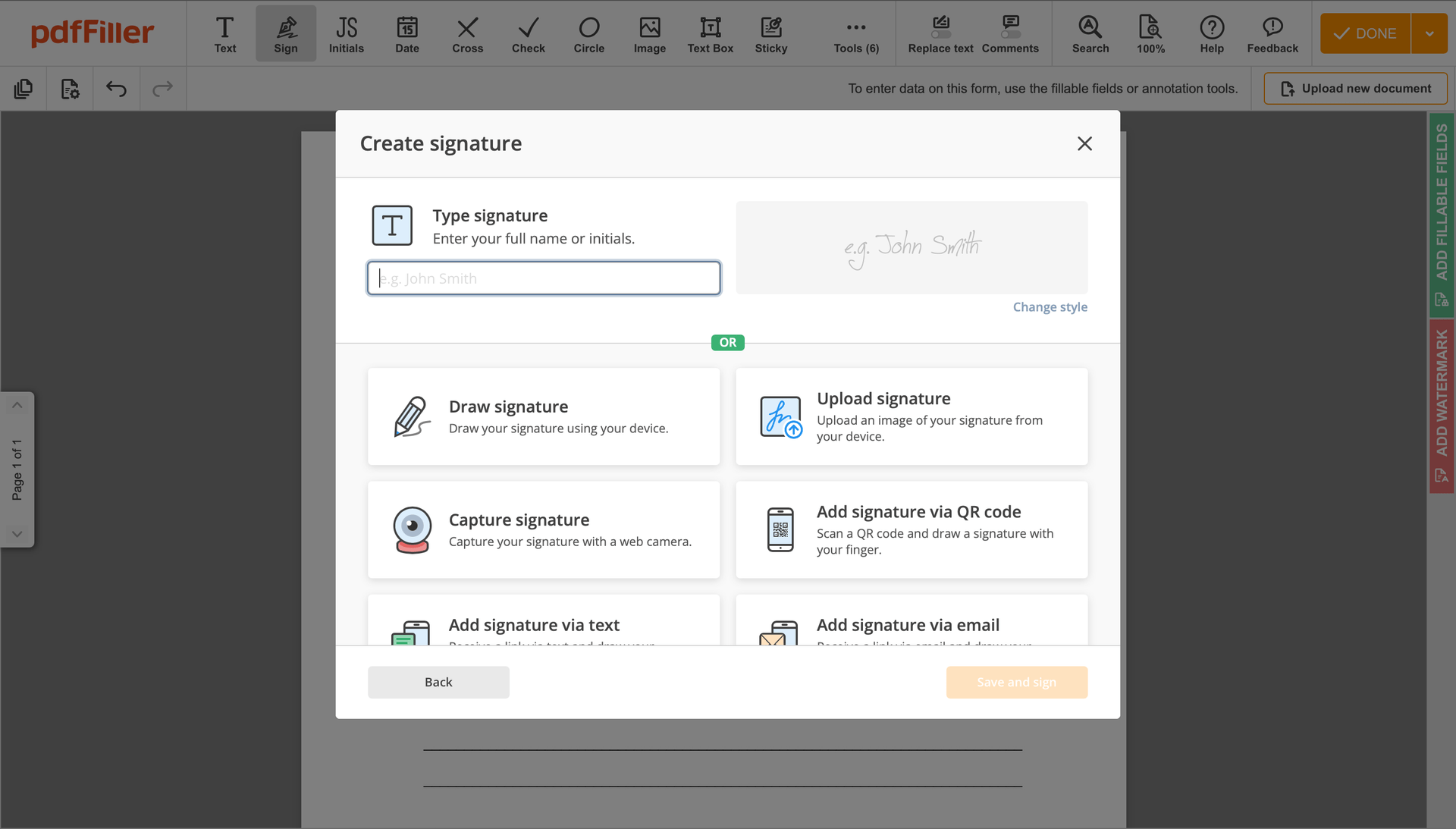

Create your electronic signature by typing, drawing, or adding your handwritten signature's photo from your laptop. Then, hit Save and sign.

Click anywhere on a document to Comment ISDA Master Agreement. You can drag it around or resize it using the controls in the hovering panel. To use your signature, click OK.

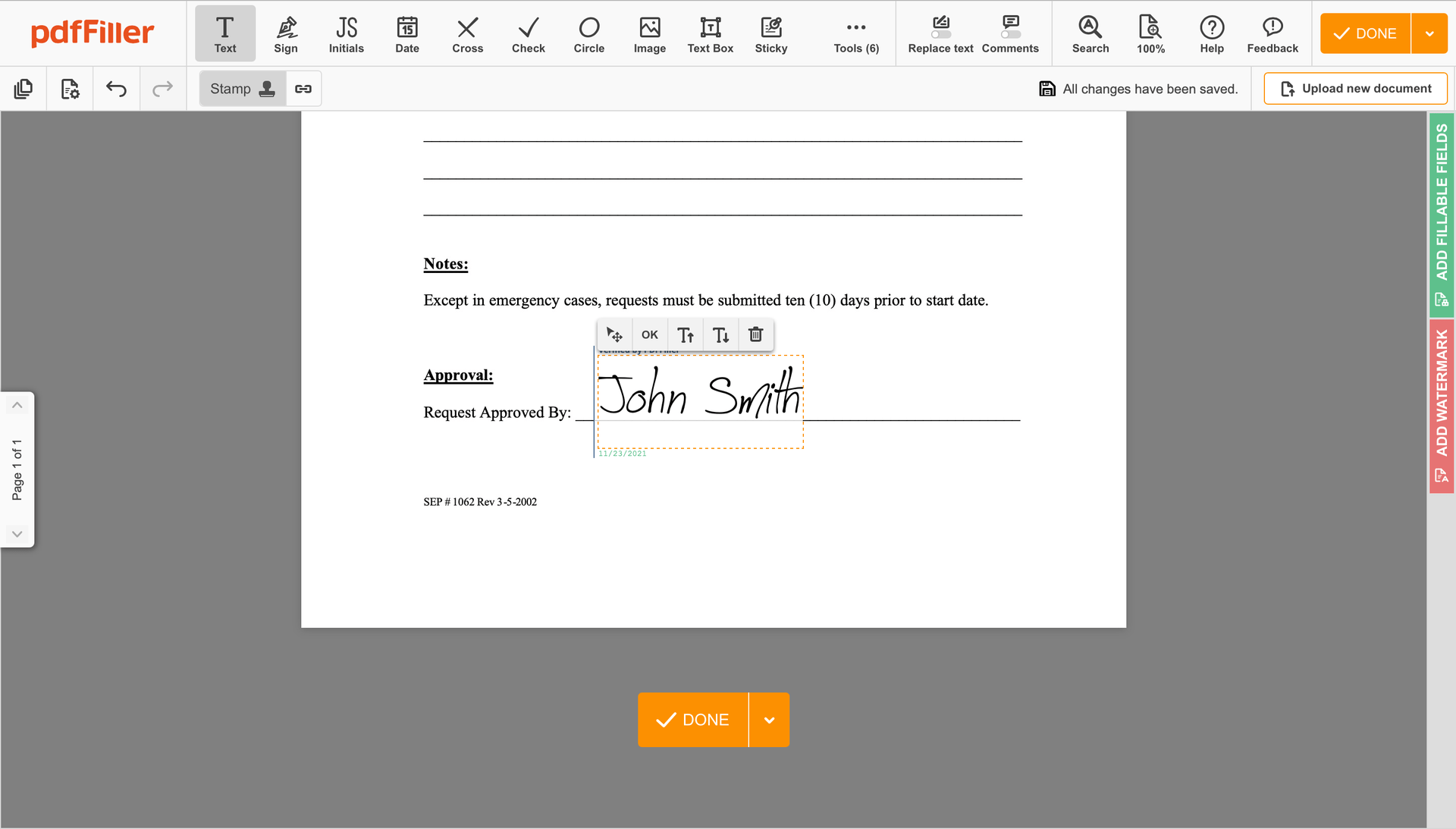

Complete the signing session by clicking DONE below your document or in the top right corner.

After that, you'll return to the pdfFiller dashboard. From there, you can download a completed copy, print the document, or send it to other people for review or approval.

Still using numerous applications to manage your documents? Try this all-in-one solution instead. Use our platform to make the process efficient. Create fillable forms, contracts, make template sand many more features, without leaving your account. You can use Comment ISDA Master Agreement right away, all features, like orders signing, reminders, requests , are available instantly. Have an advantage over other applications.

How to edit a PDF document using the pdfFiller editor:

How to Send a PDF for eSignature

What our customers say about pdfFiller

PDFfiller is really easy and its a one stop shop for all my needs especially when I am on the go. Obtaining a signature of another person and getting it automatically sent to the signature box makes everything so much easier. I love the editing feature where you can pretty much add text on the document wherever which is very helpful for my workflow.

What do you dislike?

The price is not the greatest and I would wish it could be a bit cheaper. I also think that the mobile feature could be easier to use and interface could be improved.

What problems are you solving with the product? What benefits have you realized?

I use all the features of PDFfiller it has. It probably has some that I haven't even realized that I have not used. The ease of using this program has done wonders for me and saves me time when I am in a rush.