Convert On Payment Contract For Free

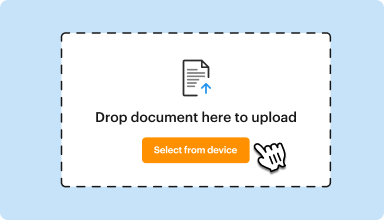

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

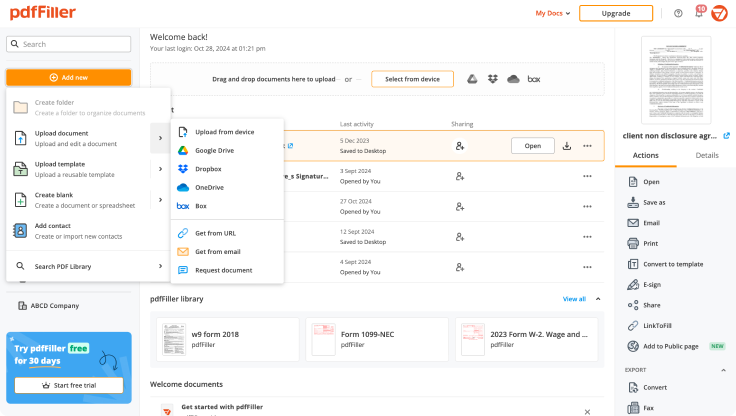

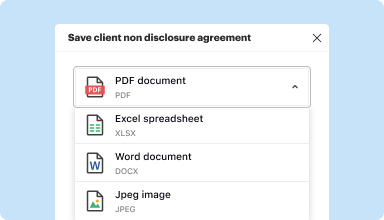

Edit, manage, and save documents in your preferred format

Convert documents with ease

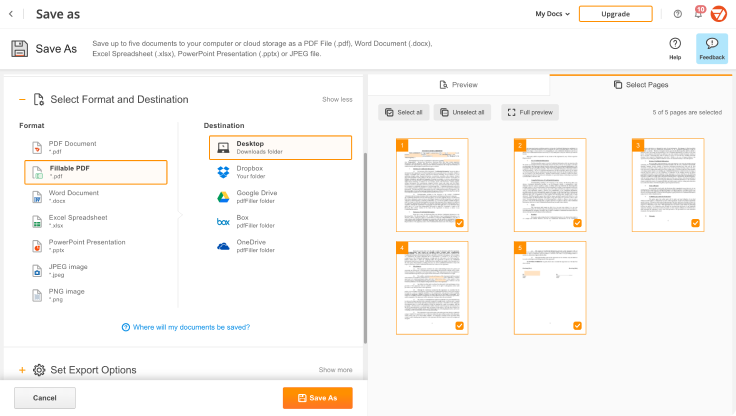

Convert text documents (.docx), spreadsheets (.xlsx), images (.jpeg), and presentations (.pptx) into editable PDFs (.pdf) and vice versa.

Start with any popular format

You can upload documents in PDF, DOC/DOCX, RTF, JPEG, PNG, and TXT formats and start editing them immediately or convert them to other formats.

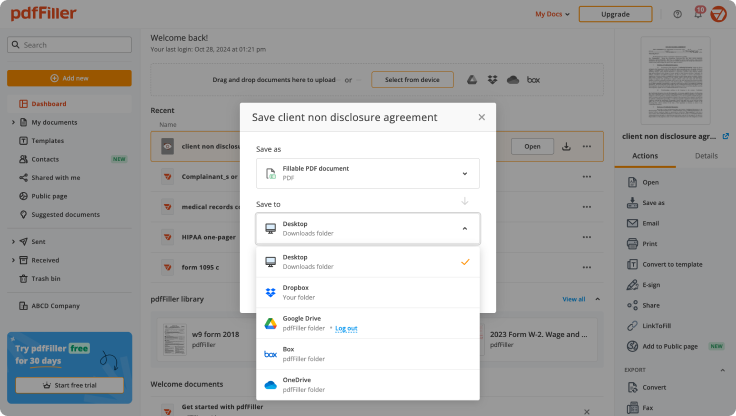

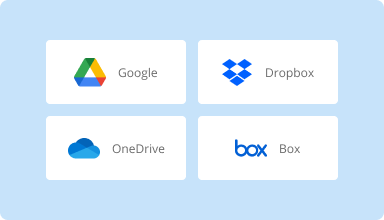

Store converted documents anywhere

Select the necessary format and download your file to your device or export it to your cloud storage. pdfFiller supports Google Drive, Box, Dropbox, and OneDrive.

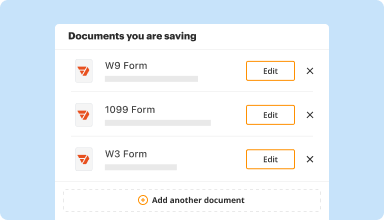

Convert documents in batches

Bundle multiple documents into a single package and convert them all in one go—no need to process files individually.

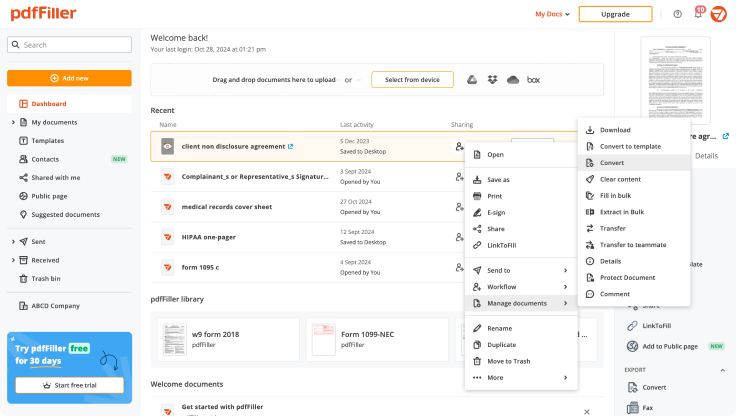

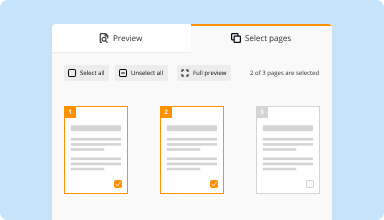

Preview and manage pages

Review the documents you are about to convert and exclude the pages you don’t need. This way, you can compress your files without losing quality.

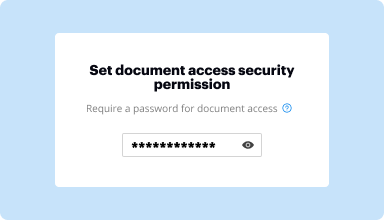

Protect converted documents

Safeguard your sensitive information while converting documents. Set up a password and lock your document to prevent unauthorized access.

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Customer trust by the numbers

64M+

users worldwide

4.6/5

average user rating

4M

PDFs edited per month

9 min

average to create and edit a PDF

Join 64+ million people using paperless workflows to drive productivity and cut costs

Why choose our PDF solution?

Cloud-native PDF editor

Access powerful PDF tools, as well as your documents and templates, from anywhere. No installation needed.

Top-rated for ease of use

Create, edit, and fill out PDF documents faster with an intuitive UI that only takes minutes to master.

Industry-leading customer service

Enjoy peace of mind with an award-winning customer support team always within reach.

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

Generally very good. When you print it saves first which I don't want it to do and "Save As" does not allow you to rename which is not right. Other than that, it does what you want.

2015-12-15

i love the copy feature so I can duplicate forms and just change the dates instead of filling out the whole form again when everything else stays the same.

2017-01-16

Great features, love the ruler that lets you type straight every line unlike Adobe Acrobat. I really like the compatibility with mobile phones to create your digital signature. Overall I was quite happy and impressed with the software. It would be great if the trial period was longer.

2019-01-17

Great for editing and preparing various…

Great for editing and preparing various documents. Great help for my letting business. Tenants and Landlords, UK

2020-02-03

Best way to organize your files

Easy to use and keeps documents nice and organized

It isnt always user friendly and so could be a bit confusing to non technological users

2023-01-13

This morning my subscription to PdfFiller was automatically renewed. Once I realized it, I notified the company to cancel my subscription and to provide a refund. Within a short time, I received a response confirming that the subscription was canceled and that the charge was reversed. I would definitely recommend this company and would use them again if I had a need.TL

2022-04-15

I wanted to use this tool temporarily…

I wanted to use this tool temporarily because I had to sign a lot of documents at the time. I kept it and use it for a lot of things now! Its very useful and worth the money.

2021-01-29

I love PDF Filler

I love PDF Filler! It allows you to take documents that are pdf and edit them. It allows you to get mobile signatures for documents.

2020-12-15

Customer Support

I have been using PDFfiller for over a year now for editing basic electrical drawings and documents for my company. Very easy platform to use.On the few occasions I have experienced problems the team at PDFfiller have been on hand to deal with it as swiftly as possible.If like me, you are not the best on computers but want a simple easy to platform to edit drawings or documents I would recommend giving PDFfiller a try.

2020-06-05

Convert On Payment Contract Feature

The Convert On Payment Contract feature streamlines your payment processing. It allows you to effortlessly convert transactions into contracts once payment is completed. This feature enhances your workflow and improves your customer experience.

Key Features

Automatic conversion of completed payments into contracts

User-friendly interface for quick setup

Customizable contract templates for various business needs

Secure data handling to protect sensitive information

Real-time notifications for updates and changes

Potential Use Cases and Benefits

Ideal for service-based businesses that require contracts upon payment

Helps freelancers streamline their invoicing and contract management

Assists rental agencies in automatically converting deposits to rental agreements

Facilitates e-commerce platforms with contract generation for purchase agreements

Enhances legal and consulting firms by automating contract issuance

The Convert On Payment Contract feature solves your problem of managing contracts after payment. By automating this process, you save time and reduce errors. This feature ensures that both you and your clients have well-documented agreements, making every transaction official and secure.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

How do I convert my contractor to full time?

If you're paid hourly as a contractor, you may need to convert that hourly pay into a salary, so you can compare to a full-time salary. Here's how I do that: Take your hourly rate and multiply it by 2,080, which is the number of hours in a year if you work 40 hours a week for 52 weeks.

How do I become a full time contractor?

Be Up Front (Within Reason) Sponsored. Become Indispensable. It goes without saying that a company won't want to hire you full time if you underperform, but even meeting the expectations of your role isn't always enough. Make Sure to Mingle. Do Your Homework.

Is it better to work as a contractor or full time?

Contractors usually work for a short, specified length of time. They come in, do a temporary job and leave. Full-time employees can carry a sense of your company's values and goals, whereas contractors are more likely to view the relationship as strictly financial. Related: Should I Hire a Contractor or an Employee?

What is a full time contract position?

Here are the major differences between a full-time job and a contract position: Job security Whereas a full-time job provides employees with the illusion of a secure position for as long as they want it, a contract position has a pre-determined end date. Pay Typically, a contract position is the higher paid one.

How much more should you be paid as a contractor?

According to the latest Dice Salary Survey, the average salary for full-time employees is $93,013. Meanwhile, the average salary for contractors employed by a staffing agency is $98,079. Those contractors who work directly for an employer (i.e., without an agency as an intermediary) pull down an average of $94,011.

How do I convert a contractor to an employee?

Verify worker classification. First, you need to make sure that the contractor really should be an employee. Notify the worker. Gather employee information. Adjust payroll. Treat the employee equally. Distribute Form W-2.

Can an employer terminate and rehire an employee as an independent contractor?

One popular alternative is to hire laid-off employees to perform their same jobs as independent contractors. Such a strategy, however, is not without risk. Misclassifying an employee as an independent contractor can result in significant costs to an employer, including back-owed taxes and penalties.

How do you manage an independent contractor?

Use a Contract to Define Work. Traditional W-2 employees have job descriptions that define their responsibilities. Communicate Clearly and Often. Before the project begins, establish a process for communicating progress. Discuss Project Measurements and Milestones. Focus on the Larger Picture.

#1 usability according to G2

Try the PDF solution that respects your time.