Convert On Salary Notice For Free

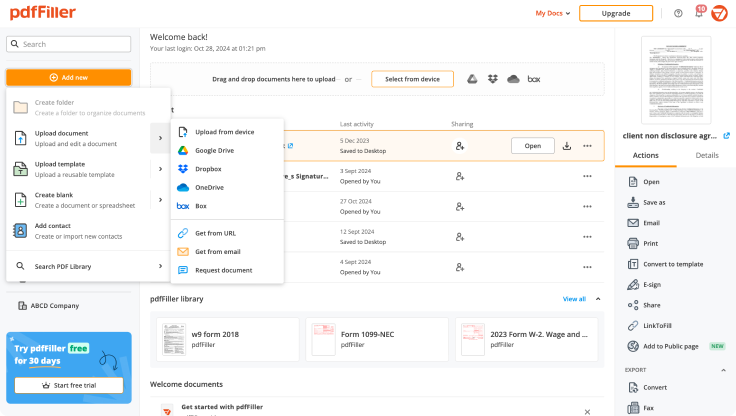

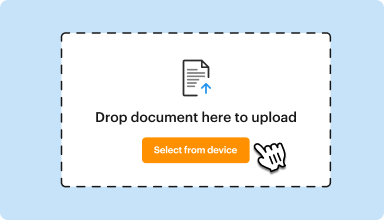

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

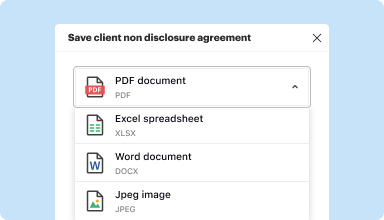

Edit, manage, and save documents in your preferred format

Convert documents with ease

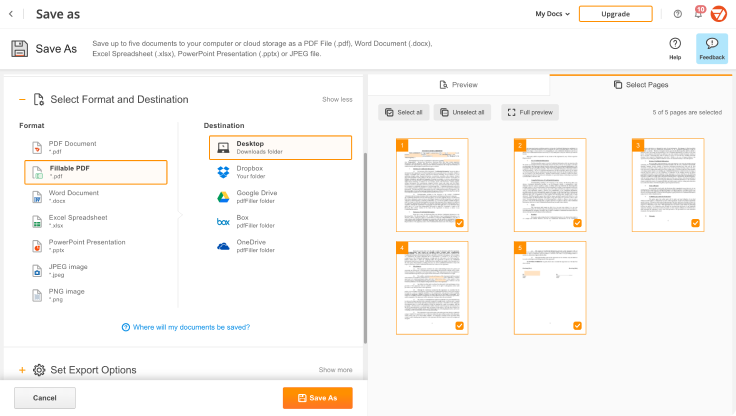

Convert text documents (.docx), spreadsheets (.xlsx), images (.jpeg), and presentations (.pptx) into editable PDFs (.pdf) and vice versa.

Start with any popular format

You can upload documents in PDF, DOC/DOCX, RTF, JPEG, PNG, and TXT formats and start editing them immediately or convert them to other formats.

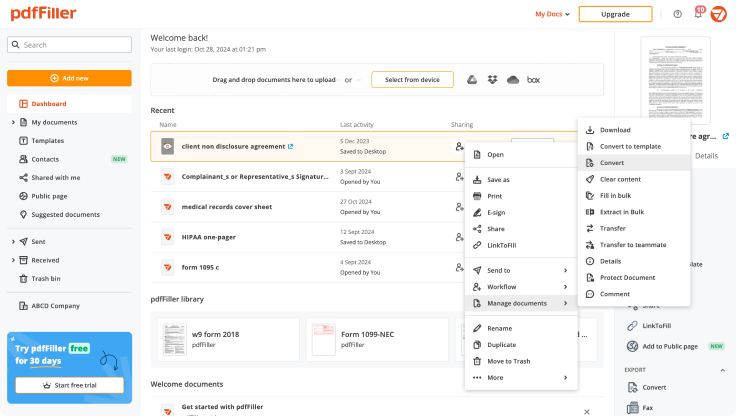

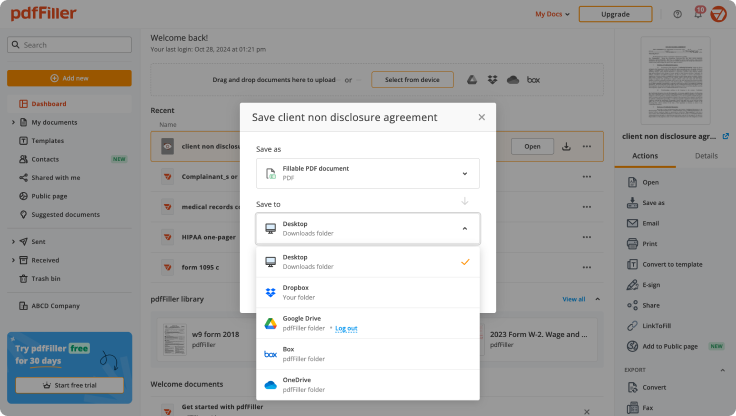

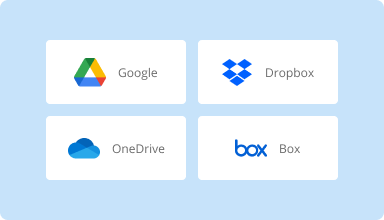

Store converted documents anywhere

Select the necessary format and download your file to your device or export it to your cloud storage. pdfFiller supports Google Drive, Box, Dropbox, and OneDrive.

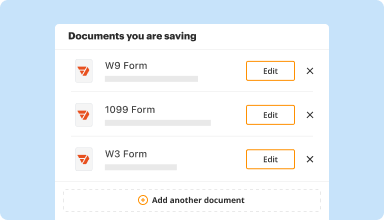

Convert documents in batches

Bundle multiple documents into a single package and convert them all in one go—no need to process files individually.

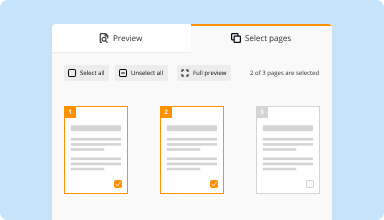

Preview and manage pages

Review the documents you are about to convert and exclude the pages you don’t need. This way, you can compress your files without losing quality.

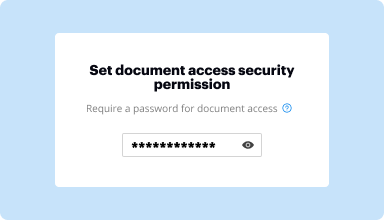

Protect converted documents

Safeguard your sensitive information while converting documents. Set up a password and lock your document to prevent unauthorized access.

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Customer trust by the numbers

64M+

users worldwide

4.6/5

average user rating

4M

PDFs edited per month

9 min

average to create and edit a PDF

Join 64+ million people using paperless workflows to drive productivity and cut costs

Why choose our PDF solution?

Cloud-native PDF editor

Access powerful PDF tools, as well as your documents and templates, from anywhere. No installation needed.

Top-rated for ease of use

Create, edit, and fill out PDF documents faster with an intuitive UI that only takes minutes to master.

Industry-leading customer service

Enjoy peace of mind with an award-winning customer support team always within reach.

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

All good. I do not like the stamp Verified By PDF filler that is attached. I wish you could email the complete forms from your own email address as well.

2016-04-05

it does important essential legal functions in ways that work but are somewhat visually disorienting and that are provided through a user-insensitive, extortive pricing model.

The fact that PayPal has removed you from their approved subscription list may be entirely technical but it does not inspire confidence.

2016-06-19

I liked that I can type in the blanks for documents , but I only needed it once and I didn't really didn't understand the price I though got it was $6 a month not $72. But the understanding of customer service was great I'm glad I'll be getting my refund. Thank you again. It's a ok service maybe for a business not personal use

2017-06-12

Quite simple and handy to fill. I would have preferred using my own signature on the completed form but I had difficulty loading an image of my signature.

2018-07-24

Organize my PDF nicely

It was smooth and easy and quick. Thank you

PDF filler is one of the best pdf converters. It has many usages. From storage, file conversion, editing and so on.

Nothing, thus I like the app in general. I can do a lot for my pdf related files.

2023-01-13

I have noticed that this is

I have noticed that, although this subreddit has 1,000,020 readers, I am not receiving 1,000,020 upvotes on my posts. I'm not sure if this is being done intentionally or if these "friends" are forgetting to click 'upvote'. Either way, I've had enough. I have compiled a spreadsheet of individuals who have "forgotten" to upvote my most recent posts. After 2 consecutive strikes, your name is automatically highlighted (shown in red) and I am immediately notified. 3 consecutive strikes and you can expect an in-person "consultation". Think about your actions.

2022-09-03

buena manera de preparar archivos para lo que me interesa . entrenamientos de futbol sala. espero que me puedan explicar como ver los contenidos en español. gracias

2021-01-23

Hi Team, All Good but sometimes it works very very slow and have improved a lot in compare to previous years as i am using since 3 yeras in a row down the line.

2020-12-05

pdfFiller has helped me so much with…

pdfFiller has helped me so much with working from home. Switching technology, updating documents and signing forms was not always smooth, but this pdfFiller kept work going.

2020-09-26

Convert On Salary Notice Feature

The Convert On Salary Notice feature streamlines the process of converting salary notifications into actionable insights. With this tool, you can easily transform salary data into a format that supports your business needs.

Key Features

Automatic conversion of salary notices into digital records

User-friendly interface for quick navigation

Secure storage of sensitive salary information

Integration with existing payroll systems

Customizable reporting tools

Potential Use Cases and Benefits

HR departments can manage salary data more efficiently

Businesses can ensure compliance with labor laws

Employees can access their salary information easily

Management can analyze salary structure for better budget planning

Organizations can track salary adjustments over time

This feature addresses a common challenge: managing salary notifications accurately and securely. By automating the conversion process, you simplify data handling, reduce errors, and save valuable time. You can focus on strategy, instead of paperwork.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

Can my job change me from salary to hourly?

When switching employees from salaried to hourly, you'll need to figure out what to pay them. The employee's hourly pay rate can be lowered to match their old weekly rate as long as they do not drop below the federal and state minimum wage.

Can an employer change you from salary to hourly without notice?

At-will employment doesn't just cover firing, however: An employer can also change the status of an at-will employee -- including, for example, the employee's hours, salary, title, job duties, worksite, and so on -- without notice and without cause.

Can your employer switch you from salary to hourly?

When switching employees from salaried to hourly, you'll need to figure out what to pay them. The employee's hourly pay rate can be lowered to match their old weekly rate as long as they do not drop below the federal and state minimum wage.

Why would a company switch from salary to hourly?

Even if the employee takes a partial day off, you must pay full salary for that day. Hourly employees are paid for the exact amount of hours they work during the pay period. Therefore, if they take partial days off and do not have benefit days to cover the hours, you do not have to pay them for the time taken.

Can an employer change you from salary to hourly without notice California?

California does not have a law addressing when or how an employer may reduce an employee's wages or whether an employer must provide employees notice prior to instituting a wage reduction. Moreover, a wage reduction can only be applied to hours worked after the change and cannot be applied to hours already worked.

Can an employer change you from exempt to nonexempt?

Yes. Even when a position qualifies for exempt status an employer may change the status to nonexempt to help cure an attendance problem. Employers choosing to change an exempt employee to nonexempt must do so with the intention of the change being long term or permanent.

Can you move someone from salary to hourly?

When switching employees from salaried to hourly, you'll need to figure out what to pay them. The employee's hourly pay rate can be lowered to match their old weekly rate as long as they do not drop below the federal and state minimum wage.

Is it legal to go from salary to hourly?

Reclassifying employees as hourly workers is legal, but employers still need to be careful. To stay compliant with the Fair Labor Standards Act (FLEA), employers need to show the U.S. Department of Labor's Wage and Hour Division when the changes were made, and why.

#1 usability according to G2

Try the PDF solution that respects your time.