Cosign Autograph Request For Free

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

Upload your document to the PDF editor

Type anywhere or sign your form

Print, email, fax, or export

Try it right now! Edit pdf

Users trust to manage documents on pdfFiller platform

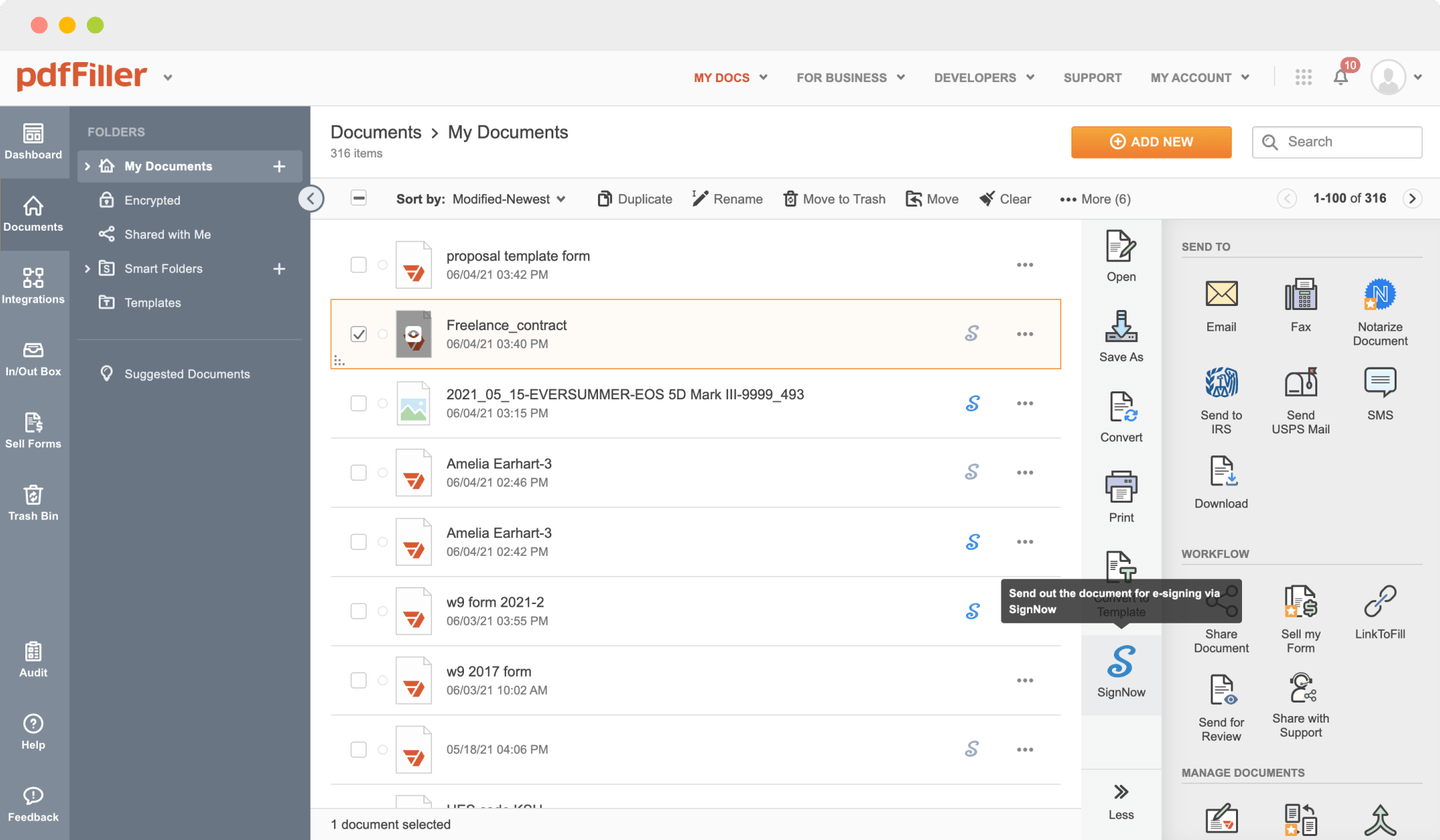

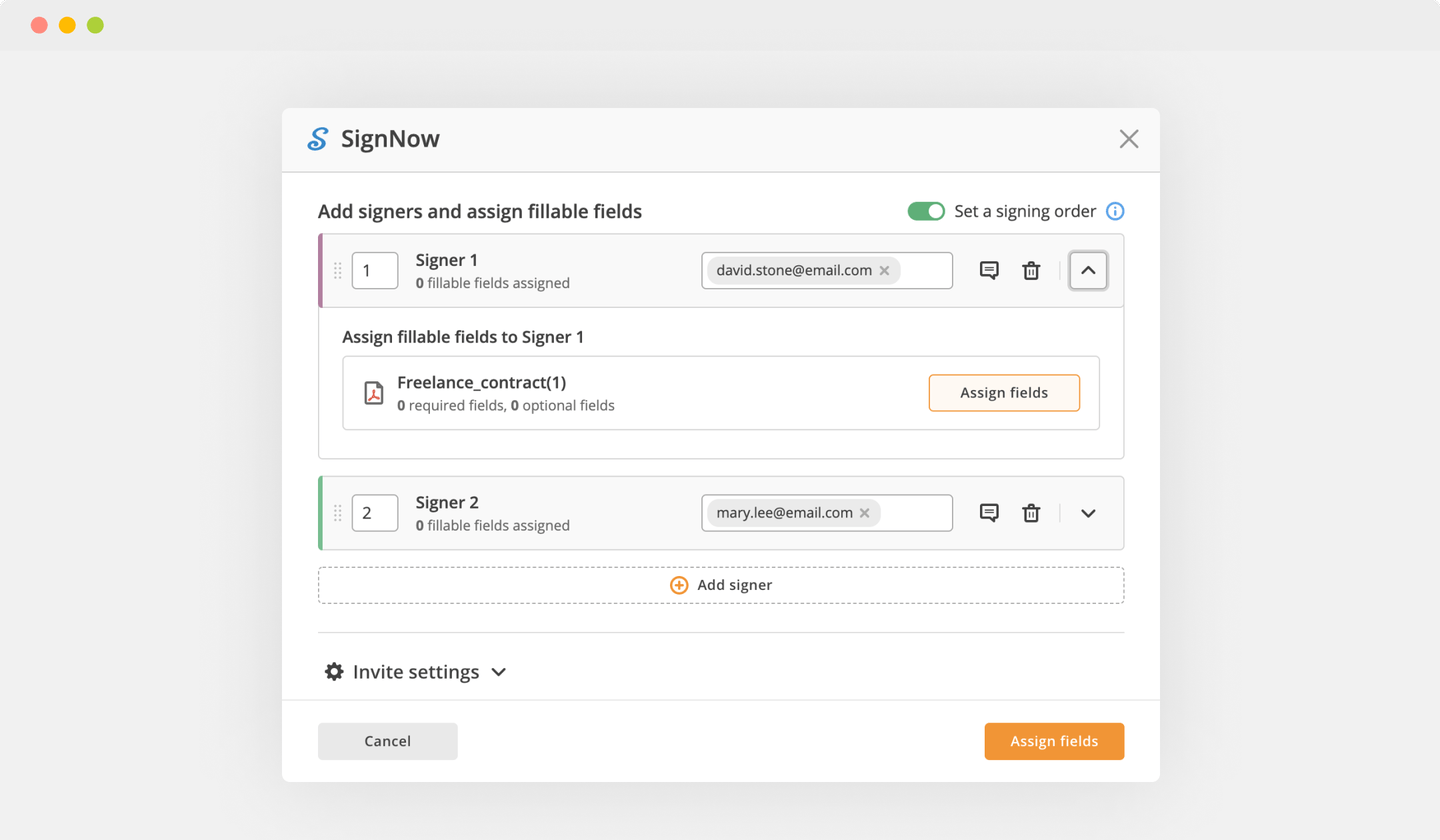

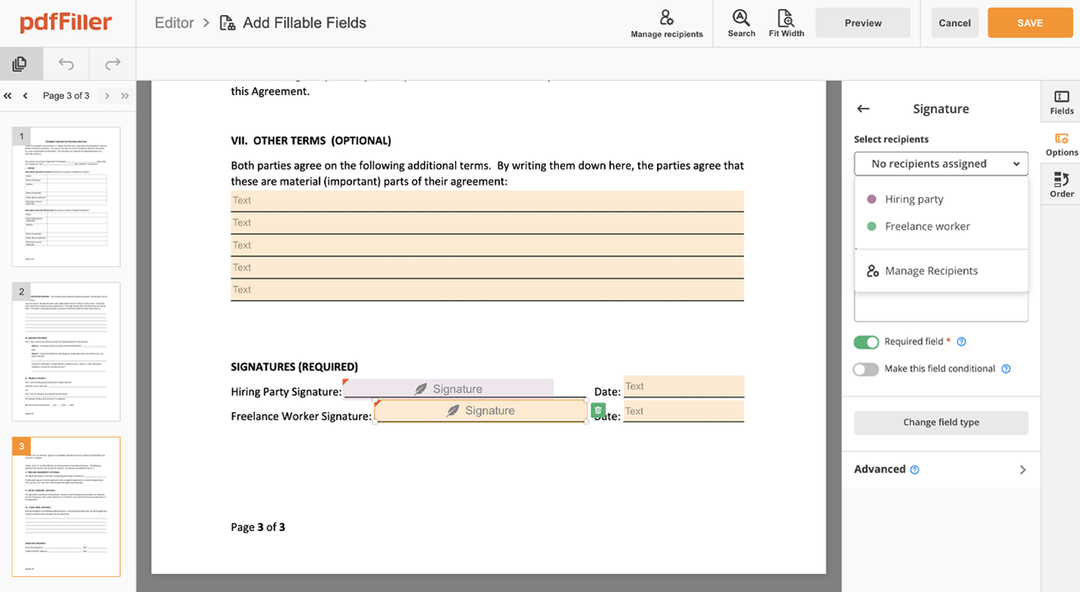

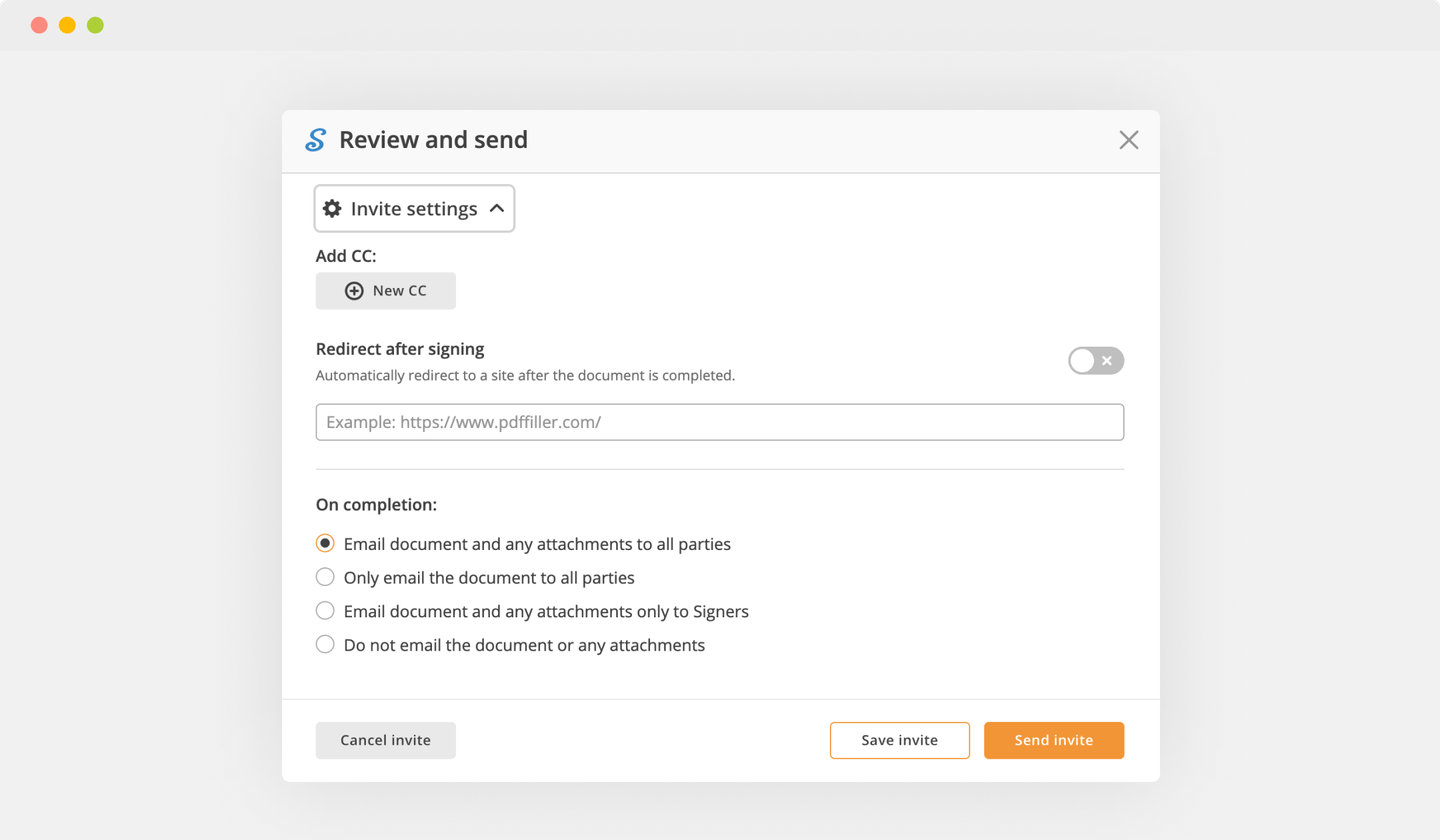

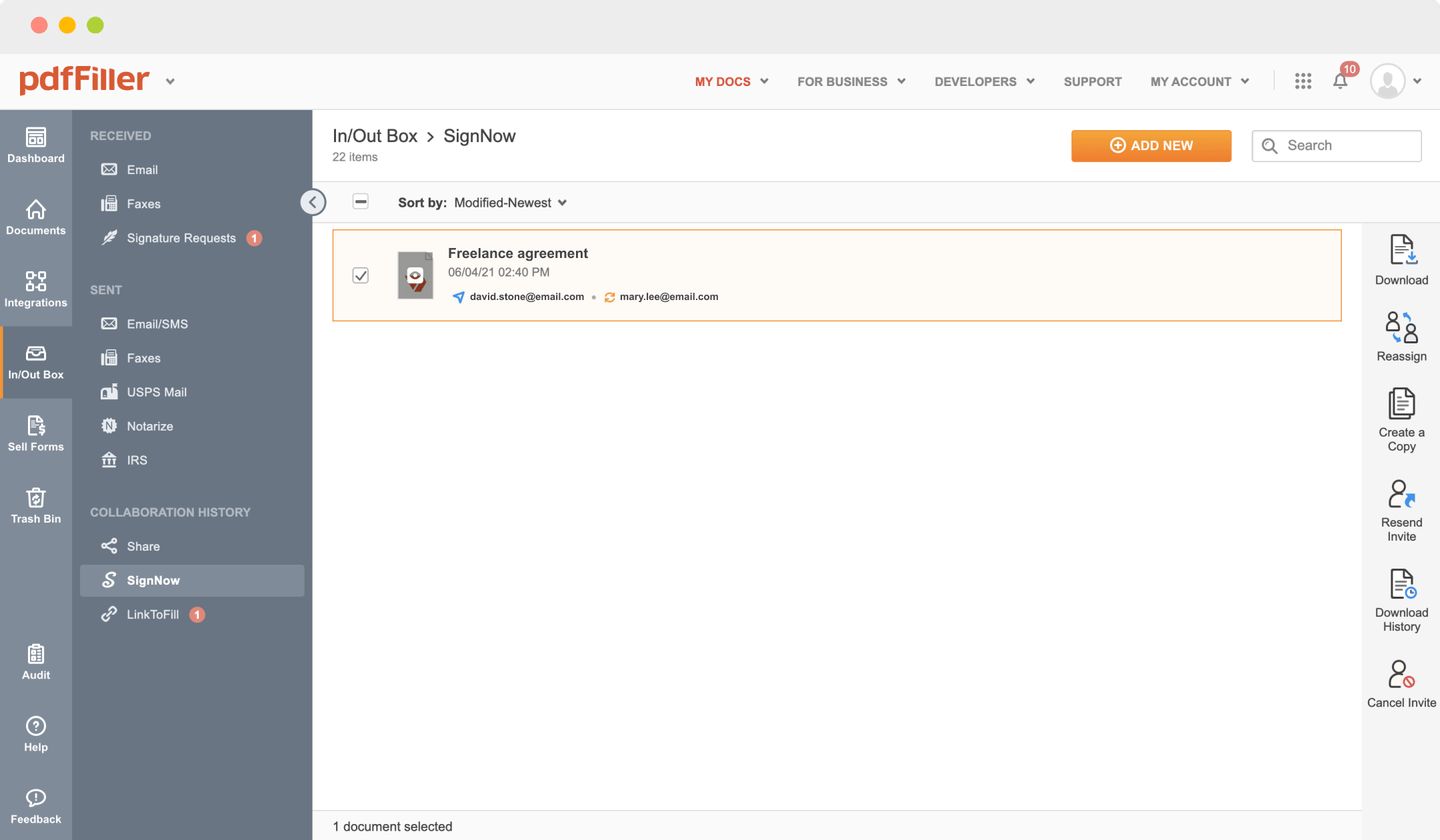

Send documents for eSignature with signNow

Create role-based eSignature workflows without leaving your pdfFiller account — no need to install additional software. Edit your PDF and collect legally-binding signatures anytime and anywhere with signNow’s fully-integrated eSignature solution.

All-in-one PDF software

A single pill for all your PDF headaches. Edit, fill out, eSign, and share – on any device.

pdfFiller scores top ratings in multiple categories on G2

How to Cosign Autograph Request

Stuck with multiple programs to manage and edit documents? We've got the perfect all-in-one solution for you. Document management is simpler, fast and efficient with our tool. Create document templates from scratch, modify existing forms and more features, without leaving your account. You can Cosign Autograph Request right away, all features, like orders signing, alerts, requests, are available instantly. Get a significant advantage over other programs.

How-to Guide

How to edit a PDF document using the pdfFiller editor:

01

Upload your form to the uploading pane on the top of the page

02

Select the Cosign Autograph Request feature in the editor's menu

03

Make the required edits to the document

04

Push “Done" button at the top right corner

05

Rename the form if it's needed

06

Print, email or save the file to your desktop

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

Patrick M

2015-01-19

I fill out a lot of forms from different organizations. Found PDF Filler after searching for a federal form. It was the top result and I started using it from there. Some organizations do not even realize how they have deployed PFD files. When you show up, or fax them their completed PDF file you get some odd reactions.

Deirdre A

2019-05-02

The questionnaire asks applicant to send proof of income and supporting documents for all expenses. I do not know how to send these and hope I'll hear from someone about how to do this.

Get a powerful PDF editor for your Mac or Windows PC

Install the desktop app to quickly edit PDFs, create fillable forms, and securely store your documents in the cloud.

Edit and manage PDFs from anywhere using your iOS or Android device

Install our mobile app and edit PDFs using an award-winning toolkit wherever you go.

Get a PDF editor in your Google Chrome browser

Install the pdfFiller extension for Google Chrome to fill out and edit PDFs straight from search results.

List of extra features

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can a cosigner remove the primary borrower?

Removing a cosigner isn't easy the primary borrower can't just take their name off the loan because it's a binding contract. What they can do is refinance, but that can only happen if their credit has improved since taking out the original auto loan, which typically takes at least two years of on-time payments.

Can you remove your name from a cosigned loan?

Removing Your Name From a Cosigned Loan If you cosigned for a loan and want to remove your name, there are some steps you can take: Get a cosigner release. Some loans have a program that will release a cosigner's obligation after a certain number of consecutive on-time payments have been made.

What does primary cosigner mean?

Cosigners are people who guarantee debt for someone who cannot qualify on his or her own. The understanding is that the primary borrower is the person legally responsible for repaying what is owed. Co-borrowers, on the other hand, are people who want to take on a shared debt with another person.

What is the difference between a co-signer and a co borrower?

A co-borrower applies for a loan with the primary applicant, and both parties are responsible for paying back the loan. A cosigner guarantees that the loan will be repaid. The cosigner doesn't intend to make any payments that's the primary borrower's job.

Who gets the credit on a cosigned loan?

If you are the cosigner on a loan, then the debt you are signing for will appear on your credit file as well as the credit file of the primary borrower. It can help even a cosigner build a more positive credit history as long as the primary borrower is making all the payments on time as agreed upon.

What happens when you cosign for a loan?

A cosigner is someone who applies for a loan with another person, and legally agrees to pay off their debt if they aren't able to make the payments. But with a cosigner, the lender will be more likely to give someone a loan because the cosigner can step in and make the payments if the other person cannot.

How do I protect myself as a cosigner?

Act like a bank.

Review the agreement together.

Be the primary account holder.

Collateralize the deal.

Create your own contract.

Set up alerts.

Check in, respectfully.

Insure your assets.

Does Cosigning hurt your credit?

In a strict sense, the answer is no. The fact that you are a cosigner in and of itself does not necessarily hurt your credit. However, even if the cosigned account is paid on time, the debt may affect your credit scores and revolving utilization, which could affect your ability to get a loan in the future.

Will Cosigning affect me buying a house?

They are correct that cosigning the loan could affect their ability to qualify for a mortgage, especially if they are planning to purchase a house in the near future. Because they share full responsibility for the debt, the loan will appear on your father or mother's credit report, as well.

Can a cosigner take your car away?

Cosigners Can't Take Your Car Cosigners don't have any rights to your vehicle, so they can't take possession of your car even if they're making the payments. What a cosigner does is lend you their credit in order to help you get approved for an auto loan.

Does Cosign help your credit?

Yes, being a cosigner on a car loan will help you build your credit history. The primary loan holder and cosigner share equal responsibility for the debt, and the loan will appear on both your credit report and hers.

What happens when you cosign a loan?

A cosigner is someone who applies for a loan with another person, and legally agrees to pay off their debt if they aren't able to make the payments. But with a cosigner, the lender will be more likely to give someone a loan because the cosigner can step in and make the payments if the other person cannot.

Is it bad to be a cosigner?

Even if the borrower is diligent about making the payments, you may still run into credit problems as a result of cosigning. Any loan you cosign will show up on your credit report as one of your own debts. Yes, that's a hassle, but if this person can't get a loan without a cosigner, there's a good reason for it.

How is a co-signer's credit affected?

In a strict sense, the answer is no. The fact that you are a cosigner in and of itself does not necessarily hurt your credit. However, even if the cosigned account is paid on time, the debt may affect your credit scores and revolving utilization, which could affect your ability to get a loan in the future.

What is a good cosigner?

In a nutshell, a cosigner is someone who guarantees that they will be legally responsible for paying back a debt if the borrower cannot pay. Some of the best people to consider reaching out to are a trusted friend or family member with a good credit history and a solid income history.

eSignature workflows made easy

Sign, send for signature, and track documents in real-time with signNow.