Cosign Conditional Field For Free

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

Upload your document to the PDF editor

Type anywhere or sign your form

Print, email, fax, or export

Try it right now! Edit pdf

Users trust to manage documents on pdfFiller platform

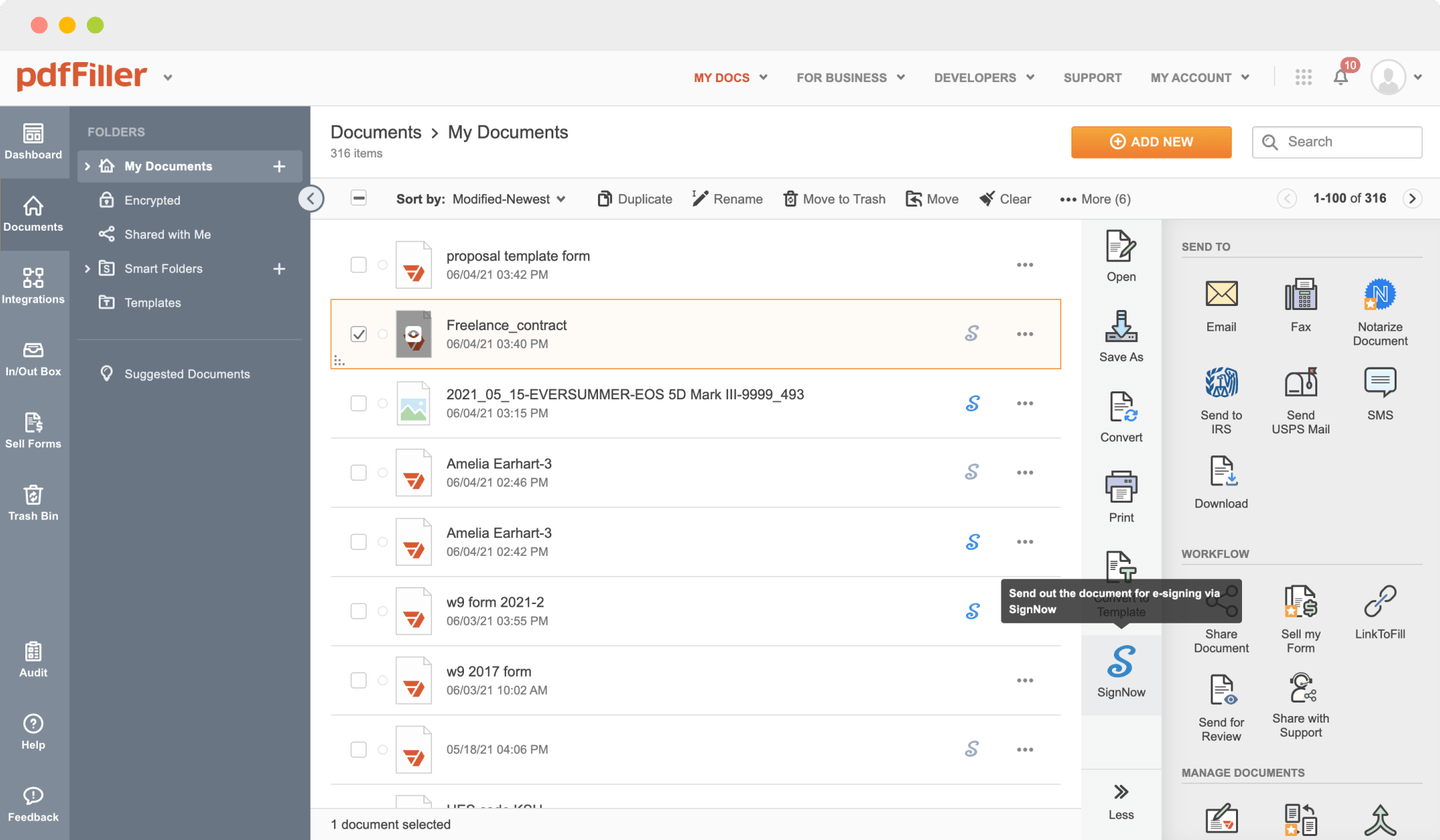

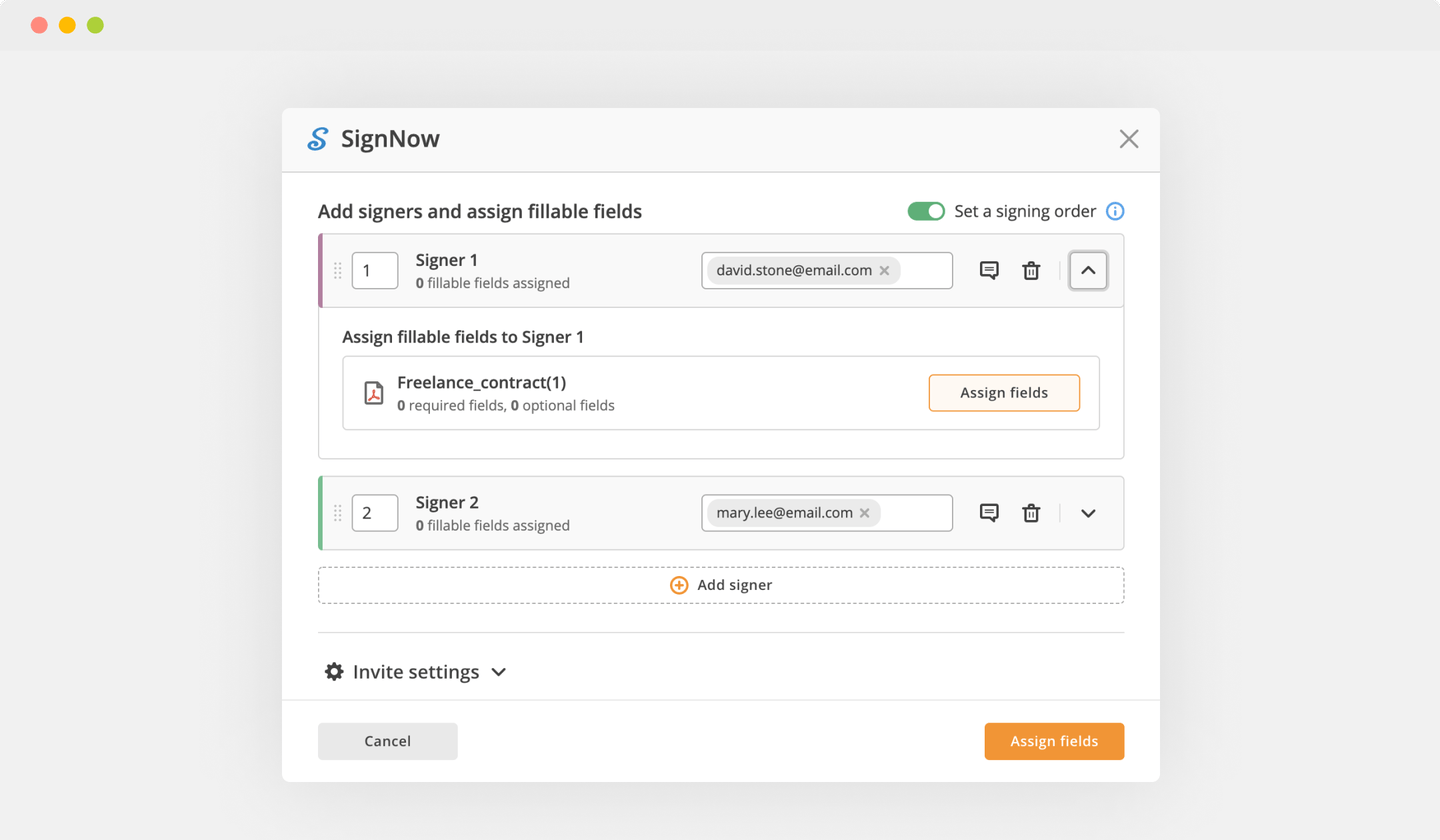

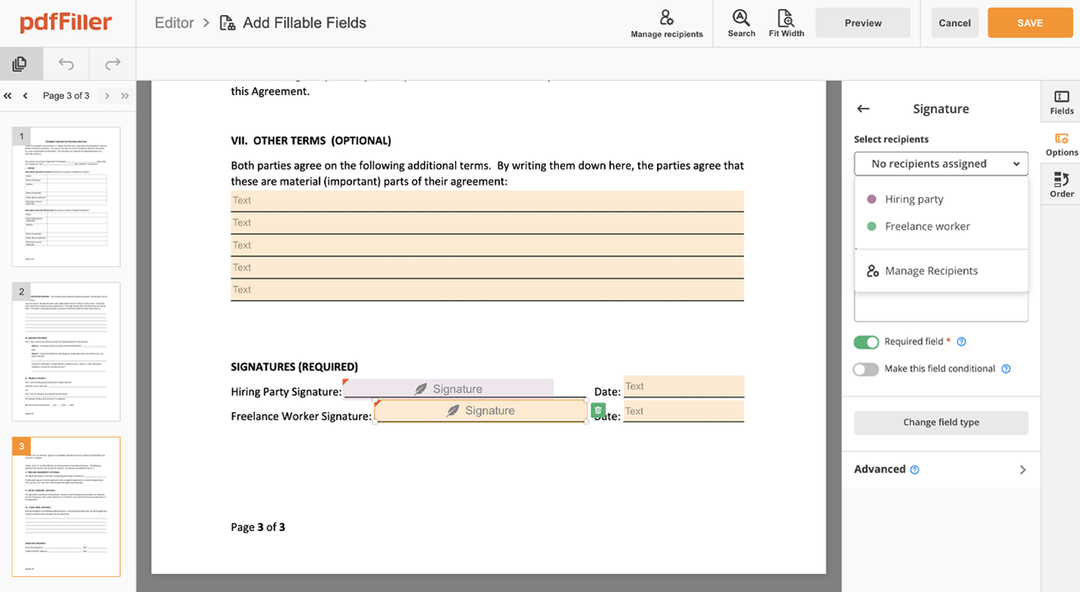

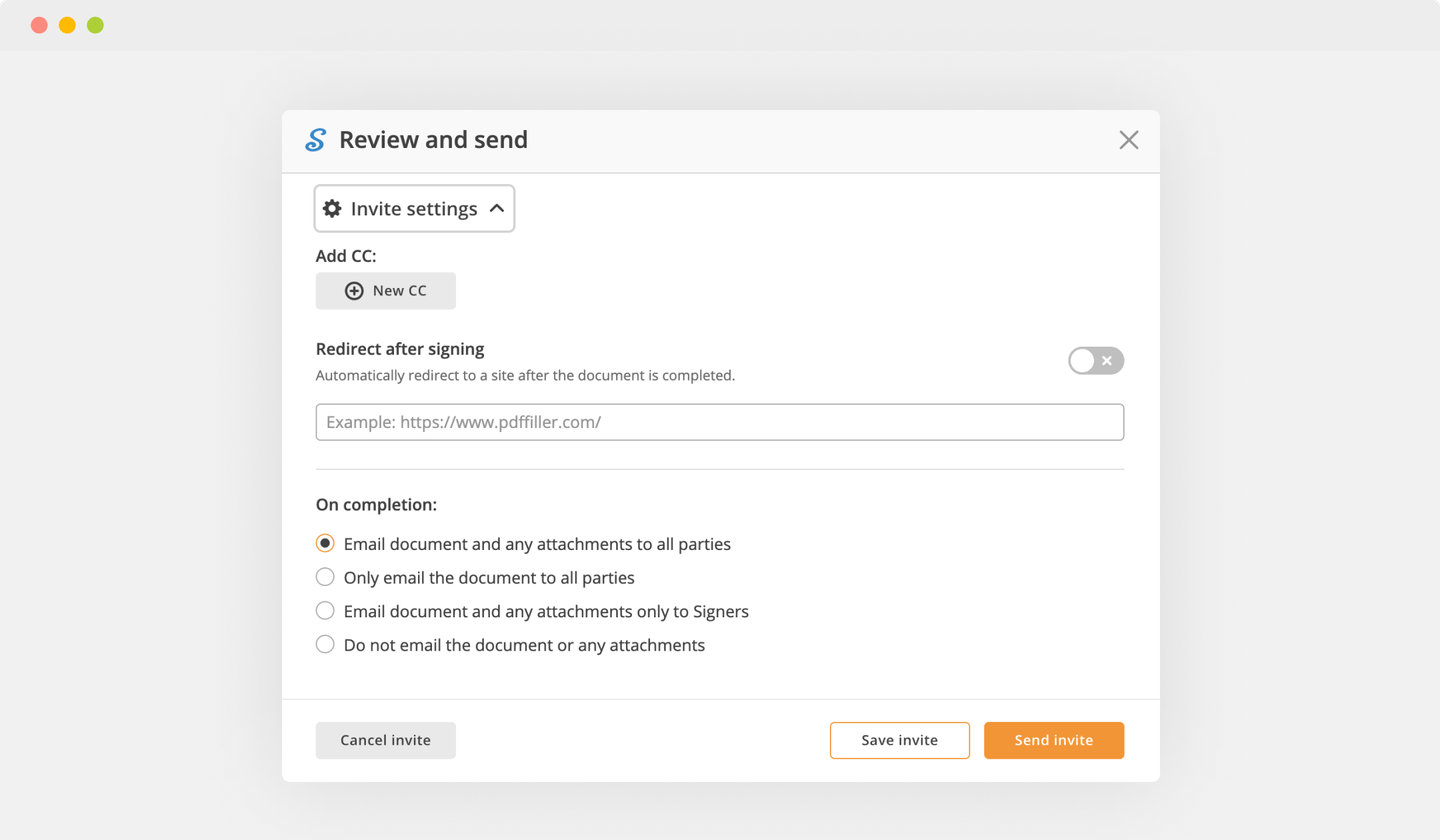

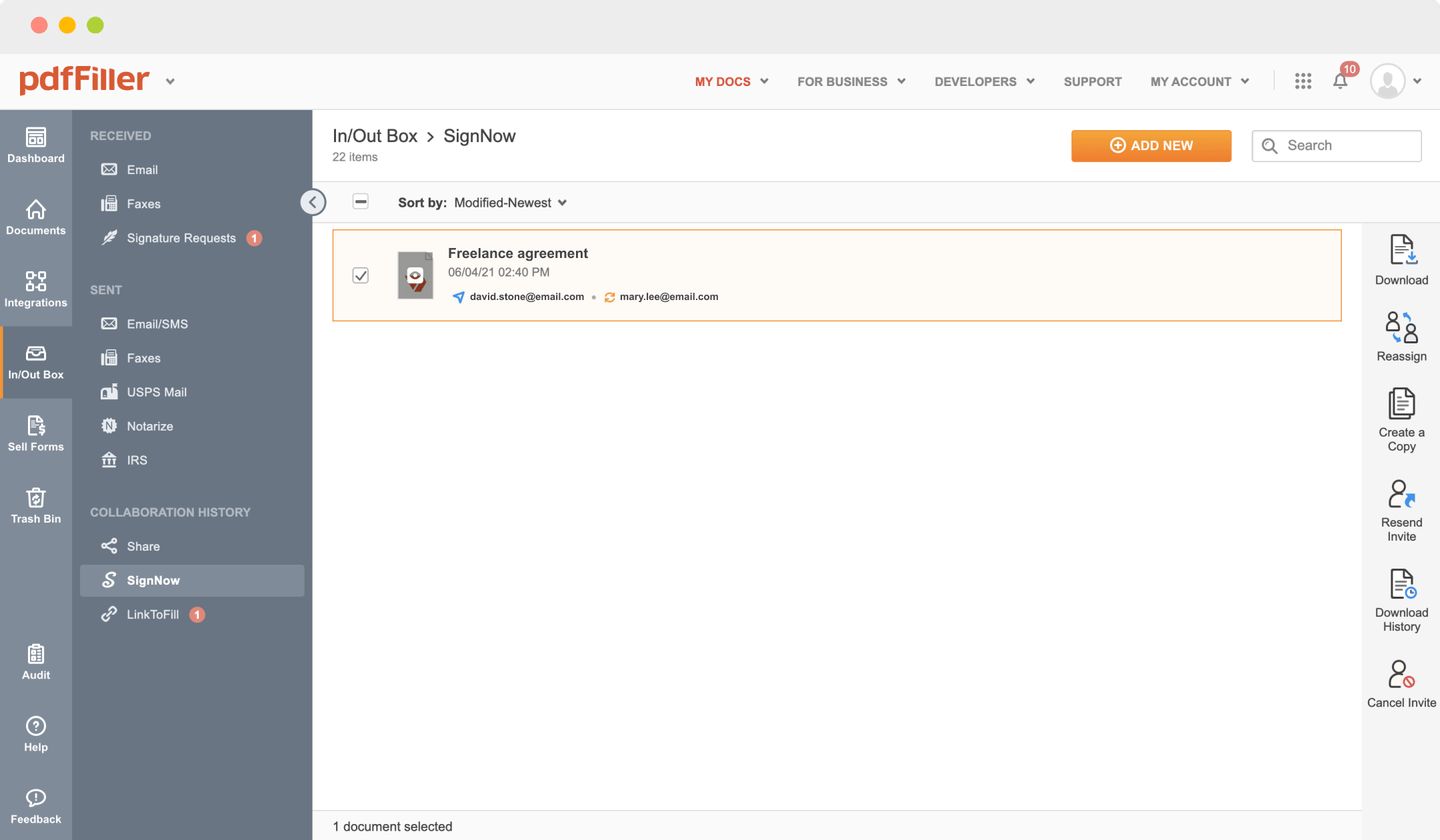

Send documents for eSignature with signNow

Create role-based eSignature workflows without leaving your pdfFiller account — no need to install additional software. Edit your PDF and collect legally-binding signatures anytime and anywhere with signNow’s fully-integrated eSignature solution.

All-in-one PDF software

A single pill for all your PDF headaches. Edit, fill out, eSign, and share – on any device.

pdfFiller scores top ratings in multiple categories on G2

How to Cosign Conditional Field

Still using numerous applications to manage your documents? We have an all-in-one solution for you. Document management becomes notably easier, faster and smoother using our editor. Create document templates on your own, edit existing forms and other features, within one browser tab. You can Cosign Conditional Field with ease; all of our features, like signing orders, reminders, requests, are available instantly to all users. Get a major advantage over those using any other free or paid programs. The key is flexibility, usability and customer satisfaction.

How-to Guide

How to edit a PDF document using the pdfFiller editor:

01

Download your form to the uploading pane on the top of the page

02

Find the Cosign Conditional Field feature in the editor's menu

03

Make all the necessary edits to your document

04

Click the orange “Done" button to the top right corner

05

Rename the document if required

06

Print, download or email the form to your device

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

Vanessa Georgiou

2019-09-04

Few years with pdffiller

I am their client for almost 3 years. I did my best to get how it works and was making bad reviews in appstore because complicated ui on the start. I was checking out competiting editors, but I could say that other apps were even more complicated. Many things changed from that time and editor became much more user friendly, got new options for saving money and time. I am less about challenging their customer service but sometimes updates are a bit confusing.

Verified Reviewer

2019-03-10

Needed some Quick 1099's - PDF Filler Came to the Rescue

Good product for what it is designed for.

Downloaded this in a pinch when I need to get a vendor a 1099 last minute. Couldn't find anything that would allow me to do this on the IRS website and PDF Filler allowed to complete one in a matter of minutes. Definite a lifesaver and helped me save a relationship with a vendor.

Automatic renewal snuck up on me. I didn't mind paying for it the first year, but this year I didn't need it.

Get a powerful PDF editor for your Mac or Windows PC

Install the desktop app to quickly edit PDFs, create fillable forms, and securely store your documents in the cloud.

Edit and manage PDFs from anywhere using your iOS or Android device

Install our mobile app and edit PDFs using an award-winning toolkit wherever you go.

Get a PDF editor in your Google Chrome browser

Install the pdfFiller extension for Google Chrome to fill out and edit PDFs straight from search results.

List of extra features

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Why Cosigning is a bad idea?

Even if the borrower is diligent about making the payments, you may still run into credit problems as a result of cosigning. Any loan you cosign will show up on your credit report as one of your own debts. Yes, that's a hassle, but if this person can't get a loan without a cosigner, there's a good reason for it.

Who gets the credit on a cosigned loan?

If you are the cosigner on a loan, then the debt you are signing for will appear on your credit file as well as the credit file of the primary borrower. It can help even a cosigner build a more positive credit history as long as the primary borrower is making all the payments on time as agreed upon.

What credit score does a cosigner need?

Generally, a cosigner is only needed when your credit score or income may not be strong enough to meet a financial institution's underwriting guidelines. If you have a stronger credit score, typically 650 and above, along with sufficient income to cover the loan payment, it's likely you will not need a co-signer.

How can I get out of a cosigned loan?

Option 1. Help the other person on the loan improve his or her financial habits.

Option 2. Talk to the lender.

Option 3. Have the car owner refinance the car loan by him or herself.

Option 4. Pay off the existing loan more quickly.

Option 5.

Option 6.

How is a co signer's credit affected?

In a strict sense, the answer is no. The fact that you are a cosigner in and of itself does not necessarily hurt your credit. However, even if the cosigned account is paid on time, the debt may affect your credit scores and revolving utilization, which could affect your ability to get a loan in the future.

What happens if I co-sign a loan?

What does it Mean to Co-Sign? When you co-sign a loan, you and the borrower complete a loan application, and you agree to pay off the loan. The application may be online or on paper, and you sign the application to take on that responsibility. A co-signer helps a borrower get approved.

What qualifies you to be a cosigner?

Cosigner Requirements The credit score a cosigner needs isn't set, but in order to qualify as a cosigner, your credit has to be in the good to excellent range. This typically requires a credit score of at least 670 or better, but the requirements vary by lender. As a cosigner, your requirements don't stop there.

Can anyone be a cosigner?

In a nutshell, a cosigner is someone who guarantees that they will be legally responsible for paying back a debt if the borrower cannot pay. Some of the best people to consider reaching out to are a trusted friend or family member with a good credit history and a solid income history.

What is involved in being a cosigner?

A cosigner is someone who applies for a loan with another person, and legally agrees to pay off their debt if they aren't able to make the payments. With a cosigner, many lenders are more likely to offer better terms on the loan, like a lower interest rate and lower fees.

What do I need to know about cosigning a loan?

A cosigner is a person who agrees to pay a borrower's debt if he or she defaults on the loan. The person asked to cosign a loan usually has a good credit score and a lengthy credit history, which greatly improves the primary borrower's odds of approval.

Can you remove yourself from a cosign?

Cosigning a loan or credit card basically tells the bank that you're willing to make payments if the other person doesn't. As a general rule, the bank won't remove your name from a cosigned debt unless the other person has demonstrated they can handle the loan on their own.

Can someone cosign if they already have a loan?

You most certainly can cosign on another car loan if you have one already. In fact, cosigning for someone can help improve your credit score since their auto loan shows up on your credit reports.

What happens if you cosign a loan?

When you co-sign a loan, you and the borrower complete a loan application, and you agree to pay off the loan. A co-signer helps a borrower get approved. Some borrowers are unable to qualify for a loan on their own: They don't have enough income to cover the loan payments, or their credit scores may be too low.

eSignature workflows made easy

Sign, send for signature, and track documents in real-time with signNow.