Cosign ESigning Request For Free

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

Upload your document to the PDF editor

Type anywhere or sign your form

Print, email, fax, or export

Try it right now! Edit pdf

Users trust to manage documents on pdfFiller platform

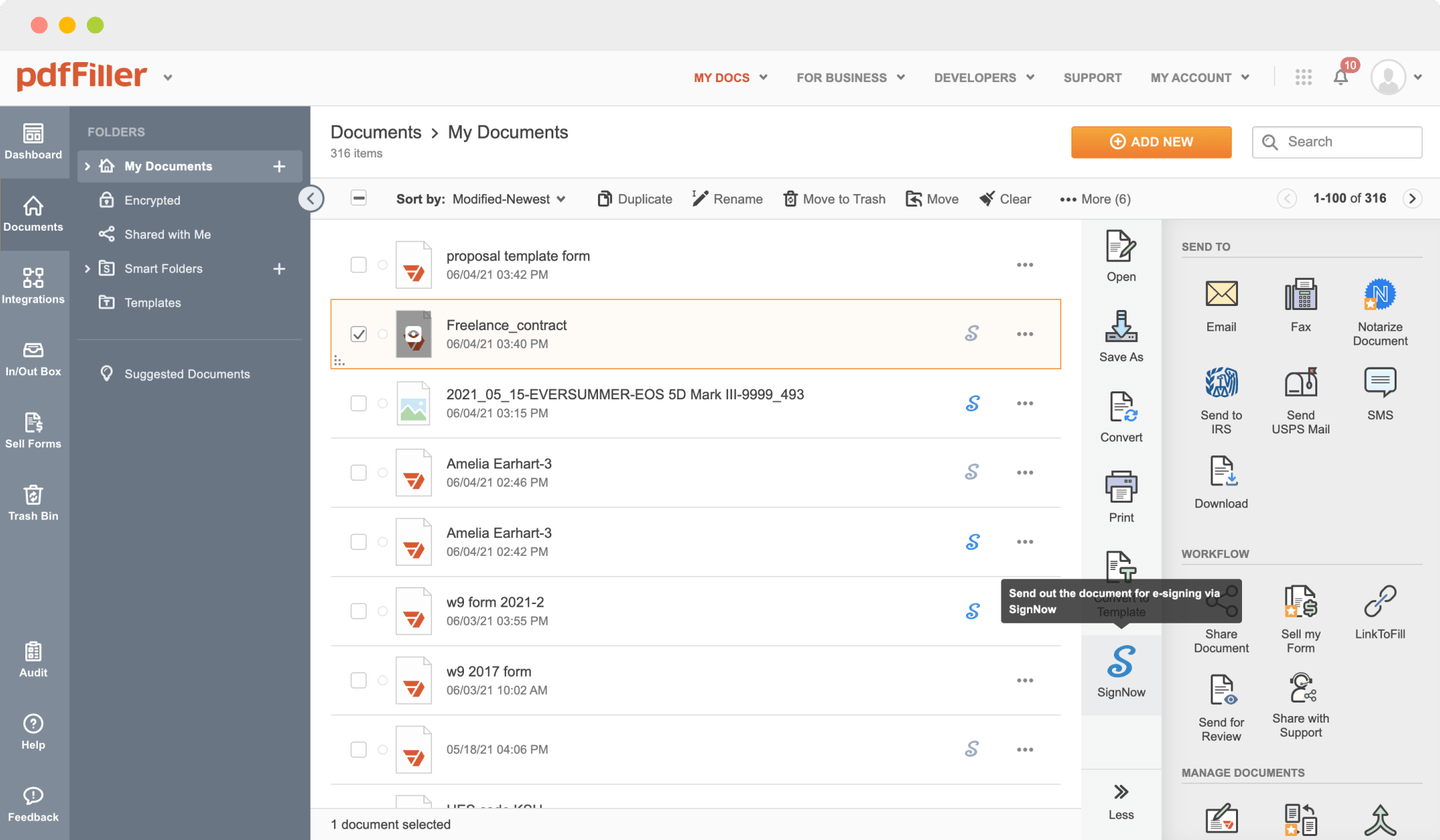

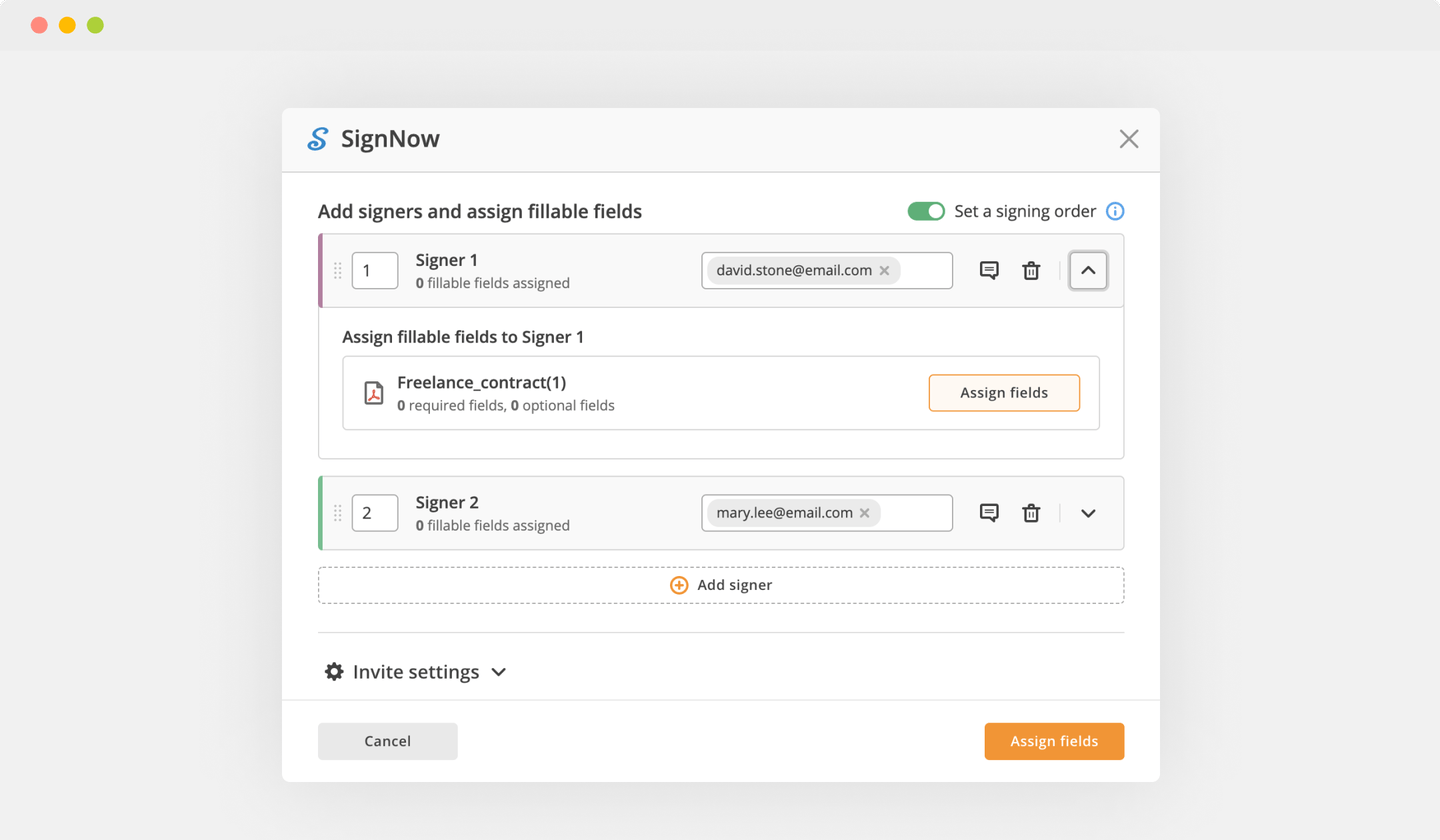

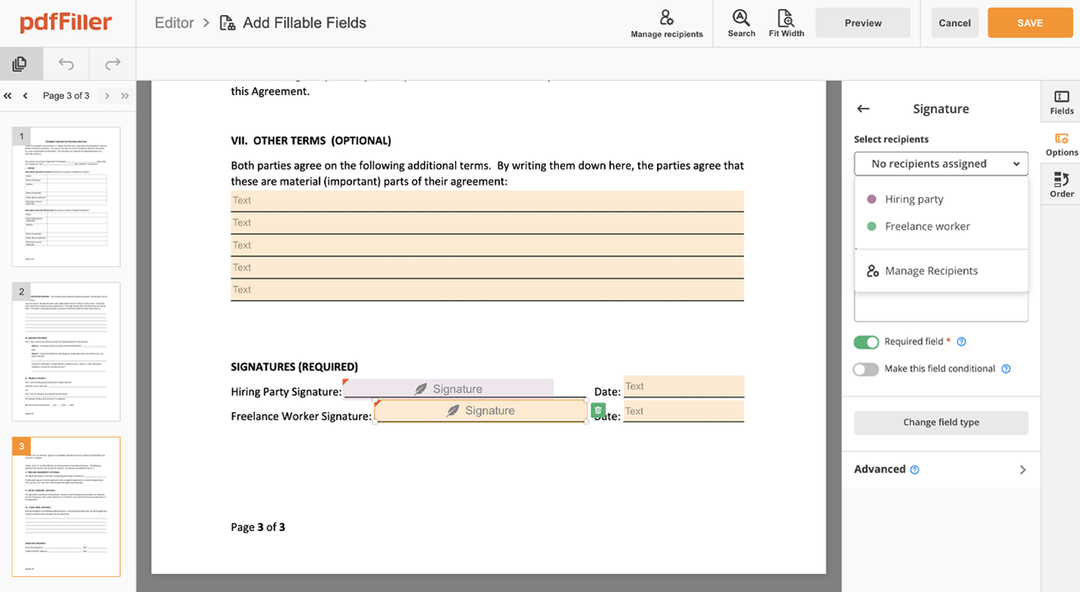

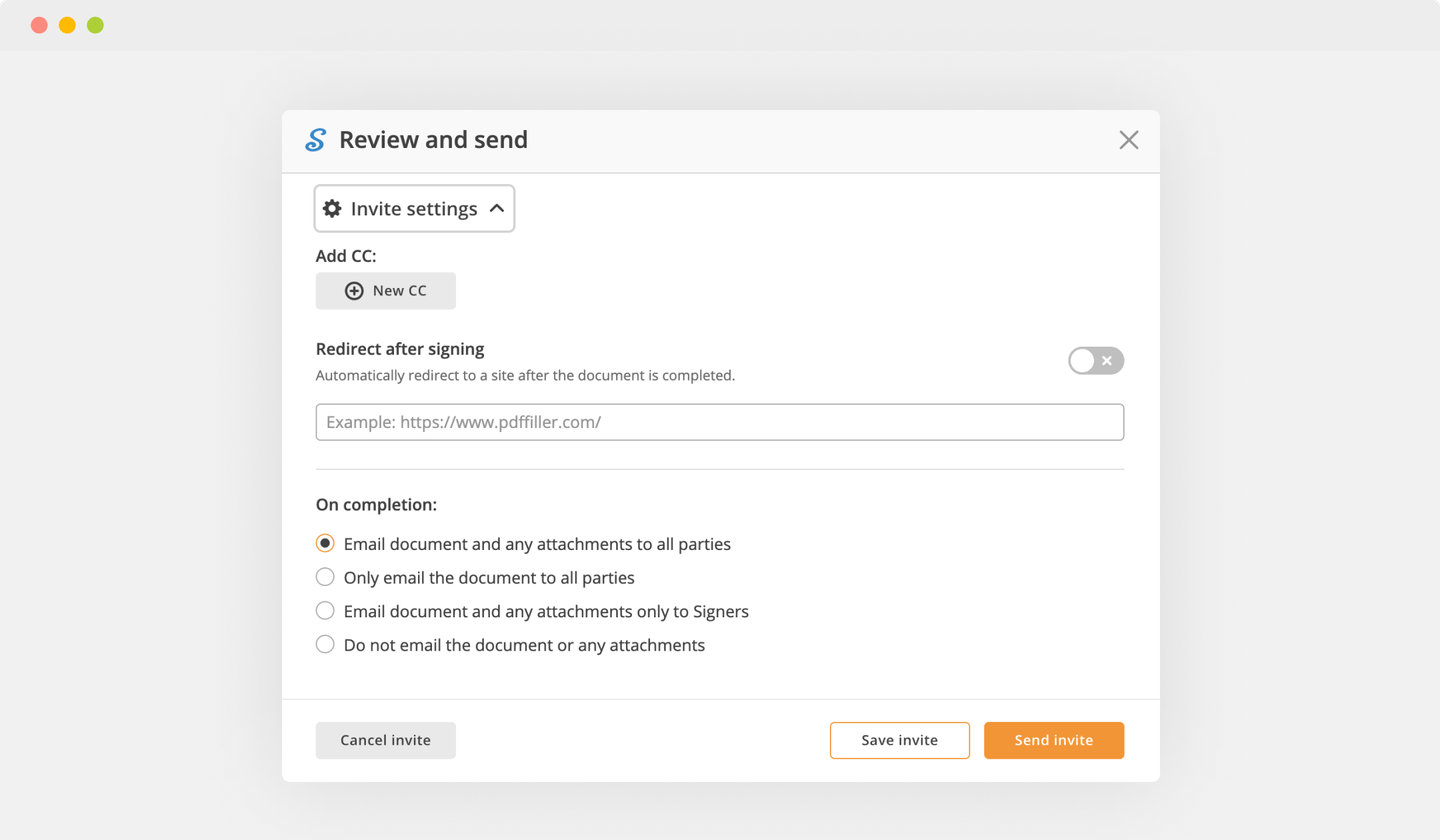

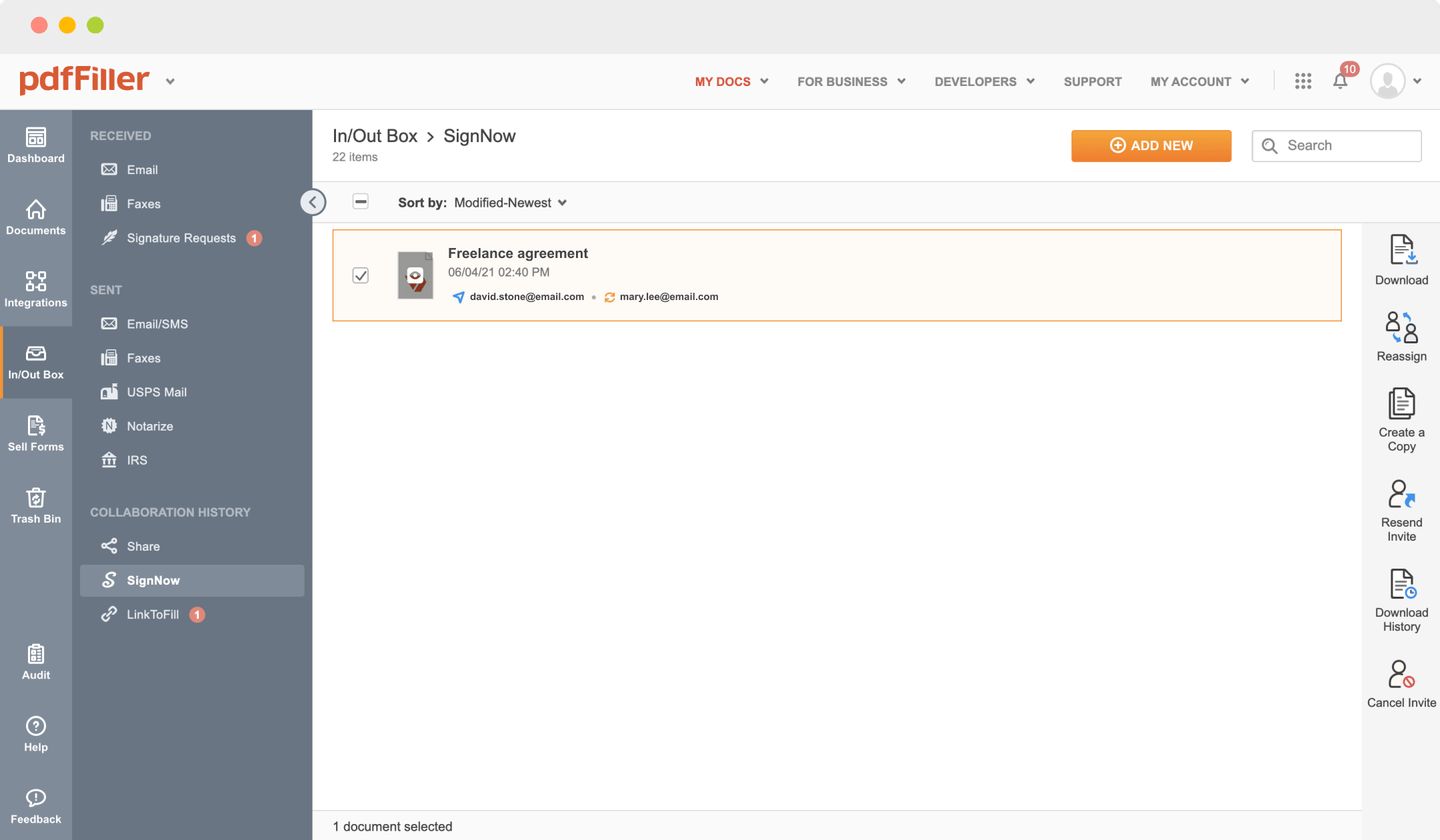

Send documents for eSignature with signNow

Create role-based eSignature workflows without leaving your pdfFiller account — no need to install additional software. Edit your PDF and collect legally-binding signatures anytime and anywhere with signNow’s fully-integrated eSignature solution.

All-in-one PDF software

A single pill for all your PDF headaches. Edit, fill out, eSign, and share – on any device.

pdfFiller scores top ratings in multiple categories on G2

How to Cosign signing Request

Still using numerous programs to create and edit your documents? We have a solution for you. Use our editor to make the process fast and efficient. Create forms, contracts, make templates, integrate cloud services and utilize more features within one browser tab. You can Cosign signing Request directly, all features, like signing orders, alerts, attachment and payment requests, are available instantly. Get a significant advantage over other applications.

How-to Guide

How to edit a PDF document using the pdfFiller editor:

01

Drag and drop your template to pdfFiller`s uploader

02

Choose the Cosign signing Request feature in the editor`s menu

03

Make all the needed edits to the file

04

Click “Done" button in the top right corner

05

Rename the document if it's needed

06

Print, share or download the form to your desktop

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

Tim

2019-01-04

His is getting much easier now that I've done it a couple times and it is very convenient to have an Online service so I can use any of my Electronic devices.

McKenzie M.

2019-05-16

Great Product!

I love this software; it has been invaluable. I have used it to fill out job applications, insurance, medical & school documents. I'll continue to use it.

It is very easy to upload documents to this software. Editing is user-friendly even for those not technically savvy. I like that I have many options in saving or exporting my finished document. Also, I like that my previous documents are saved because there has been more than once that a document has been lost or needed again. I have been saved by the fact that PDF Filler has the previously used document saved.

I have not found anything I really dislike about this software. I'll be honest in that I'm not crazy about the price but I have found this software so helpful I have been using it for over two years now. I've recommended it to several people. I did not rate the customer service because I have never used it. I guess the fact that I've been using this for over two years & never had a customer service issue speaks for itself.

Get a powerful PDF editor for your Mac or Windows PC

Install the desktop app to quickly edit PDFs, create fillable forms, and securely store your documents in the cloud.

Edit and manage PDFs from anywhere using your iOS or Android device

Install our mobile app and edit PDFs using an award-winning toolkit wherever you go.

Get a PDF editor in your Google Chrome browser

Install the pdfFiller extension for Google Chrome to fill out and edit PDFs straight from search results.

List of extra features

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I pay someone to cosign for me?

You do have to pay for our services after applying in order for us to help find you a cosigner. You can choose to pay your cosigner out-of-pocket with what you can afford. If you are applying for a loan, you could offer to pay your cosigner with a part of the loan you receive after your application is approved.

How much should a cosigner make?

So, it is important to keep two key things in mind when looking for your cosigner. Their income level would need to be sufficient to cover the loan payments should you be unable to make them. Their credit score needs to be above 650 for your lender to consider them as a reliable cosigner in most cases.

Do co-signers need good credit?

Although there might not be a required credit score, a cosigner typically will need credit in the very good or exceptional range670 or better. A credit score in that range generally qualifies someone to be a cosigner, but each lender will have its own requirement.

Is it a bad idea to cosign for someone?

Even if the borrower is diligent about making the payments, you may still run into credit problems as a result of cosigning. Any loan you cosign will show up on your credit report as one of your own debts. Yes, that's a hassle, but if this person can't get a loan without a cosigner, there's a good reason for it.

What does the Bible say about cosigning for a family member?

Proverbs, He that is surety for a stranger shall smart for it: and he that hate suretiship is sure. Someone who cosigns a loan is given many warnings from the Word of God not to mention the bank as well. It demands great responsibility and must not be entered into lightly.

How do I find a cosigner online?

Short answer: you can't find a co-signer online. If you do, it's a sure bet it's a scammer looking to separate you from your money. A co-signer is someone who is willing to take responsibility for your loan payments should you default.

What if I can't find a cosigner?

How to Find a Cosigner. Most people who cosign for a loan are friends, family members, spouses, or significant others to the primary applicant.

Non-Traditional Lending Options.

Pledge Collateral.

Reduce Your Loan Amount.

Delay Your Application.

Build Your Credit.

Can you pay for a co-signer?

You can choose to pay your cosigner out-of-pocket with what you can afford. If you are applying for a loan, you could offer to pay your cosigner with a part of the loan you receive after your application is approved.

Does a co applicant need good credit?

When applying with a co-applicant, a standard credit application is required for both borrowers. Borrowers with good credit can help low credit quality borrowers to obtain loan financing approval. They can also help to lower the interest rate on a loan for average credit quality borrowers.

Does a cosigner credit get affected?

In a strict sense, the answer is no. The fact that you are a cosigner in and of itself does not necessarily hurt your credit. However, even if the cosigned account is paid on time, the debt may affect your credit scores and revolving utilization, which could affect your ability to get a loan in the future.

Can a cosigner become the primary?

If you cosign a loan, you are giving your word that the primary applicant will make the payments to honor the contract. You can contact the lender and attempt to take over the loan to save your credit. Many lenders will not allow you to become the primary borrower without following the proper protocol.

Can a cosigner become primary borrower?

If you cosign a loan, you are giving your word that the primary applicant will make the payments to honor the contract. You can contact the lender and attempt to take over the loan to save your credit. Many lenders will not allow you to become the primary borrower without following the proper protocol.

Who owns the car primary or cosigner?

A co-borrower is someone who shares equal ownership rights and is usually a spouse. On the other hand, a cosigner is someone who signs on the car loan in order to help the primary borrower get approved. A co-borrower has ownership rights to the car, but a cosigner doesn't.

What is the cosigner responsible for?

A cosigner guarantees the person for whom they are cosigning will repay the debt on-time and in-full. They are contractually obligated to repay the debt if the person they cosigned for fails to pay. As a cosigner, you are as responsible for the debt as the person for whom you cosigned.

What credit score does a cosigner need?

Generally, a cosigner is only needed when your credit score or income may not be strong enough to meet a financial institution's underwriting guidelines. If you have a stronger credit score, typically 650 and above, along with sufficient income to cover the loan payment, it's likely you will not need a co-signer.

eSignature workflows made easy

Sign, send for signature, and track documents in real-time with signNow.