Digi-sign Donation Receipt For Free

Users trust to manage documents on pdfFiller platform

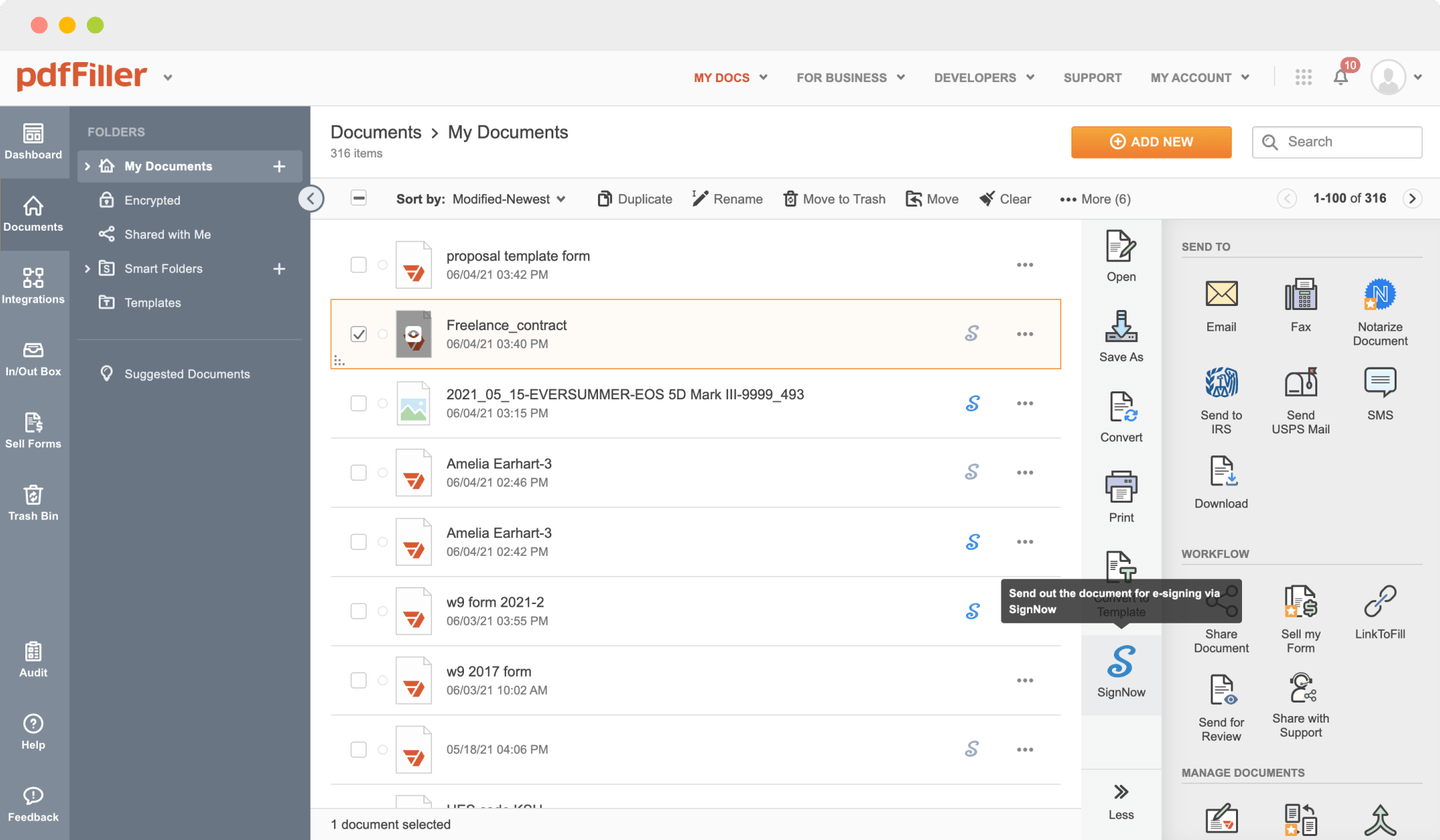

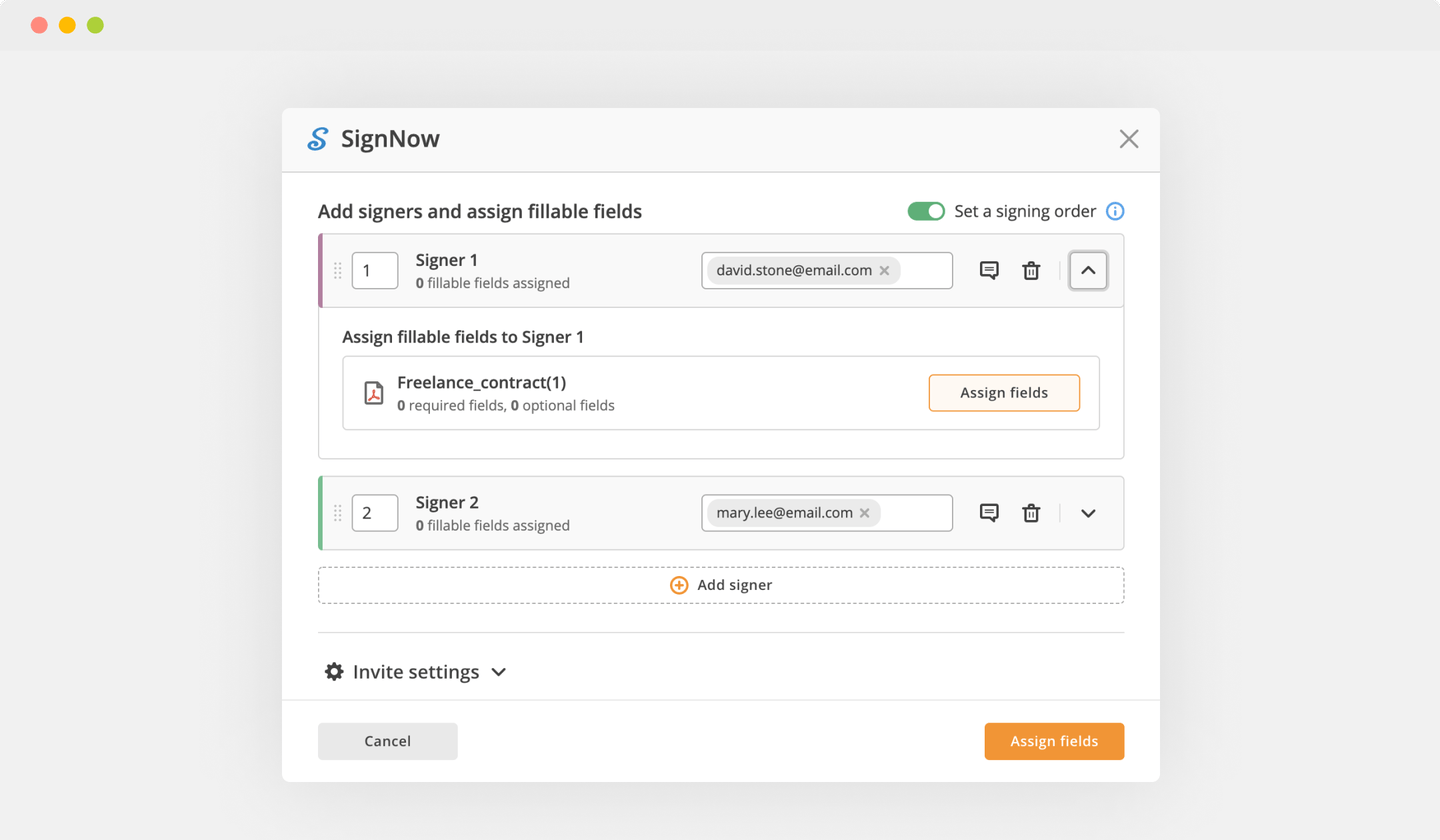

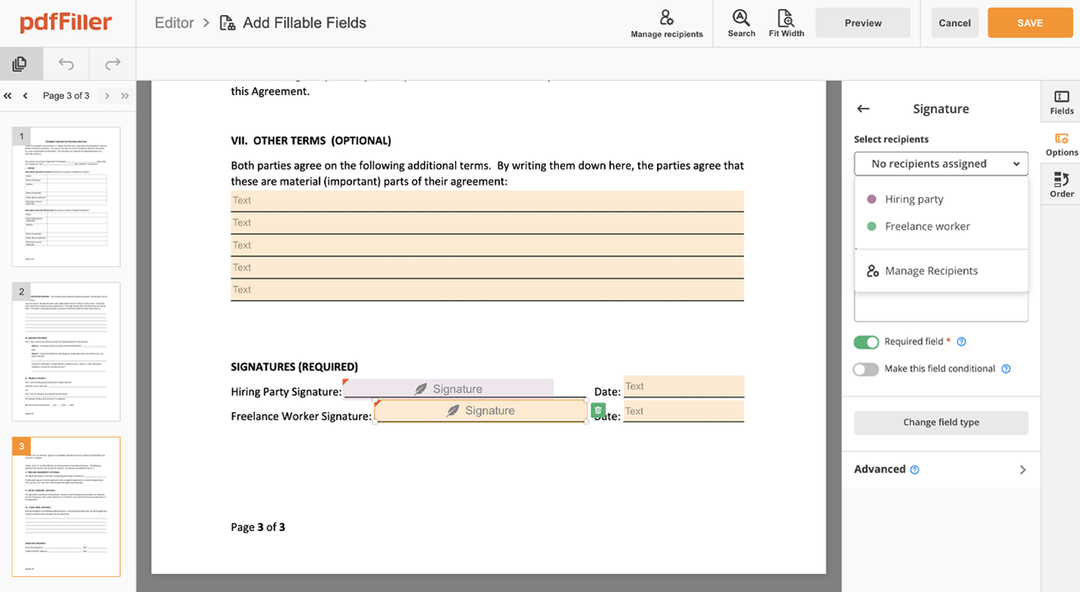

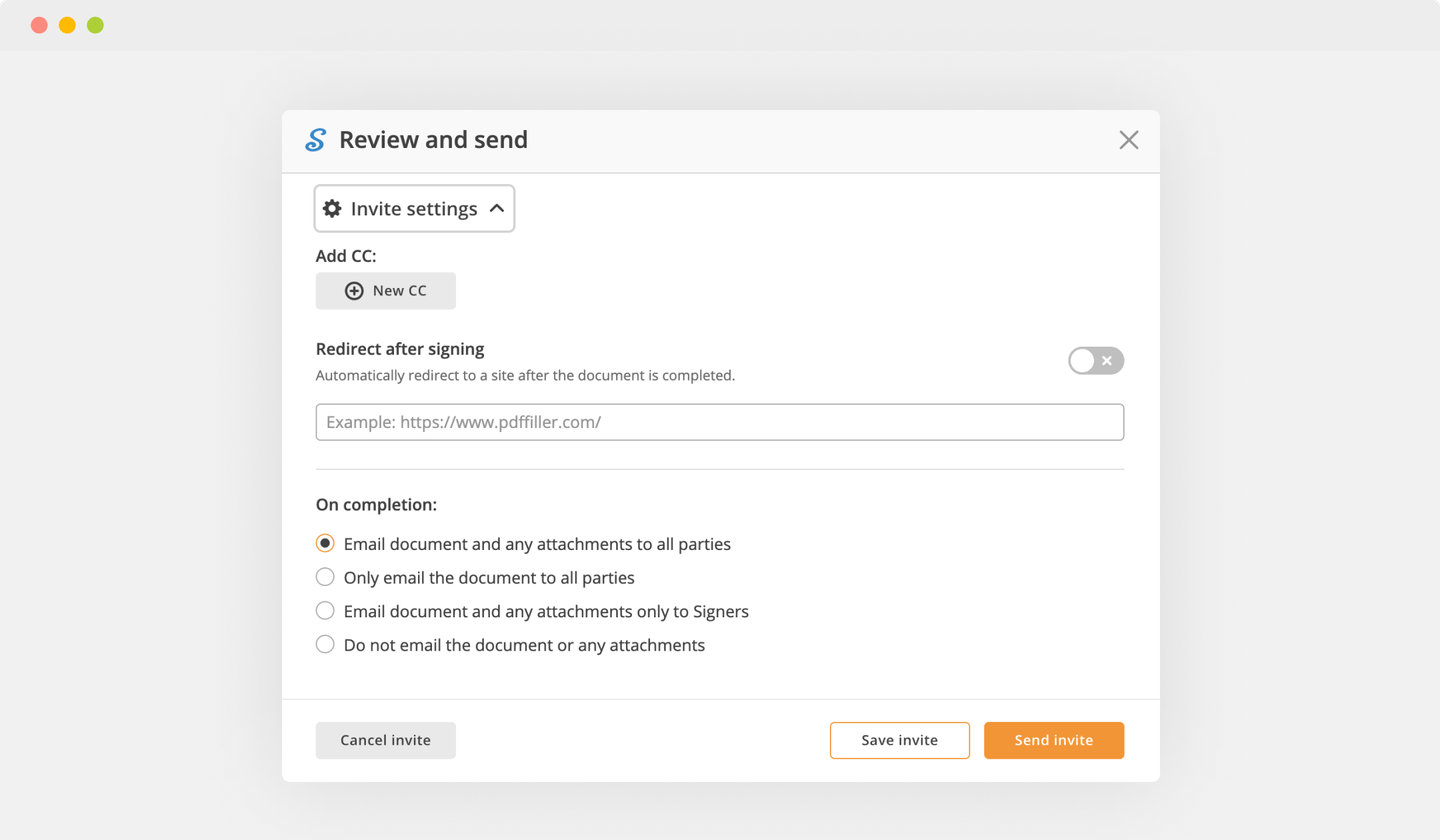

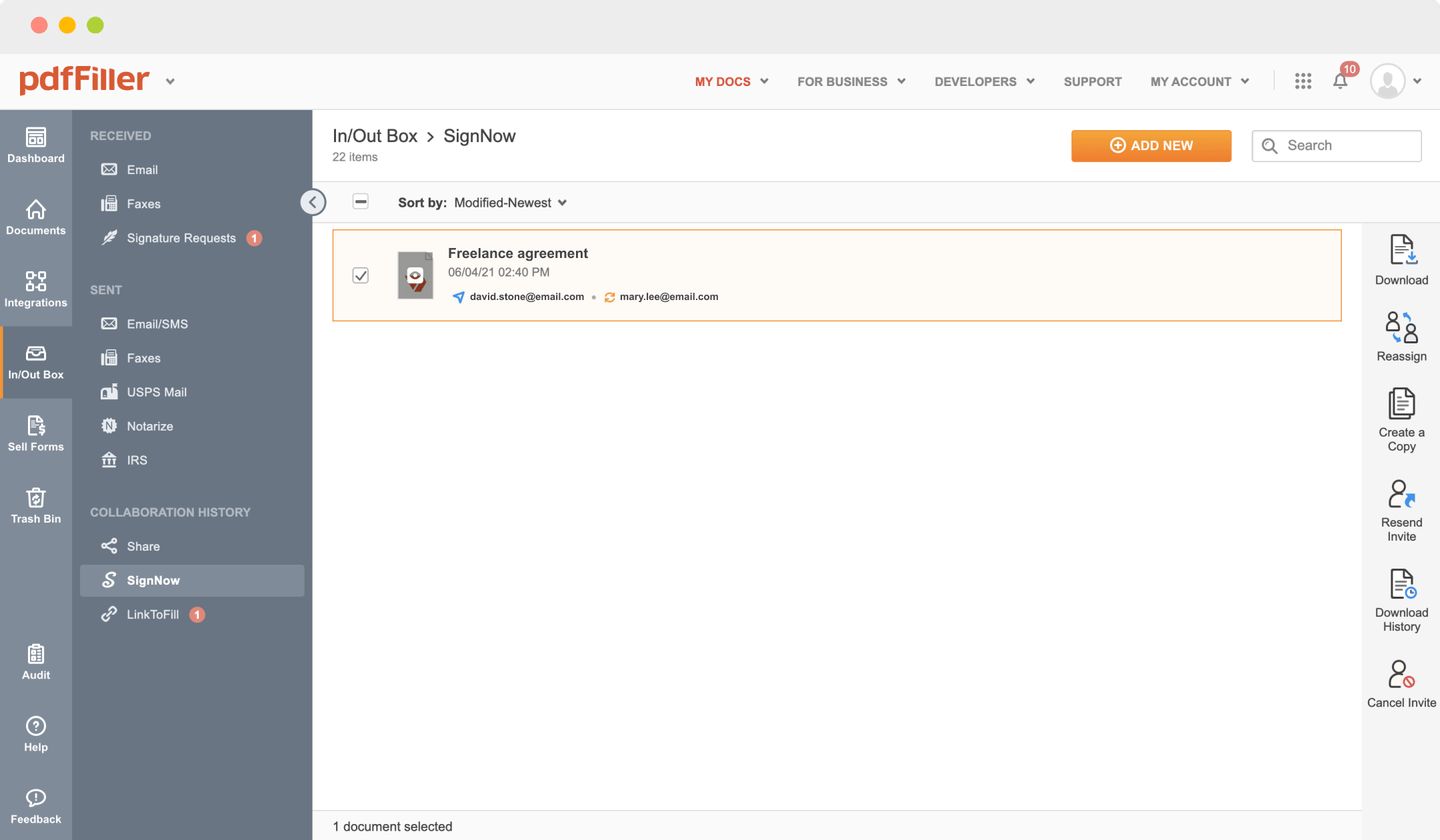

Send documents for eSignature with signNow

Watch a quick video tutorial on how to Digi-sign Donation Receipt

pdfFiller scores top ratings in multiple categories on G2

Digi-sign Donation Receipt in minutes

pdfFiller allows you to Digi-sign Donation Receipt quickly. The editor's convenient drag and drop interface allows for quick and intuitive document execution on any operaring system.

Ceritfying PDFs electronically is a quick and secure method to verify paperwork at any time and anywhere, even while on the fly.

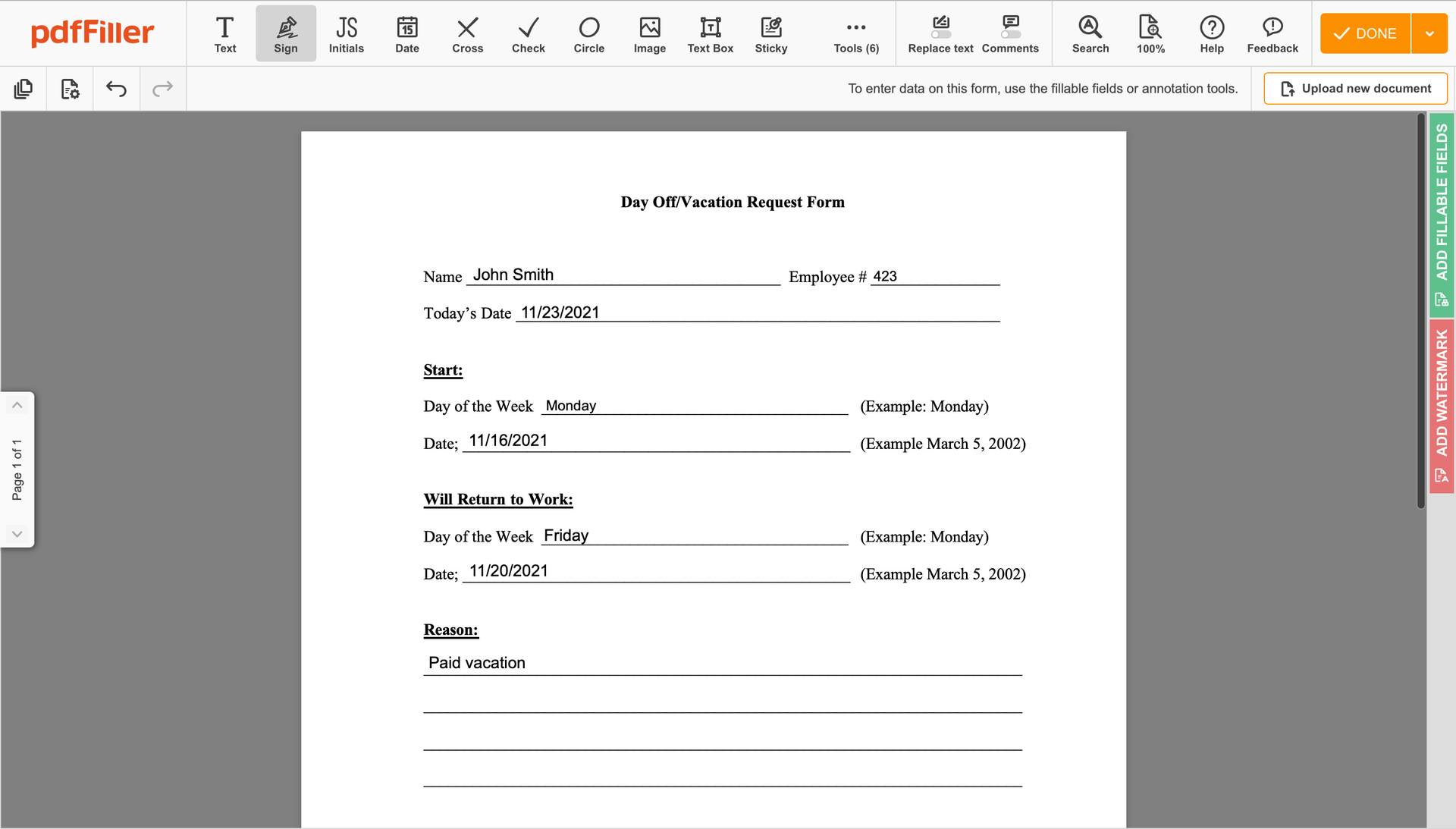

Go through the step-by-step guide on how to Digi-sign Donation Receipt online with pdfFiller:

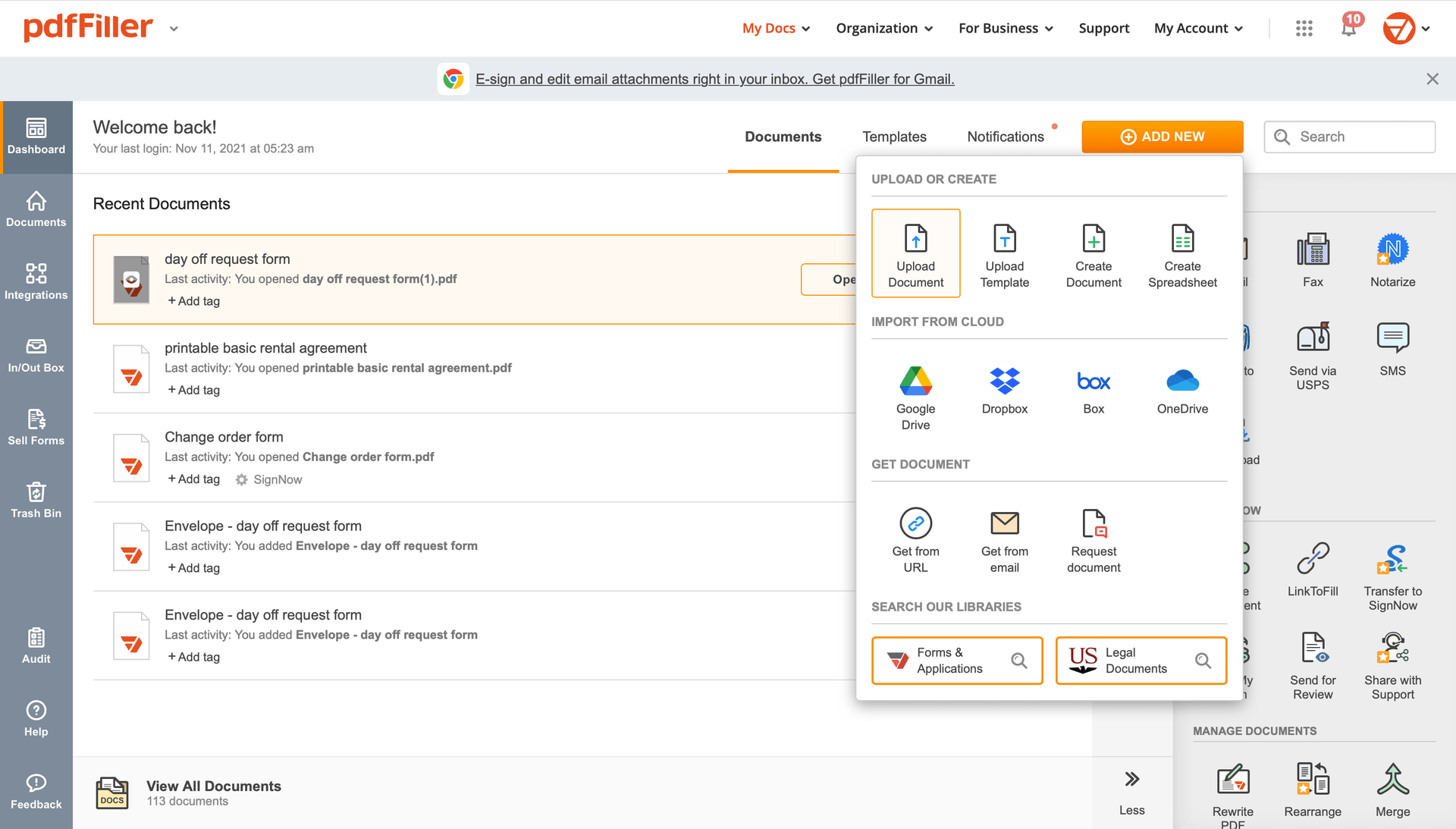

Add the document for eSignature to pdfFiller from your device or cloud storage.

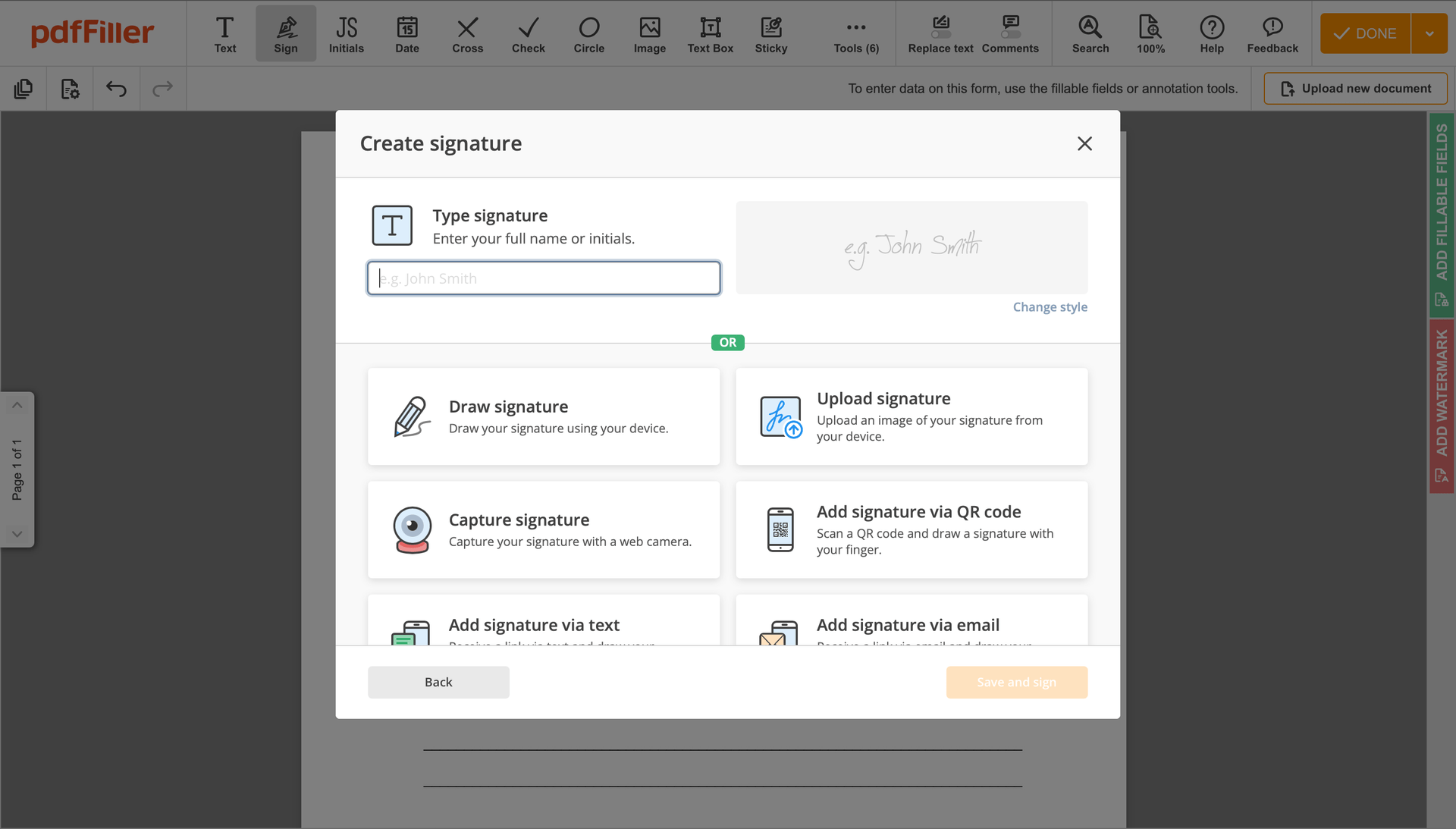

As soon as the document opens in the editor, click Sign in the top toolbar.

Create your electronic signature by typing, drawing, or adding your handwritten signature's photo from your device. Then, click Save and sign.

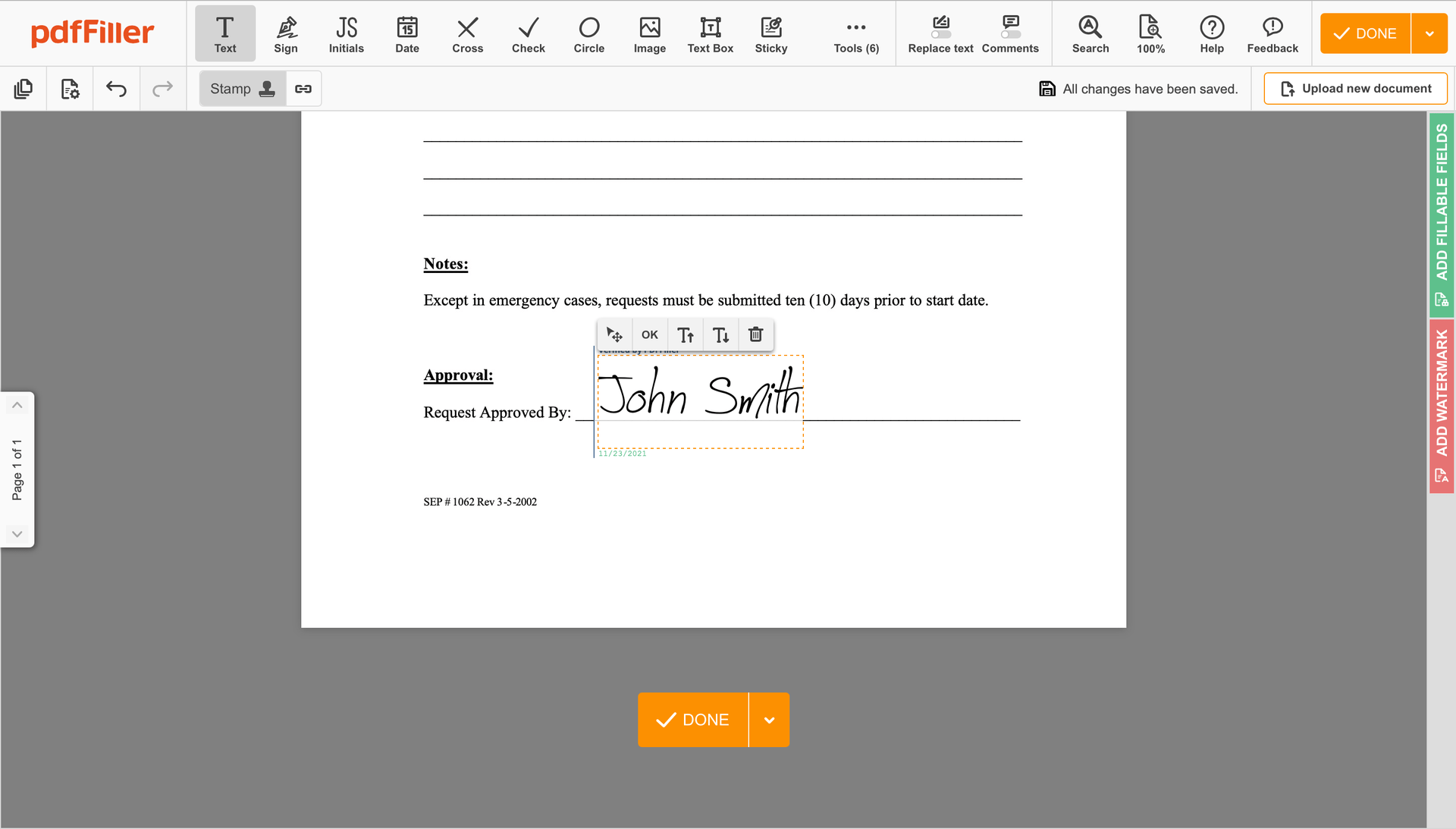

Click anywhere on a document to Digi-sign Donation Receipt. You can drag it around or resize it utilizing the controls in the floating panel. To apply your signature, hit OK.

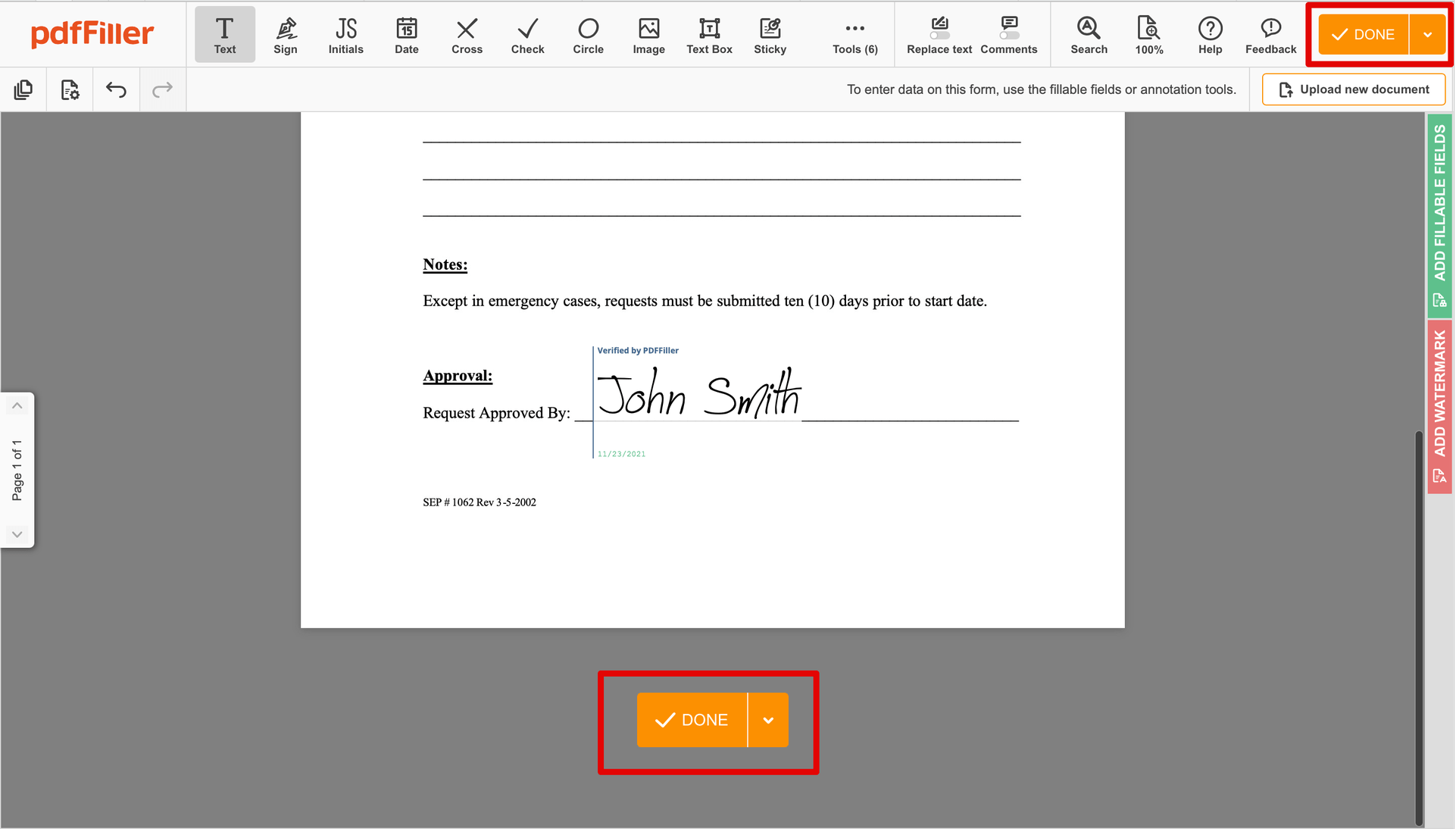

Complete the signing process by hitting DONE below your form or in the top right corner.

Next, you'll go back to the pdfFiller dashboard. From there, you can get a signed copy, print the document, or send it to other people for review or approval.

Stuck with numerous programs to manage documents? Use our all-in-one solution instead. Use our document management tool for the fast and efficient workflow. Create fillable forms, contracts, make templates, integrate cloud services and utilize even more useful features within your browser. Plus, you can use Division Donation Receipt and add high-quality professional features like signing orders, reminders, requests, easier than ever. Have a significant advantage over those using any other free or paid tools. The key is flexibility, usability and customer satisfaction.

How to edit a PDF document using the pdfFiller editor:

How to Send a PDF for eSignature

What our customers say about pdfFiller