Electronically Sign Commitment Letter For Free

Users trust to manage documents on pdfFiller platform

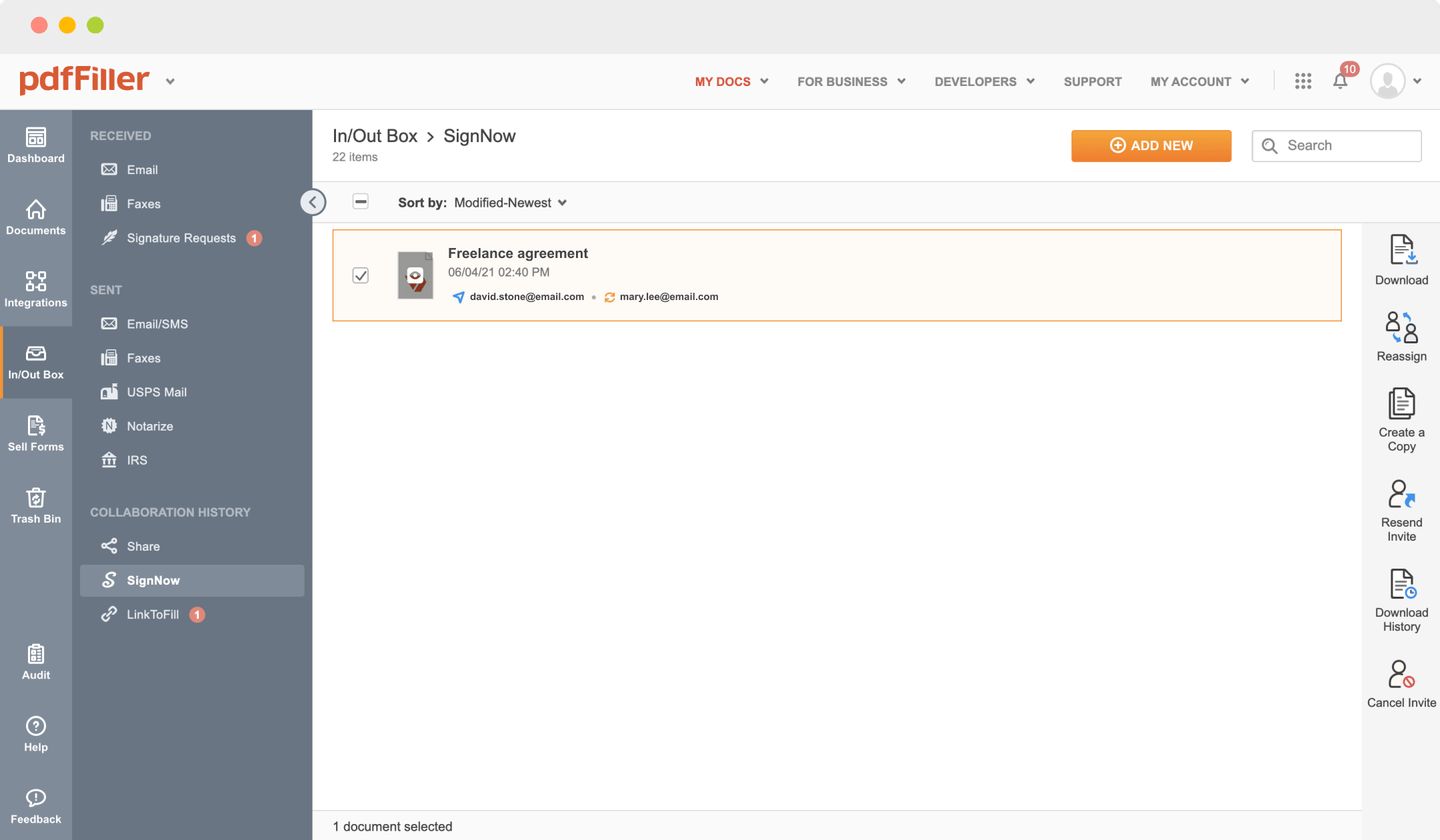

Send documents for eSignature with signNow

Watch a quick video tutorial on how to Electronically Sign Commitment Letter

pdfFiller scores top ratings in multiple categories on G2

Electronically Sign Commitment Letter in minutes

pdfFiller enables you to Electronically Sign Commitment Letter in no time. The editor's hassle-free drag and drop interface allows for fast and intuitive signing on any operaring system.

Ceritfying PDFs electronically is a fast and safe method to validate documents anytime and anywhere, even while on the go.

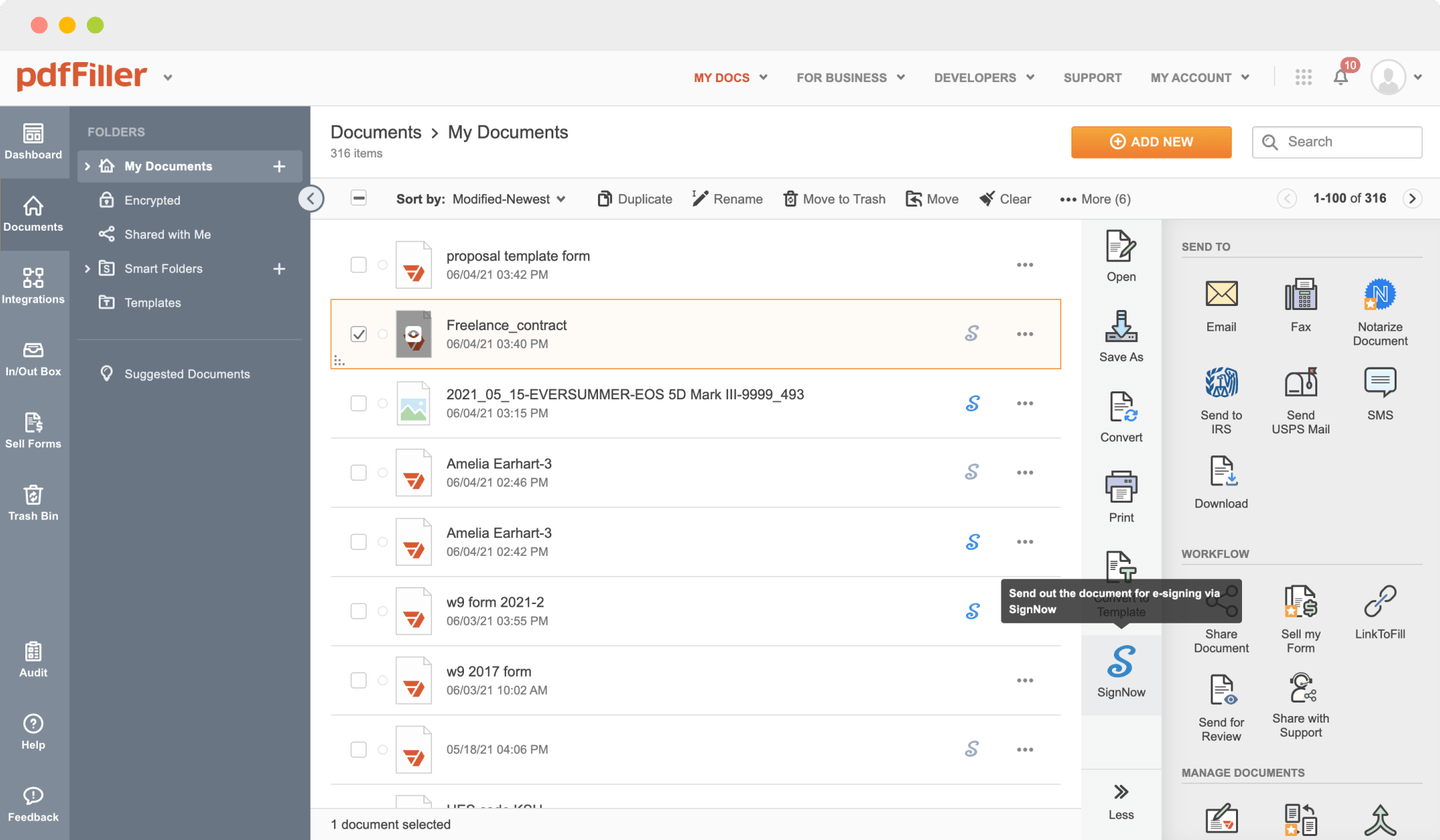

See the step-by-step instructions on how to Electronically Sign Commitment Letter online with pdfFiller:

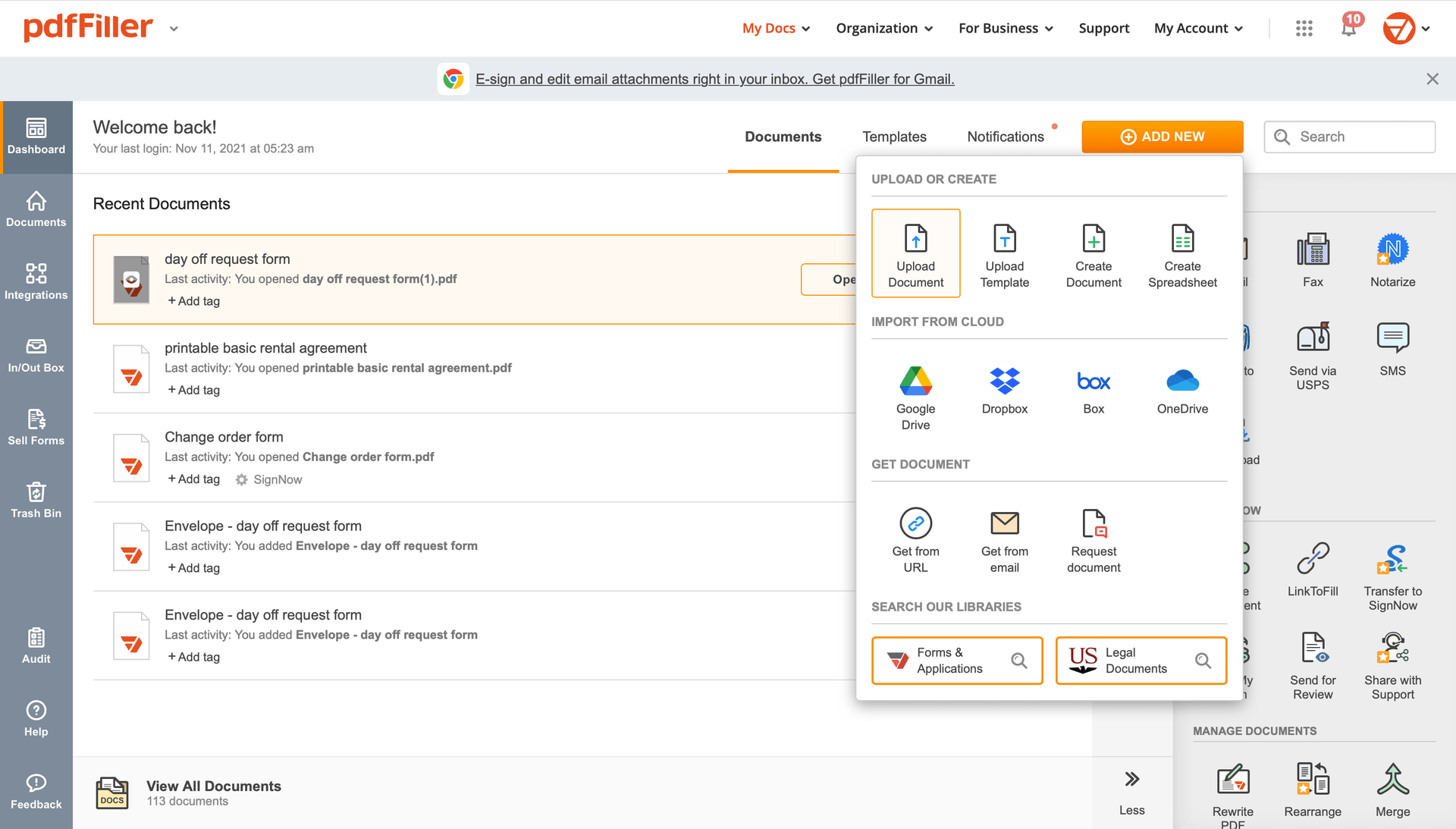

Upload the form for eSignature to pdfFiller from your device or cloud storage.

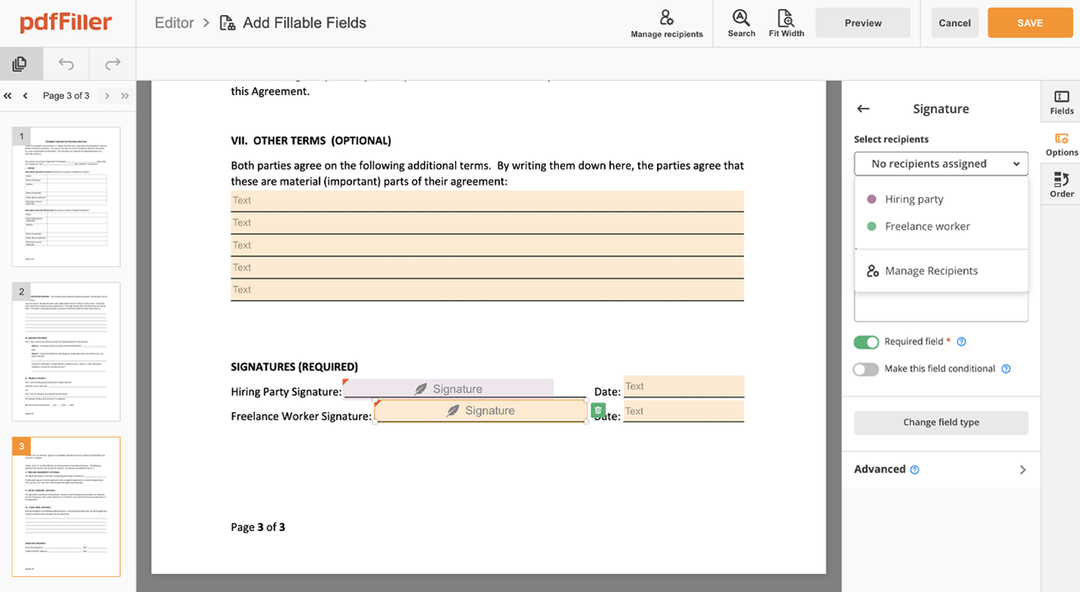

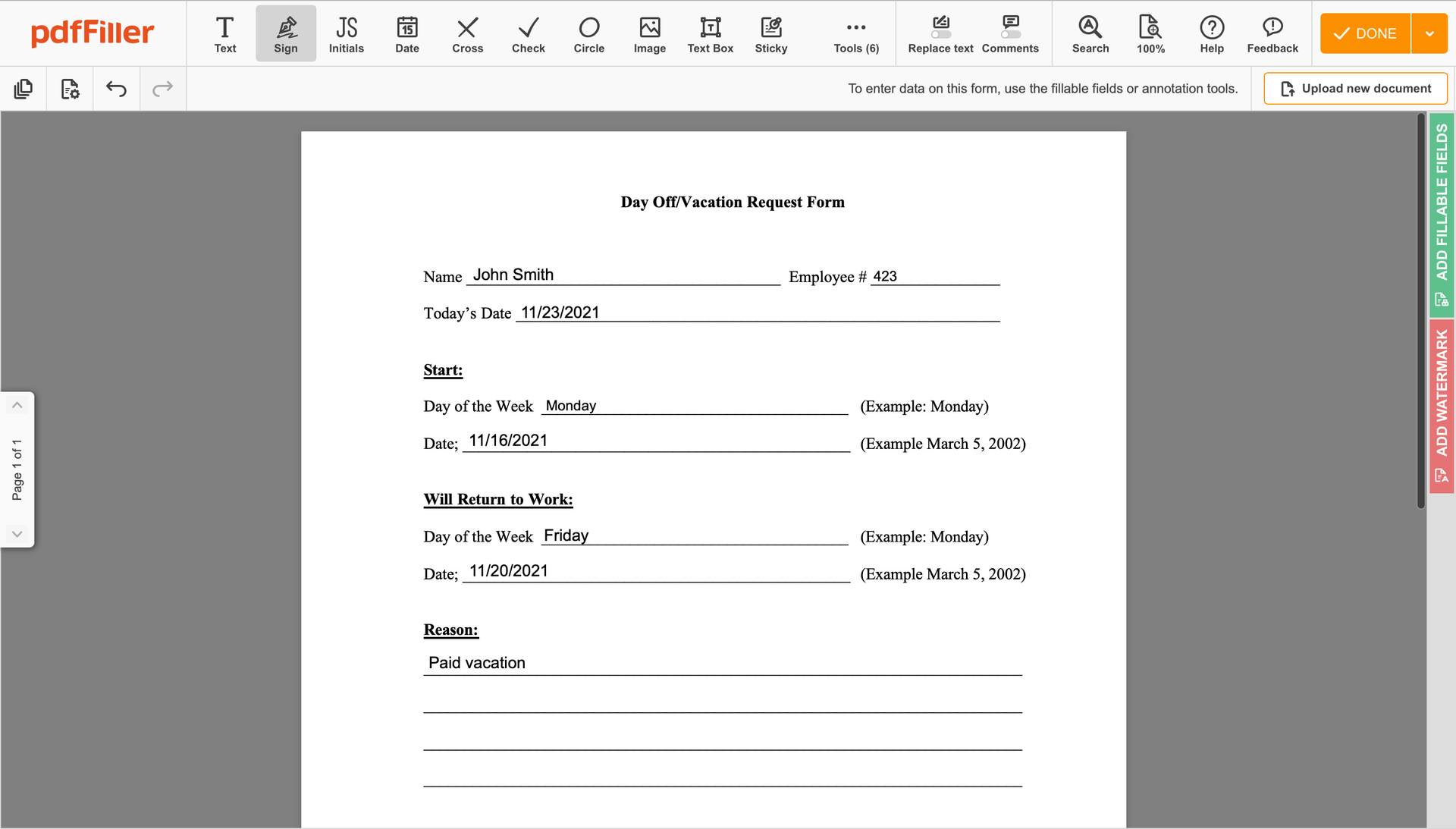

As soon as the document opens in the editor, click Sign in the top toolbar.

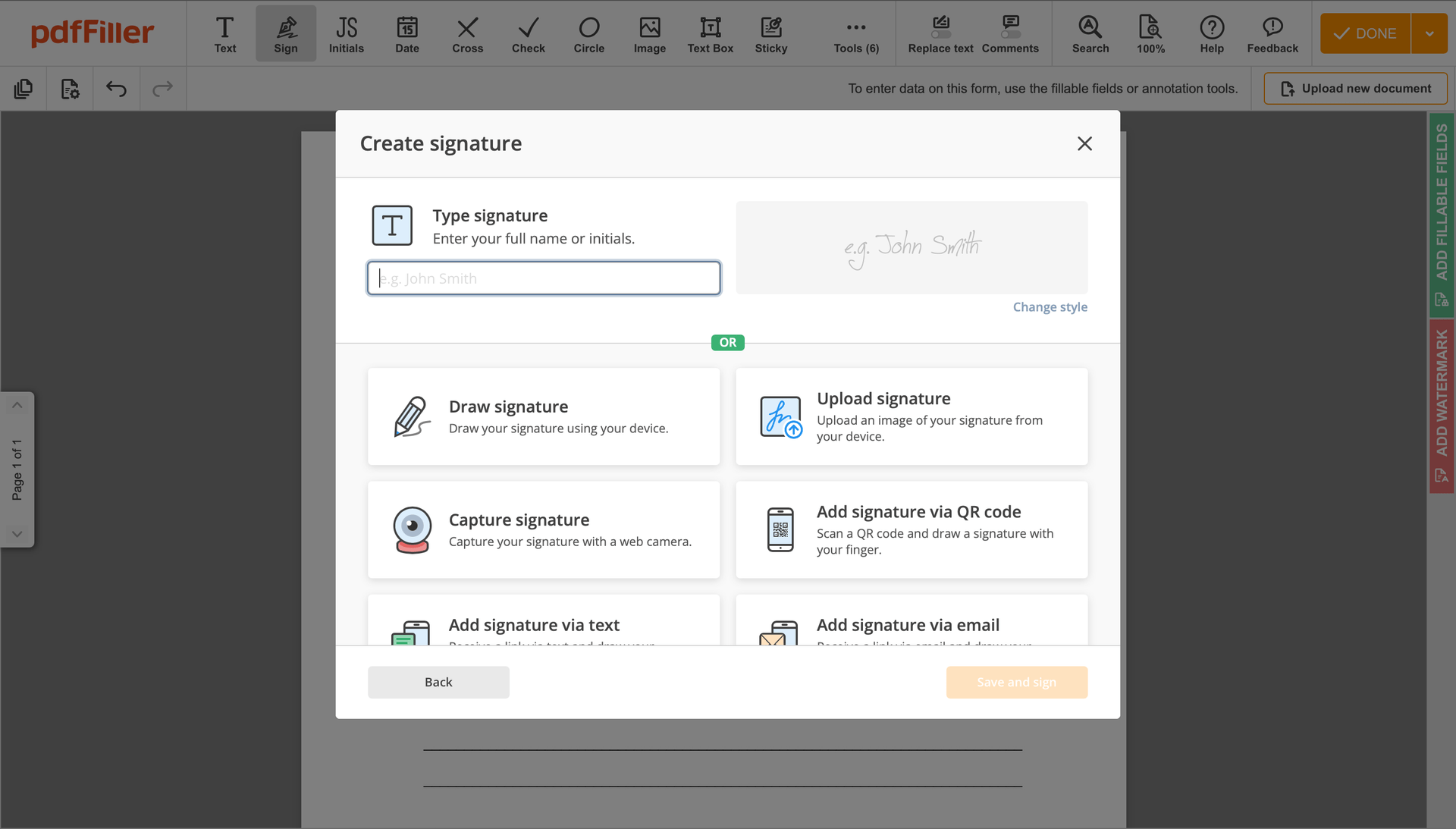

Generate your electronic signature by typing, drawing, or adding your handwritten signature's photo from your laptop. Then, hit Save and sign.

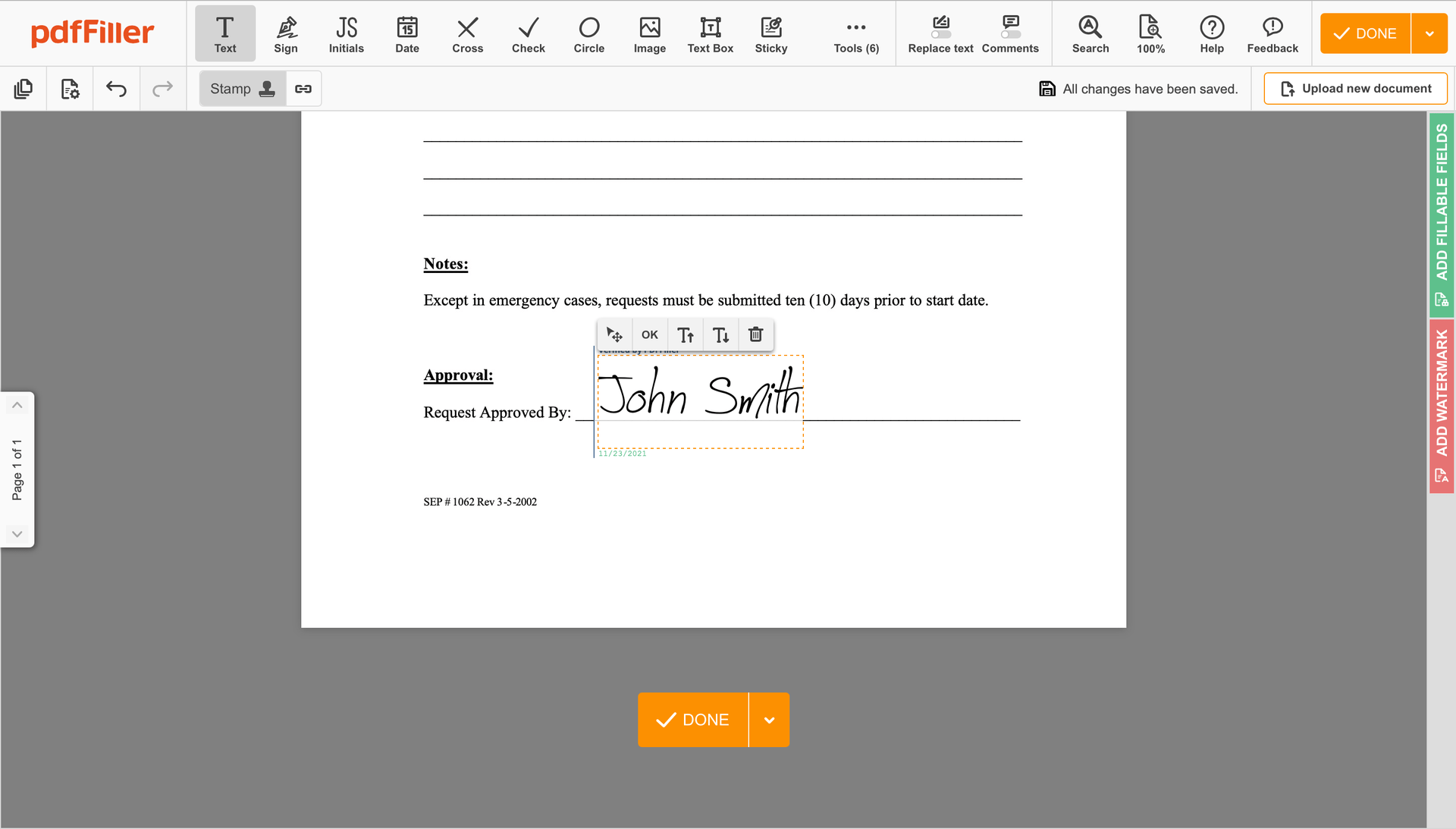

Click anywhere on a form to Electronically Sign Commitment Letter. You can move it around or resize it utilizing the controls in the floating panel. To use your signature, hit OK.

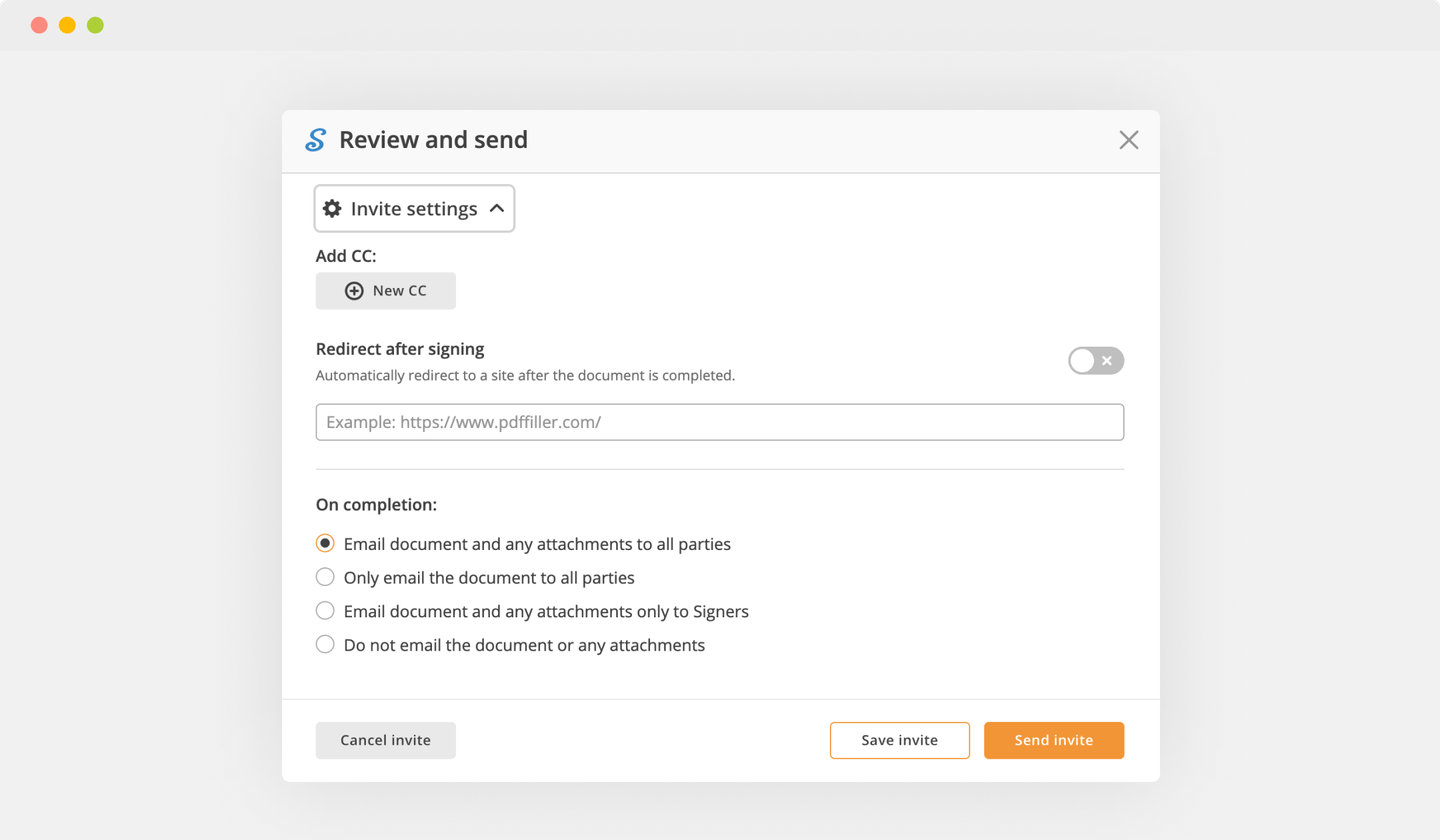

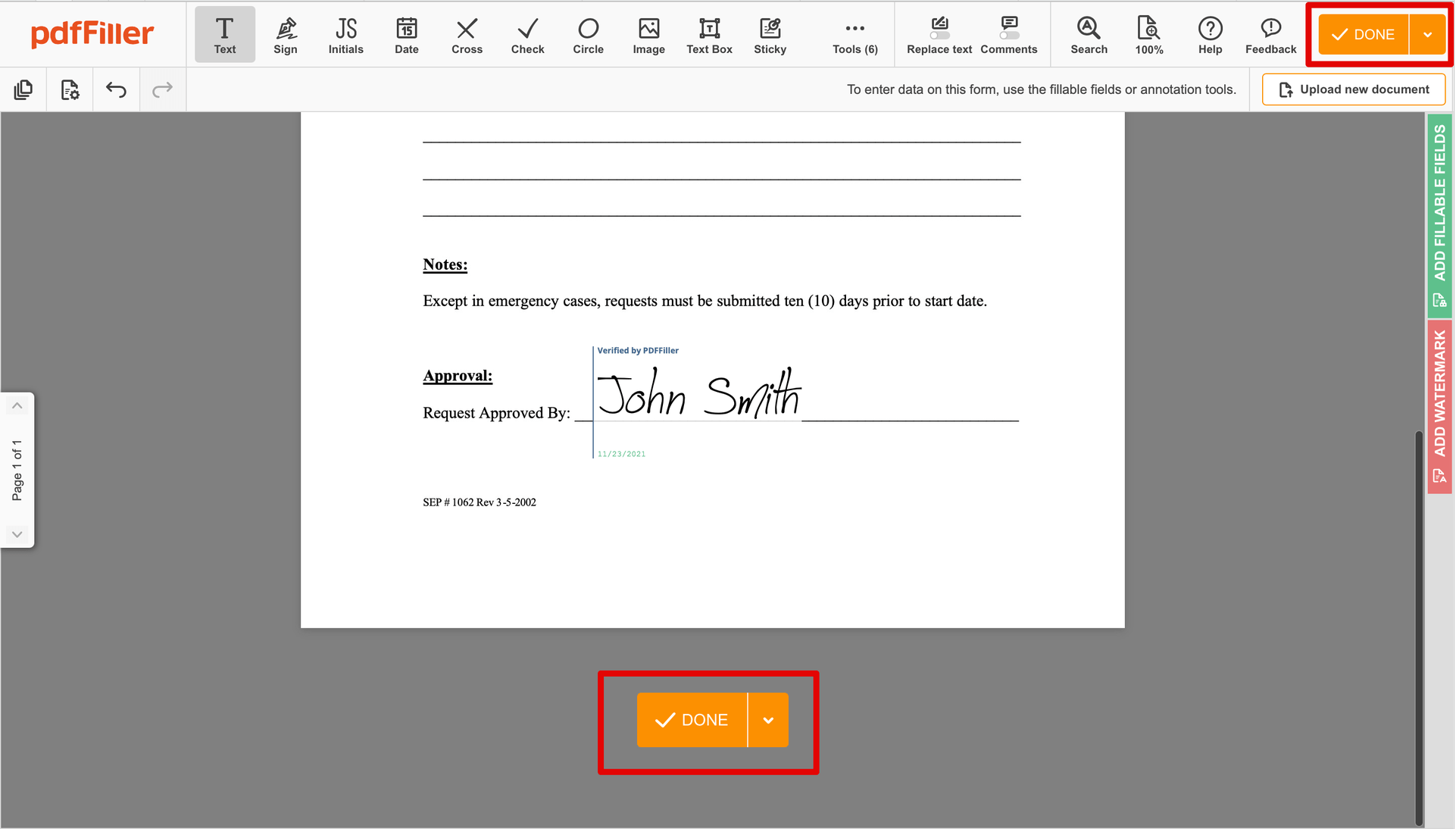

Finish up the signing process by clicking DONE below your document or in the top right corner.

Next, you'll return to the pdfFiller dashboard. From there, you can get a signed copy, print the form, or send it to other parties for review or approval.

Stuck working with numerous programs to sign and manage documents? Use this all-in-one solution instead. Use our document management tool for the fast and efficient work flow. Create document templates on your own, edit existing formsand other features, without leaving your browser. Plus, it enables you to use Electronically Sign Commitment Letter and add high-quality professional features like orders signing, reminders, requests, easier than ever. Pay as for a basic app, get the features as of pro document management tools. The key is flexibility, usability and customer satisfaction.

How to edit a PDF document using the pdfFiller editor:

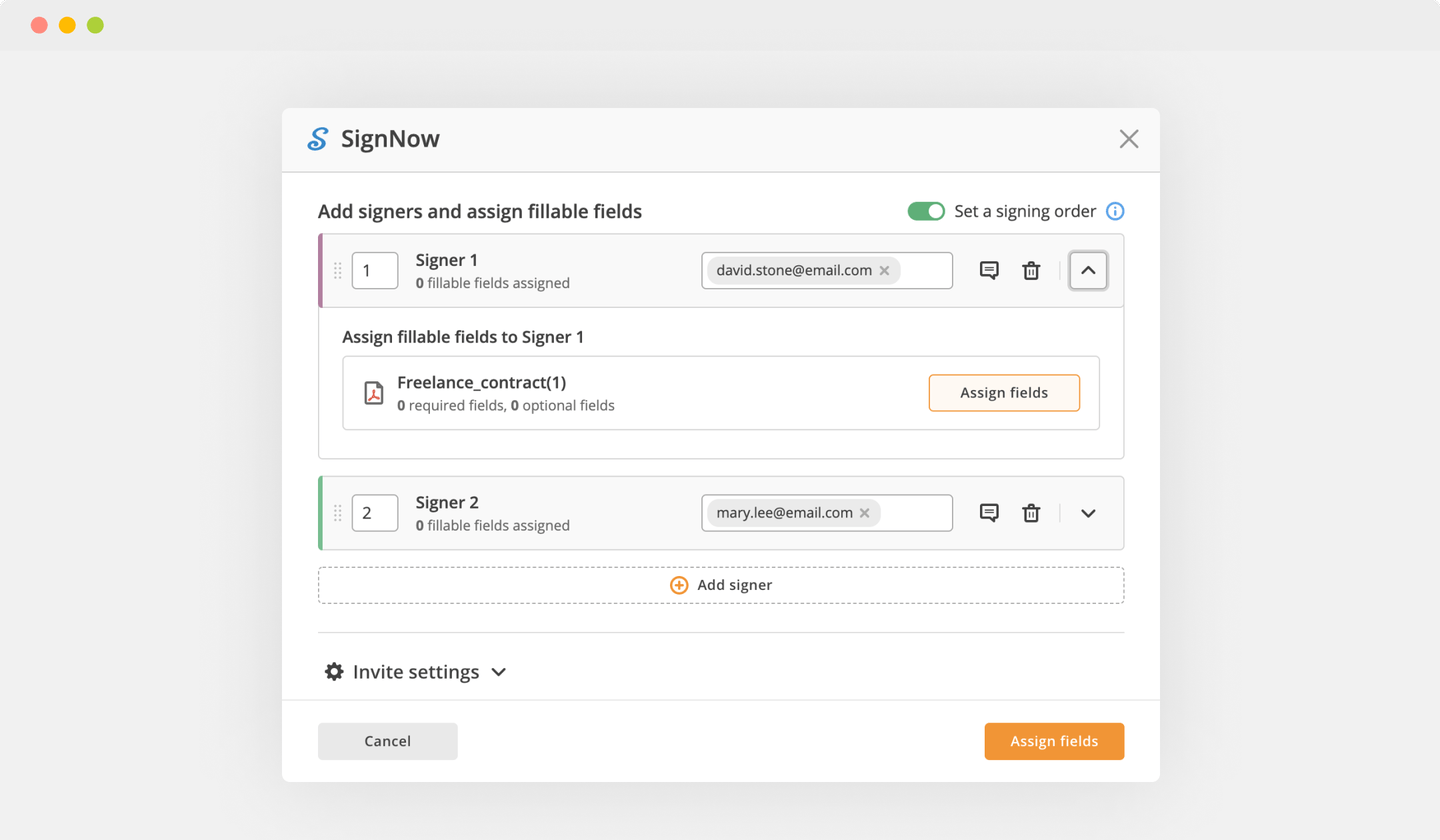

How to Send a PDF for eSignature

What our customers say about pdfFiller