Expect Signature Block Request For Free

Upload your document

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, or TXT

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

Upload your document to the PDF editor

Type anywhere or sign your form

Print, email, fax, or export

Try it right now! Edit pdf

Users trust to manage documents on pdfFiller platform

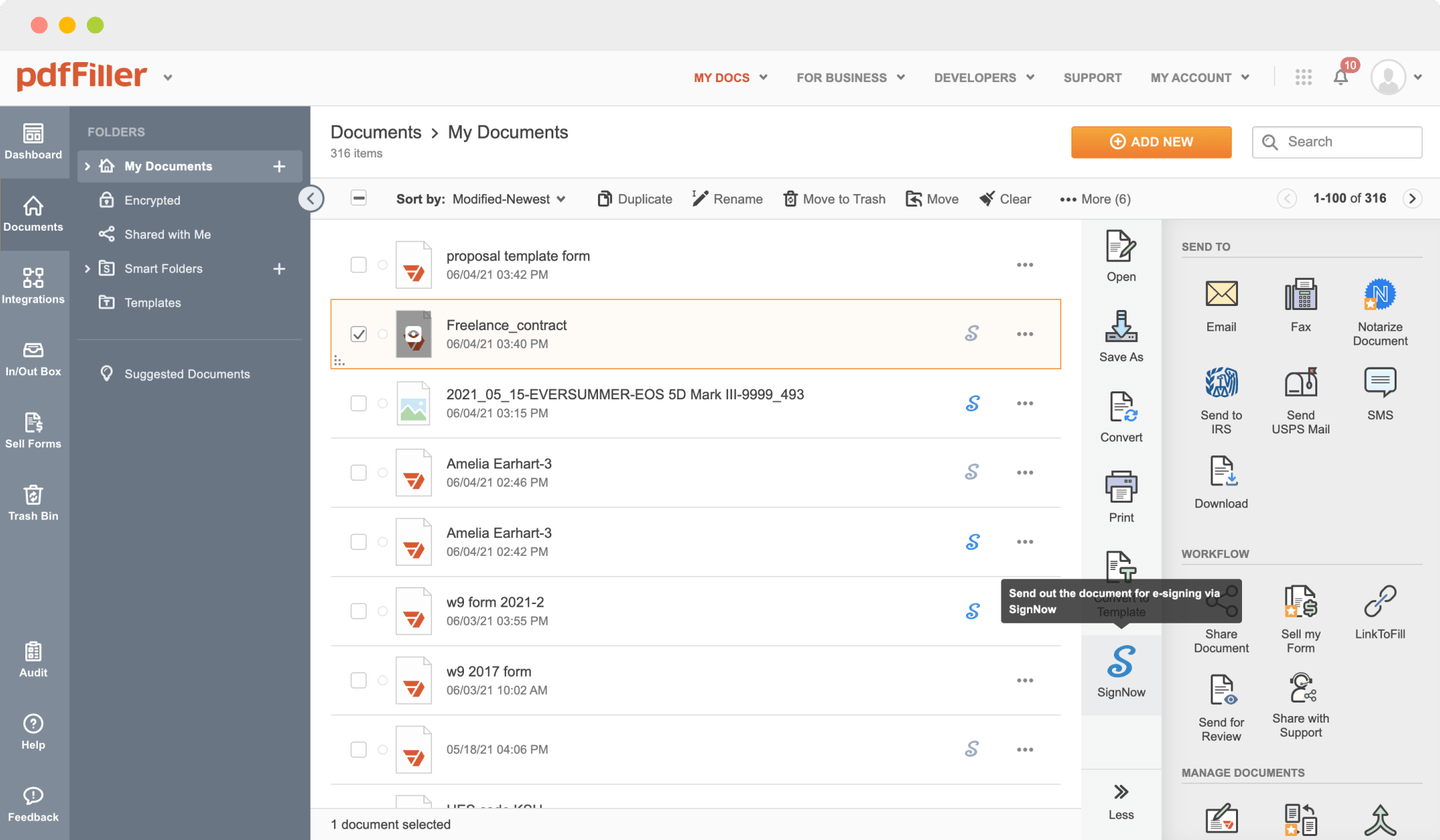

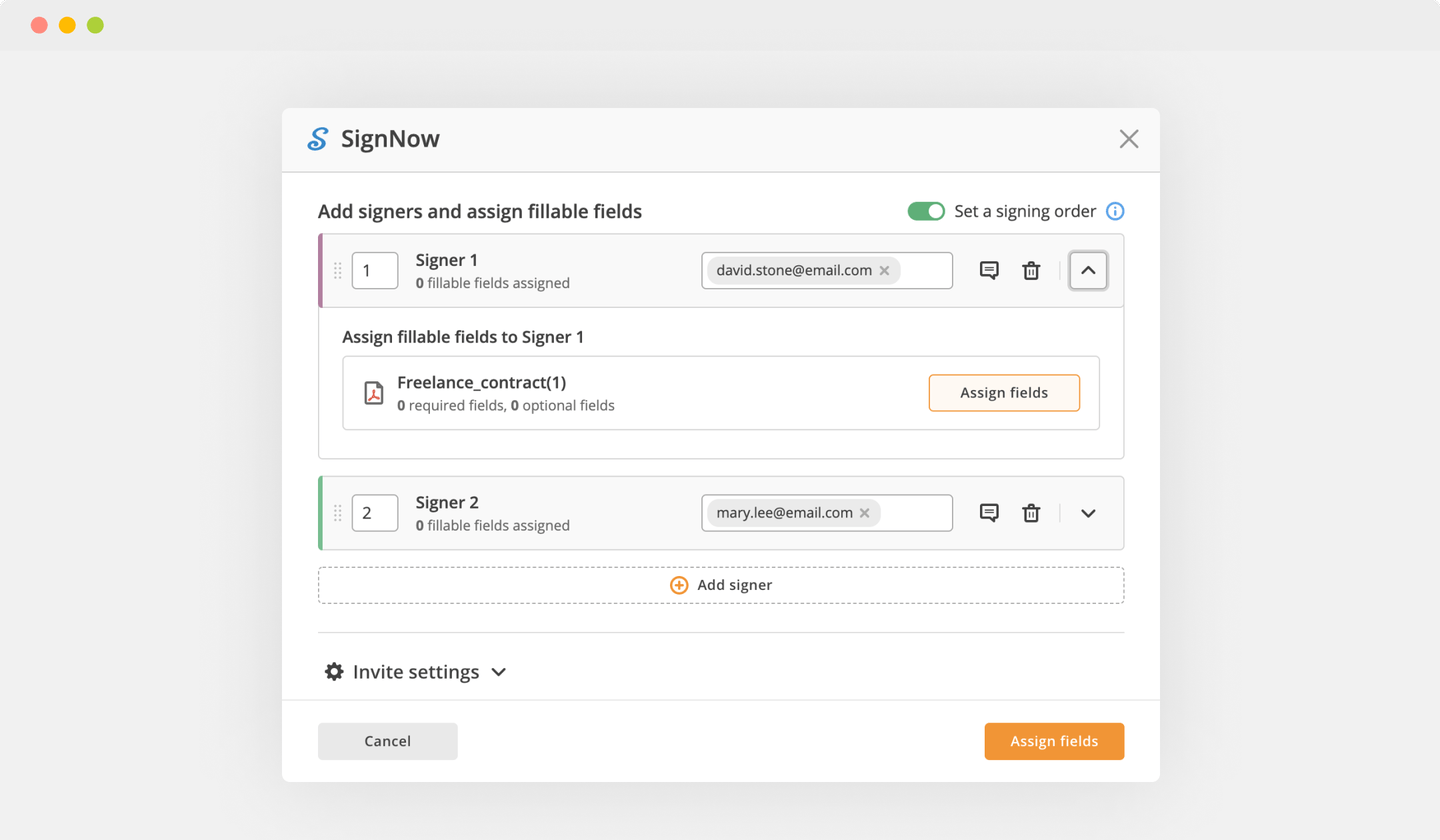

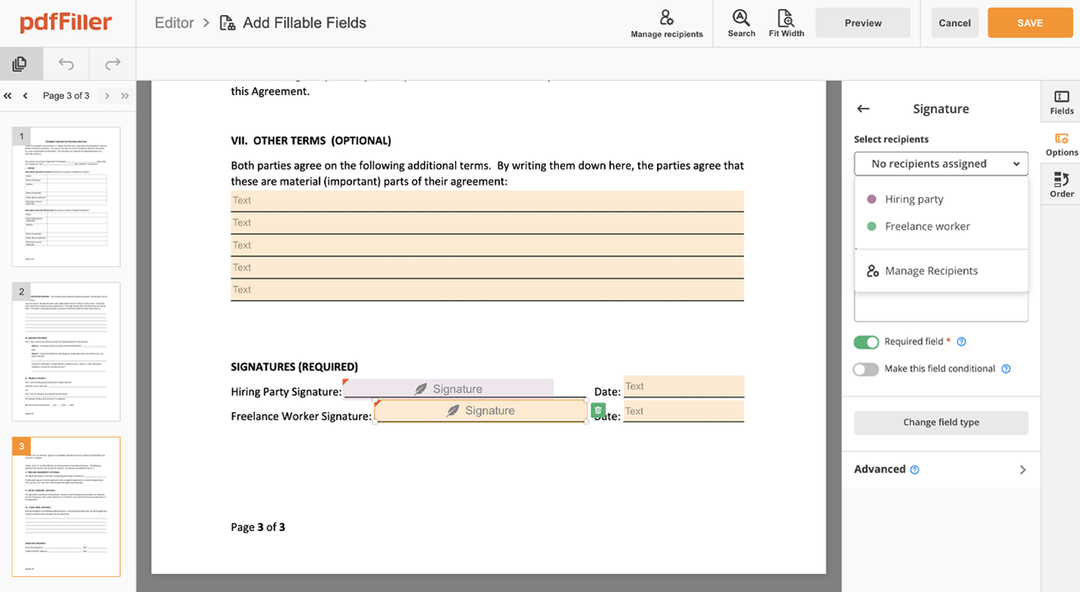

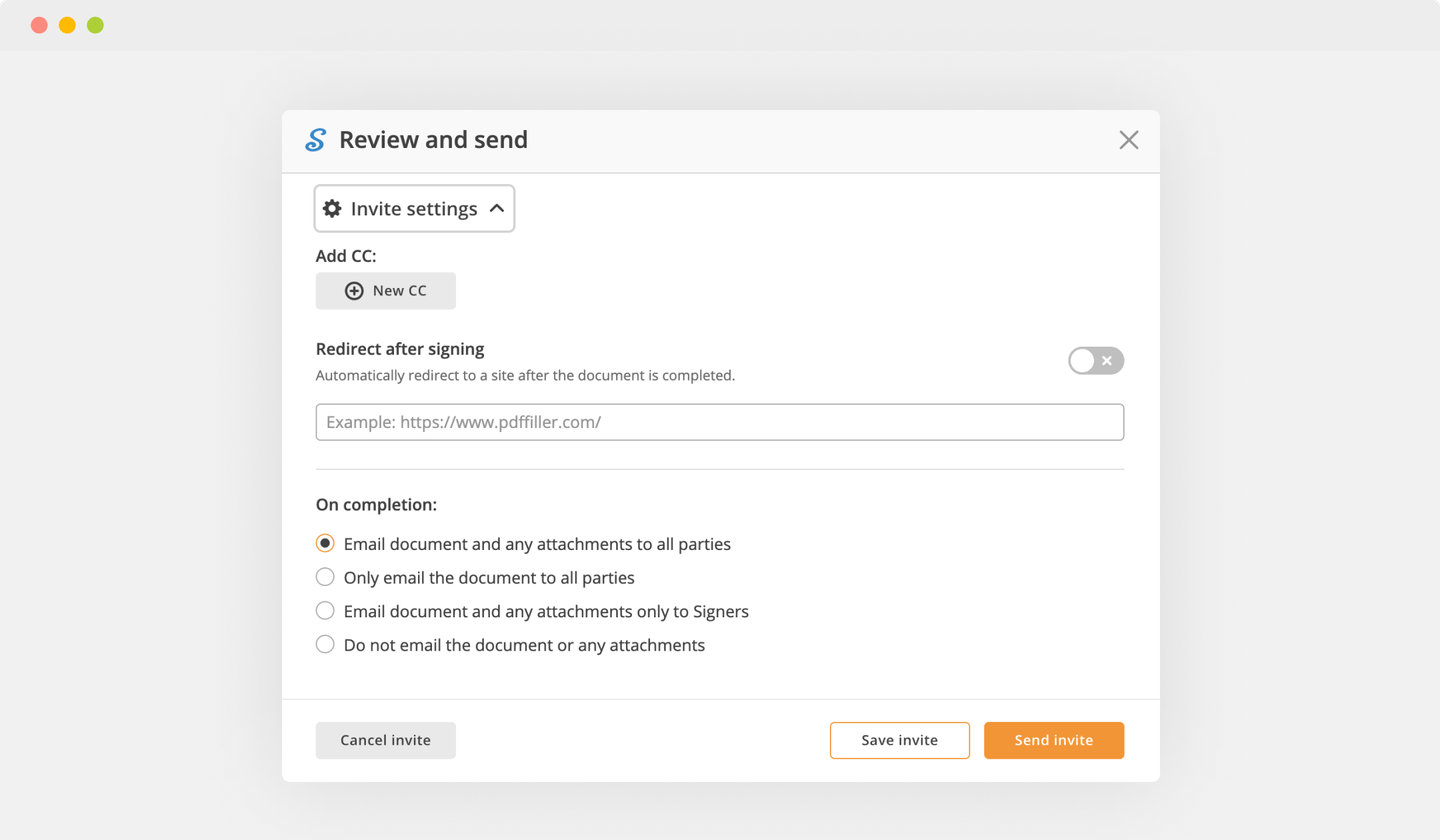

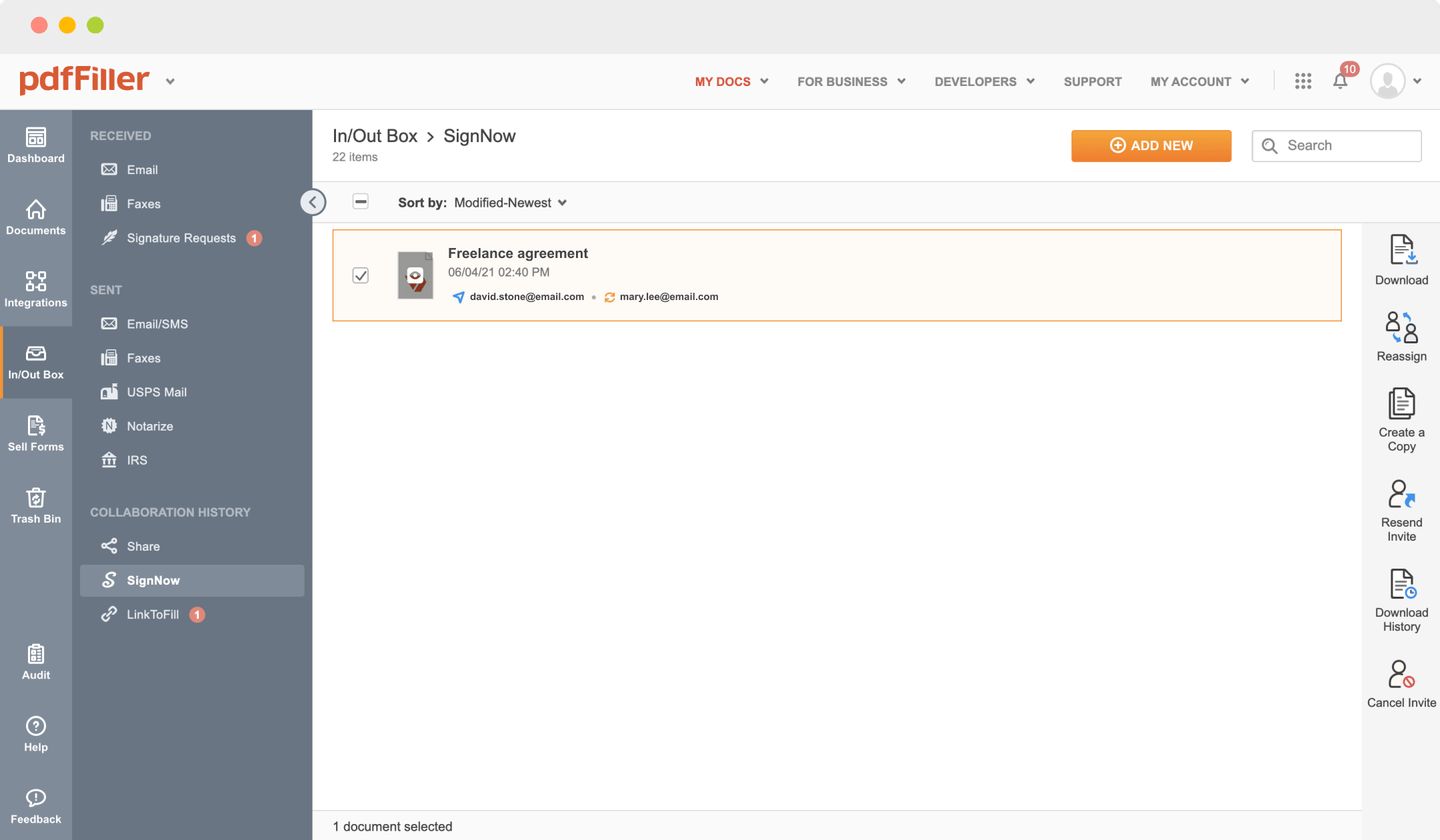

Send documents for eSignature with signNow

Create role-based eSignature workflows without leaving your pdfFiller account — no need to install additional software. Edit your PDF and collect legally-binding signatures anytime and anywhere with signNow’s fully-integrated eSignature solution.

All-in-one PDF software

A single pill for all your PDF headaches. Edit, fill out, eSign, and share – on any device.

pdfFiller scores top ratings in multiple categories on G2

How to Expect Signature Block Request

Are you stuck working with numerous programs for creating and managing documents? Try our all-in-one solution instead. Use our document management tool for the fast and efficient process. Create fillable forms, contracts, make document templates, integrate cloud services and more useful features without leaving your account. Plus, it enables you to Expect Signature Block Request and add major features like orders signing, alerts, attachment and payment requests, easier than ever. Have a major advantage over those using any other free or paid applications.

How-to Guide

How to edit a PDF document using the pdfFiller editor:

01

Download your document using pdfFiller

02

Select the Expect Signature Block Request feature in the editor's menu

03

Make all the needed edits to your document

04

Click the orange “Done" button at the top right corner

05

Rename your form if it's necessary

06

Print, email or download the template to your computer

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

Pam S

2017-11-14

It worked well for our needs. We just needed one form not available as a fill in through irs.gov. But I don't like the automatic sub renewal. We just needed it once and I didn't remember/understand that it automatically renewed.

GANESH GAVAKAR

2019-12-11

WE ARE VERY THANKSFULLY TO…

WE ARE VERY THANKSFULLY TO PDFFILLER.COM AND YOU HAD DONE GREAT JOB. SECURITY FIREBALLS RECOMMEDED. MESSAGE FROM RADHAKRISHNA INFO BUSINESS SERVICES IN IFFI SRO BANK LTD. FINRA # CRD 285979

Get a powerful PDF editor for your Mac or Windows PC

Install the desktop app to quickly edit PDFs, create fillable forms, and securely store your documents in the cloud.

Edit and manage PDFs from anywhere using your iOS or Android device

Install our mobile app and edit PDFs using an award-winning toolkit wherever you go.

Get a PDF editor in your Google Chrome browser

Install the pdfFiller extension for Google Chrome to fill out and edit PDFs straight from search results.

List of extra features

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Does IRS accept copied signatures?

Even then, it is between the taxpayer and IRS, the preparer does not need an original signed copy (or any signed copy) of a paper filed return. Form 8879 does not require a wet ink signature and also is not normally sent to the IRS. If it looks mechanical or otherwise not pen and ink, they may reject the 2848.

Does IRS accept scanned documents?

Yes, the Internal Revenue Service (IRS) has been accepting digitized or scanned versions of paper documents since 1997 in lieu of paper documents. The digitized or scanned versions of a paper document must resemble the paper version. No alterations should be made to the digital document.

Are scanned documents as good as originals?

Having a scanned signature(s) on a document is valid. This has to be the case in a world where we are more likely to work with someone geographically far, than local. To reiterate, having a scanned signature on a contract is perfectly acceptable under law. But acceptance isn't the issue.

Are you supposed to sign your tax return?

There is no signature line. The signature line on the new Form 1040 is located directly below the Dependent section, almost in the middle of the form.

What qualifies as a signed tax return?

What qualifies as a 'signed' tax return? To qualify as a 'signed tax return' the document must either: Be signed by at least one of the tax filers. Or, include the tax preparer's stamped, typed, signed, or printed name and SSN, EIN (Employer Identification Number), or PAIN (Preparer Tax Identification Number).

Can I sign my sons taxes?

Filing your child's tax return However, you must include your own signature and a notation that you are signing for the child as the parent or guardian. Signing your child's return also allows you to discuss it with the IRS in the event there are questions later on.

Can I file my taxes if my parents claim me as a dependent?

If you can be claimed as a dependent on your parents' return, you can still file your own return so that you can receive a refund of taxes withheld. (You will not get back anything for Social Security or Medicare withheld.) You will not get the $4000 personal exemption.

How do I electronically sign my tax return?

You can sign your tax return electronically by using a Self-Select PIN, which serves as your digital signature when using tax preparation software, or a Practitioner PIN when using an Electronic Return Originator (ERO). Self-Select PIN — Use the Self-Select PIN method when you're using tax preparation software.

Is an unsigned tax return valid?

Whether an unsigned return constitutes a valid return such that the Service may assess tax or issue a refund. Whether a return filed without a required entry, form, schedule, or other missing information or documentation is a valid return such that the Service may assess tax or issue a refund.

Do you have to sign your tax returns?

What qualifies as a 'signed' tax return? To qualify as a 'signed tax return' the document must either: Be signed by at least one of the tax filers. The signature must be on the line on the tax return designated for the signature of the tax filer.

Will IRS catch my mistake?

Remember that the IRS will catch many errors itself For example, if the mistake you realize you've made has to do with math, it's no big deal: The IRS will catch and automatically fix simple addition or subtraction errors. And if you forgot to send in a document, the IRS will usually reach out in writing to request it.

eSignature workflows made easy

Sign, send for signature, and track documents in real-time with signNow.