Generate Salary Form For Free

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

Discover the simplicity of processing PDFs online

Upload your document in seconds

Fill out, edit, or eSign your PDF hassle-free

Download, export, or share your edited file instantly

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Every PDF tool you need to get documents done paper-free

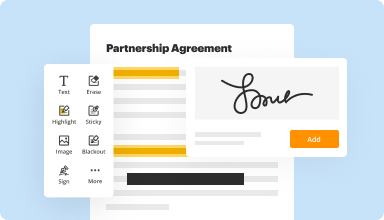

Create & edit PDFs

Generate new PDFs from scratch or transform existing documents into reusable templates. Type anywhere on a PDF, rewrite original PDF content, insert images or graphics, redact sensitive details, and highlight important information using an intuitive online editor.

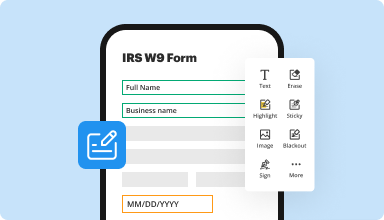

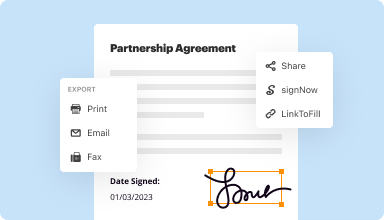

Fill out & sign PDF forms

Say goodbye to error-prone manual hassles. Complete any PDF document electronically – even while on the go. Pre-fill multiple PDFs simultaneously or extract responses from completed forms with ease.

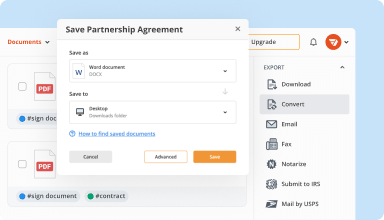

Organize & convert PDFs

Add, remove, or rearrange pages inside your PDFs in seconds. Create new documents by merging or splitting PDFs. Instantly convert edited files to various formats when you download or export them.

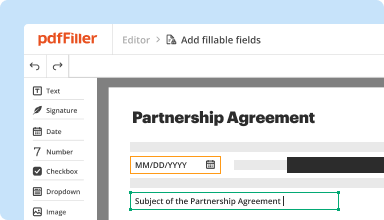

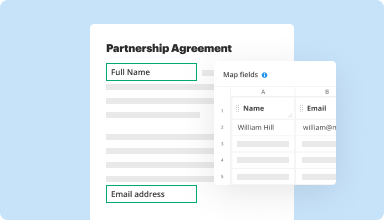

Collect data and approvals

Transform static documents into interactive fillable forms by dragging and dropping various types of fillable fields on your PDFs. Publish these forms on websites or share them via a direct link to capture data, collect signatures, and request payments.

Export documents with ease

Share, email, print, fax, or download edited documents in just a few clicks. Quickly export and import documents from popular cloud storage services like Google Drive, Box, and Dropbox.

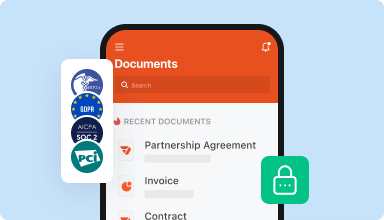

Store documents safely

Store an unlimited number of documents and templates securely in the cloud and access them from any location or device. Add an extra level of protection to documents by locking them with a password, placing them in encrypted folders, or requesting user authentication.

Customer trust by the numbers

64M+

users worldwide

4.6/5

average user rating

4M

PDFs edited per month

9 min

average to create and edit a PDF

Join 64+ million people using paperless workflows to drive productivity and cut costs

Why choose our PDF solution?

Cloud-native PDF editor

Access powerful PDF tools, as well as your documents and templates, from anywhere. No installation needed.

Top-rated for ease of use

Create, edit, and fill out PDF documents faster with an intuitive UI that only takes minutes to master.

Industry-leading customer service

Enjoy peace of mind with an award-winning customer support team always within reach.

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

I found that my typing was faster than the rate that the data shows up on the screen. I didn't like that.

My attorney found this link for me, I was unaware that this was a system I would have to pay for. A customer service ticket was generated because I needed help.

2016-01-18

I love it Its it is so easy to use. The only problem is I don't need it often enough to pay the cost of it. I only needed a couple of forms, but for a business I can see were it would be a great investment.

2017-09-08

OK. some limitations, like I need conditional logic, so if someone checks the Yes box for a question, then require them to fill out other fields. Need this conditional logic functionality, critical for my application. Else not sure PDFFiller will be useful to us.

2018-03-13

Very helpful for filling out international documents in Japanese. Typing in Japanese alphabet was not good but the copy and paste approach worked just fine!

2018-05-22

desde un inicio debería estar la indicación de que la aplicación es de pago para contemplarlo, en cuanto el funcionamiento es excelente, solo tengo duda acerca de la leyenda de que solo 5 documentos... al día al mes o a que se refieren? agradezco de antemano su atención.

2019-07-17

Positive review

It is so much easier to get my scholarships done. I hate writing on my scholarships, so I was having to completely retype the application which was taking time from me filling them out.One suggestion would be to do a student discount, like in my case using it for scholarships. A way to do this could be they have to enter there school and get a school code from someone and then that could verify they are a student so the company is not getting taken advantage of.

2020-03-22

Great Product

This software has helped mainly with electronic signature creation but also with overall PDF edits.

The software offers a number of options for editing PDFs and is fairly user-friendly. It has an easy layout.

I do not like the fact that the software can lag when working with slightly larger documents. It can also be time-consuming to learn more advanced features.

2019-11-09

Excellent software

I can edit pdf files easily. It is also very easy to place the signature on them

Excellent software, it is very easy to use. Ideal for Fax shipments from documents. I can have online documents to edit them later

Technical support is sometimes very slow. Some images lose a bit of quality. But in general lines this software is very complete

2018-07-10

The UI were strange at times(As I sometimes had to look for something specific) , but overall my experience were really good as I am able to achieve my goal everytime with ease. I were using the edit pdf feature and again a bit of trouble trying to establish what I was looking for, but once I found it, it was quite an ease.

2023-02-20

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

Can I generate my own w2?

How do I create a W-2? Companies with over 250 employees are required to file W-2s electronically, small business employers can still download and print blank copies of Form W-2 directly from the IRS website. A copy of the Form W-2 can be filled out by hand in accordance to IRS instructions and submitted by mail.

Can I fill out a w2 online?

You may file Forms W-2 and W-3 electronically on the SSA's Employer W-2 Filing Instructions and Information web page, which is also accessible at www.socialsecurity.gov/employer. You can create fill-in versions of Forms W-2 and W-3 for filing with SSA.

Can I fill out a w2 by hand?

A handwritten W-2 is OK to use. Your employer is required to file the W-2 with the IRS. The IRS will match the information reported on your return with W-2s it has received from employers.

Can I create a w2 online?

Why choose our W2 Generator? Our W-2 generator is the simplest and the most advanced W-2 generator tool you will find online. In less than 2 minutes, you can create a W-2 form, automatically filled with correct calculations and ready to be sent to your employees.

How do I submit a w2 Electronically?

You must provide a copy of your Forms W-2 to the authorized IRS e-file provider before the provider sends the electronic return to the IRS. You don't need to send your Forms W-2 to the IRS and should keep them in a safe place with a copy of your tax return.

How do I file a W 2 with the IRS?

Form W-2. Employers must complete, file electronically or by mail with the Social Security Administration (SSA), and furnish to their employees Form W-2, Wage and Tax Statement (PDF) showing the wages paid and taxes withheld for the year for each employee.

How can I get my w2 online for free?

Online Request. Go to the IRS Website at www.irs.gov. Telephone Request. Call the IRS at 1-800-908-9946. Mail Request. Mail a 4506-T (Request for Transcript of Tax Return) form, which can be found on the Printable Forms section of our webpage (www.hostos.cuny.edu/ofa).

How can I get a copy of my w2 online?

Online Request. Go to the IRS Website at www.irs.gov. Telephone Request. Call the IRS at 1-800-908-9946. Mail Request. Mail a 4506-T (Request for Transcript of Tax Return) form, which can be found on the Printable Forms section of our webpage (www.hostos.cuny.edu/ofa).

#1 usability according to G2

Try the PDF solution that respects your time.