Safeguard Phone Settlement For Free

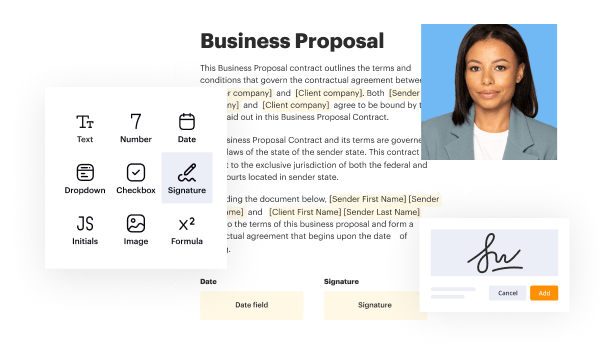

Create a legally-binding electronic signature and add it to contracts, agreements, PDF forms, and other documents – regardless of your location. Collect and track signatures with ease using any device.

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

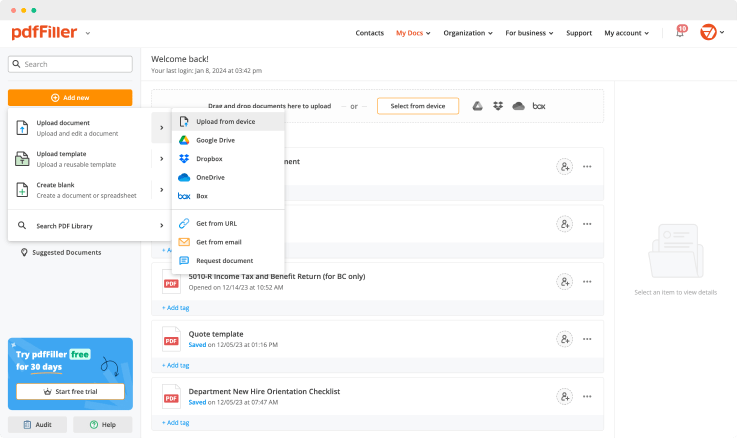

Upload a document

Generate your customized signature

Adjust the size and placement of your signature

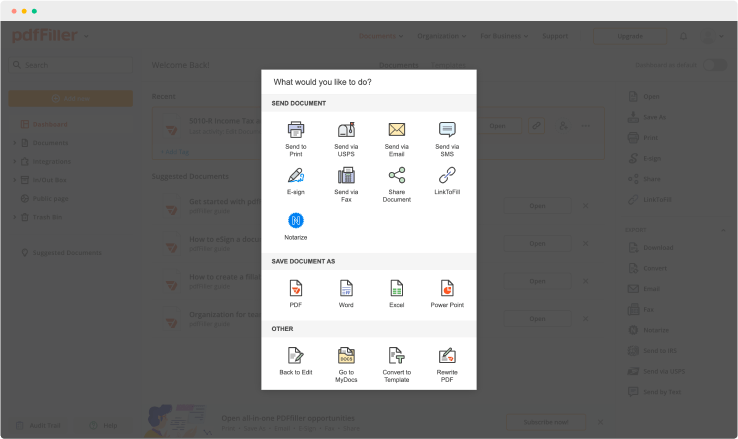

Download, share, print, or fax your signed document

Join the world’s largest companies

Employees at these companies use our products.

How to Add a Signature to PDF (and Send it Out for Signature)

Watch the video guide to learn more about pdfFiller's online Signature feature

pdfFiller scores top ratings in multiple categories on G2

4.6/5

— from 710 reviews

Why choose pdfFiller for eSignature and PDF editing?

Cross-platform solution

Upload your document to pdfFiller and open it in the editor.

Unlimited document storage

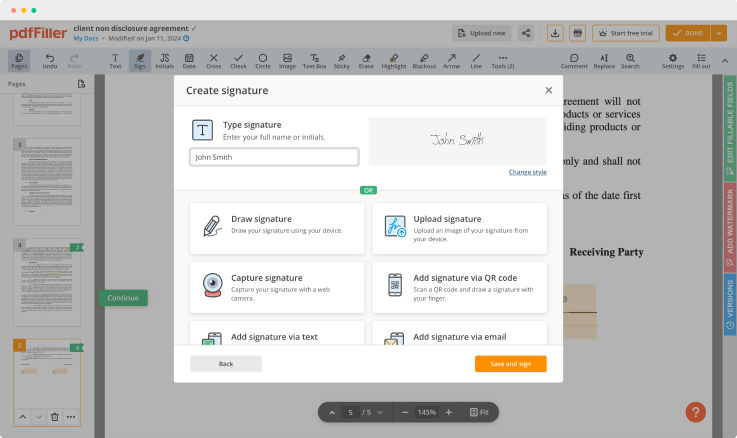

Generate and save your electronic signature using the method you find most convenient.

Widely recognized ease of use

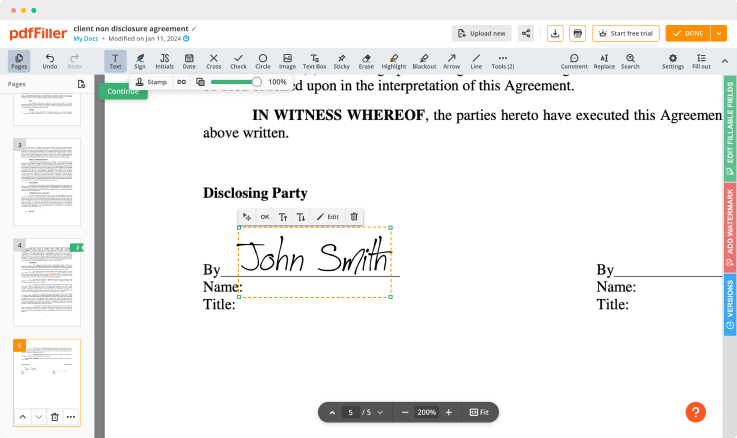

Resize your signature and adjust its placement on a document.

Reusable templates & forms library

Save a signed, printable document on your device in the format you need or share it via email, a link, or SMS. You can also instantly export the document to the cloud.

The benefits of electronic signatures

Bid farewell to pens, printers, and paper forms.

Efficiency

Enjoy quick document signing and sending and reclaim hours spent on paperwork.

Accessibility

Sign documents from anywhere in the world. Speed up business transactions and close deals even while on the go.

Cost savings

Eliminate the need for paper, printing, scanning, and postage to significantly cut your operational costs.

Security

Protect your transactions with advanced encryption and audit trails. Electronic signatures ensure a higher level of security than traditional signatures.

Legality

Electronic signatures are legally recognized in most countries around the world, providing the same legal standing as a handwritten signature.

Sustainability

By eliminating the need for paper, electronic signatures contribute to environmental sustainability.

Enjoy straightforward eSignature workflows without compromising data security

GDPR compliance

Regulates the use and holding of personal data belonging to EU residents.

SOC 2 Type II Certified

Guarantees the security of your data & the privacy of your clients.

PCI DSS certification

Safeguards credit/debit card data for every monetary transaction a customer makes.

HIPAA compliance

Protects the private health information of your patients.

CCPA compliance

Enhances the protection of personal data and the privacy of California residents.

Safeguard Phone Settlement Feature

The Safeguard Phone Settlement feature provides a reliable way for you to protect your mobile device investment. With this feature, you can secure your phone against unforeseen issues that may arise, ensuring peace of mind.

Key Features

Instant coverage for damaged or lost phones

Easy claims process with fast approvals

Affordable monthly payment options

Comprehensive support for various phone models

Access to dedicated customer service

Use Cases and Benefits

Perfect for busy individuals who rely on their phones daily

Ideal for families wanting to protect devices for children

Great for business professionals using phones for work

Useful for travelers who may risk damaging their devices

Helps avoid costly repair or replacement bills

The Safeguard Phone Settlement feature addresses your concerns over unexpected phone mishaps. By providing quick solutions, it helps you avoid the stress of costly repairs or replacements, ensuring your device is always protected. This feature allows you to enjoy your phone without worry, so you can focus on what matters most.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

How can I protect my settlement money?

Keep Your Funds Separate. Deposit your injury settlement check in a segregated account & don't deposit any other money in the account. Use a Prepaid Debit Card. Our Experienced Bankruptcy Attorney Is Here To Help.

Can my lawsuit settlement be garnished?

Money awarded in personal injury settlements in California is technically “exempt” under the law. That means that creditors cannot legally garnish that money (take it from your bank accounts). In cases like this, your settlement money essentially gets taken by mistake.

Can settlement money be garnished?

Protecting a Workers' Compensation Settlement In most cases, workers' comp settlements are exempt from garnishment as are other settlement types. Debt collectors cannot garnish them, except certain government agencies.

Can debt collectors take your settlement?

Money awarded in personal injury settlements in California is technically “exempt” under the law. That means that creditors cannot legally garnish that money (take it from your bank accounts). When creditors file suit against you, a court may order you to pay.

Can the IRS take my lawsuit settlement?

If you receive money from a lawsuit judgment or settlement, you may have to pay taxes on that money. After you collect a settlement, the IRS typically regards that money as income, and taxes it accordingly. However, every rule has exceptions. The IRS does not tax award settlements for personal injury cases.

Can a lawyer hold a settlement check?

Usually, a settlement check is sent to the attorney of record. The attorney may hold the check in a trust or escrow account until it clears. Your attorney will also deduct his or her own share from the settlement funds for the legal services that he or she provided and for the advancement of any legal costs.

What do I do with my settlement money?

Understand the Tax Implications. Getting a handle on how much your windfall may be taxed is a crucial first step in managing your money. Get a Good Financial Advisor. Pay Off Debt and Save. Invest in Education. Invest in Your Home. Donate to Charity. Invest in Business, Friends, or Family. Enjoy Yourself!

How do you invest in a settlement?

Know The Tax Consequences. Create a plan. Hire a professional. Get a life insurance. Invest in education. Invest in income-generating vehicles. Invest in your house. Give Back And Share Your Blessings.

Ready to try pdfFiller's? Safeguard Phone Settlement

Upload a document and create your digital autograph now.