Separate Currency Record For Free

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

Discover the simplicity of processing PDFs online

Upload your document in seconds

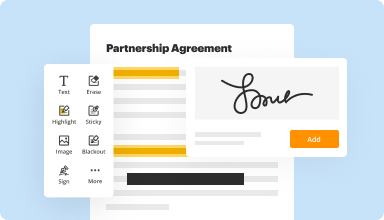

Fill out, edit, or eSign your PDF hassle-free

Download, export, or share your edited file instantly

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Every PDF tool you need to get documents done paper-free

Create & edit PDFs

Generate new PDFs from scratch or transform existing documents into reusable templates. Type anywhere on a PDF, rewrite original PDF content, insert images or graphics, redact sensitive details, and highlight important information using an intuitive online editor.

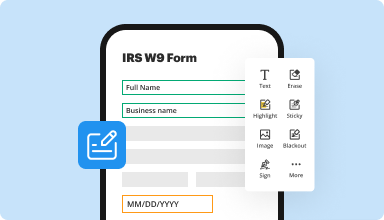

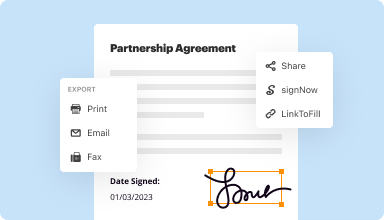

Fill out & sign PDF forms

Say goodbye to error-prone manual hassles. Complete any PDF document electronically – even while on the go. Pre-fill multiple PDFs simultaneously or extract responses from completed forms with ease.

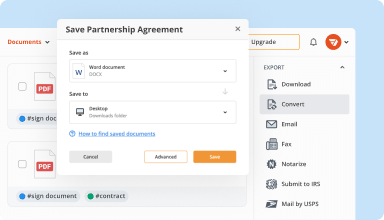

Organize & convert PDFs

Add, remove, or rearrange pages inside your PDFs in seconds. Create new documents by merging or splitting PDFs. Instantly convert edited files to various formats when you download or export them.

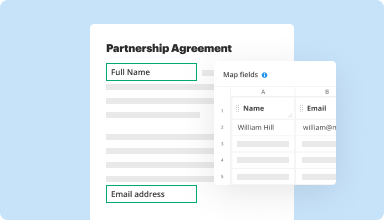

Collect data and approvals

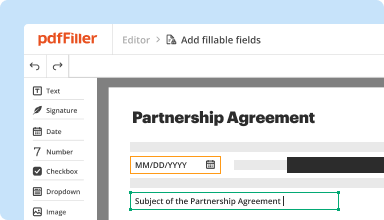

Transform static documents into interactive fillable forms by dragging and dropping various types of fillable fields on your PDFs. Publish these forms on websites or share them via a direct link to capture data, collect signatures, and request payments.

Export documents with ease

Share, email, print, fax, or download edited documents in just a few clicks. Quickly export and import documents from popular cloud storage services like Google Drive, Box, and Dropbox.

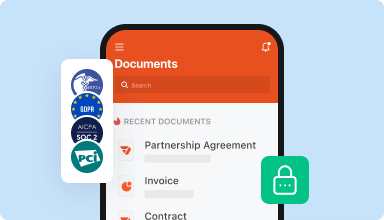

Store documents safely

Store an unlimited number of documents and templates securely in the cloud and access them from any location or device. Add an extra level of protection to documents by locking them with a password, placing them in encrypted folders, or requesting user authentication.

Customer trust by the numbers

64M+

users worldwide

4.6/5

average user rating

4M

PDFs edited per month

9 min

average to create and edit a PDF

Join 64+ million people using paperless workflows to drive productivity and cut costs

Why choose our PDF solution?

Cloud-native PDF editor

Access powerful PDF tools, as well as your documents and templates, from anywhere. No installation needed.

Top-rated for ease of use

Create, edit, and fill out PDF documents faster with an intuitive UI that only takes minutes to master.

Industry-leading customer service

Enjoy peace of mind with an award-winning customer support team always within reach.

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

LIKED THE ABILITY TO SAVE AND PRINT BUT IT TOOK SEVERAL TRIAL AND ERROR EXPERIENCES TO FIGURE OUT THE PROCESS. SOMEONE WITH VERY LITTLE COMPUTER EXPERIENCE WOULD FIND THIS FRUSTRATING

2016-01-21

Very simple to use and create your own invoice for your company and you can e-mail to your client from the same site that also provides a security code for the receiver to access your invoice and you receive a notice when they do.

2017-03-30

It's a great program that's easy to use. It makes documents appear professional by enabling me to type in then instead of write by hand. I will definitely be renewing my subscription. Plus, the price is affordable.

2017-10-04

just started using the PDF Filler, its a great application, easy to navigate, one can get a lot of legal stuff done on it if you own a business and very affordable.

2020-02-03

What do you like best?

I like the chat help desk. I liken having a person I can chat with without a long delay. I really do not like have a charter limit on my response, I really do not have that much to say, therefore you get fluff.

What do you dislike?

not being able to locate the forms needed at times. Sometimes hen I attempt to use the form, I do not know the form number and it causes a delay. I do not like having a 40 Character limit for the questions. I really do not have that much to say

Recommendations to others considering the product:

I would recommend this product ,because it allows my agency to provide the client with the information needed. I really do not have any additional information to supply.

What problems are you solving with the product? What benefits have you realized?

I can service my clients fasters.

I like the chat help desk. I liken having a person I can chat with without a long delay. I really do not like have a charter limit on my response, I really do not have that much to say, therefore you get fluff.

What do you dislike?

not being able to locate the forms needed at times. Sometimes hen I attempt to use the form, I do not know the form number and it causes a delay. I do not like having a 40 Character limit for the questions. I really do not have that much to say

Recommendations to others considering the product:

I would recommend this product ,because it allows my agency to provide the client with the information needed. I really do not have any additional information to supply.

What problems are you solving with the product? What benefits have you realized?

I can service my clients fasters.

2019-01-02

A good all rounder for filling pdfs and signing forms

pdfFiller is a useful tool that lets me fill, sign and send client contracts

I like being able to add text to pdf forms, then email,download or print the completed forms

I have to be honest, it's a bit clunky and takes some getting used to

2023-01-17

It is a great help in editing documents, specially when there are corrections needed to be made. Files that cannot be converted to a Word or Excel file is easily edited here.

2020-09-30

What do you like best?

The link to fill option and the ability to manipulate pdfs.

What do you dislike?

Nothing yet. I plan to purchase again next year.

What problems are you solving with the product? What benefits have you realized?

Quicker document processing with the link to fill feature allowing to obtain digital signatures.

2020-08-07

This platform has completely…

This platform has completely transformed the way I manage documents. From editing PDFs to creating fillable forms, the tools are intuitive and incredibly easy to use.

2025-06-14

Separate Currency Record Feature

The Separate Currency Record feature helps you manage multiple currencies effortlessly. This tool ensures that your financial records remain clear and organized, allowing you to focus on your business.

Key Features

Track transactions in different currencies

Generate reports based on currency types

Easily convert currencies for accurate bookkeeping

Integrate with existing financial software

Access detailed transaction history for each currency

Potential Use Cases and Benefits

Ideal for businesses operating in international markets

Useful for freelancers working with international clients

Beneficial for e-commerce platforms accepting various currencies

Helps accountants maintain accurate financial records

Enables quick decision-making based on financial insights

This feature addresses common problems such as confusion in financial reporting and difficulties in tracking multiple currencies. By using Separate Currency Record, you can simplify your financial management, reduce errors, and gain a clearer understanding of your business performance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

How do you record foreign currency translation?

Determine the functional currency of the foreign entity. ...

Remeasure the financial statements of the foreign entity into the functional currency. ...

Record gains and losses on the translation of currencies. ...

Current rate Method. ...

Temporal Rate Method.

What is translation in accounting?

Foreign currency translation, or simply currency translation is an accounting method by which an international company translates the results of its foreign subsidiaries in its reporting currency. ... Record gains and losses that result from the currency translation.

What is translation reserve in accounting?

Foreign currency translation is used to convert the results of a parent company's foreign subsidiaries to its reporting currency. This is a key part of the financial statement consolidation process. ... Remeasure the financial statements of the foreign entity into the reporting currency of the parent company.

What is translation exposure with example?

Translation exposure (also known as translation risk) is the risk that a company's equities, assets, liabilities, or income will change in value as a result of exchange rate changes. This occurs when a firm denominates a portion of its equities, assets, liabilities, or income in a foreign currency.

What is translation gain or loss?

Increase or decrease in net assets resulting when a balance sheet is converted from one currency to another and the assets exposed to exchange rate fluctuations do not correspond with similarly exposed liabilities. See also transaction exchange gain or loss.

How do I report foreign currency transactions?

Most taxpayers report their foreign exchange gains and losses under Internal Revenue Code Section 988. This option is best if you posted a loss because you can take the full deduction in the current tax year. Foreign exchange losses can be deducted against all types of income.

What is a foreign currency transaction?

A foreign-currency transaction is one that requires settlement, either payment or receipt, in a foreign currency. When the exchange rate changes between the original purchase or sale transaction date and the settlement date, there is a gain or loss on the exchange.

How do I report foreign exchange losses?

Traders on the foreign exchange market, or Forex, use IRS Form 8949 and Schedule D to report their capital gains and losses on their federal income tax returns. Forex net trading losses can be used to reduce your income tax liability.

Do you have to pay taxes on foreign currency exchange?

The Internal Revenue Service taxes foreign currencies at their value in dollars, which can create record keeping and exchange challenges. You may have to pay taxes on gains if you make a profit on exchanging currencies. You must keep detailed records and note the exchange rates used in case you are audited by the IRS.

What is foreign currency translation gains or losses?

Foreign currency transactions that are recorded and translated at one rate and then result in transactions at a later date and different rate give rise to gains or losses. Gains or losses from foreign currency transactions are included in current income.

#1 usability according to G2

Try the PDF solution that respects your time.