Share Identification Notice For Free

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

Discover the simplicity of processing PDFs online

Upload your document in seconds

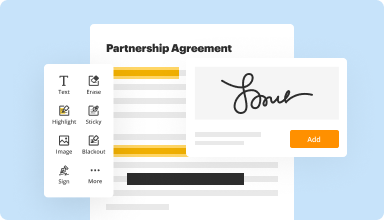

Fill out, edit, or eSign your PDF hassle-free

Download, export, or share your edited file instantly

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Every PDF tool you need to get documents done paper-free

Create & edit PDFs

Generate new PDFs from scratch or transform existing documents into reusable templates. Type anywhere on a PDF, rewrite original PDF content, insert images or graphics, redact sensitive details, and highlight important information using an intuitive online editor.

Fill out & sign PDF forms

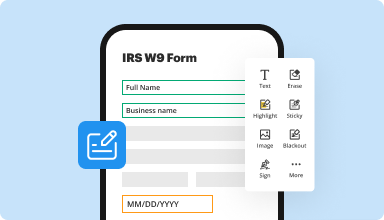

Say goodbye to error-prone manual hassles. Complete any PDF document electronically – even while on the go. Pre-fill multiple PDFs simultaneously or extract responses from completed forms with ease.

Organize & convert PDFs

Add, remove, or rearrange pages inside your PDFs in seconds. Create new documents by merging or splitting PDFs. Instantly convert edited files to various formats when you download or export them.

Collect data and approvals

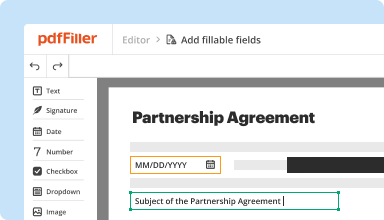

Transform static documents into interactive fillable forms by dragging and dropping various types of fillable fields on your PDFs. Publish these forms on websites or share them via a direct link to capture data, collect signatures, and request payments.

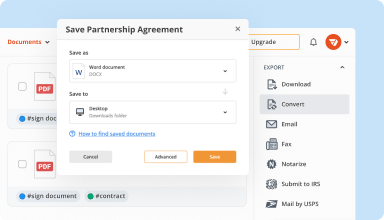

Export documents with ease

Share, email, print, fax, or download edited documents in just a few clicks. Quickly export and import documents from popular cloud storage services like Google Drive, Box, and Dropbox.

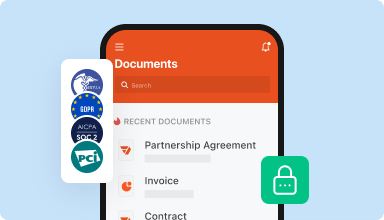

Store documents safely

Store an unlimited number of documents and templates securely in the cloud and access them from any location or device. Add an extra level of protection to documents by locking them with a password, placing them in encrypted folders, or requesting user authentication.

Customer trust by the numbers

64M+

users worldwide

4.6/5

average user rating

4M

PDFs edited per month

9 min

average to create and edit a PDF

Join 64+ million people using paperless workflows to drive productivity and cut costs

Why choose our PDF solution?

Cloud-native PDF editor

Access powerful PDF tools, as well as your documents and templates, from anywhere. No installation needed.

Top-rated for ease of use

Create, edit, and fill out PDF documents faster with an intuitive UI that only takes minutes to master.

Industry-leading customer service

Enjoy peace of mind with an award-winning customer support team always within reach.

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

I found the system complicated for someone not very experienced with computers. I still do not know how to find, on your system, the forms that I have completed. Where are they? How do I save them to my computer? I will keep working to find the answers.

2016-04-02

PDFfiller is a great program and easy to use. When you need to sign a document and email...and don't want to have to print, sign, scan and email...this is the program for you. Works great for the real estate agent.

2018-10-18

What do you like best?

This is available everywhere where you go. You do not have to take your computer or have a software installed on your laptop. You can access it from anywhere else. In addition, it is very user friendly to navigate through the platform to accomplish what you would like to do.

What do you dislike?

I just don't have any dislike. So there is not much to say for this area.

Recommendations to others considering the product:

It is easy and available for access anywhere you access a computer. You do not have to have one.

What problems are you solving with the product? What benefits have you realized?

All my PDF applications are done through the platform. Fast, available always, and you can do it on any computer or mobile device.

This is available everywhere where you go. You do not have to take your computer or have a software installed on your laptop. You can access it from anywhere else. In addition, it is very user friendly to navigate through the platform to accomplish what you would like to do.

What do you dislike?

I just don't have any dislike. So there is not much to say for this area.

Recommendations to others considering the product:

It is easy and available for access anywhere you access a computer. You do not have to have one.

What problems are you solving with the product? What benefits have you realized?

All my PDF applications are done through the platform. Fast, available always, and you can do it on any computer or mobile device.

2019-01-02

Excellent features

This allowed me to add to my PDFs that I couldn't before.

This product saves time. I was trying to find something that lets me add a text box or even text to my pdf files. This product does this! Very cool!

I can't think of anything. It does what I needed it to do. Excellent and easy to use for my documents.

2019-11-05

Handy little software for fillable PDFs

Create fillable PDFs in minutes with PDFfiller. We use a lot of paper forms and it wasn't until recently that we began transferring all our old school paper and pen documents to these nifty fillable PDFs that folks can easily and conveniently complete and submit online.

Sometimes PDFfiller lags a bit but it's not annoying enough to stop using. Overall, I'm very pleased with the product.

2018-04-10

pdfFiller was useful, intuitive and feature rich. It not only provided access to nearly 100 useful form templates but allowed me to have the ability to edit them right from the site. Excellent!

2024-01-13

PDFFiller is amazing

PDFFiller is amazing. They help all the time when I have issues and make it easy to get things figured out.

I appreciate the time they take to help step by step

2023-08-24

Paul at pdf was absolutely brilliant…

Paul at pdf was absolutely brilliant and very helpful. Cancelled my sub that was from my previous employer and refunded my fee. Couldnt of asked for a better person to help. Thank you!. Great asset to any company.

2021-03-13

PDFfiller was an easy and convenient service to use. I filled out my PDF no problem and saved my documents. The customer support team was extremely helpful and accommodating when I needed to change my plan. Highly recommend!

2020-06-10

Share Identification Notice Feature

The Share Identification Notice feature provides a straightforward way for users to manage and identify shares efficiently. This tool streamlines the communication process related to share ownership, ensuring clarity and compliance.

Key Features

Automatic notifications for share transactions

User-friendly interface for easy tracking

Customizable settings to manage preferences

Comprehensive reporting options

Secure data handling to protect sensitive information

Potential Use Cases and Benefits

Investors can keep track of their share holdings effectively

Companies can ensure compliance with regulatory requirements

Financial advisors can provide better services to clients

Shareholders can receive timely updates about their investments

Administrators can manage share registries more efficiently

By implementing the Share Identification Notice feature, you can reduce confusion and enhance transparency in share management. This tool addresses common challenges such as missed notifications and regulatory compliance, helping you stay informed and organized.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

What is specific share identification method?

Specific Share Identification is an accounting strategy for investors who wish to optimize their tax treatment when selling off their holdings in a particular company or fund which were originally purchased at different prices and different times.

What is specific identification cost basis?

The specific identification method of calculating the tax basis for shares is when you choose which shares of the same company or mutual fund that are purchased at different times and prices to sell. With this method, you choose the shares that will minimize your taxable gains or offset other gains.

How do you determine cost basis?

You can calculate your cost basis per share in two ways: Take the original investment amount ($10,000) and divide it by the new number of shares you hold (2,000 shares) to arrive at the new per-share cost basis ($10,000/2,000 = $5).

What if cost basis is unknown?

To find an unknown cost basis for stocks and bonds, you first must determine the purchase date. If no purchase records exist, take an educated guess about when you might have bought the securities based on life events happening when they were purchased. If you inherited the stocks or bonds, find the date of death.

Can you use average cost basis for individual stocks?

Average Cost Double Category (ACDC) ACDC is a method the Internal Revenue Service allows for calculating cost basis on mutual funds. It may not be used to figure the cost basis when selling individual bonds and stocks. With ACDC, the cost basis is calculated based on how long the shares were held.

Can you choose which shares to sell?

When you decide to sell a portion of your holdings in a stock, you have to decide which shares you actually want to sell. Two of the most common methods used in this decision are known as FIFO and LIFO, and the choice you make can have a big impact on your taxes.

Which shares should I sell first?

The first-in, first-out method is the default way to decide which shares to sell. Under FIFO, if you sell shares of a company that you've bought on multiple occasions, you always sell your oldest shares first.

How do I sell specific shares?

The specific-shares method only works if certain conditions are met. The method requires that the investor has purchased multiple lots of the same security at different prices, is selling only some of the investor's shares in a stock and has kept a record of the cost basis of each stock or fund purchase.

Video Review on How to Share Identification Notice

#1 usability according to G2

Try the PDF solution that respects your time.