Sign Mortgage Deed For Free

Join the world’s largest companies

How to Send a PDF for eSignature

Why choose pdfFiller for eSignature and PDF editing?

Cross-platform solution

Unlimited document storage

Widely recognized ease of use

Reusable templates & forms library

The benefits of electronic signatures

Efficiency

Accessibility

Cost savings

Security

Legality

Sustainability

Enjoy straightforward eSignature workflows without compromising data security

GDPR compliance

SOC 2 Type II Certified

PCI DSS certification

HIPAA compliance

CCPA compliance

Sign Mortgage Deed Feature

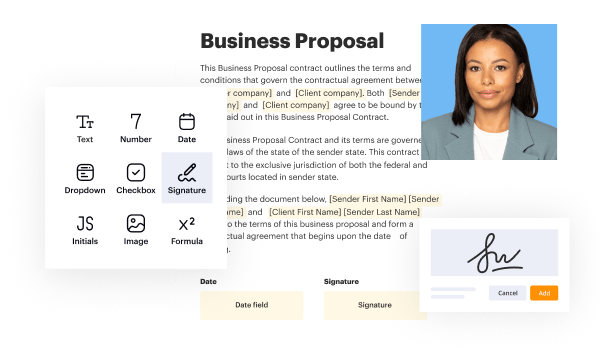

The Sign Mortgage Deed feature simplifies the process of signing and managing mortgage documents. You can now handle your mortgage transactions with ease and confidence, enhancing your experience in home financing.

Key Features

Potential Use Cases and Benefits

This feature addresses the common challenges of traditional mortgage signing. By providing a secure and straightforward method for handling documents, you can avoid the delays and frustrations often associated with physical signatures. Embrace a smoother mortgage experience that saves you time and reduces stress.

Sign Mortgage Deed with the swift ease

pdfFiller allows you to Sign Mortgage Deed in no time. The editor's handy drag and drop interface allows for quick and intuitive document execution on any device.

Signing PDFs online is a quick and secure method to validate papers at any time and anywhere, even while on the fly.

See the detailed guide on how to Sign Mortgage Deed online with pdfFiller:

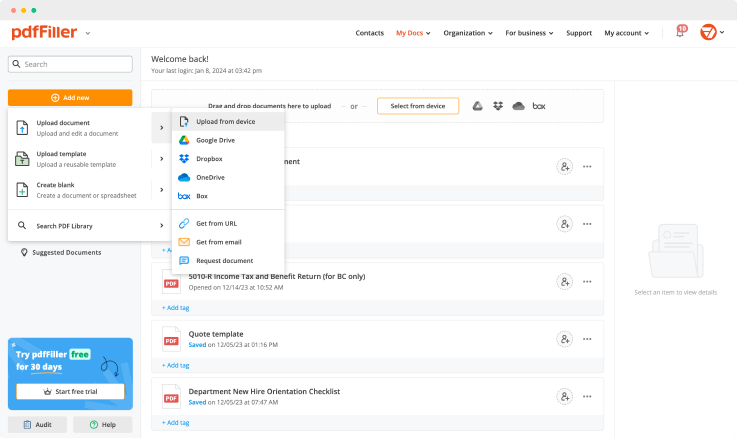

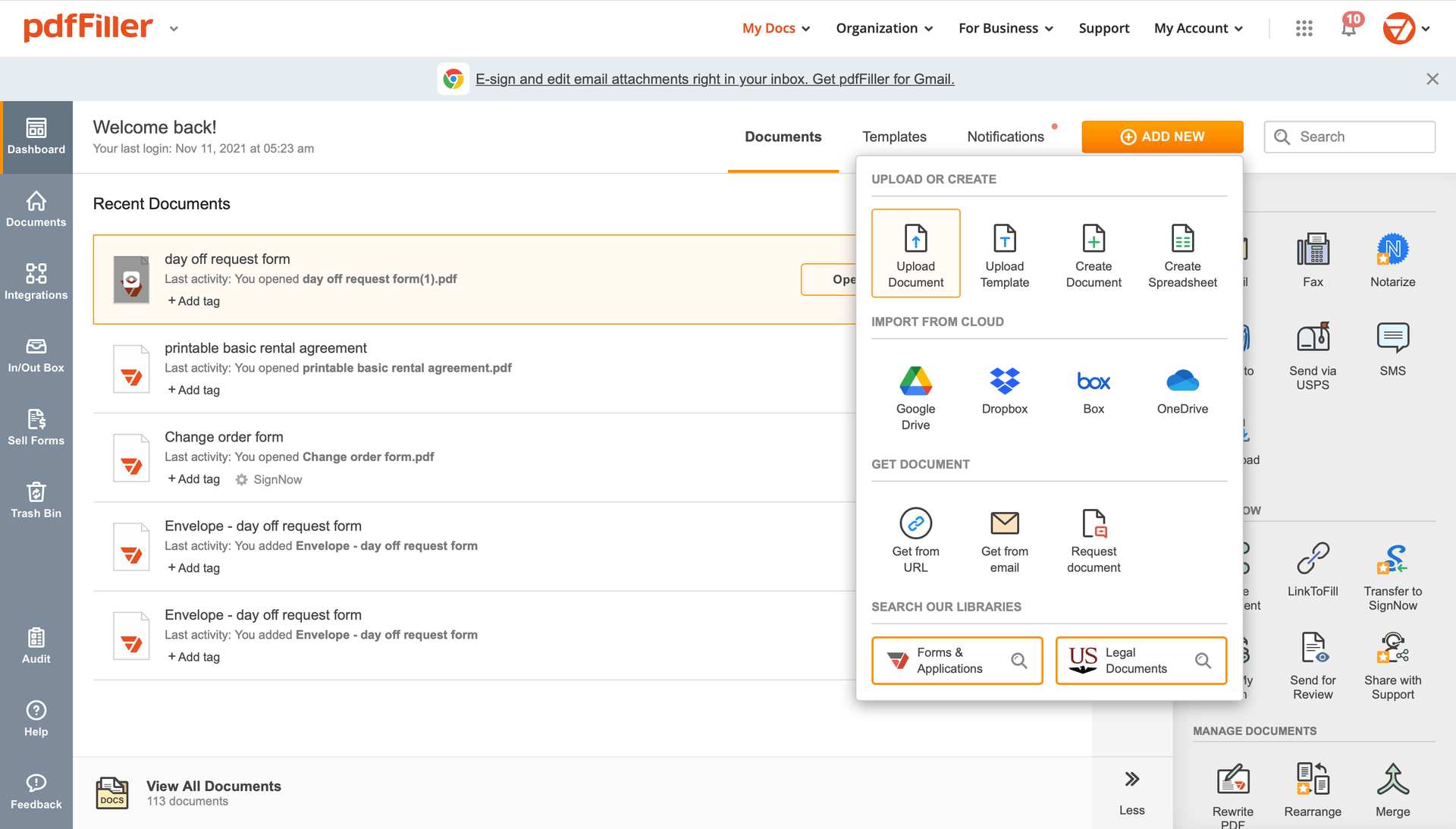

Add the document you need to sign to pdfFiller from your device or cloud storage.

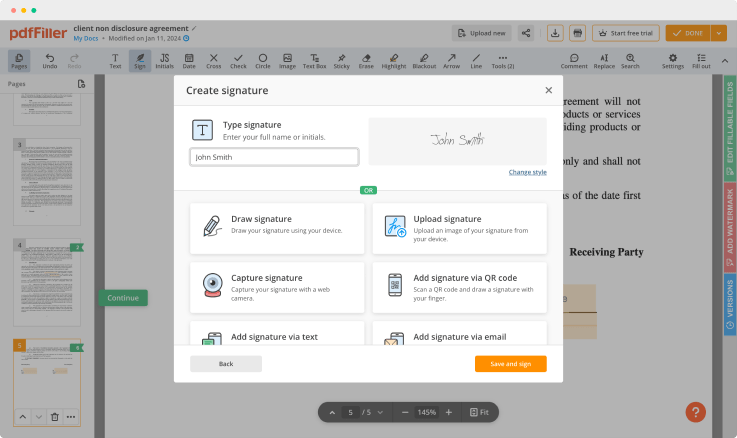

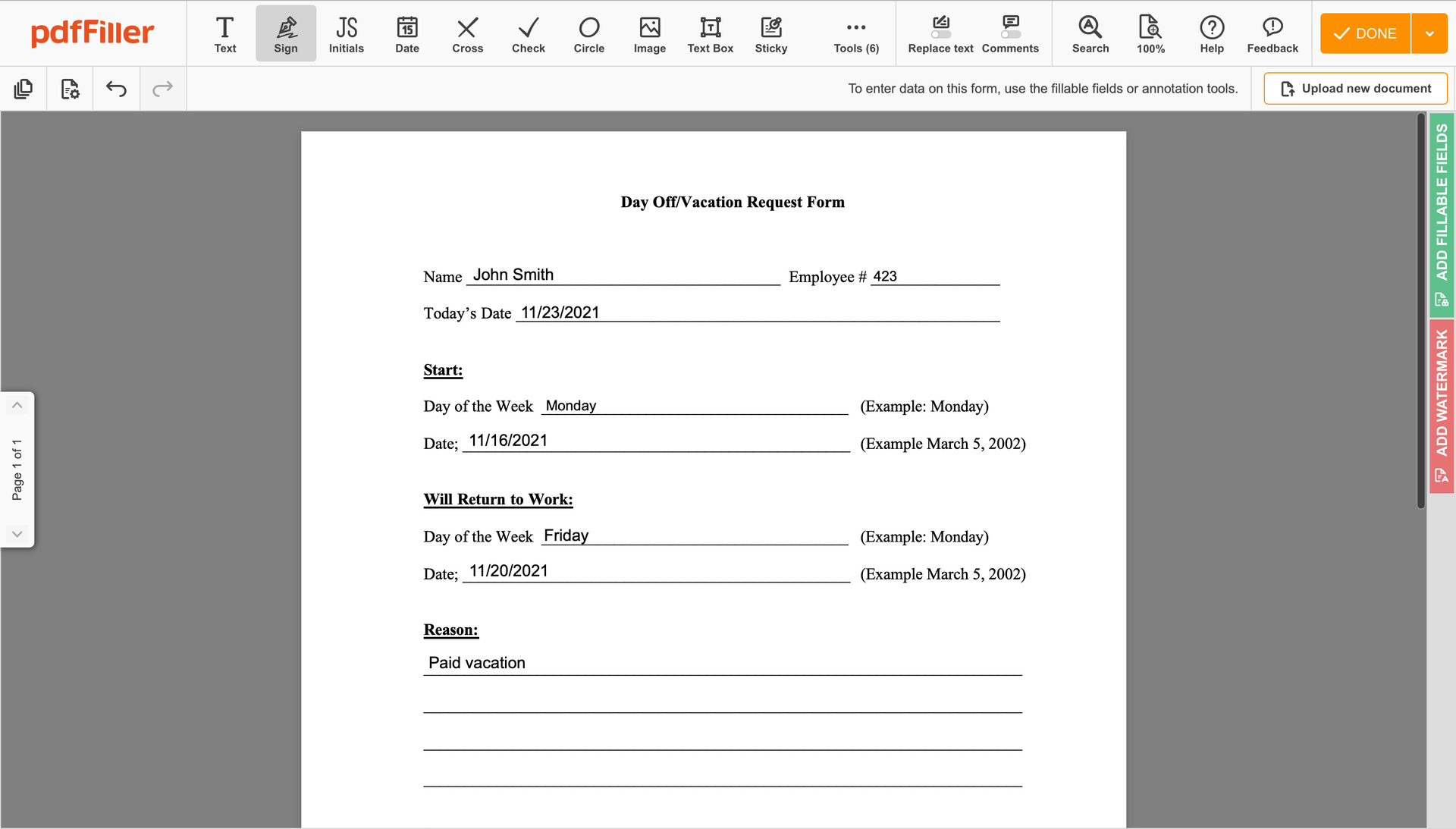

Once the document opens in the editor, hit Sign in the top toolbar.

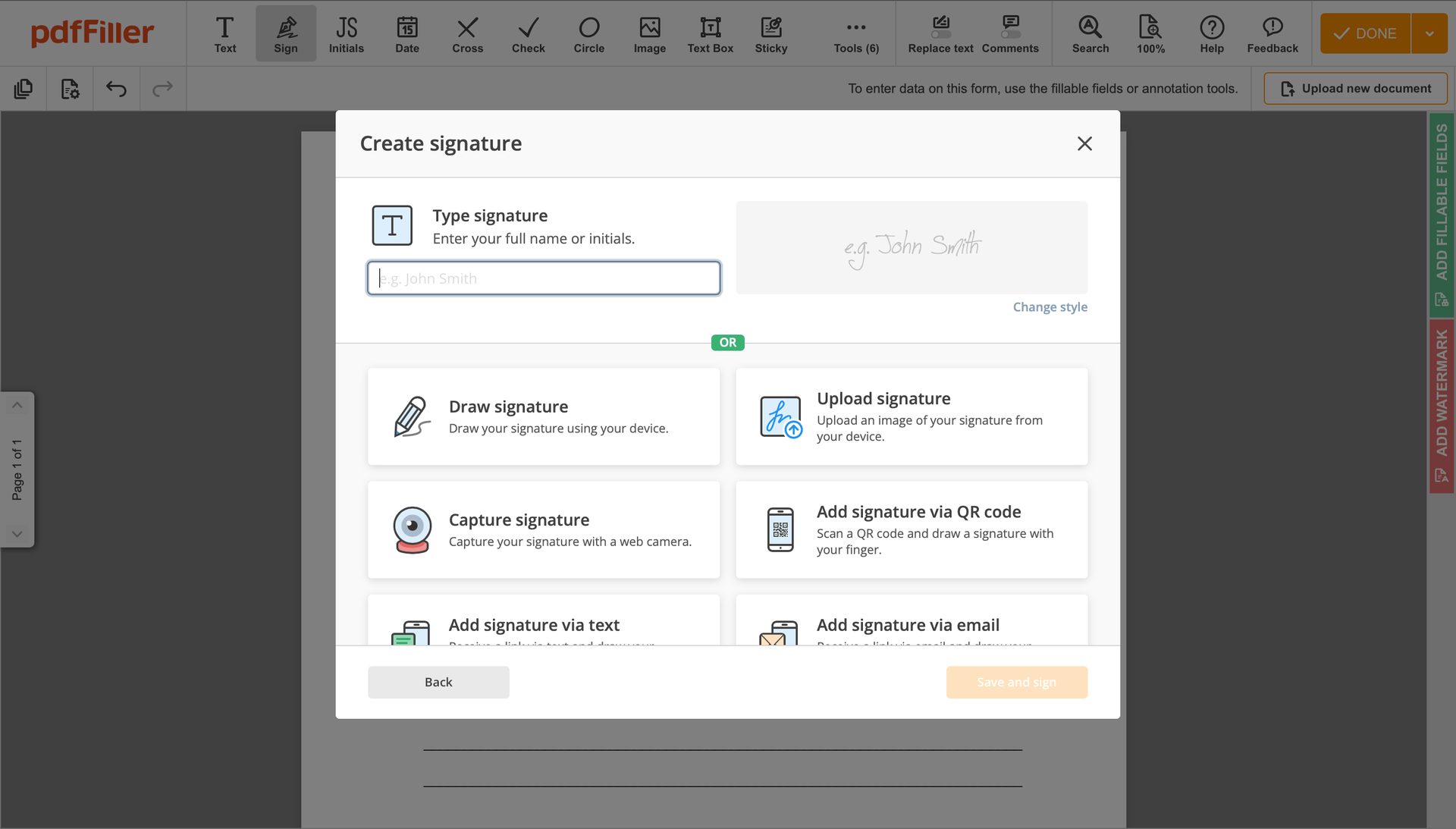

Create your electronic signature by typing, drawing, or adding your handwritten signature's photo from your laptop. Then, hit Save and sign.

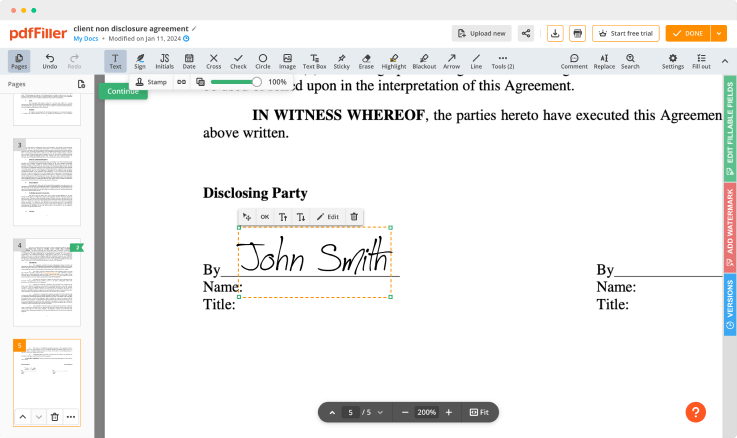

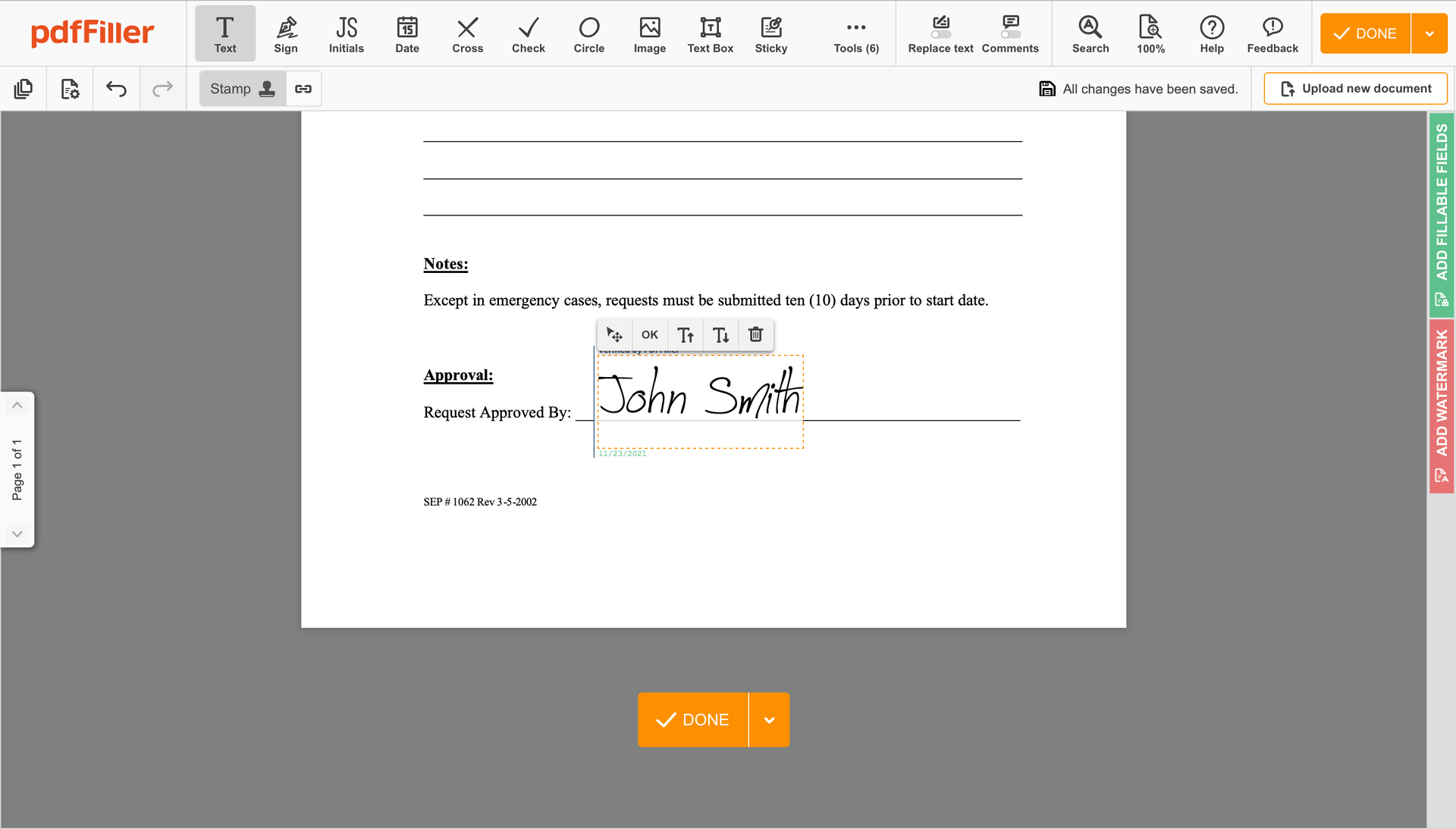

Click anywhere on a form to Sign Mortgage Deed. You can move it around or resize it utilizing the controls in the floating panel. To apply your signature, hit OK.

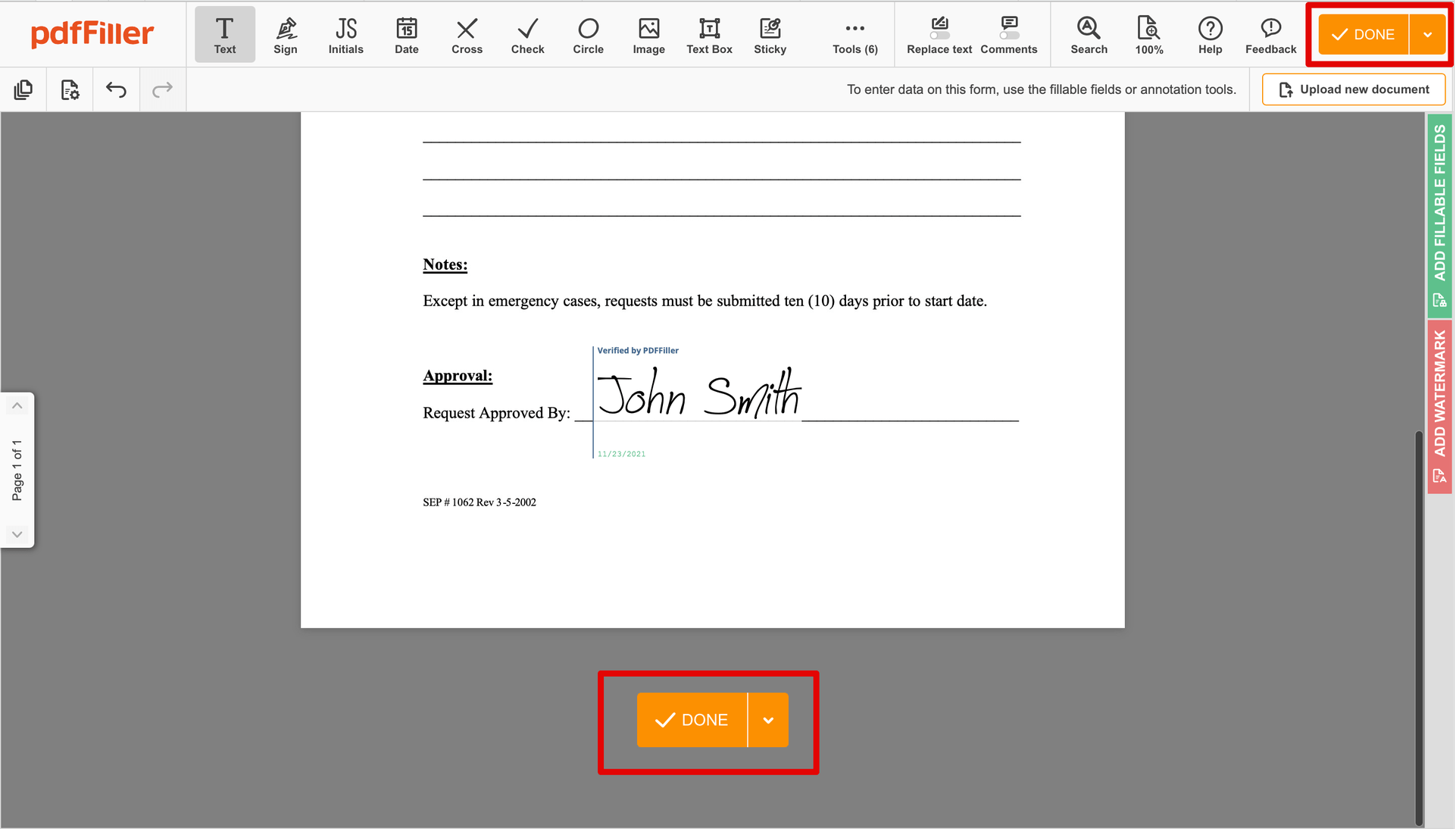

Finish up the signing process by clicking DONE below your document or in the top right corner.

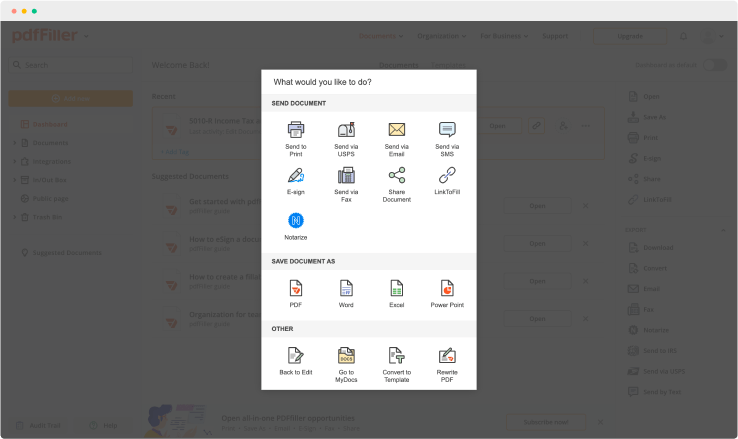

After that, you'll return to the pdfFiller dashboard. From there, you can download a completed copy, print the form, or send it to other people for review or validation.

Stuck with numerous applications to create and edit documents? We have a solution for you. Document management is more simple, fast and efficient using our editing tool. Create fillable forms, contracts, make templates, integrate cloud services and utilize even more useful features within one browser tab. You can use Sign Mortgage Deed with ease; all of our features, like orders signing, alerts, attachment and payment requests, are available to all users. Get an advantage over those using any other free or paid programs. The key is flexibility, usability and customer satisfaction.

How to edit a PDF document using the pdfFiller editor:

For pdfFiller’s FAQs

Ready to try pdfFiller's? Sign Mortgage Deed