Signature Block Commitment Letter For Free

Users trust to manage documents on pdfFiller platform

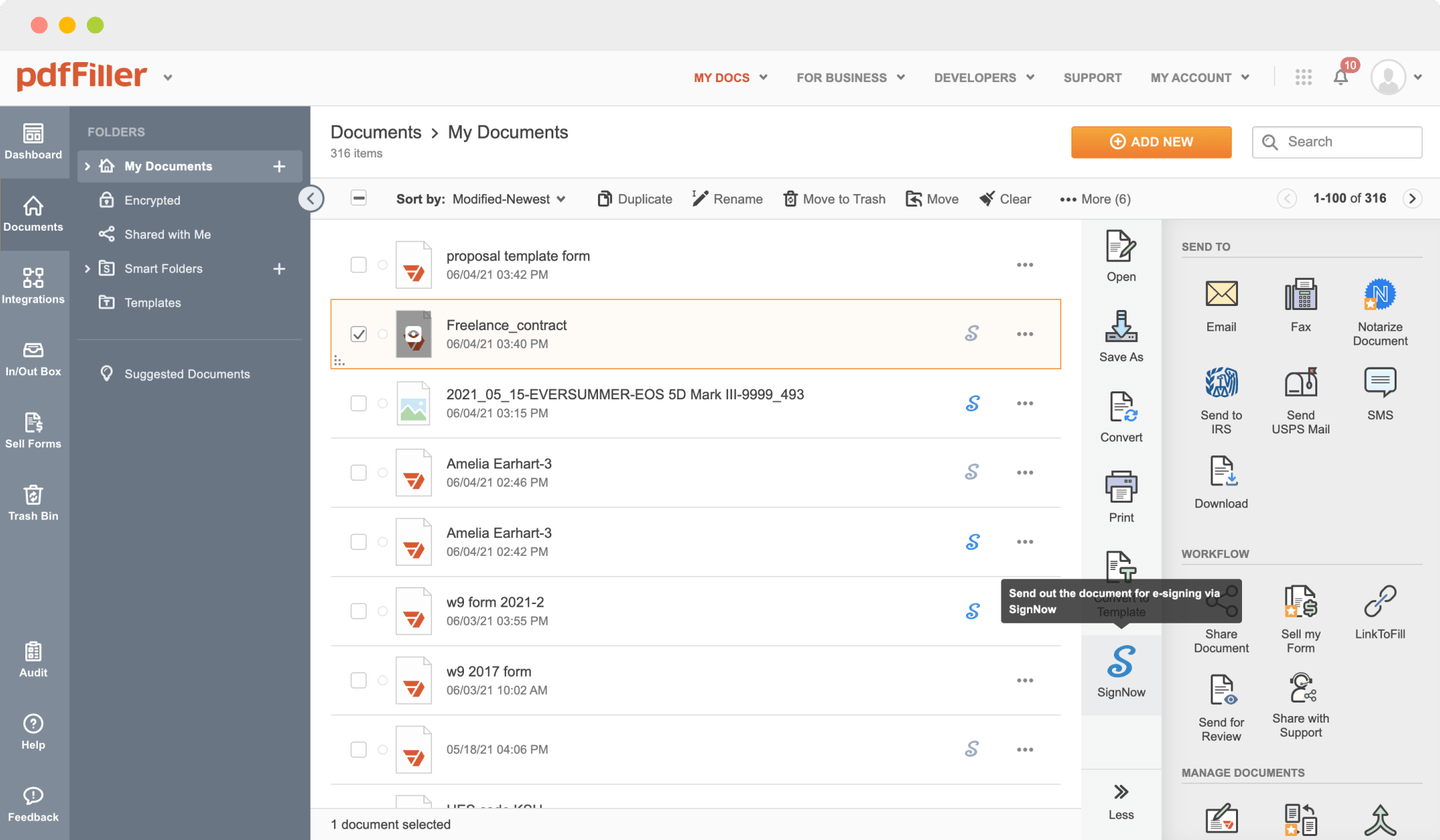

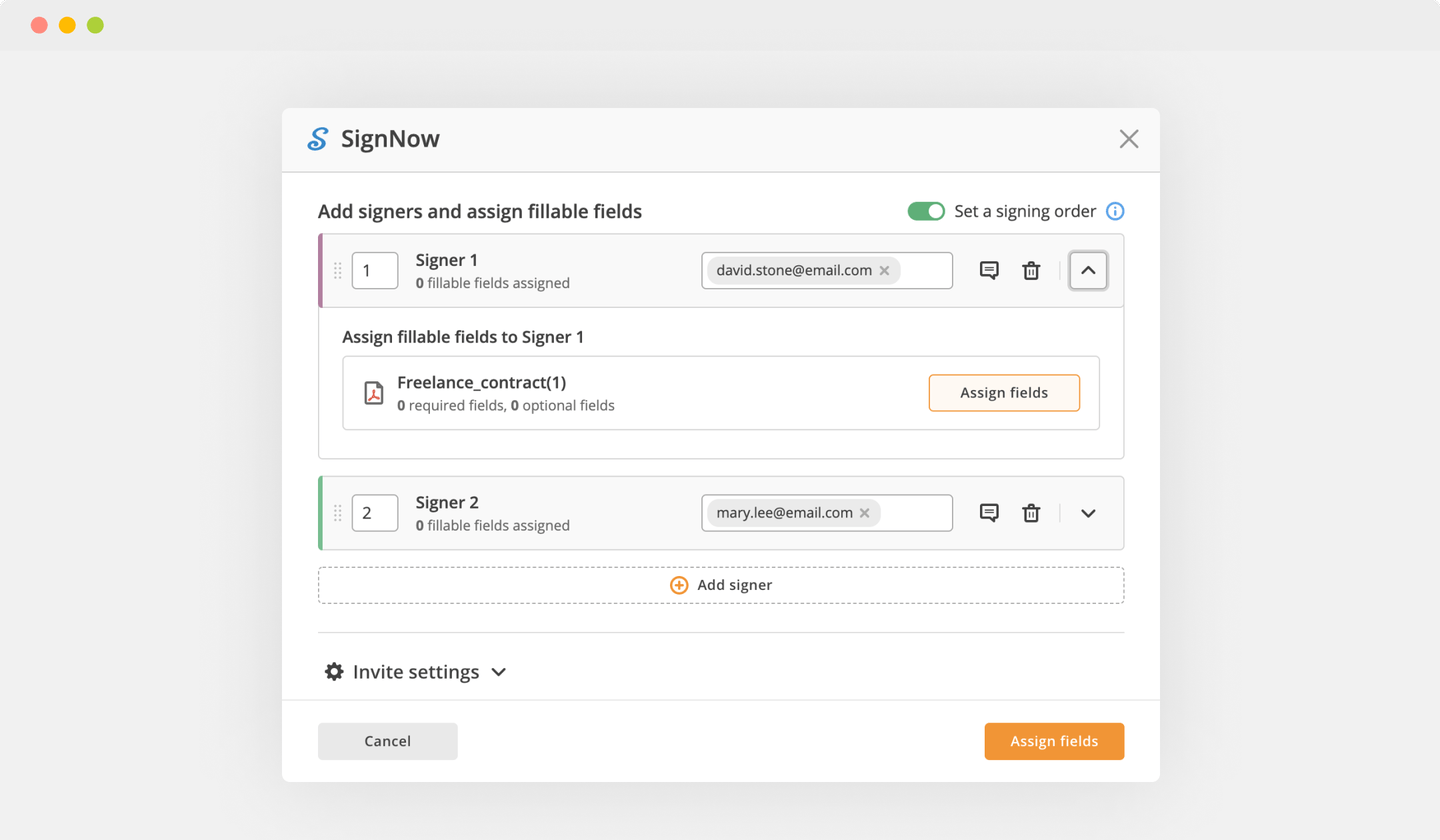

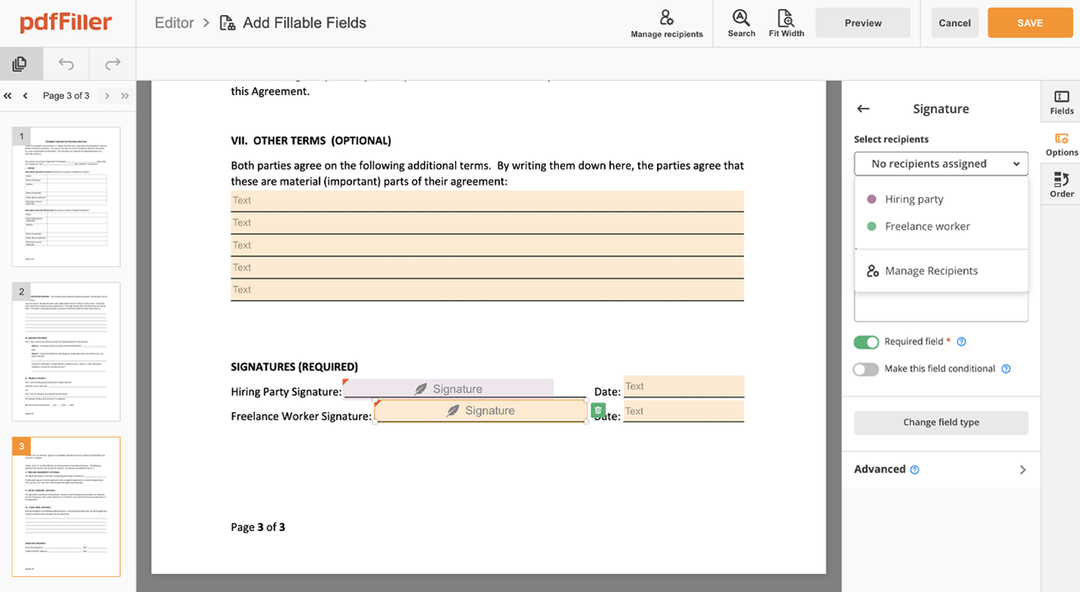

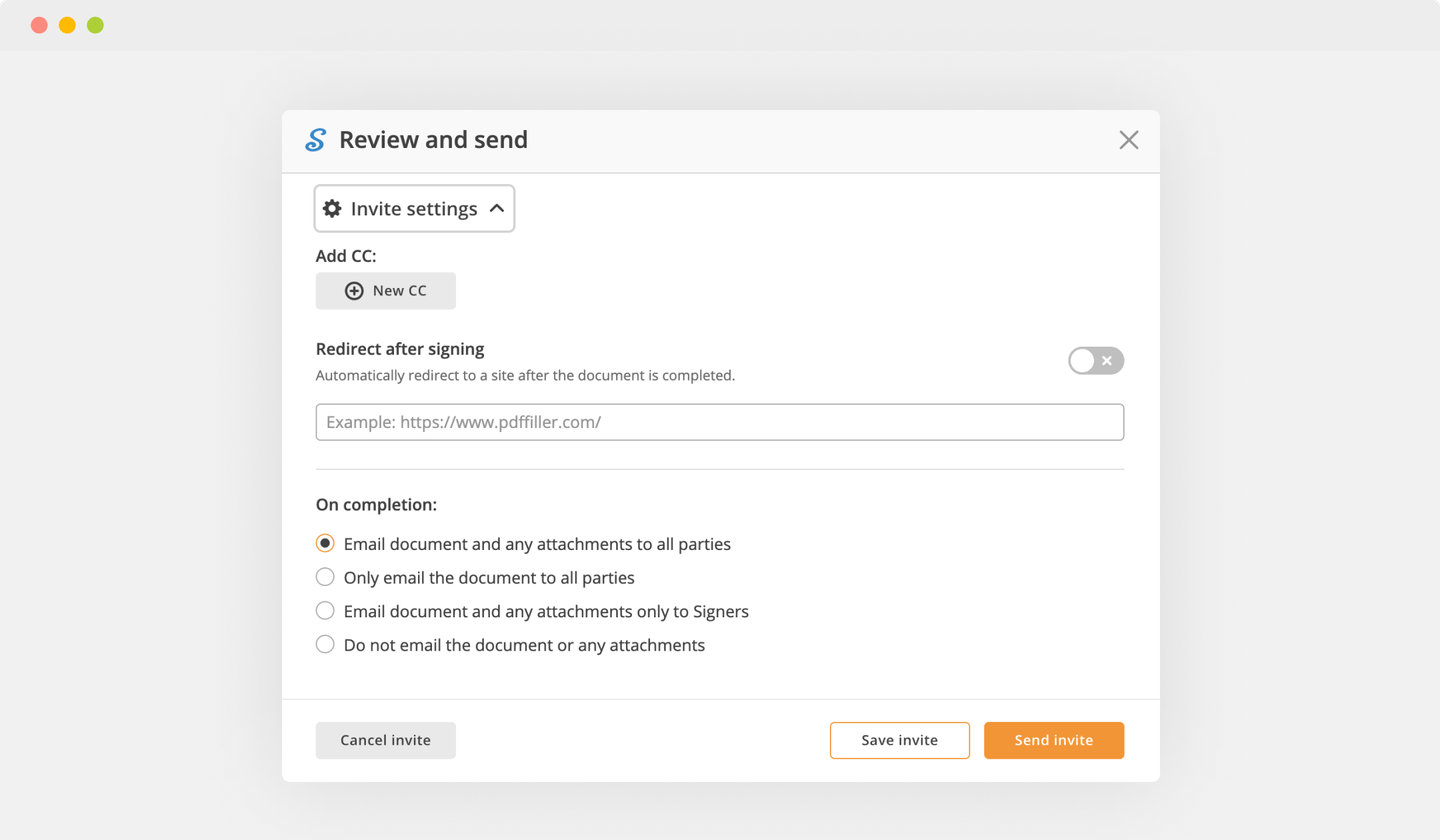

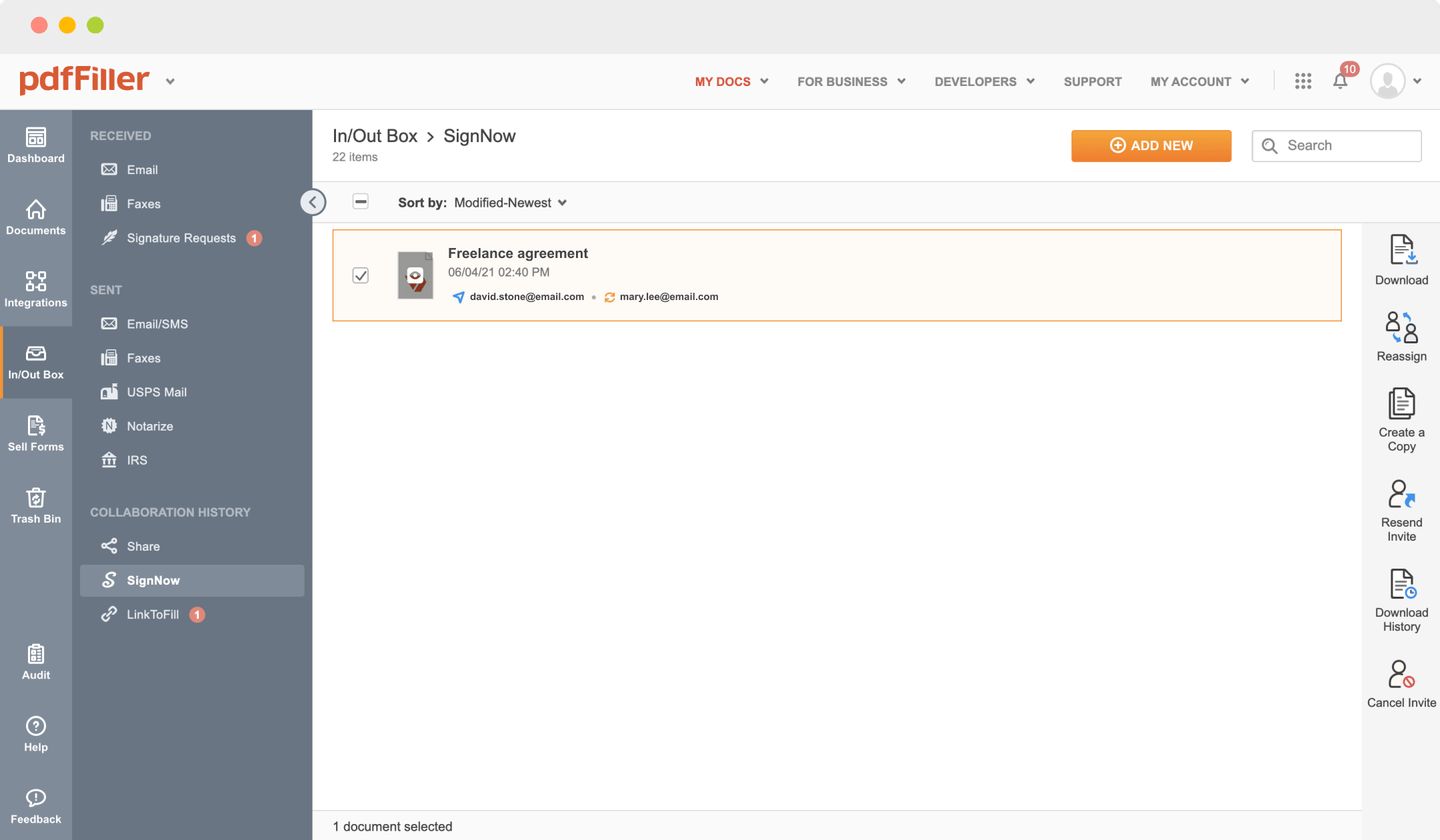

Send documents for eSignature with signNow

Watch a short video walkthrough on how to add an Signature Block Commitment Letter

pdfFiller scores top ratings in multiple categories on G2

Add a legally-binding Signature Block Commitment Letter with no hassle

pdfFiller allows you to manage Signature Block Commitment Letter like a pro. Regardless of the system or device you run our solution on, you'll enjoy an user-friendly and stress-free method of executing paperwork.

The entire pexecution process is carefully protected: from adding a file to storing it.

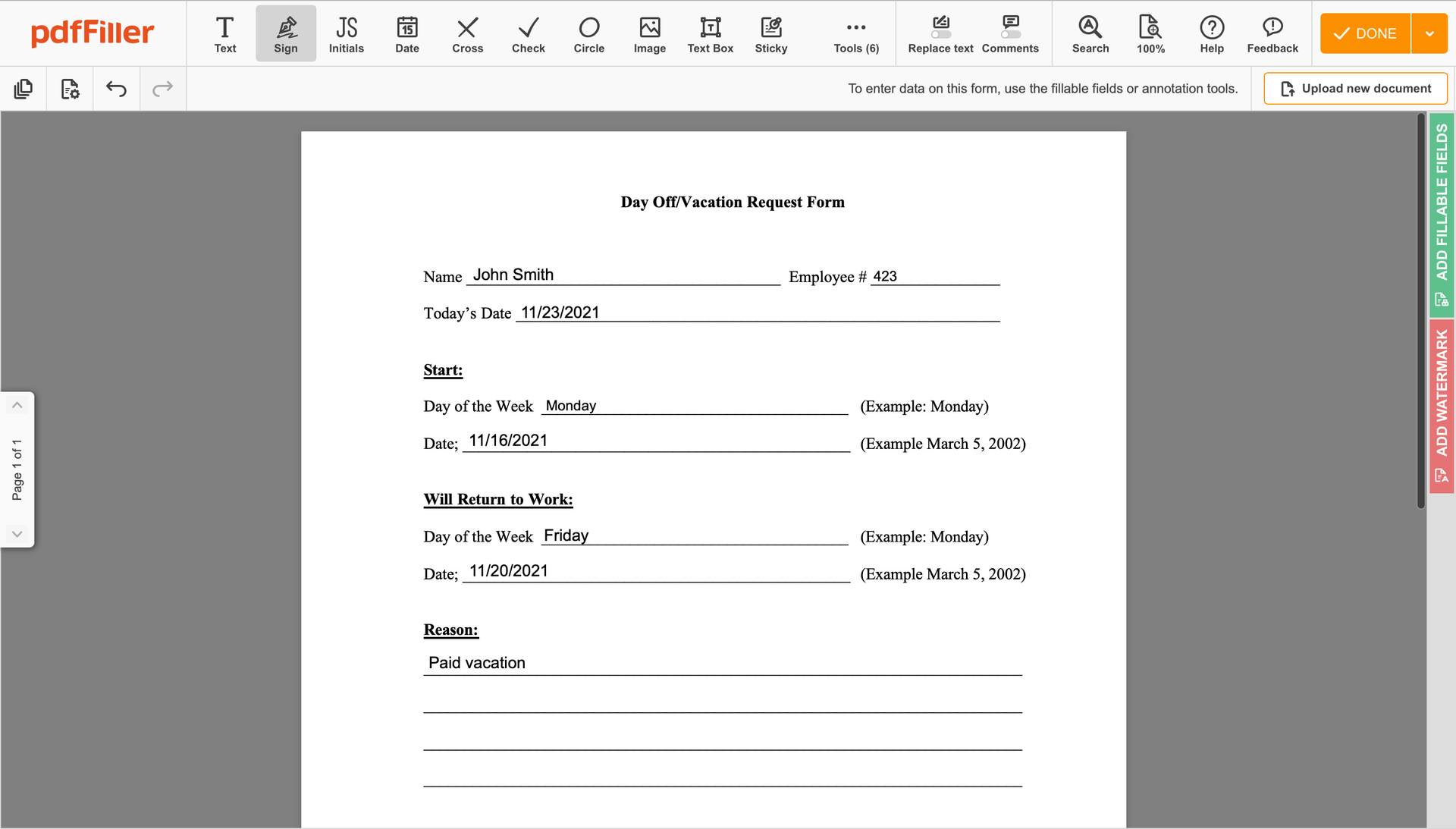

Here's how you can create Signature Block Commitment Letter with pdfFiller:

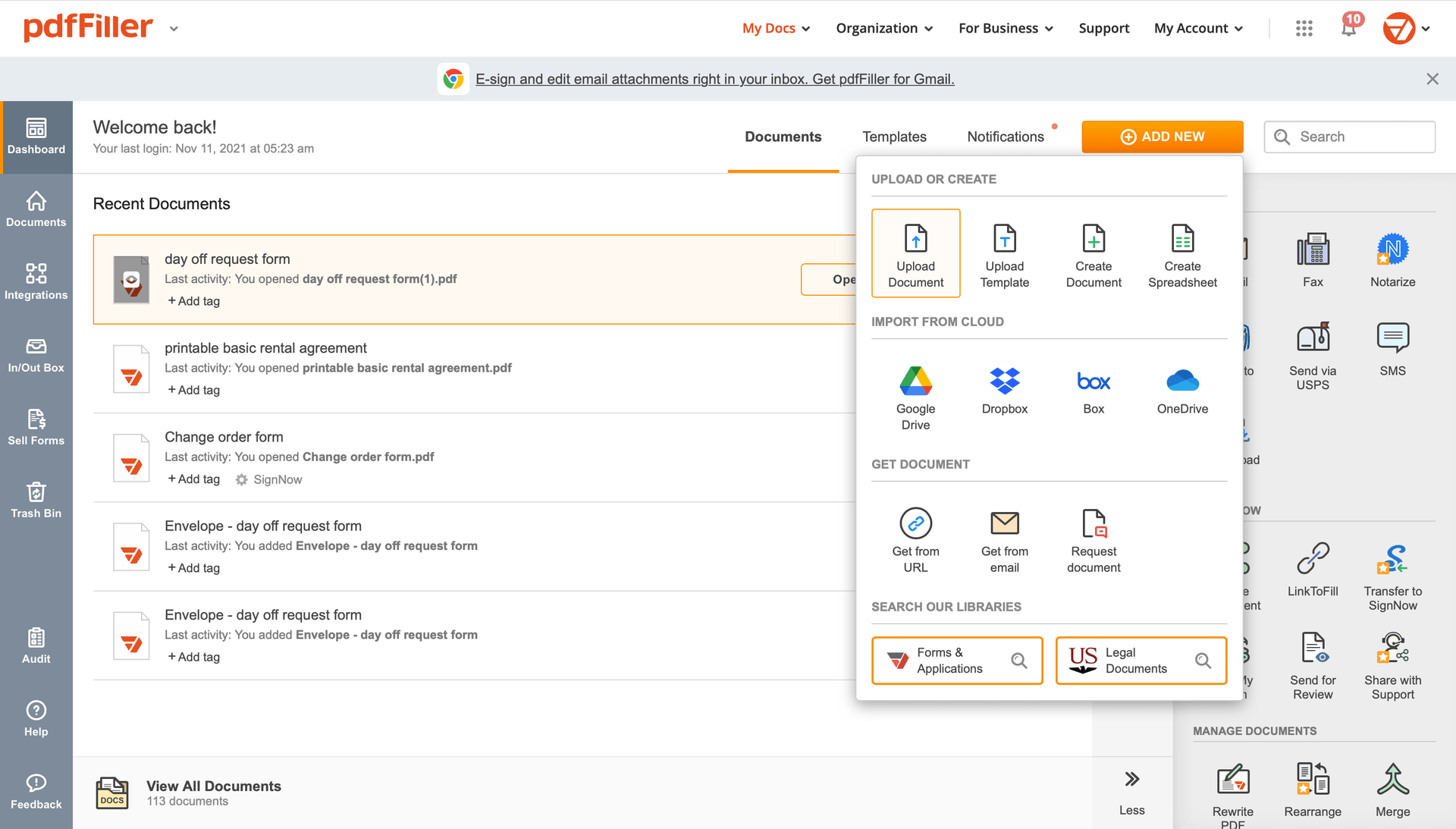

Choose any available option to add a PDF file for signing.

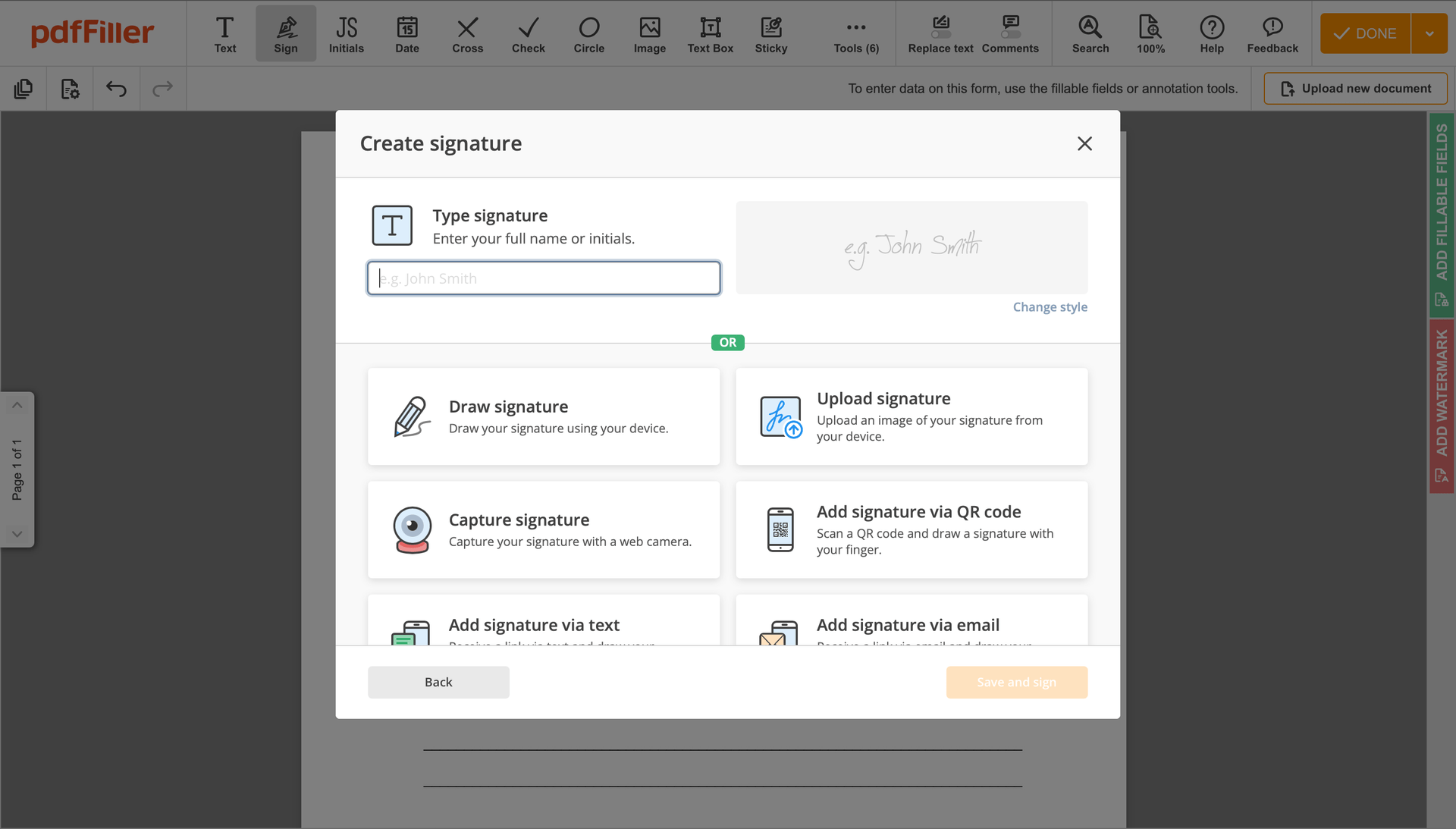

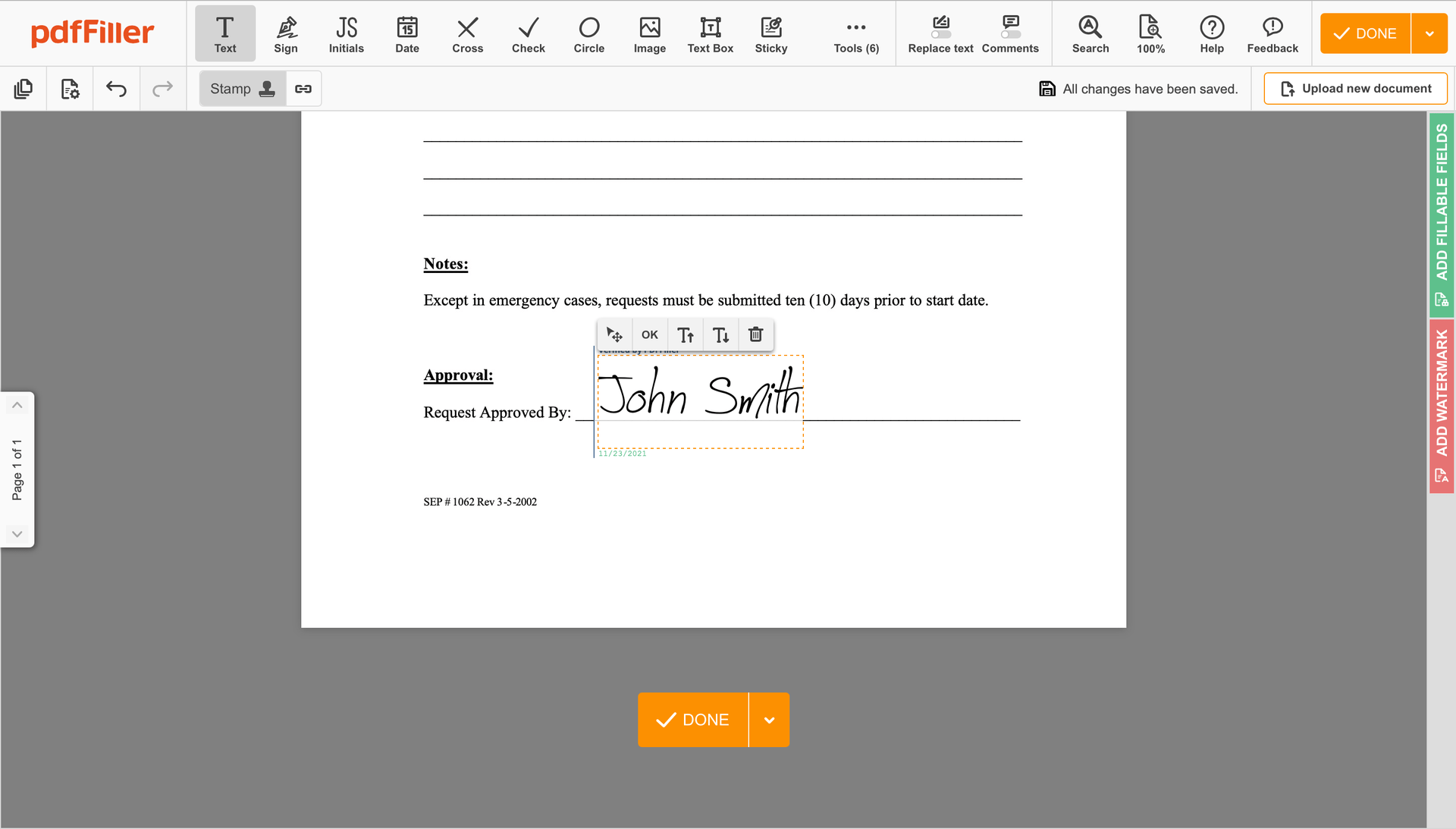

Utilize the toolbar at the top of the interface and choose the Sign option.

You can mouse-draw your signature, type it or add a photo of it - our tool will digitize it automatically. As soon as your signature is set up, hit Save and sign.

Click on the form area where you want to add an Signature Block Commitment Letter. You can move the newly generated signature anywhere on the page you want or change its configurations. Click OK to save the adjustments.

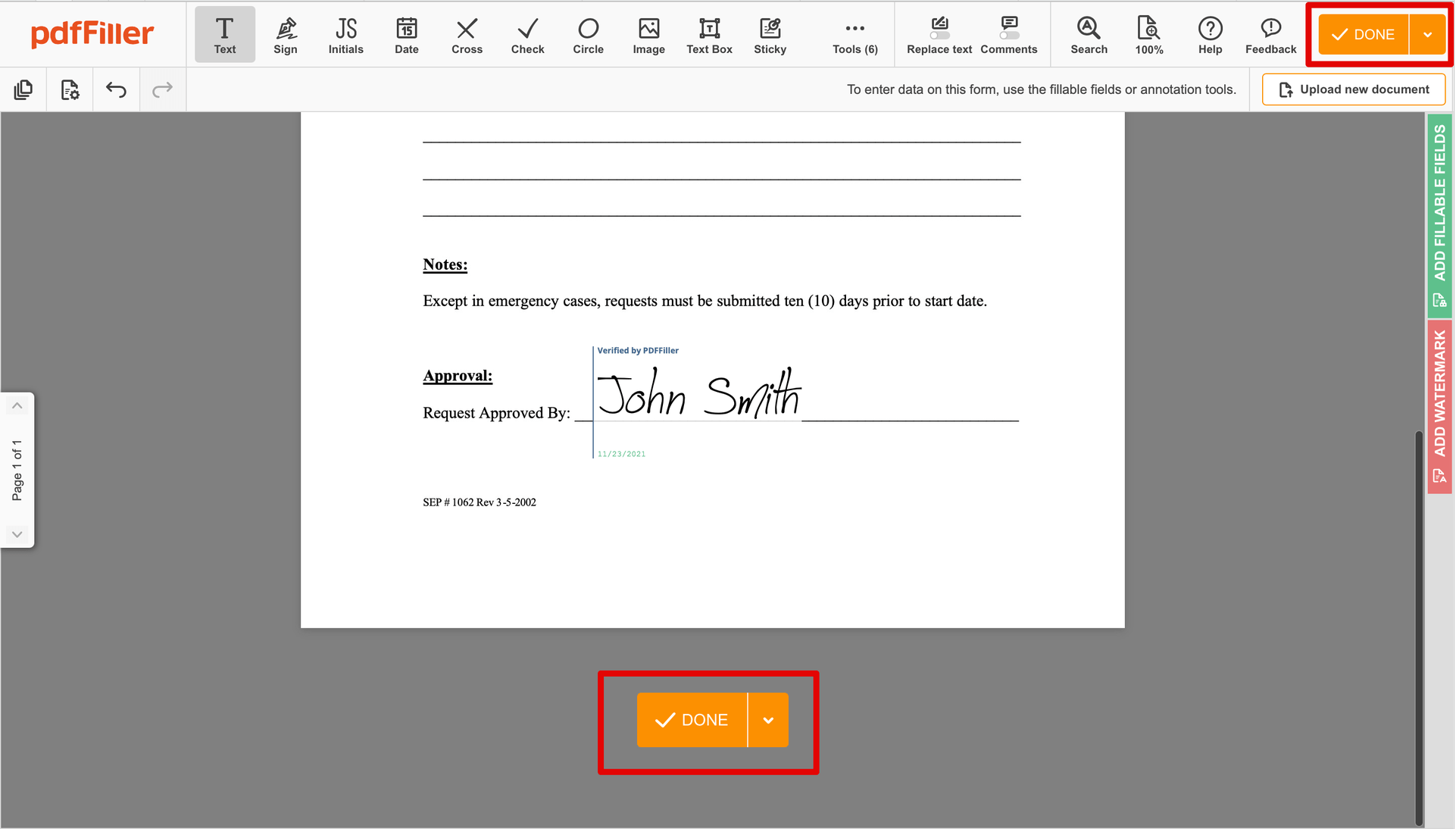

Once your document is good to go, click on the DONE button in the top right corner.

Once you're done with signing, you will be taken back to the Dashboard.

Use the Dashboard settings to get the completed copy, send it for further review, or print it out.

Stuck working with numerous applications for creating and signing documents? Try this all-in-one solution instead. Use our document editor to make the process efficient. Create fillable forms, contracts, make document templates, integrate cloud services and many more useful features within one browser tab. You can use Signature Block Commitment Letter directly, all features, like orders signing, alerts, requests , are available instantly. Have the value of full featured platform, for the cost of a lightweight basic app. The key is flexibility, usability and customer satisfaction. We deliver on all three.

How to edit a PDF document using the pdfFiller editor:

How to Send a PDF for eSignature

What our customers say about pdfFiller