Signature Service Promissory Note Template For Free

Users trust to manage documents on pdfFiller platform

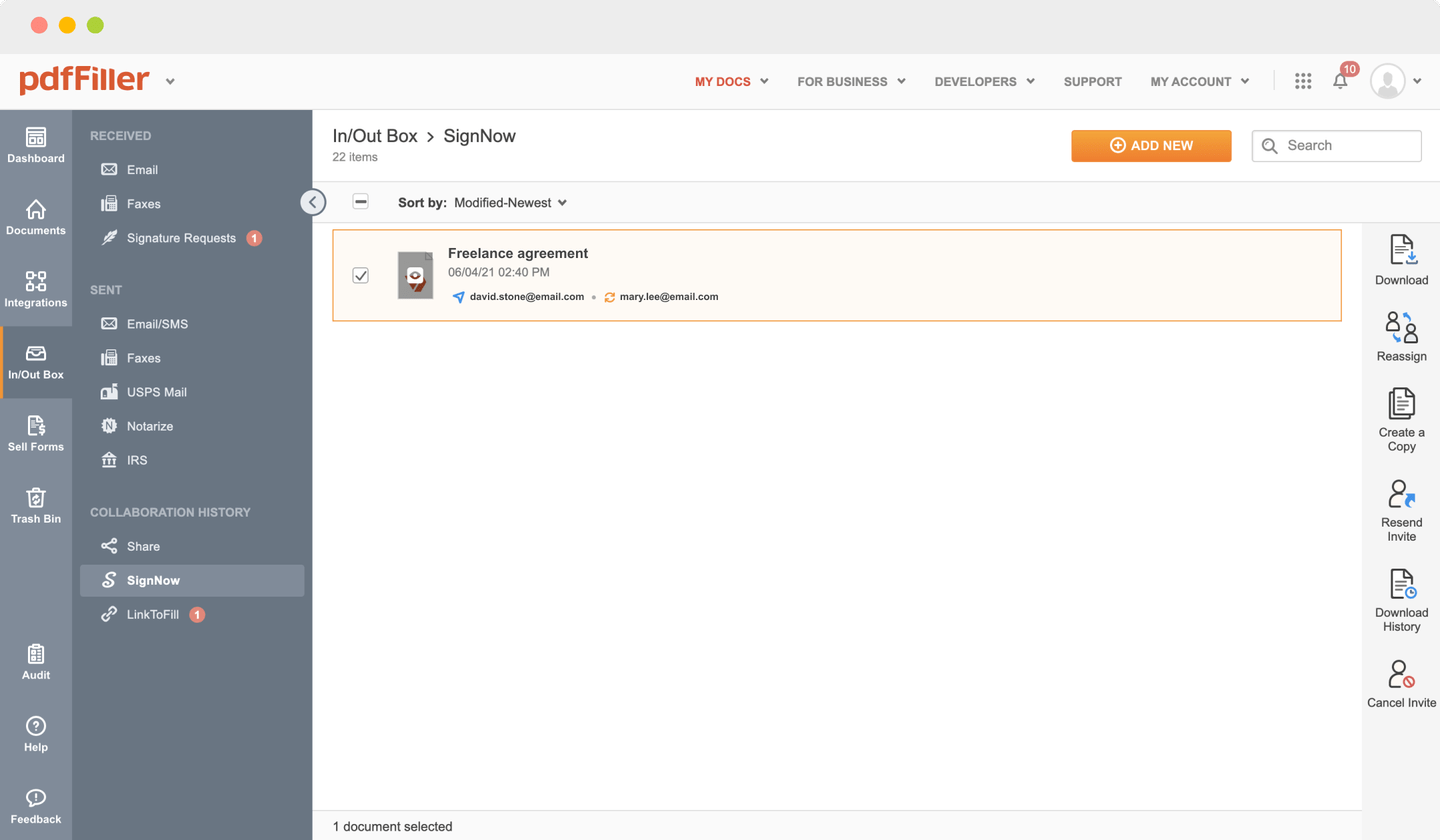

Send documents for eSignature with signNow

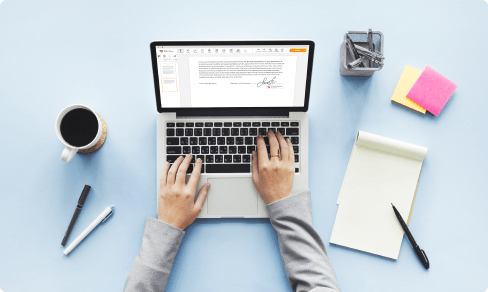

Watch a short video walkthrough on how to add an Signature Service Promissory Note Template

pdfFiller scores top ratings in multiple categories on G2

Add a legally-binding Signature Service Promissory Note Template with no hassle

pdfFiller allows you to deal with Signature Service Promissory Note Template like a pro. No matter the platform or device you use our solution on, you'll enjoy an easy-to-use and stress-free way of executing paperwork.

The whole pexecution flow is carefully protected: from importing a file to storing it.

Here's the best way to generate Signature Service Promissory Note Template with pdfFiller:

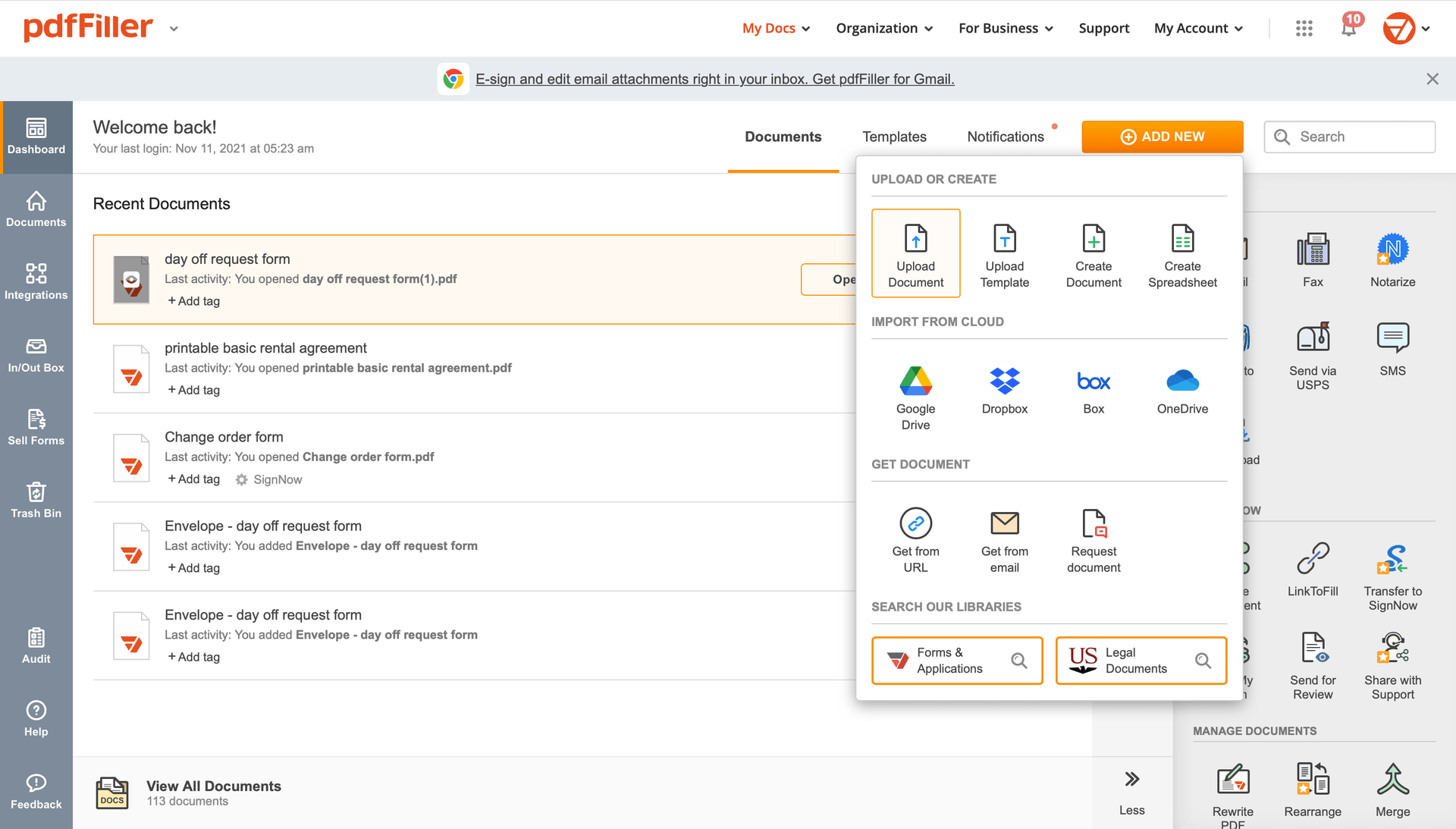

Choose any available way to add a PDF file for completion.

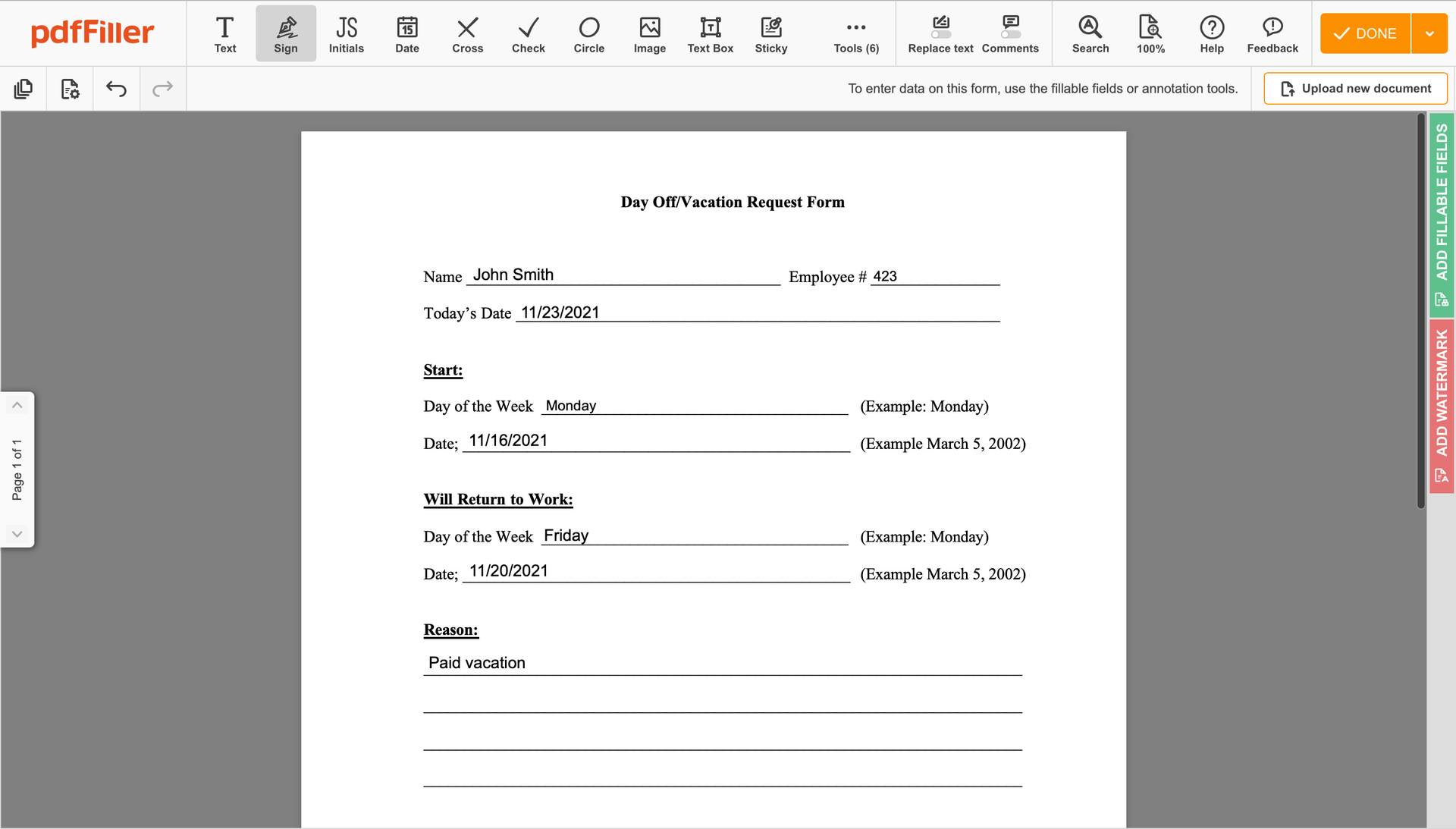

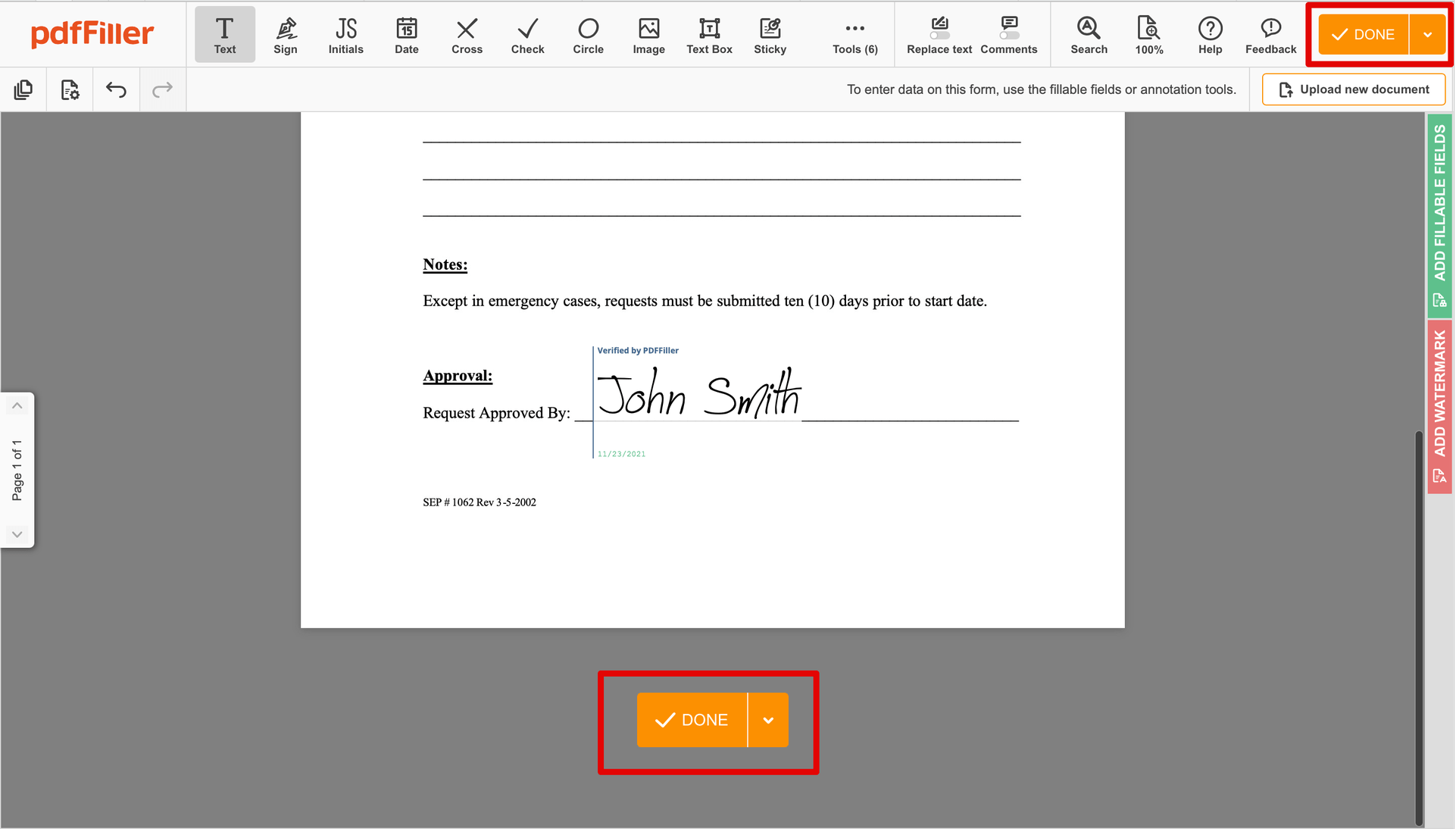

Utilize the toolbar at the top of the page and choose the Sign option.

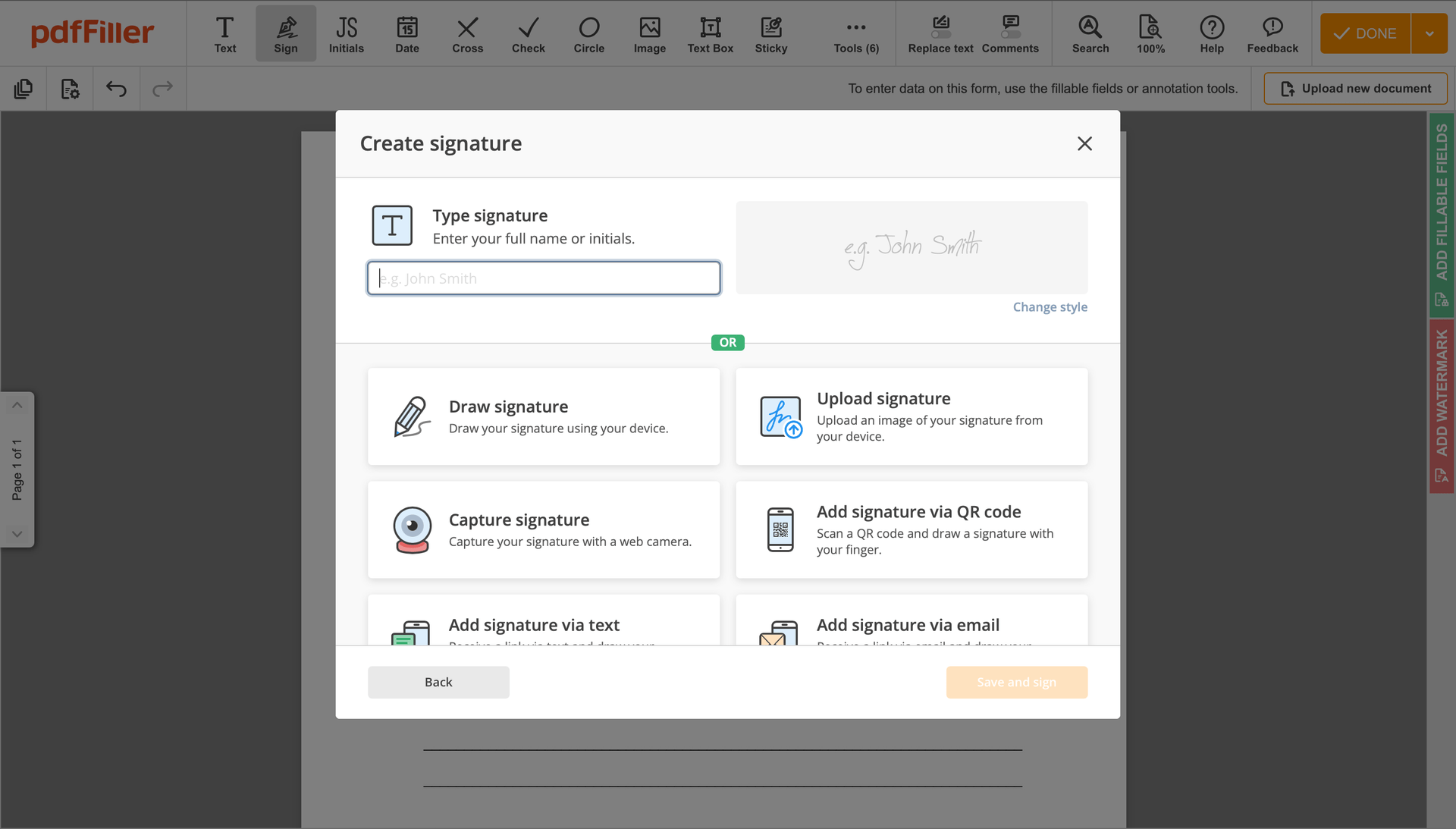

You can mouse-draw your signature, type it or upload an image of it - our tool will digitize it automatically. As soon as your signature is set up, click Save and sign.

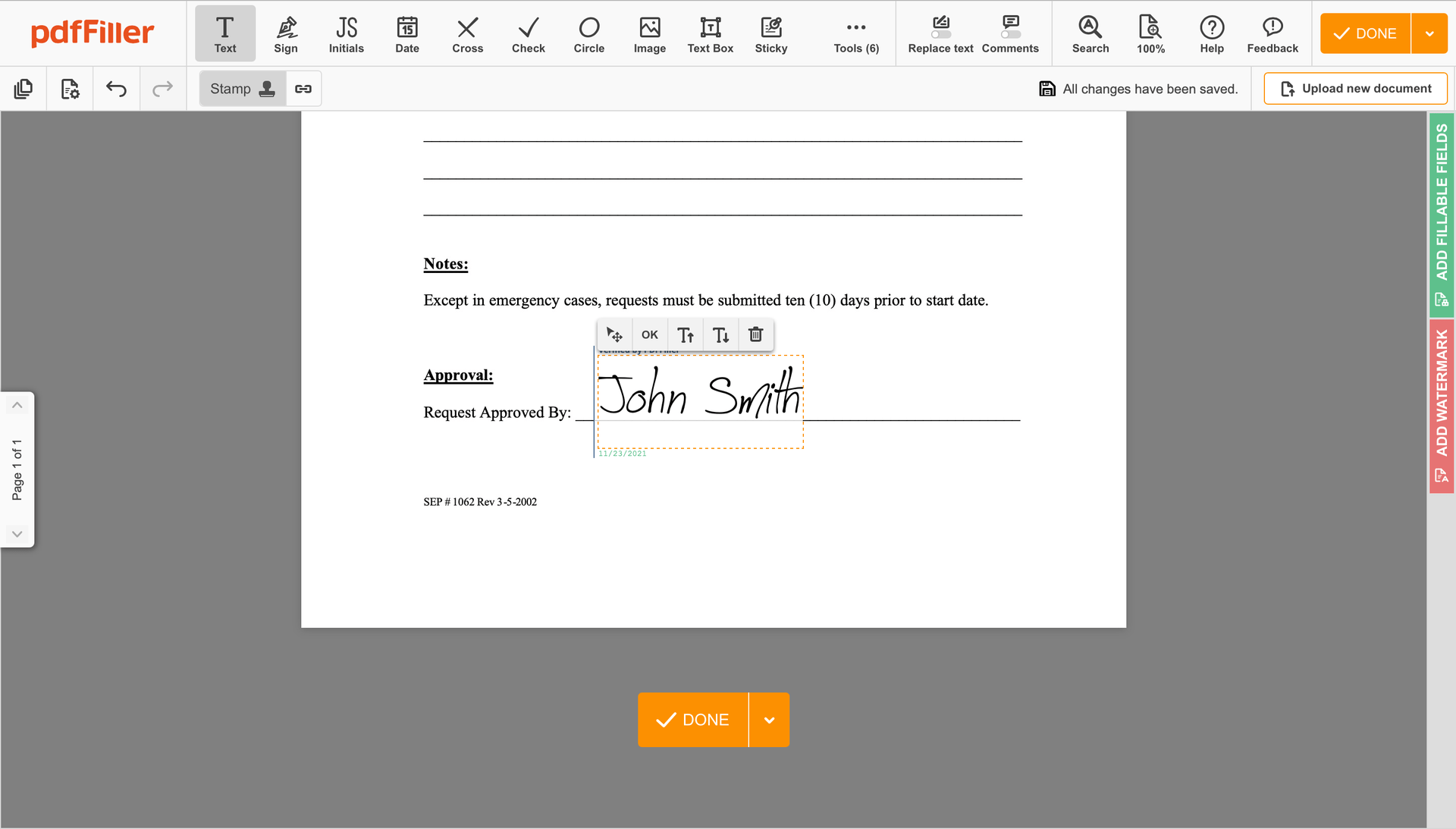

Click on the form place where you want to put an Signature Service Promissory Note Template. You can drag the newly generated signature anywhere on the page you want or change its configurations. Click OK to save the adjustments.

As soon as your form is all set, click on the DONE button in the top right area.

As soon as you're done with certifying your paperwork, you will be taken back to the Dashboard.

Utilize the Dashboard settings to get the executed copy, send it for further review, or print it out.

Still using numerous applications to create and modify your documents? Try this all-in-one solution instead. Document management becomes more simple, fast and smooth using our document editor. Create document templates completely from scratch, edit existing forms, integrate cloud services and many more useful features within one browser tab. Plus, you can use Signature Service Promissory Note Template and add major features like orders signing, reminders, requests, easier than ever. Get a major advantage over those using any other free or paid programs.

How to edit a PDF document using the pdfFiller editor:

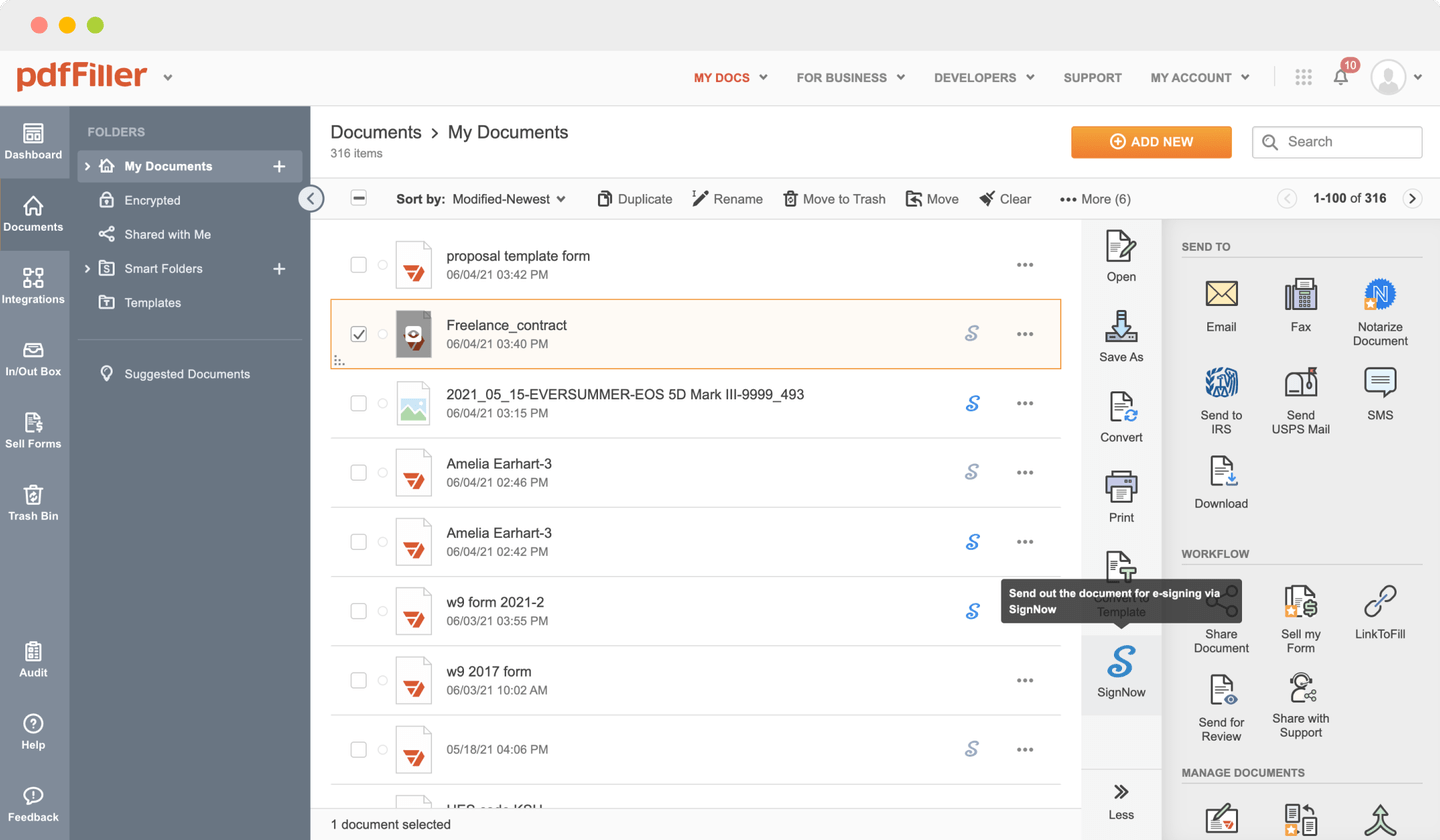

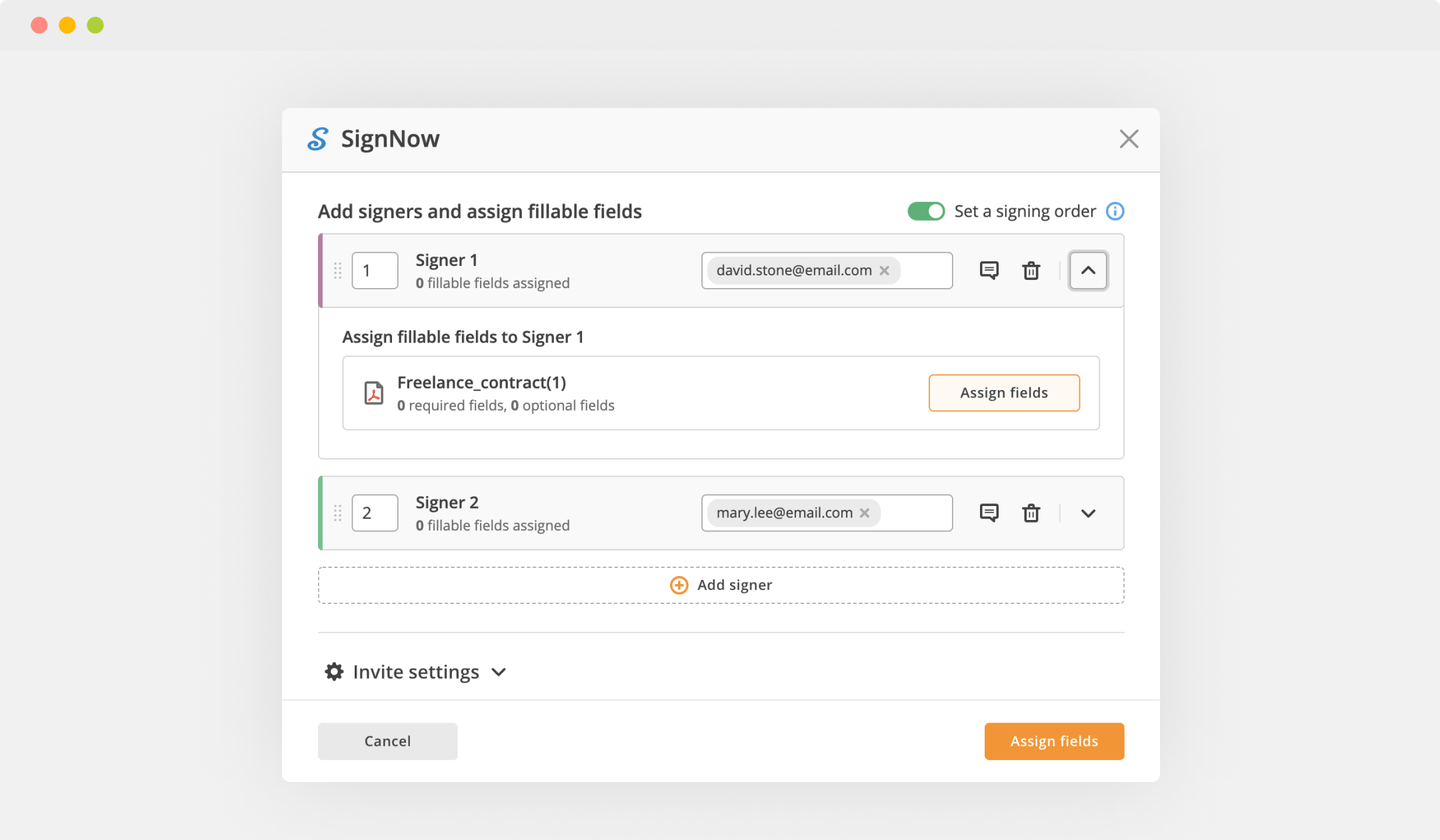

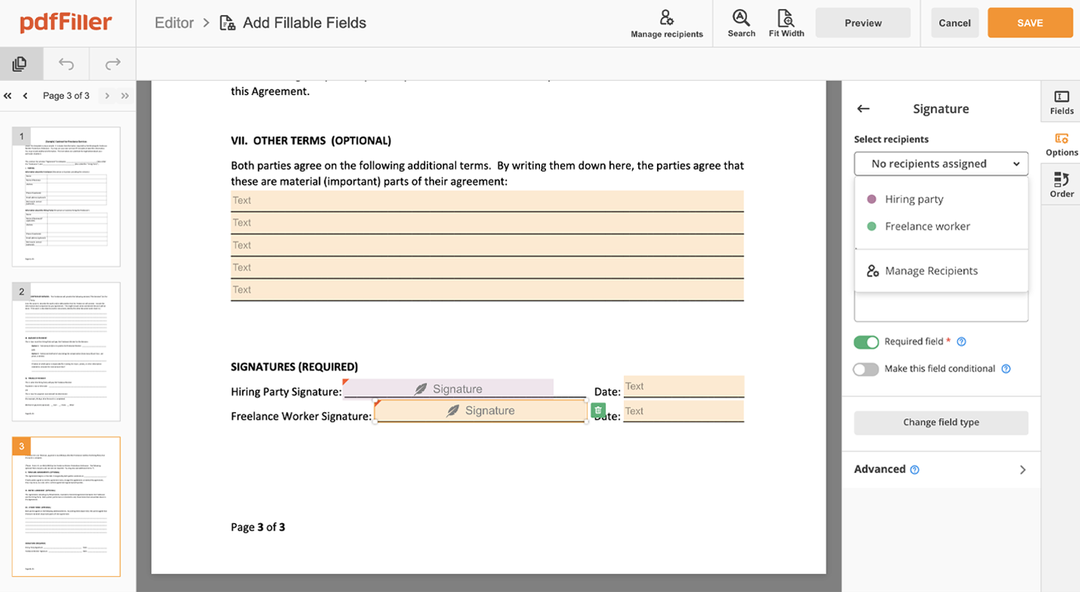

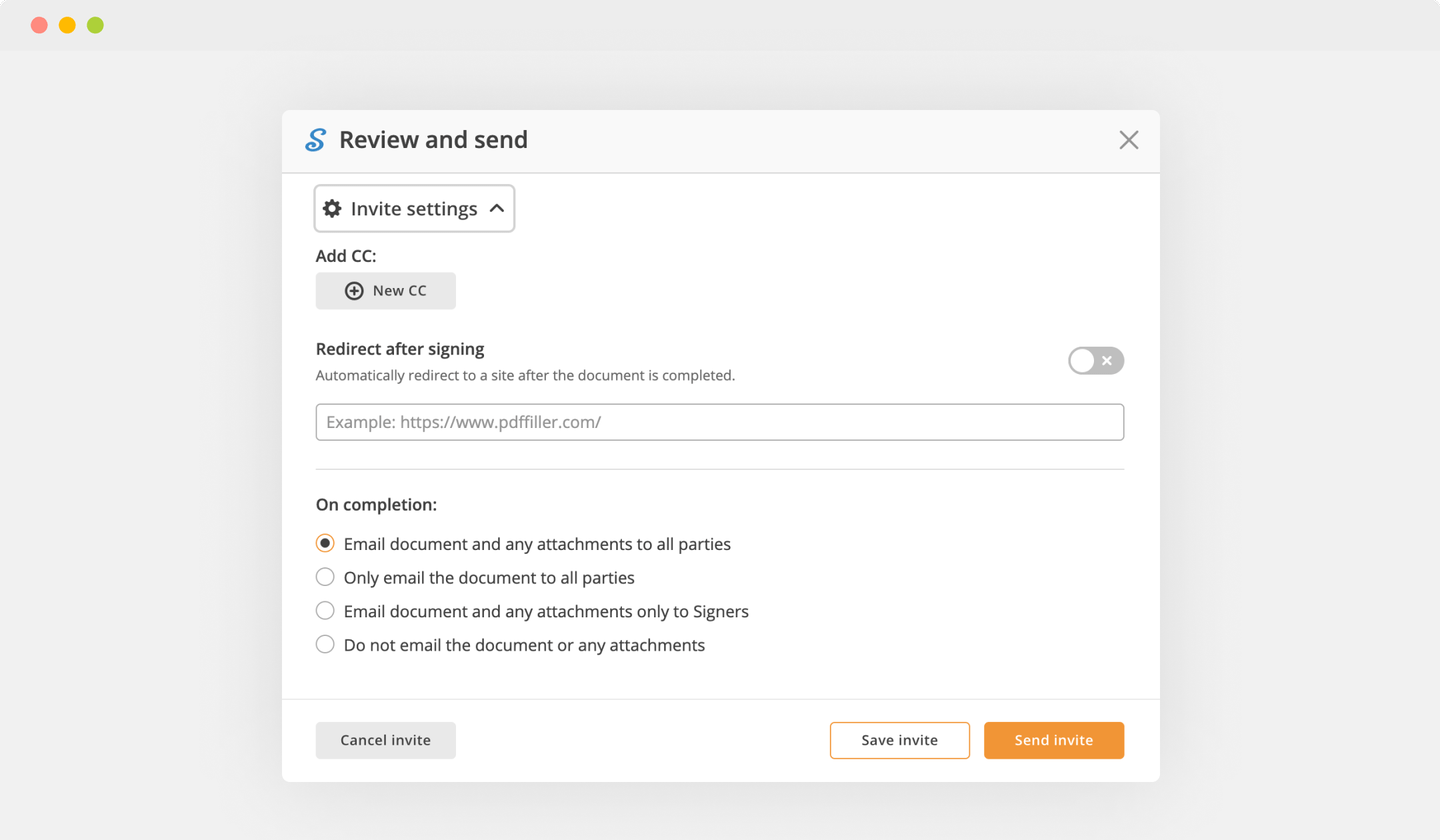

How to Send a PDF for eSignature

What our customers say about pdfFiller