Store Stamp Deed For Free

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

Discover the simplicity of processing PDFs online

Upload your document in seconds

Fill out, edit, or eSign your PDF hassle-free

Download, export, or share your edited file instantly

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Every PDF tool you need to get documents done paper-free

Create & edit PDFs

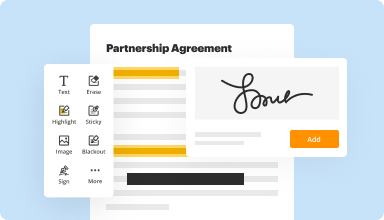

Generate new PDFs from scratch or transform existing documents into reusable templates. Type anywhere on a PDF, rewrite original PDF content, insert images or graphics, redact sensitive details, and highlight important information using an intuitive online editor.

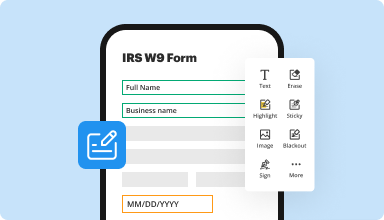

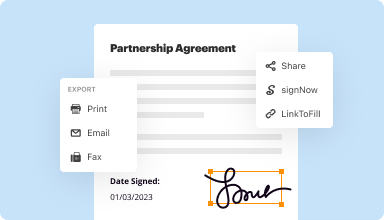

Fill out & sign PDF forms

Say goodbye to error-prone manual hassles. Complete any PDF document electronically – even while on the go. Pre-fill multiple PDFs simultaneously or extract responses from completed forms with ease.

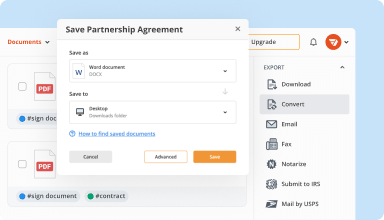

Organize & convert PDFs

Add, remove, or rearrange pages inside your PDFs in seconds. Create new documents by merging or splitting PDFs. Instantly convert edited files to various formats when you download or export them.

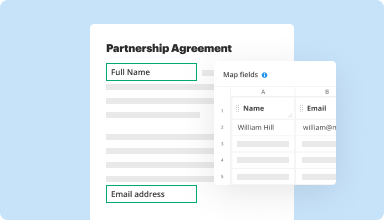

Collect data and approvals

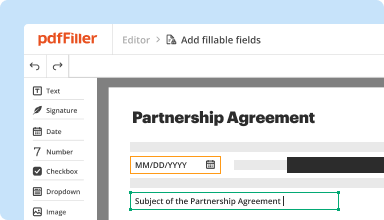

Transform static documents into interactive fillable forms by dragging and dropping various types of fillable fields on your PDFs. Publish these forms on websites or share them via a direct link to capture data, collect signatures, and request payments.

Export documents with ease

Share, email, print, fax, or download edited documents in just a few clicks. Quickly export and import documents from popular cloud storage services like Google Drive, Box, and Dropbox.

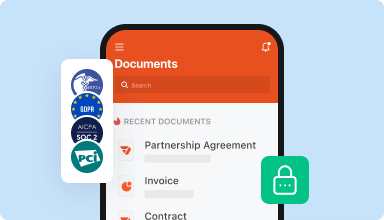

Store documents safely

Store an unlimited number of documents and templates securely in the cloud and access them from any location or device. Add an extra level of protection to documents by locking them with a password, placing them in encrypted folders, or requesting user authentication.

Customer trust by the numbers

64M+

users worldwide

4.6/5

average user rating

4M

PDFs edited per month

9 min

average to create and edit a PDF

Join 64+ million people using paperless workflows to drive productivity and cut costs

Why choose our PDF solution?

Cloud-native PDF editor

Access powerful PDF tools, as well as your documents and templates, from anywhere. No installation needed.

Top-rated for ease of use

Create, edit, and fill out PDF documents faster with an intuitive UI that only takes minutes to master.

Industry-leading customer service

Enjoy peace of mind with an award-winning customer support team always within reach.

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

I had a little trouble finding the right form for the Post Office EDDM program. First, I got an outdated form which was corrected at the post office. When I complained to customer support, they were very helpful and I was able to access the up-to-date form.

2014-06-25

I have just been informed by my college that I can't use this format. After paying for it and working with it for months, they prefer I use a format with expandable boxes for each indicator. This is a user friendly method but my only difficulty as been that the only information I can add to the PDF is what fits in the fixed boxes. This would be a suggestion in the formatting of this PDF.

2014-11-28

No issues once I contacted the support department who answered my questions. I understand that you are in business to make money on a service. I just felt it was costly for a piece of paper or two that would cost me 10. Cents at a FedEx or Office Max type business.

2016-08-11

This tool is AMAZING!!! I've wasted so much time over the years bringing images into Word and overlaying text boxes to accomplish what this tool does SO easily. Thank You! One suggestion: when I click on a document page on the left side of the screen, it would be great if that page opened roughly where I clicked. That is, if I click on the bottom of the page image on the left, it would be great if the page opened with the bottom showing, rather than having to scroll down to the bottom. This would make it the same as Acrobat.

2017-01-20

I am happy with PDF filler. It has been such a great help with my court docs. I am constantly having to complete docs and with PDF filler all the information is saved and I only have to edit and save for next court hearing. PDF filler has saved me so much time and headaches. Thank you!

2018-08-28

The only thing I really had a problem…

The only thing I really had a problem with is that I completed what I thought was a "free" form and then had to sign up for a free trial. The actual program is very useful and helpful and relatively easy to navigate through.

2019-07-03

Love the app!

Overall I really like the app and it has been quite useful for me as a realtor =)

Great way to fill out forms and make your own fillable master form.

I have had a hard time figuring out how to easily share and send the form you want and the notifications when you receive it back. Wish I could save the docket in my own files

2019-03-12

Simple and powerful to use to edit, sign and reorganise pages quickly thanks to its web interface.

For me, it is a must-have and is reasonably priced compared to its competitors.

2023-01-10

Cust Svc EXCELLENT - Product, so-so

Product not user-friendly enough for me - I am a bit tech "challenged" HOWEVER customer service is excellent.

2021-09-01

Store Stamp Deed Feature

The Store Stamp Deed feature streamlines the process of creating, managing, and tracking store deeds. This tool enables you to efficiently handle essential legal documents, making your operations smoother and more compliant.

Key Features

Create digital store deeds in minutes

Store deeds securely in the cloud

Access deeds anytime, from any device

Easily share deeds with stakeholders

Track changes and history of each deed

Use Cases and Benefits

Perfect for small business owners who need quick access to legal documents

Ideal for real estate professionals managing multiple properties

Great for startups needing to establish robust documentation

Supports law firms in organizing client documents efficiently

Enhances collaboration through easy-sharing features

By using the Store Stamp Deed feature, you can reduce paperwork, minimize risks, and maintain compliance with legal standards. This tool addresses common frustrations by providing a clear, organized way to manage your important documents. Let us help you simplify your workflow and keep your business operations hassle-free.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

Who typically pays for deed stamps?

The buyer or the seller can pay the tax. In some areas of the country, it's customary for one or the other to pay, while in other areas it can be negotiated as part of the sales contract.

Does buyer or seller pay doc stamps?

The party responsible for payment of the documentary stamp tax on a sale is usually determined by the terms of the purchase agreement. However, because the seller is required to provide marketable title to the property, the seller usually pays these taxes.

Who pays doc stamps in Florida buyer or seller?

In Florida, all parties are legally liable for the stamp, unless one party is otherwise exempt. The seller traditionally pays the tax on the deed, and the buyer covers the stamp if engaging in a mortgage. However, not all real estate transactions qualify for the tax.

Who pays transfer taxes buyer or seller?

In California, the seller traditionally pays the transfer tax. Depending on local market conditions, transfer taxes can become a negotiating point during closing. For instance, in a strong seller's market, the seller may have multiple offers and will likely find a buyer who agrees to pay the transfer tax.

Who pays revenue stamps at closing?

State Revenue Stamps You are then responsible for buying the tax stamp from the Register of Deeds in your county. A land transfer tax of 1% of the sales price is added on top of the excise tax. This is a state tax that is always the seller's responsibility to pay at closing.

What fees do a seller pay at closing in Florida?

Sellers closing costs are deducted from the total profit of the sale, if there is any. Typically, sellers can expect to pay around 3% in closing costs in Florida, and up to 9%, including realtor commissions.

Who pays for recording the deed?

Recording fees: These fees may be paid by you or by the seller, depending upon your agreement of sale with the seller. The buyer usually pays the fees for legally recording the new deed and mortgage.

Who is responsible for recording a deed?

In the United States, the (recorder) of deeds is often an elected county office and is called the county recorder. In some U.S. states, the functions of a recorder of deeds are a responsibility of the county clerk (or the county's clerk of court), and the official may be called a clerk-recorder or recorder-clerk.

#1 usability according to G2

Try the PDF solution that respects your time.