Texas Form 2076

What is Texas Form 2076?

Texas Form 2076 is a document used for reporting state and local sales and use tax due for a specific reporting period in Texas. It is important for businesses to accurately fill out this form to ensure compliance with tax regulations.

What are the types of Texas Form 2076?

There are two main types of Texas Form 2076: the Texas Sales and Use Tax Return and the Texas Sales and Use Tax Return (Short Form). The short form is available for taxpayers with a lower tax liability or simpler reporting requirements.

Texas Sales and Use Tax Return

Texas Sales and Use Tax Return (Short Form)

How to complete Texas Form 2076

To successfully complete Texas Form 2076, follow these steps:

01

Gather all necessary financial records and sales data for the reporting period.

02

Carefully fill in all required fields with accurate information.

03

Double-check the form for any errors or missing information before submitting.

04

Submit the completed form along with any required payment by the specified deadline.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Texas Form 2076

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

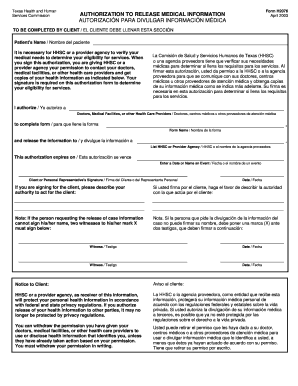

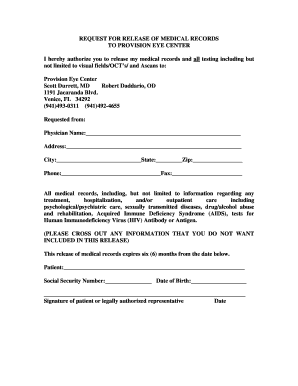

What is the law on releasing medical records in Texas?

Texas law gives a deadline of 15 business days to provide medical records upon receipt of a request and any agreed upon fees. This same deadline also applies if the physician feels it would be harmful to release copies of medical records to a patient.

How do I get my mental health records in Texas?

The Department of State Health Services is committed to providing full access to public information. To request records under the Texas Public Information Act: Submit a request in writing via U.S. Mail, fax or email. Include contact information and a clear description of the records you are requesting.

Does a patient have the right to their medical records in Texas?

In Texas you have the right to: See and get a copy of your medical record. within 15 business days after they receive your request and payment for copies ("business days" do not include weekends).

How long does a doctor have to provide medical records in Texas?

(b) Maintenance of Medical Records. (1) A licensed physician shall maintain adequate medical records of a patient for a minimum of seven years from the anniversary date of the date of last treatment by the physician.Texas Administrative Code. TITLE 22EXAMINING BOARDSRULE §165.1Medical Records2 more rows

How much can a doctor charge for medical records in Texas?

Copy Fees for Medical Records in an Electronic Format For medical records provided in an electronic format, the rules provide that physicians may charge no more than $25 for 500 pages or fewer and $50 for more than 500 pages.

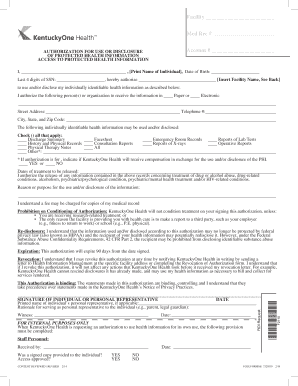

How to fill out authorization for release of protected health information?

The complete name of the person or entity to receive the protected health information (PHI) A specific description of the information to be used or disclosed, including the dates of service. The purpose of the requested use and disclosure.

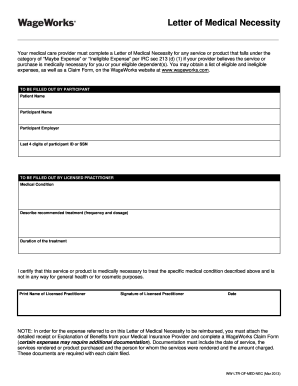

Related templates