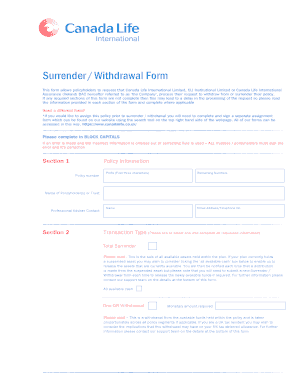

Insurance Cancellation Letter Canada

What is Insurance cancellation letter Canada?

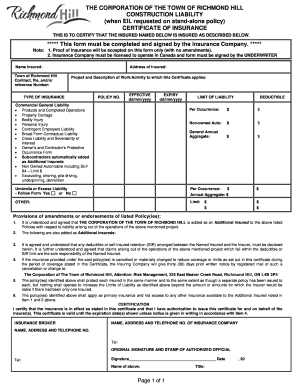

An Insurance cancellation letter Canada is a formal document used to notify an insurance provider that you wish to terminate your insurance policy. It includes important details such as your policy number, the effective date of cancellation, and the reason for canceling the policy.

What are the types of Insurance cancellation letter Canada?

There are two main types of Insurance cancellation letter Canada:

Voluntary cancellation letter – where the policyholder initiates the cancellation of the policy.

Involuntary cancellation letter – where the insurance provider cancels the policy due to non-payment or other policy violations.

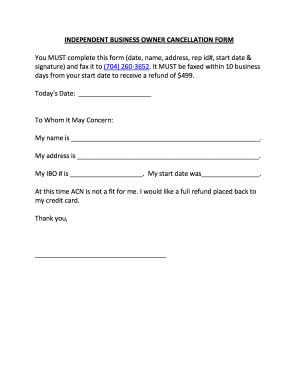

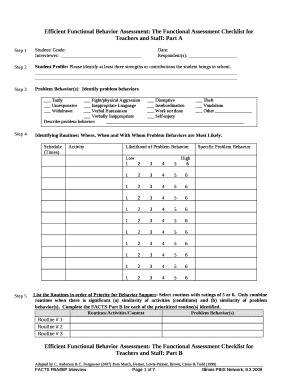

How to complete Insurance cancellation letter Canada

To complete an Insurance cancellation letter Canada, follow these steps:

01

Start by addressing the letter to your insurance provider.

02

Include your policy number and the effective date of cancellation.

03

Clearly state the reason for canceling the policy.

04

Express your desire for a refund if applicable.

05

Provide your contact information for further communication.

06

Sign the letter and send it to your insurance provider.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Insurance cancellation letter canada

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How do I write an insurance cancellation request?

How Do You Write An Insurance Cancellation Letter? Keep it simple : A one-page notice of cancellation will do. Include all required information : Make sure to include all required information by your insurer for cancellation notification. Be polite, but firm : Write in a polite, yet firm tone.

How do I write a letter of cancellation for insurance?

Your letter should include: Date of notice. Insurance company name and address. Appropriate department name and contact person. Insured's name (found in the declarations page of the policy) Insured's mailing address. Insured's phone number. Policy number. Coverage period (on declarations page)

How do you write a formal email cancellation?

Hi (Recipient's name), I'm sorry for the late notice, but I will need to cancel our meeting scheduled for (insert date and times). I appreciate that this email is late, but it's unavoidable because (include reasons why). Can you confirm that you have received this email?

Can I cancel my auto insurance at any time in Canada?

Yes, you can cancel your insurance policy at any time. But yes, there will be a cancellation fee if you cancel your policy early.

How do I politely cancel my insurance?

Be courteous, but firm, in notifying your insurance company of your decision to cancel your policy. Indicate that you expect the insurance company to send you a written confirmation that the cancellation has been put into effect. Request a refund of any unused premiums that you have already paid.

What do you say to cancel insurance?

Send your cancellation letter, if applicable If that's the case, you'll learn what they need from your phone call with the company. The most important parts are stating your policy number, intent to cancel, the effective date of the cancellation and your request for any refunds.

Related templates