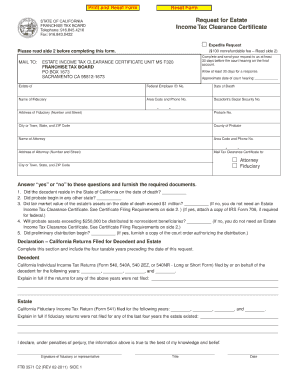

Tin Certificate Check

What is Tin certificate check?

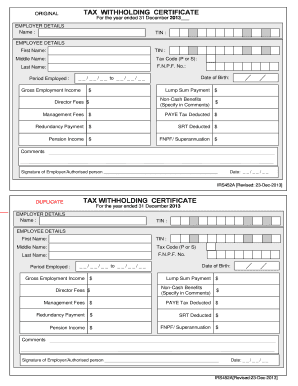

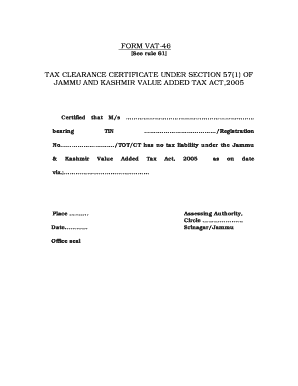

A Tin certificate check is a process used to verify the authenticity and validity of a Taxpayer Identification Number (TIN) certificate. This is important for businesses and individuals to ensure compliance with tax regulations and avoid any potential legal issues.

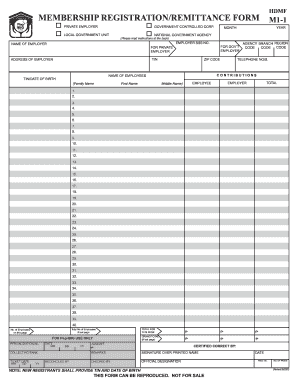

What are the types of Tin certificate check?

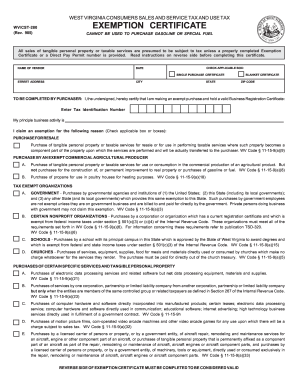

There are two main types of Tin certificate checks that can be performed: online verification and physical verification.

Online verification: This method involves checking the TIN number through an online portal or official website of the tax authority.

Physical verification: This method requires visiting the tax office or relevant government agency in person to verify the TIN certificate.

How to complete Tin certificate check

To complete a Tin certificate check, follow these steps:

01

Gather all necessary information about the TIN certificate.

02

Choose the type of verification method you want to use (online or physical).

03

Submit the TIN details and any required documents for verification.

04

Wait for the confirmation or verification of the TIN certificate.

05

Ensure the information matches and is correct before proceeding with any transactions or business activities.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

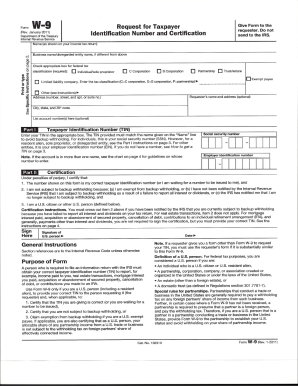

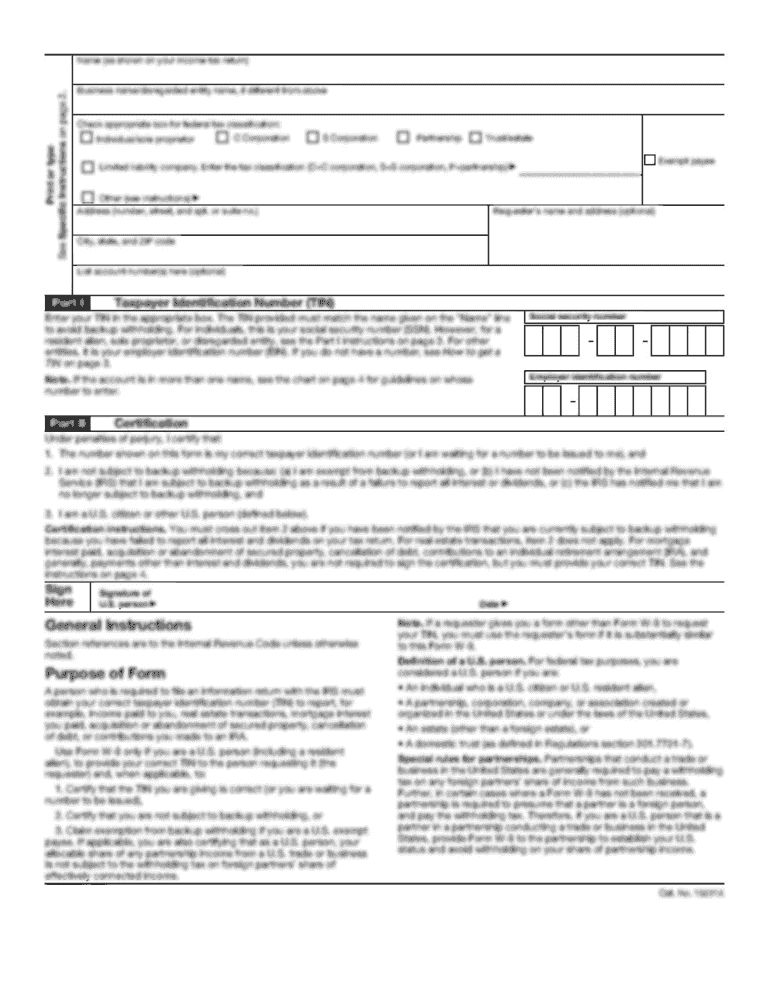

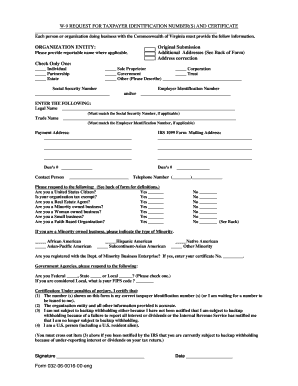

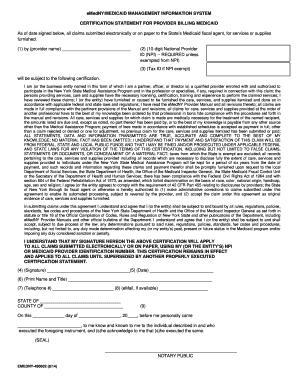

How do I fill out a Request for Taxpayer Identification Number and Certification?

You'll then fill out the form line by line. Line 1 – Name. Line 2 – Business name. Line 3 – Federal tax classification. Line 4 – Exemptions. Lines 5 & 6 – Address, city, state, and ZIP code. Line 7 – Account number(s) Part I – Taxpayer Identification Number (TIN) Part II – Certification.

How do I verify a TIN?

Visit the BIR RDO. If the RDO where you applied for a TIN is near your home or office, your best option is to go there to personally request for TIN number verification. Proceed to the Taxpayers' General Services or Customer Service counter and present your valid ID or birth certificate for identity verification.

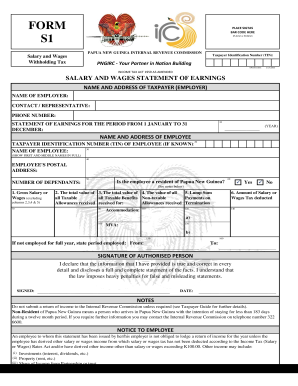

How do you fill out a tax form?

Here's a step-by-step look at how to complete the form. Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number. ... Step 2: Indicate Multiple Jobs or a Working Spouse. ... Step 3: Add Dependents. ... Step 4: Add Other Adjustments. ... Step 5: Sign and Date Form W-4.

How can I check my TIN number online?

Do you know you can check for your TIN online from the comfort of your desk? For registered businesses, enterprises and not-for-profit-organisations that have not obtained or have forgotten their TIN, click here: http://apps.firs.gov.ng/tinverification and type in your RC Number / BN Number to ascertain your TIN.

How can I get my TIN number certificate online?

Log-In with User ID/Password. Fill in the TIN Registration form by providing relevant information of the applicant/Company. Preview the submitted application. Obtain E-TIN Certificate.

How do I check my TIN?

Call the BIR hotlines. If the first two methods of retrieving your TIN didn't work, you'll need to request it directly from the BIR. Here are the BIR numbers to call for recovering your TIN: Trunkline: 8981-7000 / 8929-7676. Customer Assistance Division: 8981-7003 / 8981-7020 / 8981-7030 / 8981-7040 / 8981-7046.

How do I get an e-TIN copy?

Single proprietors and professionals may apply for an e-TIN by going to www.ereg.bir.gov.ph. He or she must have a unique and valid email address, as this is where the TIN and other instructions on taxpayer's registration will be sent.

How do I print a TIN certificate?

Visit the web portal (ura.go.ug) Click on eservices. Go to Print Submitted Form on the right hand side and enter in your Reference Number and the Search Code as they appear on the Acknowledgement Receipt that you received after submitting your application on the URA web portal. Click on the print form button.

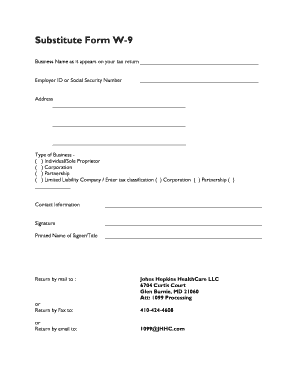

Can I print AW 9 form online?

▶ Go to www.irs.gov/FormW9 for instructions and the latest information. Give Form to the requester. Do not send to the IRS. Print or type.

Where can I get IRS tax forms for free?

During the tax filing season, many libraries and post offices offer free tax forms to taxpayers. Some libraries also have copies of commonly requested publications. Many large grocery stores, copy centers and office supply stores have forms you can photocopy or print from a CD.

How can I check my TIN online?

How To Recover TIN Number (Lost or Forgotten) Online Using the BIR Mobile TIN Verifier App. Install the TIN Verifier Mobile Application on Your Mobile Device. ... Open the App and Read the Privacy Policy. ... Select the TIN VERIFIER Button. Read the Disclaimer and Click Proceed. ... Select TIN INQUIRY.

How can I check if a TIN number is valid?

Two Steps for TIN Number Verification Visit the website of the online information system TINXSYS (Tax Information Exchange System), a government initiative to help the commercial tax departments of States to identify the interstate exchange and monitor them effectively. Just enter the TIN and expect the results.

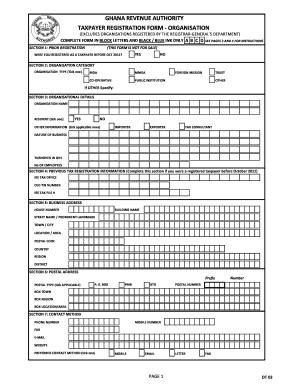

How can I check my TIN number online in Ghana?

You can verify your TIN online here. Through the GRA self-service portal: You can visit the online self-service portal on the GRA website www.gra.gov.gh to match your TIN to your Ghana Card PIN yourself.

How do I verify a TIN with the IRS?

Follow the steps below to check the TIN Match status for your entity: Login to your Tax1099 account. ... Enter the Business Name, TIN Number, and submit the TIN verification data. View the TIN Match report and check the TIN Number search status.