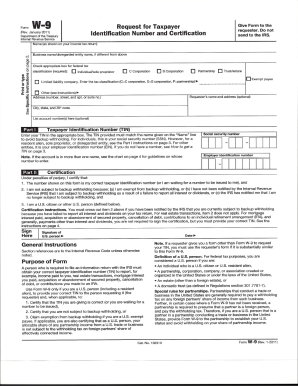

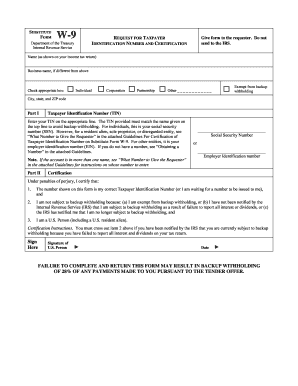

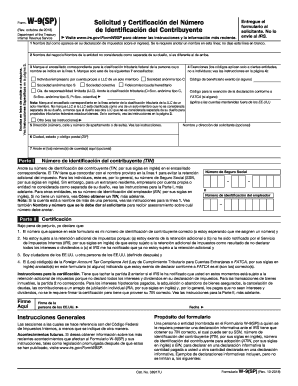

2020 W-9 Form

What is 2020 w-9 form?

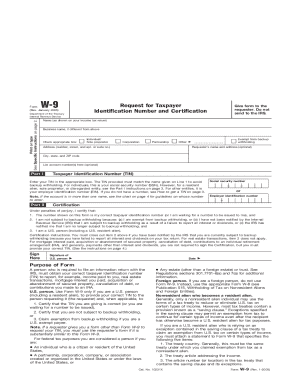

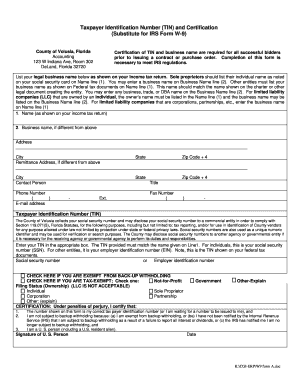

The 2020 w-9 form is a document used in the United States for tax purposes. It is used by businesses to request the taxpayer identification number (TIN) of an individual or entity. The form is used to report income earned by the taxpayer that is not subject to withholding, such as income from freelance work or rental properties.

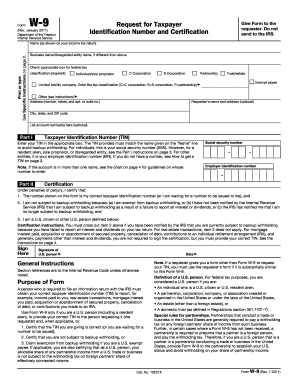

What are the types of 2020 w-9 form?

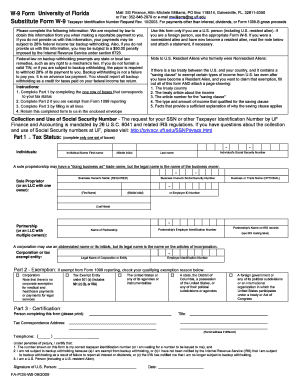

There are two main types of 2020 w-9 forms: the individual form and the business form. The individual form is used by individuals who are required to provide their TIN to businesses they are working with. The business form is used by businesses to request TINs from individuals they are paying for services.

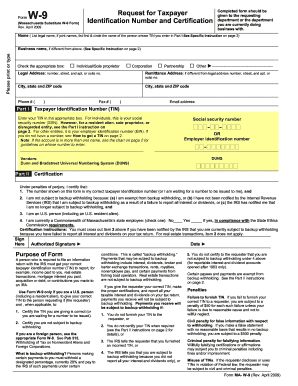

How to complete 2020 w-9 form?

Completing the 2020 w-9 form is a straightforward process. Here are the steps to fill out the form:

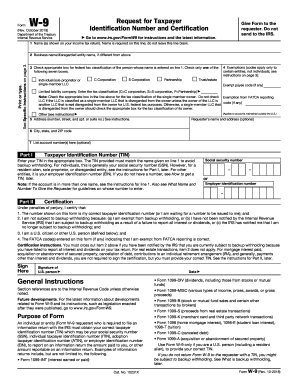

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.