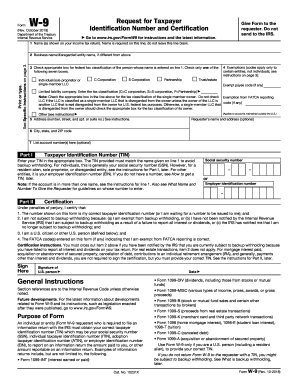

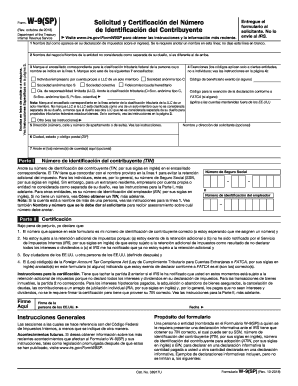

Form W-9

What is Form W-9?

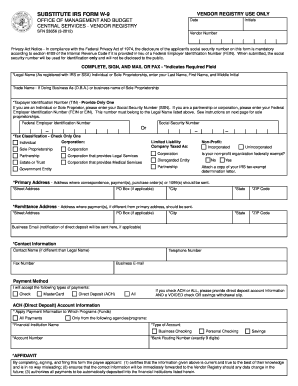

Form W-9 is a tax form used by businesses to gather information from vendors or independent contractors. It provides the employer with the contractor's taxpayer identification number (TIN) for reporting purposes.

What are the types of Form W-9?

There are two main types of Form W-9: Individual or Sole Proprietor and Limited Liability Company (LLC). Individuals or Sole Proprietors use Form W-9 to provide their personal information, while LLCs provide information about their business entity.

Individual or Sole Proprietor

Limited Liability Company (LLC)

How to complete Form W-9

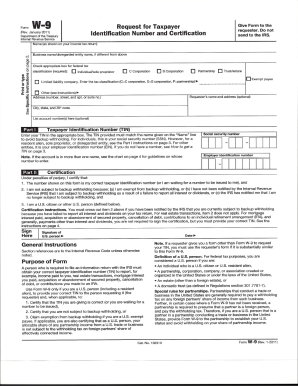

To complete Form W-9, follow these steps:

01

Provide your name as shown on your tax return

02

Enter your business name if different from your name

03

Check the appropriate federal tax classification

04

Provide your address and TIN

05

Sign and date the form

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Form w-9

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How do I fill out a W-9 form?

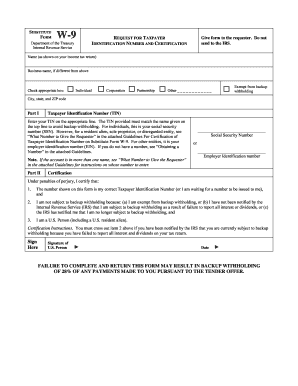

W-9 Form Instructions Line 1 – Name. Line 2 – Business name. Line 3 – Federal tax classification. Line 4 – Exemptions. Lines 5 & 6 – Address, city, state, and ZIP code. Line 7 – Account number(s) Part I – Taxpayer Identification Number (TIN) Part II – Certification.

Can I fill out a w9 form online?

The process to fill out the W-9 is relatively simple, as it only contains five simple steps. Smallpdf has hosted the W-9 2019 form from within our PDF Editor, so you can fill this form out online, using our free service. Afterward, you may print or save the completed form to your local drive, to send to your client.

Who needs to fill out a w9?

Employers who work with independent contractors must provide them with a W-9 form to fill out before starting work. There are specific criteria for who is classified as an “independent contractor” and will need to fill out a W-9 form.

Can you fill out a W9 electronically?

The IRS accepts electronic signatures The W4 and W9 forms may be completed via e signatures, and the IRS regulations around them are reasonable. Minimize printing, signing, and mailing your IRS documents by signing them electronically.

Where can I download w-9 form?

▶ Go to www.irs.gov/FormW9 for instructions and the latest information. Give Form to the requester.

How do I fill out a W9 for free?

0:25 1:35 How to Fill Out a W9 Form Online - YouTube YouTube Start of suggested clip End of suggested clip Website or go to pdffiller.com. And get the newest sample of form w9 that you can fill out sign andMoreWebsite or go to pdffiller.com. And get the newest sample of form w9 that you can fill out sign and submit.

How do I create a W-9?

W-9 Form Instructions Line 1 – Name. Line 2 – Business name. Line 3 – Federal tax classification. Line 4 – Exemptions. Lines 5 & 6 – Address, city, state, and ZIP code. Line 7 – Account number(s) Part I – Taxpayer Identification Number (TIN) Part II – Certification.

How can I get a free w9 form?

Go to www.irs.gov/Forms to view, download, or print Form W-7 and/or Form SS-4. Or, you can go to www.irs.gov/OrderForms to place an order and have Form W-7 and/or SS-4 mailed to you within 10 business days.

Can I print a W-9 form online?

Fill out your Social Security Number or Employer Identification Number. Sign and date the form, click 'Print' or 'Download' to print or save the W-9 to your computer as a PDF.