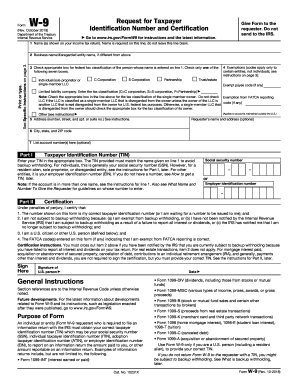

W-9 Form Download

What is W-9 form download?

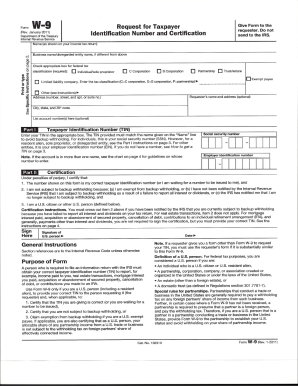

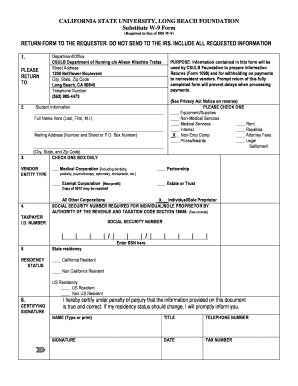

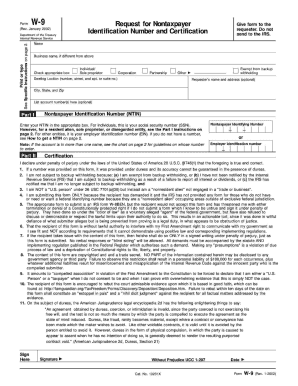

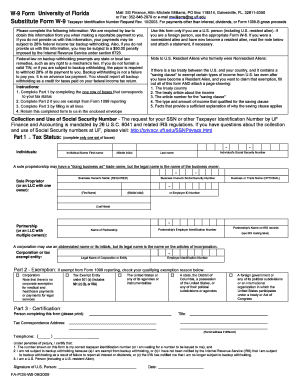

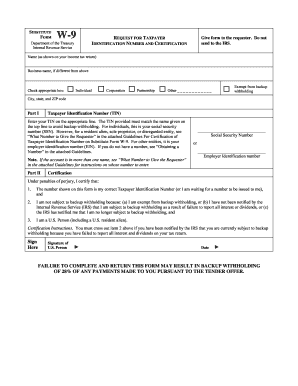

The W-9 form download is a document used by businesses to request information from vendors they pay. It is a standard IRS form that requires vendors to provide their taxpayer identification number, such as a Social Security Number or Employer Identification Number.

What are the types of W-9 form download?

There are several types of W-9 form download, including:

Individual

Sole proprietorship

Corporation

Partnership

Limited liability company

How to complete W-9 form download

Completing a W-9 form download is simple and straightforward. Here are the steps to fill out the form:

01

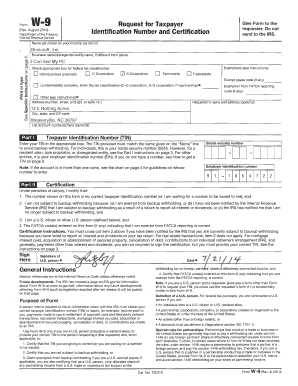

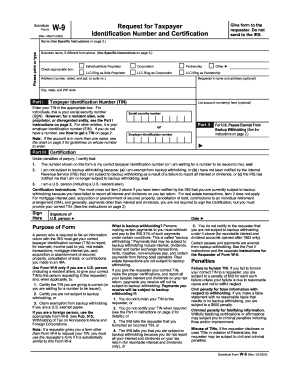

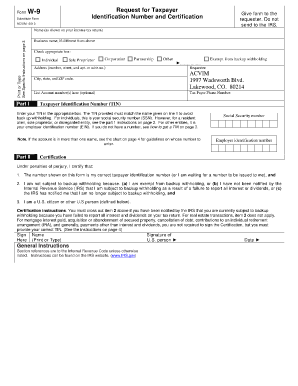

Provide your name and business name, if applicable

02

Enter your taxpayer identification number

03

Indicate your tax classification

04

Sign and date the form

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out W-9 form download

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

Can you fill out a W9 electronically?

The IRS accepts electronic signatures The W4 and W9 forms may be completed via e signatures, and the IRS regulations around them are reasonable. Minimize printing, signing, and mailing your IRS documents by signing them electronically.

Where can I download w-9 form?

▶ Go to www.irs.gov/FormW9 for instructions and the latest information. Give Form to the requester.

How do I fill out a W9 form in PDF?

0:20 1:35 How to Fill Out a W9 Form Online - YouTube YouTube Start of suggested clip End of suggested clip Use only secure channels to fill out and send your w9. You can either get your copy from the irs.MoreUse only secure channels to fill out and send your w9. You can either get your copy from the irs. Website or go to pdffiller.com.

How do I fill out a W-9 form for an individual?

W-9 Form Instructions Line 1 – Name. Line 2 – Business name. Line 3 – Federal tax classification. Line 4 – Exemptions. Lines 5 & 6 – Address, city, state, and ZIP code. Line 7 – Account number(s) Part I – Taxpayer Identification Number (TIN) Part II – Certification.

Can I print a W-9 form online?

Fill out your Social Security Number or Employer Identification Number. Sign and date the form, click 'Print' or 'Download' to print or save the W-9 to your computer as a PDF.

Can you fill out W-9 digitally?

It can be called a “request for taxpayer identification number and certification” but “W-9” is more typically used. W-9s can be e-signed and sent back to you digitally, saving time for contract workers and companies alike.

Can I create my own W-9?

You can create a filled-out Form W-9 online at the IRS website.

How do I create a W-9 form?

W-9 Form Instructions Line 1 – Name. Line 2 – Business name. Line 3 – Federal tax classification. Line 4 – Exemptions. Lines 5 & 6 – Address, city, state, and ZIP code. Line 7 – Account number(s) Part I – Taxpayer Identification Number (TIN) Part II – Certification.

How can I get a free w9 form?

Go to www.irs.gov/Forms to view, download, or print Form W-7 and/or Form SS-4. Or, you can go to www.irs.gov/OrderForms to place an order and have Form W-7 and/or SS-4 mailed to you within 10 business days.

How do I download my W-9?

The W-9 can be downloaded from the IRS website, and the business must then provide a completed W-9 to every employer it works for to verify its EIN for reporting purposes.