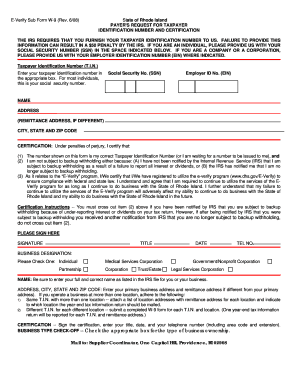

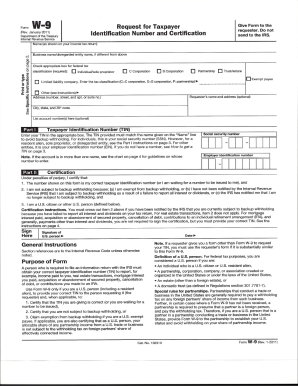

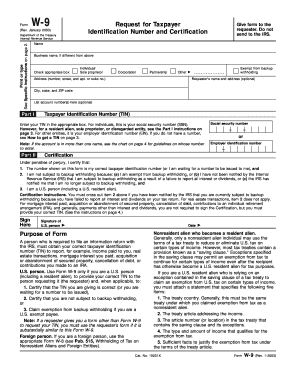

How do you fill out a W-9 Request for Taxpayer Identification Number and Certification?

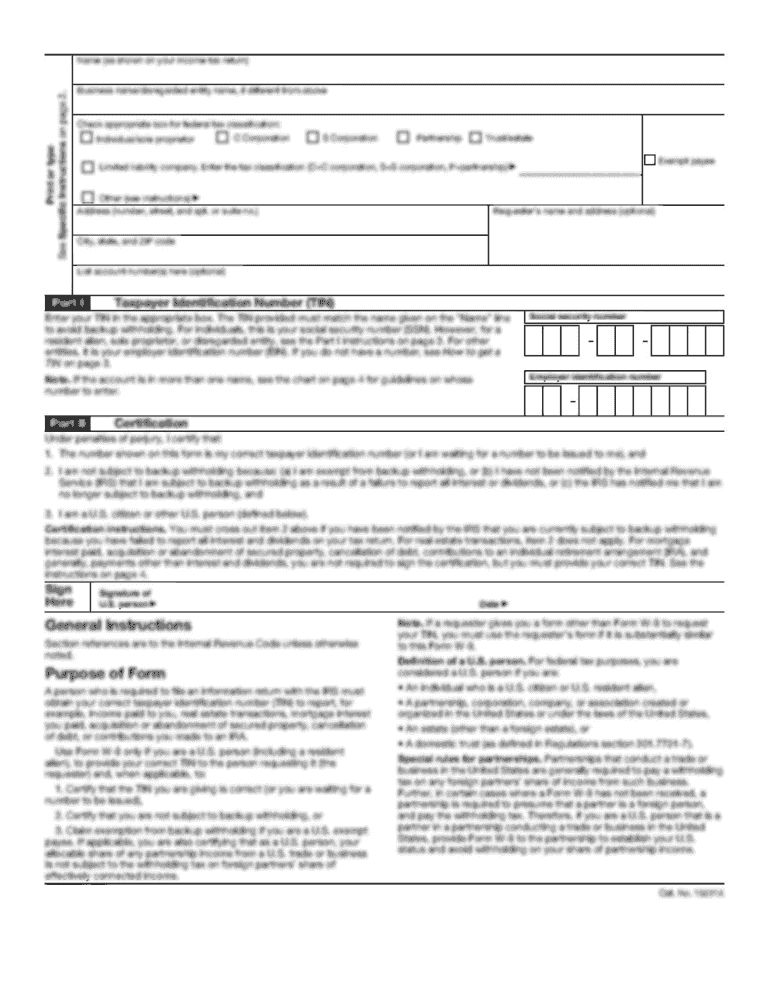

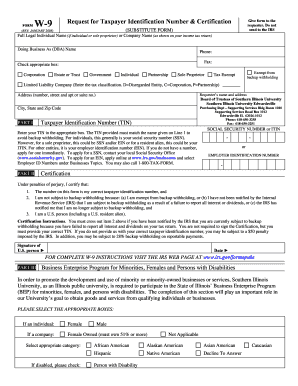

You'll then fill out the form line by line. Line 1 – Name. Line 2 – Business name. Line 3 – Federal tax classification. Line 4 – Exemptions. Lines 5 & 6 – Address, city, state, and ZIP code. Line 7 – Account number(s) Part I – Taxpayer Identification Number (TIN) Part II – Certification.

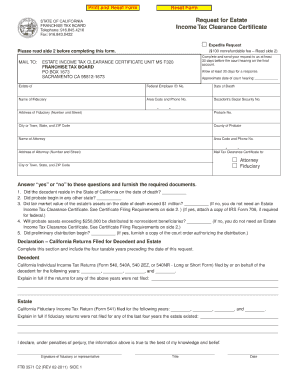

How do you fill out a tax form?

How to Fill Out Form 1040 Step 1: Fill In Your Basic Information. The first half of Form 1040 asks some basic questions about your filing status, identification, contact information, and dependents. ... Step 2: Report Your Income. ... Step 3: Claim Your Deductions. ... Step 4: Calculate Your Tax. ... Step 5: Claim Tax Credits.

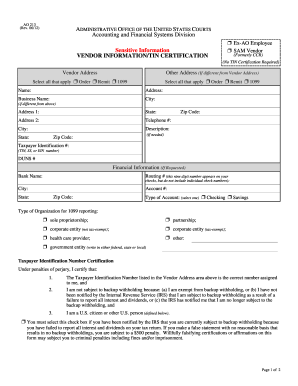

How can I get TIN number certificate?

How to Get TIN Number for Business Purposes Step 1: Secure an Application Form. ... Step 2: Submit the Documentary Requirements and Other Forms. ... Step 3: Pay the Annual Registration Fee and Documentary Stamps. ... Step 4: Get the Certificate of Registration from the RDO (Regional District Officer)

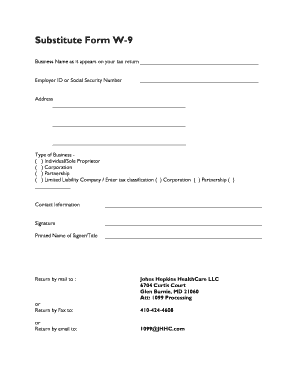

How do I fill out a w9 form?

0:20 1:35 How to Fill Out a W9 Form Online - YouTube YouTube Start of suggested clip End of suggested clip Number this may be either your individual social security number if you're a sole proprietorship. OrMoreNumber this may be either your individual social security number if you're a sole proprietorship. Or your employer. Identification. Number if you're another type of business.

How do I get a TIN certificate?

Log-In with User ID/Password. Fill in the TIN Registration form by providing relevant information of the applicant/Company. Preview the submitted application. Obtain E-TIN Certificate.

Can I print AW 9 form online?

▶ Go to www.irs.gov/FormW9 for instructions and the latest information. Give Form to the requester. Do not send to the IRS. Print or type.

Can I apply for TIN ID online?

If you are self-employed, the steps below are necessary on how to get TIN ID online. Visit the BIR eReg website either using your computer or phone. Carefully fill the online form and submit. Wait for the confirmation message from the Bureau of Internal Revenue.

How long does it take to get a TIN number in Guyana?

The process usually takes approximately fifteen (15) minutes.

How can I get my TIN certificate online?

TIN Registration Process for Individuals STEP 1: Visit the verification portal – Joint Tax Board. STEP 2: Select your date of birth. STEP 3: Select your preferred search criteria (BVN, NIN or registered number) from the drop-down menu. STEP 4: Enter the digit of the search criteria you selected in the previous step.

How do I print a TIN certificate?

Visit the web portal (ura.go.ug) Click on eservices. Go to Print Submitted Form on the right hand side and enter in your Reference Number and the Search Code as they appear on the Acknowledgement Receipt that you received after submitting your application on the URA web portal. Click on the print form button.

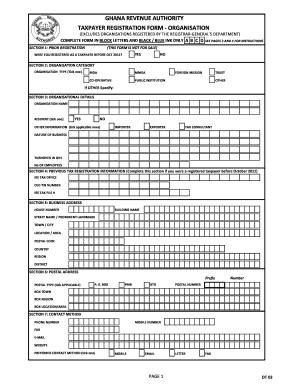

How can I register my TIN number online in Ghana?

Online Ghana Passport Application, Renewal And Replacement Procedures Step 1: Visit A GRA Domestic Tax Revenue Division Office To Begin The Application Process. Step 2: Fill And Submit The TIN Registration form. Step 3: Wait For Collection of Your TIN number. Download TIN Registration Form PDF 2020 / 2021.

How can I get a free ITIN number?

You can call the IRS toll-free at 800-829-1040 if you are in the United States or 267-941-1000 (not a toll-free number) if you are outside the United States.

Where can I get IRS tax forms for 2020?

You can access forms and publications on the IRS website 24 hours a day, seven days a week, at http://www.irs.gov. Taxpayer Assistance Centers. There are 401 TACs across the country where IRS offers face-to-face assistance to taxpayers, and where taxpayers can pick up many IRS forms and publications.

Your Employer Identification Number (EIN) is your federal tax ID. You need it to pay federal taxes, hire employees, open a bank account, and apply for business licenses and permits. It's free to apply for an EIN, and you should do it right after you register your business.

Where can I get 2021 IRS tax forms?

Get the current filing year's forms, instructions, and publications for free from the Internal Revenue Service (IRS). Download them from IRS.gov. Order by phone at 1-800-TAX-FORM (1-800-829-3676)

Where can I get the W 7 form?

You can submit it in person at any IRS Taxpayer Assistance Center that performs in-person document reviews; most major cities have such assistance centers, and there is at least one center in every state. You can also submit tax returns with W-7 forms by mail to: Internal Revenue Service. ITIN Operation.

How do I fill out a w9 for free?

0:25 1:35 How to Fill Out a W9 Form Online - YouTube YouTube Start of suggested clip End of suggested clip Website or go to pdffiller.com. And get the newest sample of form w9 that you can fill out sign andMoreWebsite or go to pdffiller.com. And get the newest sample of form w9 that you can fill out sign and submit.

Can I download my ss4 online?

Form SS-4, the application for an EIN, is available online. You'll need information about your business, including the administrator or trustee of your business, and name of responsible party along with their social security number or tax ID.